Automotive Lubricants Market Size, Share, Trends, Industry Analysis Report

: By Product, Vehicle Type (Internal Combustion Engine and Electric Vehicles), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1119

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Lubricants Market Overview

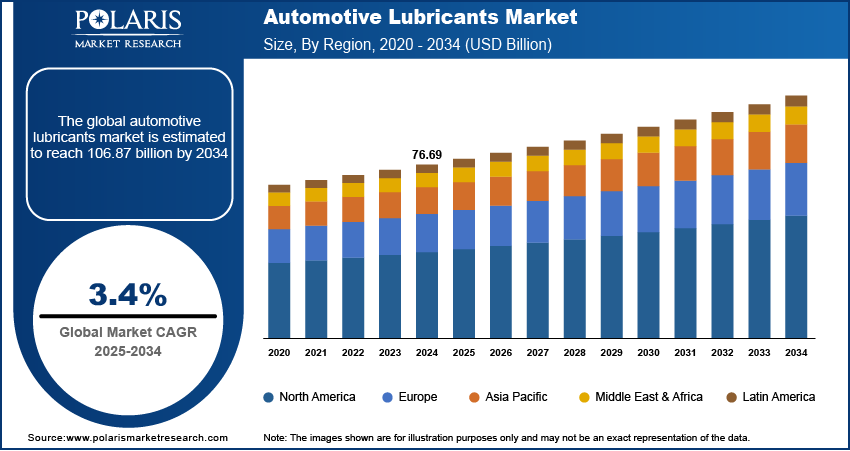

The global automotive lubricants market size was valued at USD 76.69 billion in 2024. The market is expected to grow from USD 79.17 billion in 2025 to USD 106.87 billion by 2034, exhibiting a CAGR of 3.4% from 2025 to 2034. Rising vehicle production, growing demand for high-performance and eco-friendly lubricants, and increased focus on engine efficiency and maintenance are fueling automotive lubricants market growth.

Key Insights

- The engine oil segment accounted for the largest market share in 2024.

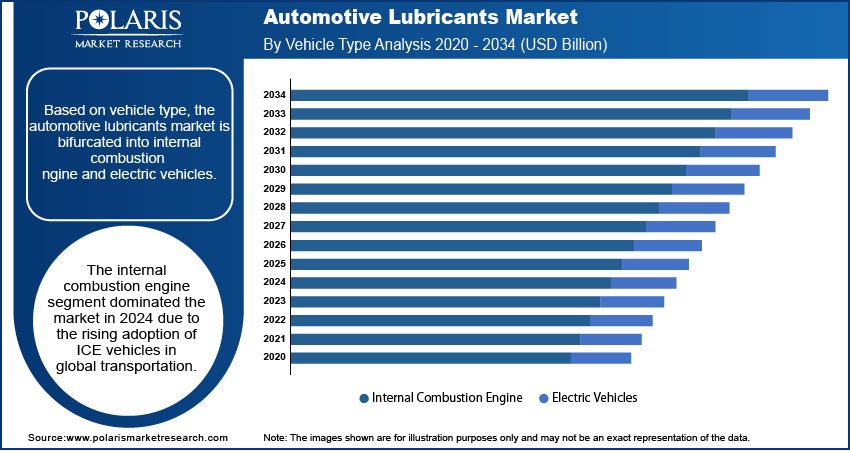

- The internal combustion engine segment dominated the market in 2024 due to growing adoption of internal combustion engine (ICE) vehicles in worldwide transportation.

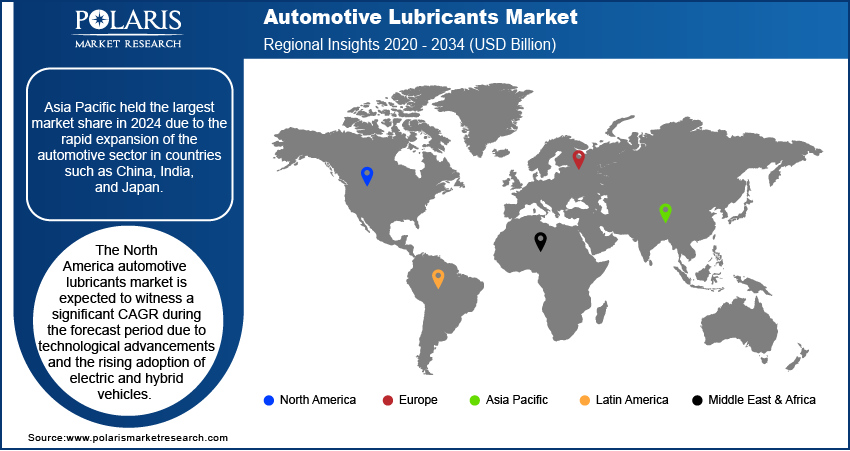

- Asia Pacific automotive lubricants market held the largest market share in 2024.

- China dominated the region profiting from huge vehicle production potential and massive consumer base.

- North America is anticipated to observe a notable CAGR during the forecast period.

- The US plays an important part in the growth with a robust demand for superior commodities and well-established automotive industry.

Industry Dynamics

- The requirement of lubricants is increasing with growing vehicle production to meet the demand for lubrication at several stages of lifecycle from assembly lines and procedural sustenance and repairs.

- Major players in the market such as ExxonMobil Lubricants Pvt. Ltd have announced the launch of the modern range of advanced lubricants for passenger vehicles with progressive technology to attract varied customer segments involving automotive makers, service providers and distinct vehicle owners.

- The growing approval and acquisition of eco-friendly lubricants drive the market demand.

- The growing footprint of artificial lubricants because of advantages including superior fuel productivity have prolonged the oil drain intervals from once in 6-12 months to 18-24 months.

Market Statistics

2024 Market Size: USD 76.69 billion

2034 Projected Market Size: USD 106.87 billion

CAGR (2025-2034): 3.4%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Automotive lubricants are essential fluids used in vehicles to reduce friction between moving parts, thereby enhancing performance and longevity. They serve multiple functions, including cooling, cleaning, and protecting engine components from wear and corrosion.

The growing demand for high-performance and lightweight vehicles is driving the automotive lubricants market growth. As automakers aim to produce more fuel-efficient, faster, and lighter vehicles, engine components generate high operating temperatures, which necessitate the use of high-performance lubricants that can withstand extreme conditions, reduce friction, and enhance engine longevity. Lightweight vehicles, with their smaller, more compact engines and advanced materials like aluminum or composites, require specialized lubricants to optimize efficiency and maintain smooth performance.

The growing popularity and adoption of environment-friendly lubricants drive the automotive lubricants market demand. Automotive manufacturers and service providers are adopting eco-friendly lubricants to meet green certifications and enhance their product appeal. Furthermore, the improved performance characteristics of eco-friendly lubricants, such as higher biodegradability and reduced carbon footprint management, appeal to environmentally conscious consumers, driving a shift from traditional to sustainable lubrication solutions.

Automotive Lubricants Market Dynamics

Increasing Production of Motor Vehicles

The need for lubricants, such as engine oils, transmission fluids, and greases, increases with rising vehicle production, as each vehicle requires lubrication at various stages of its lifecycle, from assembly lines to routine maintenance and repairs. In addition, the growing diversity of vehicle types, including passenger cars, commercial vehicles, and electric vehicles, is driving the development of specialized lubricants, further expanding the market. Therefore, as the production of motor vehicles increases, the automotive lubricants market revenue also spurs. For instance, as per the data published by the European Automobile Manufacturers' Association, 85.4 million motor vehicles were produced worldwide in 2022, an increase of 5.7% compared to 2021.

Rising Product Launches by Key Players

Key players in the market such as ExxonMobil Lubricants Pvt. Ltd announced the launch of its latest range of advanced lubricants for passenger vehicles in July 2022, with advanced technology to attract diverse customer segments, including automotive manufacturers, service providers, and individual vehicle owners. These product launches by key players in the market are fueling the global automotive lubricants market Additionally, product launches are accompanied by aggressive marketing and promotional activities that raise awareness about the benefits of advanced lubricants, encouraging greater adoption.

Automotive Lubricants Market Segment Insights

Automotive Lubricants Market Assessment Based on Product

The automotive lubricants market, based on product, is segmented into engine oil, gear oil, transmission fluids, brake fluids, coolants, and greases. The engine oil segment accounted for a larger automotive lubricants market share in 2024 due to its essential role in maintaining engine performance, reducing friction, and enhancing fuel efficiency. Engine oils are critical for both passenger and commercial vehicles, ensuring optimal engine operation and extending the lifespan of internal components. The increasing global vehicle fleet, particularly in emerging economies with rising disposable incomes, has fueled the demand for high-quality engine oils. Additionally, the growing adoption of synthetic and semi-synthetic engine oils, which offer superior thermal stability and protection under extreme conditions, has contributed to the dominance of the segment.

The brake fluids segment is expected to grow at a robust pace in the coming years, owing to the increasing focus on safety and the rise in advanced braking systems such as automotive brake systems and EBD in vehicles. The increasing penetration of electric and hybrid vehicles, which require specialized brake fluids due to their unique braking mechanisms, is also propelling the segment's growth. Furthermore, the push for compliance with stringent safety regulations and growing consumer awareness about the importance of regular vehicle maintenance are encouraging frequent replacement and use of premium-grade brake fluids.

Automotive Lubricants Market Evaluation Based on Vehicle Type

The automotive lubricants market, based on vehicle type, is segmented into internal combustion engine and electric vehicles. The internal combustion engine segment dominated the market in 2024 due to the rising adoption of internal combustion engine (ICE) vehicles in global transportation. ICE vehicles remain the primary mode of mobility in many regions, particularly in emerging markets like China and India. These vehicles rely heavily on lubricants for efficient engine operation, cooling, and wear reduction, driving consistent demand. Factors such as increasing vehicle production, the growing middle-class population in developing nations, and the high replacement rates of lubricants due to regular maintenance cycles have further supported the growth of the segment.

Automotive Lubricants Market Regional Analysis

By region, the study provides the automotive lubricants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2024 due to the rapid expansion of the automotive sector in countries such as China, India, and Japan. China dominated the region, benefiting from its massive vehicle production capacity and vast consumer base. The increasing disposable income of middle-class populations and growing urbanization across the region have led to a surge in vehicle ownership, driving the adoption of automotive lubricants. Additionally, robust industrial activities and the widespread use of two-wheelers and commercial vehicles in countries like India contribute significantly to the demand for lubricants. The presence of major automotive manufacturers and continuous investments in infrastructure development have further supported the growth of the region. Innovations in product offerings, such as eco-friendly and high-performance lubricants, also cater to the evolving needs of consumers in Asia Pacific, contributing to its leadership position.

The North America automotive lubricants market is expected to witness a significant CAGR during the forecast period due to technological advancements and the rising adoption of hybrid and electric vehicles. The US plays a crucial role in this growth, with a strong demand for premium-grade products and a well-established automotive industry. Consumers in North America show a preference for synthetic and specialized formulations that enhance vehicle efficiency and comply with stringent environmental regulations. Additionally, the growing emphasis on sustainability has prompted manufacturers to develop bio-based and eco-friendly products tailored to meet regional standards. The rising vehicle maintenance awareness among consumers and a focus on extending vehicle lifespans have further accelerated demand for automotive lubricants in the region.

Automotive Lubricants Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the automotive lubricants market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The automotive lubricants market is fragmented, with the presence of numerous global and regional market players. Major players in the automotive lubricants market include Sasol; Indian Oil Corporation Ltd; HP Lubricants; Philipps 66; Fuchs; Cepsa; BP p.l.c.; Exxon Mobil; CASTROL LIMITED; Shell; Repsol; TotalEnergies; and LUKOIL.

Exxon Mobil Corporation is a multinational oil and gas corporation. It was formed in 1999 through the merger of Exxon Corporation and Mobil Corporation, two of the most prominent oil companies in the United States. ExxonMobil is headquartered in Irving, Texas. Exxon Mobil is primarily engaged in the exploration, production, refining, and marketing of oil and natural gas, as well as the manufacturing and marketing of petrochemicals and other chemical products. Its core operations span the entire energy value chain. Exxon Mobil is a global energy company with operations in over 70 countries. The company explores and produces crude oil and natural gas in various regions, including the United States, Europe, Africa, Asia, and the Middle East.

TotalEnergies is a prominent global integrated energy company, established in 1924, that operates across the entire oil and gas value chain, from exploration and production to refining and marketing. TotalEnergies is headquartered in Paris, France, and employs over 100,000 people across approximately 120 countries. The company’s diverse portfolio includes oil, biofuels, natural gas, green gases, renewables, and electricity, reflecting its commitment to providing energy that is more affordable, reliable, and sustainable for a growing global population.

List of Key Companies in Automotive Lubricants Market

- Sasol

- Indian Oil Corporation Ltd

- HP Lubricants

- Philipps 66

- Fuchs

- Cepsa

- BP p.l.c.

- Exxon Mobil

- CASTROL LIMITED

- Shell

- Repsol

- TotalEnergies

- LUKOIL

Automotive Lubricants Industry Developments

February 2025: FUCHS officially inaugurated the expansion of its production facility in Isando, Johannesburg, South Africa. According to FUCHS, the expansion is aimed at improving its capacity for automotive, mining, industrial, and specialty lubricants.

February 2025: TotalEnergies Marketing announced the signing of a supplier partnership with Meineke, a prominent car care center. The company stated that the collaboration will leverage the premium products of TotalEnergies and the premium services of Meineke. It aims to improve the total service offerings to drivers in the U.S.

December 2024: IndianOil partnered with Madras Motor Sports Club to supply STORM-X, high-octane petrol for the 3rd and 4th rounds of the Indian National Racing Championship at Madras International Circuit in the 2024 season. A total of 55 barrels of STORM-X were dispatched for the 3rd round at the launch ceremony.

June 2024: Castrol, a lubricant company, announced the release of a range of products within the Castrol EDGE line, including high-performance lubricants for SUVs and Hybrids.

November 2022: TotalEnergies, a global energy company that produces and sells a variety of energy products, including oil and biofuels, natural gas and green gases, renewables, and electricity, announced the launch of its global range of EV Fluids in India.

Automotive Lubricants Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Internal Combustion Engine

- Electric Vehicles

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 76.69 billion |

|

Market Size Value in 2025 |

USD 79.17 billion |

|

Revenue Forecast by 2034 |

USD 106.87 billion |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025 –2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive lubricants market size was valued at USD 76.69 billion in 2024 and is projected to grow to USD 106.87 billion by 2034.

The global market is projected to register a CAGR of 3.4% from 2025 to 2034.

Asia Pacific had the largest share of the global market in 2024

A few of the key players in the market are Sasol; Indian Oil Corporation Ltd; HP Lubricants; Philipps 66; Fuchs; Cepsa; BP p.l.c.; Exxon Mobil; CASTROL LIMITED; Shell; Repsol; TotalEnergies; and LUKOIL.

The brake fluids segment is projected to witness significant growth in the coming years.

The internal combustion engine segment dominated the market in 2024.