Meat Snacks Market Share, Size, Trends & Industry Analysis Report

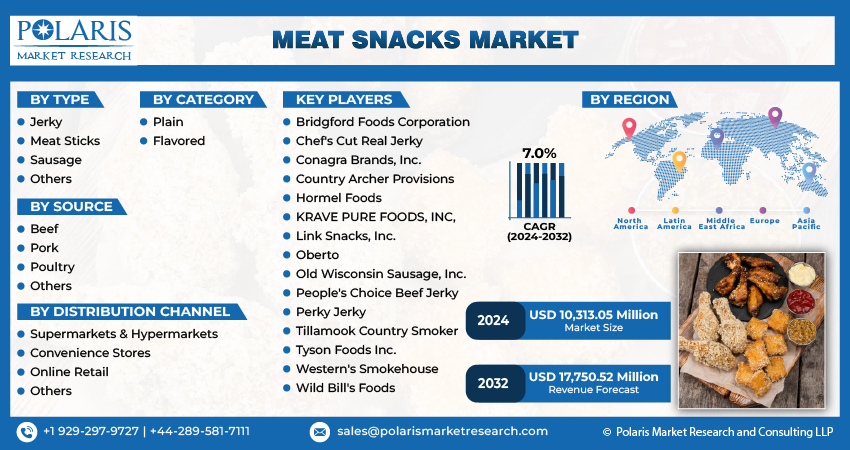

By Type (Jerky, Meat Sticks, Sausage, Others); By Source; By Category; By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3509

- Base Year: 2024

- Historical Data: 2020-2023

The global Meat Snacks Market was valued at USD 12.4 billion in 2024 and is expected to grow at a CAGR of 8.70% from 2025 to 2034. On-the-go nutrition trends and protein-rich diet preferences are fueling market growth.

Meat Snacks Market Overview

The meat snacks market has witnessed significant growth in recent years due to changing consumer preferences and dietary habits. This emerging category, which includes meat snacks like jerky and sticks, has become a focus for traditional and innovative players in the food industry.

One of the primary driving factors behind the expansion of the meat snacks market is the prevailing health and wellness trend. Consumers are increasingly conscious of their dietary choices, meat snacks have emerged as a go-to option for those seeking convenient, protein-rich alternatives. With an emphasis on maintaining a healthier lifestyle, individuals are turning to these snacks as a satisfying and nutritionally dense solution, aligning with their fitness goals and dietary requirements.

To Understand More About this Research:Request a Free Sample Report

The demand for convenient snacking options has been another factor propelling the meat snacks market forward.

For instance, in 2021, sales of meat snacks in convenience stores across the United States reached an impressive figure of approximately $2.16 billion, as reported by Convenience Store Products magazine.

Notably, within the category of traditional jerky brands, Old Trapper secured the third position in terms of sales, establishing itself as one of the top-performing products in United States convenience stores. Modern lifestyles, characterized by hectic schedules and on-the-go routines, have led consumers to seek portable and easy-to-consume snacks. Meat snacks, with their non-perishable nature and inherent convenience, have positioned themselves as an ideal solution for individuals looking to satiate their hunger without compromising on nutrition or taste.

Flavor innovation has played a pivotal role in the market's evolution. Manufacturers have responded to the diverse palate of consumers by introducing an array of flavors, enhancing the appeal of meat snacks. This focus on taste has not only attracted new consumers but has also retained the interest of existing ones, contributing to the sustained growth of the market.

Meat Snacks Market Dynamics

Market Drivers

Rising Demand for Convenient Snacking

Consumers are increasingly in search of convenient snacking options, and major players in the meat snacks market are continually enhancing their offerings. The popularity of meat snacks is on the rise, particularly among the working population and the younger generation, driven by their busy lifestyles. According to Convenience Store Products magazine, meat snacks recorded sales of nearly USD 2.16 billion in convenience stores in the United States in 2021. Old Trapper, a traditional jerky brand has third highest sold product in terms of sales in U.S. convenience stores.

The evolving snacking habits of consumers reflect a preference for more sophisticated options with functional benefits. This shift has resulted in a heightened demand for specialized snacks like meat snacks, which are quick food products crafted from various meats such as turkey, beef, and pork. Consumers are now seeking snacks with elevated protein content and are drawn to traditional meat items reimagined with complex flavor profiles, aligning with a preference for natural product images. In March 2021, Cherkizovo Group introduced a new range of meat snacks under the Cherkizovo Premium brand, encompassing pork, chicken, and turkey snacks made from cured and dried meat.

Increased Awareness of Protein Benefits

The meat snacks market is experiencing a notable surge, propelled by the heightened awareness of the nutritional benefits associated with protein consumption. As consumers become increasingly health-conscious, the demand for convenient and protein-packed snacks has witnessed a significant upswing. Meat snacks, including options crafted from beef, turkey, and pork, have become a favored choice among individuals with hectic lifestyles, particularly the working population and the younger generation. For instance, According to Euromonitor International in 2022, the meat snacks generated USD 4,828.6 Billion in 2022 that indicate the significant growth from USD 3,513.3 Billion in 2018. This underscores the market's robust growth and the evolving preferences of consumers.

The appeal of meat snacks extends beyond mere convenience, as consumers now seek functional benefits from their snacking choices. The emphasis on high protein content has become a defining factor in shaping snacking habits, leading to an increased demand for specialist snacks like meat-based options. Many traditional jerky brands have found considerable success, securing prominent positions among the most-sold products in U.S. convenience stores. Recognizing the evolving preferences of consumers, companies like Cherkizovo Group have seized the opportunity to introduce innovative offerings. In March 2021, Cherkizovo Group launched a new range of meat snacks under the Cherkizovo Premium brand, offering a variety of choices, including pork, chicken, and turkey snacks, all crafted from cured and dried meat.

Market Restraints

Rising Emphasis on Reducing Red Meat Consumption and Environmental Consciousness

While the meat snacks market has experienced significant growth and popularity, several restraining factors have influenced its trajectory. One notable challenge is the increasing awareness and concern among consumers regarding health and nutrition. As more individuals prioritize healthier lifestyles, there is a growing emphasis on reducing red meat consumption and embracing plant-based alternatives. For instance, Initial data from the Federal Information Centre for Agriculture (BZL) reveals a sustained long-term decline in meat consumption in 2022. Per capita meat consumption was 52 kilograms, indicating a decrease of approximately 4.2 kilograms from the previous year 2021.

The breakdown shows a reduction of about 2.8 kilograms in pork consumption, 900 grams in beef and veal, and 400 grams in poultry meat. This decline in meat consumption may be attributed to the ongoing shift towards plant-based diets, reflecting changing dietary preferences among the populace. This shift in dietary preferences poses a challenge to the traditional meat snacks market, requiring manufacturers to adapt and innovate to meet the evolving demands of health-conscious consumers.

Moreover, regions such as North America and Europe are seeing an increase in demand for plant-based meat products. Furthermore, the development of cultured meat products is expected to gain significance, particularly in regions where the acceptability of meat substitutes is comparatively low, such as Asia Pacific, the Middle East, and Africa.

Report Segmentation

The market is primarily segmented based on type, source, category, distribution channel, and region.

|

By Type |

By Source |

By Category |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Meat Snacks Market Segmental Analysis

By Type Analysis

- Jerky segment dominates the meat snacks market, constituting half of total sales, with its appeal rooted in affordability, convenience, and universal taste preferences. Traditionally associated with convenience stores and gas stations, jerky's extended shelf life caters to those seeking non-perishable snacks. Its filling nature makes it a popular choice as a meal supplement. Evolving consumer preferences have led to a shift towards healthier and more natural options, with companies incorporating grass-fed beef, fresh vegetables, reduced sugars, and innovative flavor profiles to meet changing demands.

- Meat sticks is anticipated to hold 7.3% CAGR over forecast period. Meat sticks, including beef sticks, offer a distinct texture compared to traditional beef jerky, with a softer consistency that appeals to consumers for its ease of consumption. These snacks are prized for their high protein content and low carb profile, making them a convenient option for on-the-go individuals. However, their preservation often involves the use of chemical additives like nitrates and nitrites, raising concerns among health-conscious consumers regarding their long-term consumption.

By Source Analysis

- Beef source segment holds over 45.5% share in 2023 Beef jerky's popularity stems from its perceived filling nature, convenience, and health benefits, appealing to a wide range of consumers, particularly those following paleo and keto diets or seeking high-protein snacks. Its long shelf life and variety of flavors further enhance its appeal, leading to its availability across diverse retail outlets. As consumer preferences shift towards grass-fed beef, market leaders like Jack Link's Beef Jerky continue to dominate the meat snacks sector, with beef products contributing significantly to their revenue share.

- Pork source segment is accounted for over 25.4% share in 2023 and forecasted to reached at over 26% in 2032. Pork stands as a versatile and widely consumed meat globally, prized for its high protein content and diverse culinary applications. Pork jerky, known for its tender texture and flavor-absorbing capabilities, offers a spectrum of tastes depending on seasoning choices. Its succulent nature and adaptability to various marinades result in sweet, tangy, or spicy flavors. Pork's higher fat content compared to beef makes it a preferred choice for sausages, contributing to their juiciness and flavor, while its historical availability and affordability further solidify its prominence in culinary traditions worldwide.

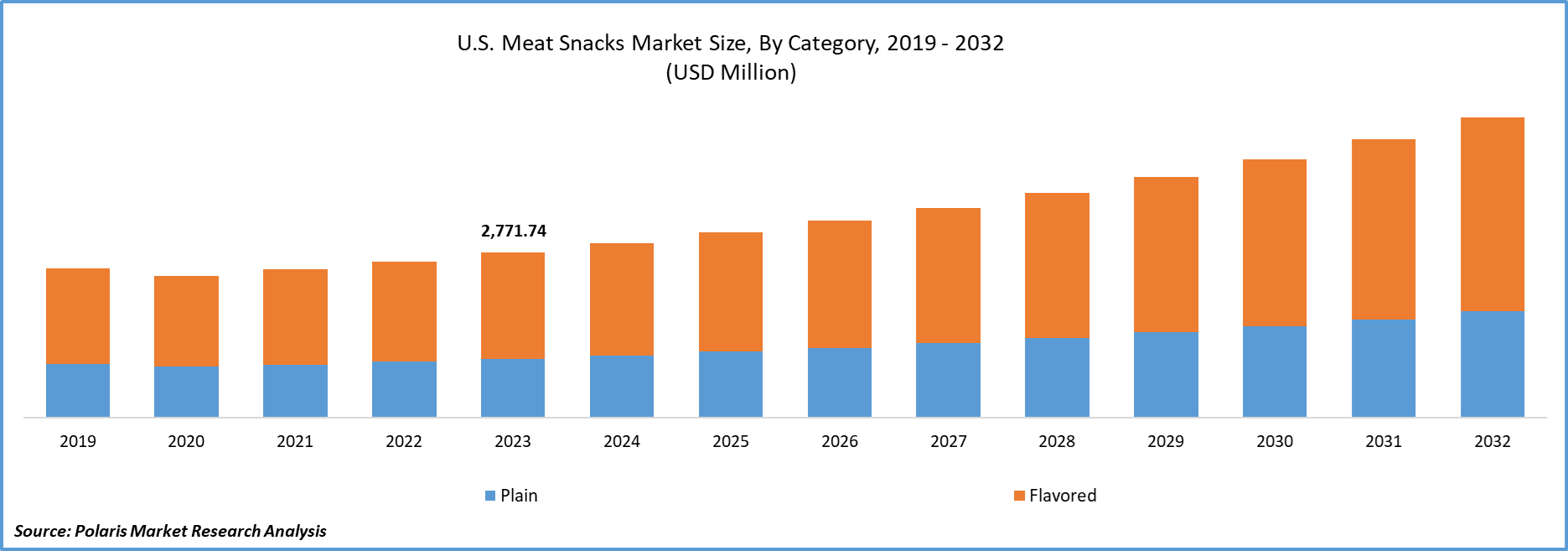

By Category Analysis

- Based on category analysis, the market has been segmented on the basis of plain, and, flavored. Plain category segment anticipated to hold above 34.6% share over the forecast period. Plain or unflavored meat snacks cater to individuals seeking simplicity and the natural taste of meat without added seasonings. These options allow consumers to fully appreciate the inherent qualities of the meat and may attract those with dietary preferences or restrictions, offering simpler ingredient lists without added sugars or artificial flavorings. Examples like traditional beef jerky or plain meat sticks highlight the pure essence of the chosen protein, appealing to purists who value authenticity and minimal processing in their snacks.

- The flavored segment of meat snacks is positioned to dominate the market's revenue share over 64.4% offering consumers a wide array of taste options from classic to exotic flavors. This diversity increases the likelihood of repeat purchases and encourages consumers to explore new flavors, driving overall demand. Additionally, flavored meat snacks' versatility extends beyond snacking, making them suitable for use in various culinary applications, further enhancing their appeal to consumers seeking convenience and satisfaction in their snacks. Recent launches, like Chomps' Habanero Beef and Taco Beef varieties, exemplify the industry's trend towards introducing innovative flavors to meet evolving consumer preferences.

Meat Snacks Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share in 2024

The North America region holds largest share over 38% in 2023. The increasing demand for high-protein, low-carb snacks in North America is propelled by a growing awareness of health and wellness among consumers. Recognizing the role of protein in muscle building, weight management, and satiety, individuals are seeking convenient options that align with their nutritional goals. To cater to this trend, key producers like Jack Link's and Frito-Lay collaborated in April 2023, introducing beef jerky and meat sticks flavored with iconic Doritos tastes. This innovative approach reflects a commitment to providing healthier snack alternatives while meeting consumer preferences for convenience and taste. Through reformulating products with leaner cuts of meat, natural ingredients, and enhanced protein content, North American meat snack producers are contributing to the overall wellness goals of their customer base, highlighting the dynamic nature of the market.

Asia Pacific region is anticipated to hold the 7.3% CAGR over forecast period. The increasing popularity of meat sausages in the Asia Pacific region is fueling the growth of the meat snacks market, driven by their diverse flavors and convenient form. With widespread acceptance among consumers and their versatility for snacking, meat sausages have become a preferred choice, contributing to a surge in demand for meat snacks. Factors such as the growing populations in countries like China and India, coupled with long working hours, are further boosting this trend, as consumers seek convenient and protein-rich snack options to align with healthier snacking habits amidst busy lifestyles.

Competitive Landscape

The meat snacks market is fiercely competitive, driven by factors like evolving consumer tastes, technological advancements, and a focus on innovation and marketing. Players constantly differentiate themselves through unique offerings, competitive pricing, and wide distribution networks. With consumer preferences shifting towards healthier options, companies focus on product differentiation and quality assurance to maintain their competitive edge and capitalize on the growing demand for convenient, protein-rich snacks in an increasingly dynamic market.

Some of the major players operating in the global market include:

- Bridgford Foods Corporation

- Chef's Cut Real Jerky

- Conagra Brands, Inc.

- Country Archer Provisions

- Hormel Foods

- KRAVE PURE FOODS, INC,

- Link Snacks, Inc.

- Oberto

- Old Wisconsin Sausage, Inc.

- People's Choice Beef Jerky

- Perky Jerky

- Tillamook Country Smoker

- Tyson Foods Inc.

- Western's Smokehouse

- Wild Bill's Foods

Recent Developments

- In May 2025, MrBeast partnered with Jack Link’s to launch Beast Packs, a high-protein meat snack line targeting Gen Z and families, expanding his food brand portfolio with beef jerky, biltong, and beef bars worldwide.

- In August 2023, Country Archer Provisions introduced Rosemary Turkey Mini Sticks and Original Beef Jerky Snack Packs, providing health-conscious consumers with clean-label, flavorful, and convenient protein snacks just in time.

- In May 2023, Tyson Foods acquired Williams Sausage Company, Inc., strengthening its capacity and product range, with Emily Billingsley overseeing operations to ensure business continuity.

- In March 2023, Fontanini introduced the groundbreaking Cup & Char Sausage, a game-changing addition to Hormel Foods' portfolio, revolutionizing the pizza topping experience with distinctive Italian flavors and crispy caramelized edges.

- In March 2023, Tyson introduced Chicken Sandwiches and Sliders, offering restaurant-quality taste in the convenience of home, satisfying instant cravings with Original and Spicy options.

Report Coverage

- The meat snacks market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

- The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, source, category, distribution channel, and their futuristic growth opportunities.

Meat Snacks Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 13.5 Billion |

|

Revenue forecast in 2034 |

USD 26.3 Billion |

|

CAGR |

8.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Source, By Category, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Meat Snacks Market Size Worth $ 26.3 Billion By 2034.

Top market players in the Meat Snacks Market are include Link Snacks, Inc., Oberto, Conagra Brands, Inc., Tyson Foods Inc.

North America contribute notably towards the global Meat Snacks Market.

Meat Snacks Market exhibiting the CAGR of 8.70% during the forecast period

The Meat Snacks Market report covering key are type, source, category, distribution channel and region.