Master Data Management Market Share, Size, Trends, Industry Analysis Report

By Component (Software, Services); By Deployment Type; By Organization Size; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM2655

- Base Year: 2024

- Historical Data: 2020-2023

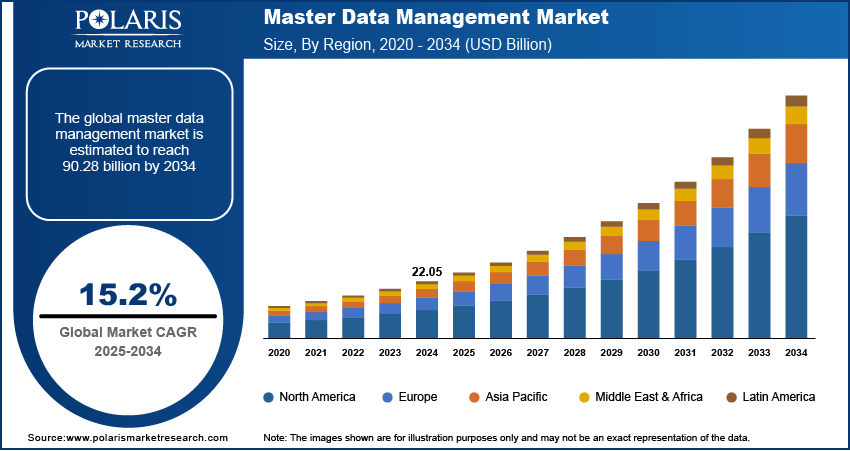

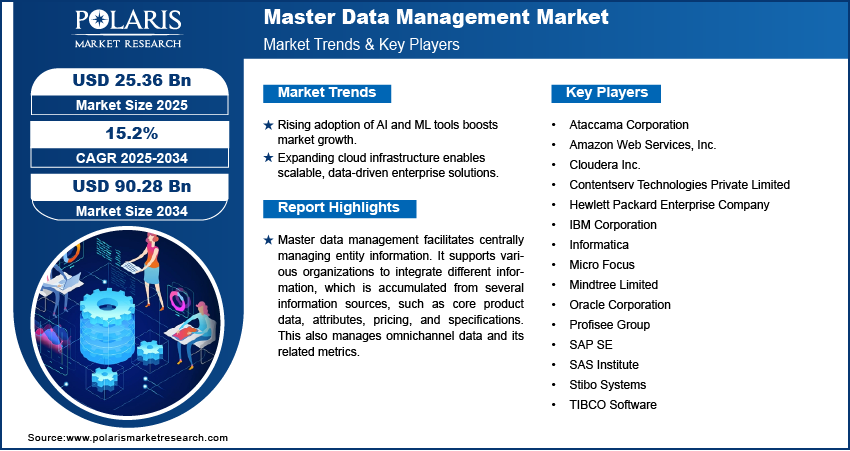

The global master data management market was valued at USD 22.05 billion in 2024 and is expected to grow at a CAGR 15.2% during the forecast period. Master data management offers a uniform and standardized set of data related to products, customers, and suppliers from different IT systems. Master data management assists in enhancing the quality of data by maintaining consistent and accurate information elements across users.

Key Insights

- Services segment is expected to be lucrative during the forecast period. This is due to rising demand for implementation, consulting, and ongoing MDM support services.

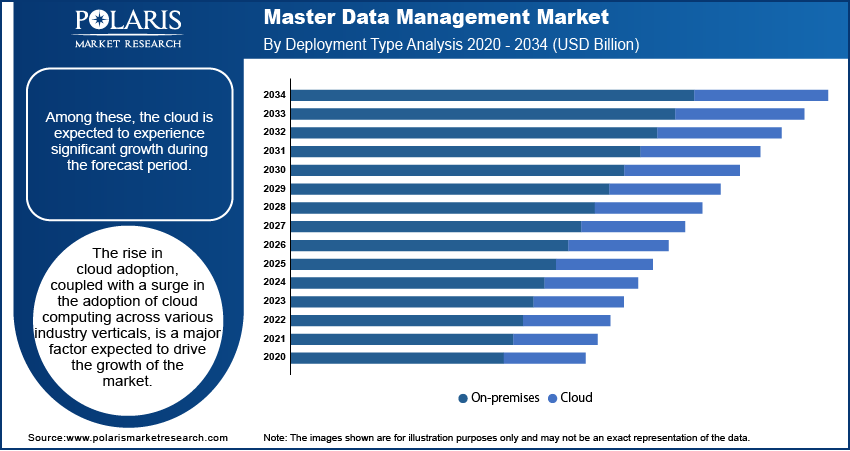

- Cloud segment is expected to have the highest CAGR during the forecast period. The market is driven by increasing preference for scalable and cost-efficient MDM solutions.

- Large enterprises segment accounted for the largest market share in 2024 as they require centralized data governance to manage complex, distributed enterprise data systems effectively.

- BFSI end-use industry accounted for the largest market share. This is due to rising demand for accurate, real-time customer and financial data.

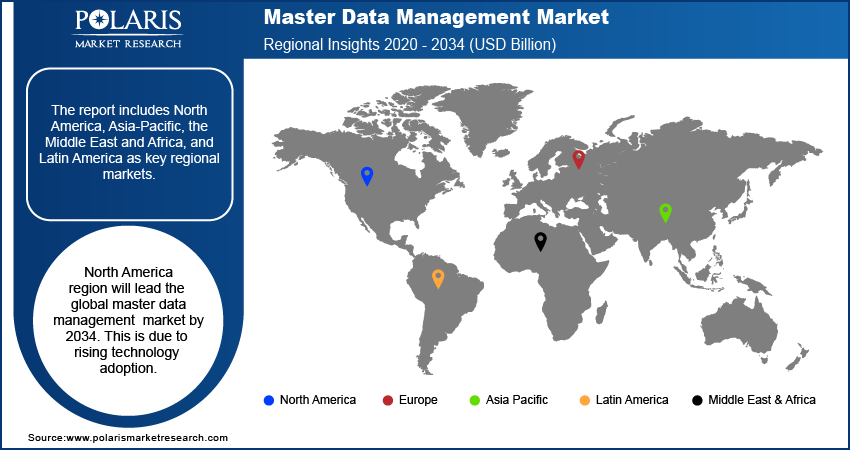

- North America region will lead the global master data management market by 2034. This is due to rising technology adoption.

Industry Dynamics

- The market is growing due to increased emphasis on data‑driven decision‑making across industries.

- The market is fueling because of growing adoption of AI/ML‑powered tools.

- Advancements in cloud architectures, integration platforms, and scalable storage solutions create opportunities for providers to serve global enterprise needs.

- The hinders for the market includes data silos, and shortage of skilled personnel.

Market Statistics

- 2024 Market Size: USD 22.05 Billion

- 2034 Projected Market Size: USD 90.28 Billion

- CAGR (2025–2034): 15.2%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Master data management facilitates centrally managing entity information. It supports various organizations to integrate different information, which is accumulated from several information sources, such as core product data, attributes, pricing, and specifications. This also manages omnichannel data and its related metrics.

The e-commerce industry is growing at a tremendous pace globally, owing to a rise in consumer demand for products, growing internet access, and a rise in the penetration of smartphones. Global online sales are increasing by almost 18% every year. In countries such as India, Mexico, the Philippines, and China, the e-commerce industry is growing at a rate of more than 25%. The rapid growth in the e-commerce industry would drive the demand for master information handling solutions during the forecast period.

The outbreak of COVID-19 is anticipated to offer lucrative opportunities for key players operating in the global master data management market. The surge in the need for informed decision-making, analyzing product data to form future business strategies, and rising spending has led to increased revenue generation.

In addition, the demand for master information handling is expected to rise at a significant rate, as demand for retail is expected to increase due to increased e-commerce penetration across the globe, opening opportunities for players in this industry.

Industry Dynamics

Growth Drivers

Enterprises across various industries, such as healthcare, retail, and BFSI, among others, are investing and implementing new technologies such as AI and ML to grow and gain an edge over their competitors. Growth in digitization and a greater need for efficient master data management tools support the growth of this industry.

Technological advancements enable industry players to launch new innovative products and solutions. AI-enabled solutions also enhance client experience and fulfillment, thereby leading to increased revenue and profits.

Similarly, ML-enabled solutions help organizations manage compliance digital revolution and achieve improved operational proficiency by sensing any forthcoming issues related to information quality and hence, providing proper solutions to the same. Companies such as IBM Corporation and Akenoe offer ML-enabled solutions.

Report Segmentation

The market is primarily segmented based on component, deployment type, organization size, end-use, and region.

|

By Component |

By Deployment Type |

By Organization Size |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Services segment is expected to be lucrative during the forecast period

The market for the services segment is expected to grow at a fast pace during the forecast period. There has been increased demand for services among end users, as it ensures optimized operation of platforms, software, and solution. Furthermore, a greater need for cloud-based master data management services has been observed.

Moreover, training and consulting services are projected to witness remarkable growth in the industry in the near future. Training and consulting services play a vital role in conveying adequate knowledge to employees about the functioning of the solution.

Cloud segment is expected to have highest CAGR during the forecast period

Among these, the cloud is expected to experience significant growth during the forecast period. The rise in cloud adoption, coupled with a surge in the adoption of cloud computing across various industry verticals, is a major factor expected to drive the growth of the market. This is attributed to the fact that master data management exhibit the capability to distribute compute resources in single or multiple regions and meet high availability of requirements.

Large enterprises segment accounted for the largest market share

Large enterprises have significant information management investments that help them implement advanced technologies into infrastructure to increase their overall productivity and efficiency. This, in turn, has propelled the adoption of master information management in large enterprises. In addition, large enterprises opt for proprietary information management to handle massive information volume, which supplements the growth of the industry.

BFSI end-use industry accounted for the largest market share in 2024

The BFSI industry account for the largest share in 2024. BFSI industry vertical includes the enterprises such as retail, private, corporate, and investment banking service providers, NBFCs (non-banking financial companies), mutual funds, pension funds, insurance service providers, and other smaller financial entities.

There is an increase in the adoption of MDM in the BFSI industry as it provides numerous benefits to the end users, such as collecting and unifying information from various separate files into one source, Identifying and fixing inconsistent master information and others.

The BFSI industry is witnessing massive technology adoption and continuous change in consumer demands with digitalization & net banking. With the emergence of automation in current business models, the industry is continuously changing, due to which the adoption of MDM has increased over a period of time.

North America region will lead the global master data management market by 2034

North American region is expected to account for a larger share in the market. The retail industry is large & competitive in this region. An increase in the adoption of MDM in eCommerce is expected to drive the expansion of the master data management market in this region. North America has great adoption of advanced technologies in most industries.

In addition, the region is home to major players who offer advanced master data management. Vendors in this market have come up with innovative master information management software to cater to the rise in demand for advanced master data management services among several industries such as retail, manufacturing, logistics, and others.

Competitive Insight

Some of the major players operating in the global market include Amazon Web Services, Inc., Ataccama Corporation, Contentserv Technologies Private Limited, Cloudera Inc., Hewlett Packard Enterprise Company, IBM Corporation, Informatica, Micro Focus, Mindtree Limited, Oracle Corporation, Profisee Group, SAP SE, SAS Institute, Stibo Systems, and TIBCO Software.

These leading market players operating in the global market are investing in technological advancements to offer enhanced solutions in the market. These companies are also acquiring other companies to strengthen presence in the market. Several small and medium-sized players have entered the market to cater to the growing consumer demand.

Recent Developments

In February 2024, Semarchy launched its Acceleration Toolkit to simplify MDM adoption, boost user engagement, and accelerate business value realization.

In January 2021, Oracle Corporation partnered with KPIT, which is global service provider in digital solution to provide better product information management solution to its customer.

In May 2020, IBM Corporation introduced latest version of its product information management solution that is IBM invention master V12.0 which will help users understand information.

Master Data Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 22.05 billion |

| Market size value in 2025 | USD 25.36 billion |

|

Revenue forecast in 2034 |

USD 90.28 billion |

|

CAGR |

15.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Deployment Type, By Organization Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Amazon Web Services, Inc., Ataccama Corporation, Contentserv Technologies Private Limited, Cloudera Inc., Hewlett Packard Enterprise Company, IBM Corporation, Informatica, Micro Focus, Mindtree Limited, Oracle Corporation, Profisee Group, SAP SE, SAS Institute, Stibo Systems, and TIBCO Software. |

FAQ's

• The global market size was valued at USD 22.05 billion in 2024 and is projected to grow to USD 90.28 billion by 2034.

• The global market is projected to register a CAGR of 15.2% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players in the market are Amazon Web Services, Inc., Ataccama Corporation, Contentserv Technologies Private Limited, Cloudera Inc., Hewlett Packard Enterprise Company, IBM Corporation, Informatica, Micro Focus, Mindtree Limited, Oracle Corporation, Profisee Group, SAP SE, SAS Institute, Stibo Systems, and TIBCO Software.

• Large enterprises segment accounted for the largest market share in 2024.

• Cloud segment is expected to have the highest CAGR during the forecast period.