Mechanical Ventilators Market Share, Size, Trends, Industry Analysis Report

By Ventilation (Non-invasive, Invasive); By Product; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4570

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

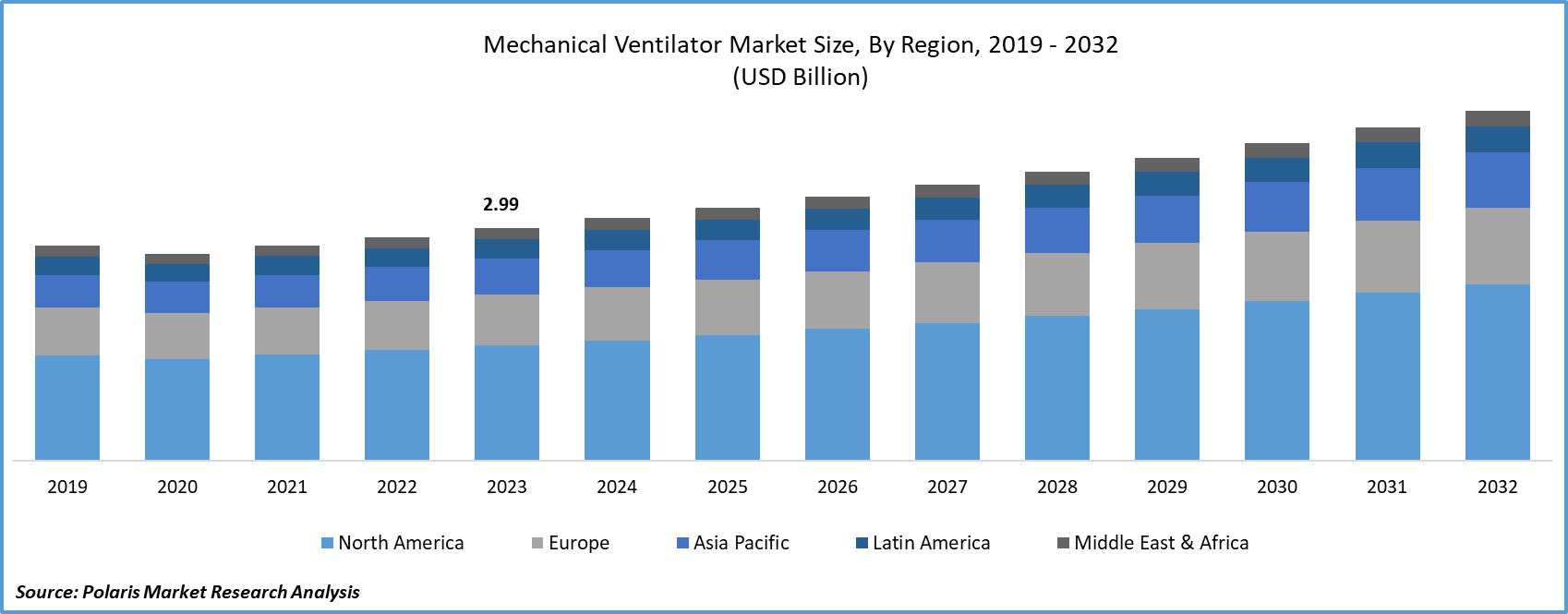

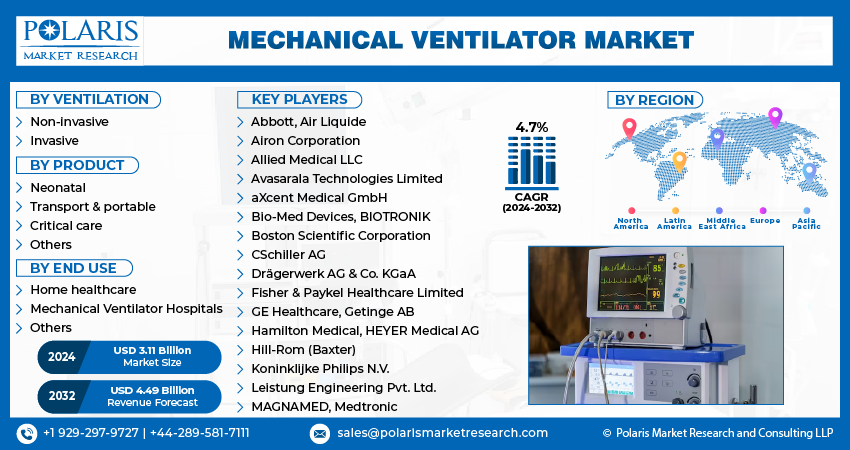

Global mechanical ventilator market size was valued at USD 2.99 billion in 2023. The market is anticipated to grow from USD 3.11 billion in 2024 to USD 4.49 billion by 2032, exhibiting a CAGR of 4.7% during the forecast period

Mechanical Ventilator Market Overview

Mechanical Ventilation functions as a life support measure, utilizing machines called Mechanical Ventilators to assume the respiratory task when an individual is unable to do so independently. In situations where breathing difficulties arise, surgical intervention may be warranted. A physician creates an opening in the person's windpipe, known as the trachea, through a procedure commonly referred to as tracheostomy. Instead of utilizing the person's nose or mouth, air passes through a metal or plastic tube inserted into the tracheostomy opening, termed a tracheostomy tube. Non-invasive ventilation (NIV) involves providing ventilatory support without resorting to an invasive artificial airway, such as an endotracheal tube or tracheostomy tube. The endotracheal tube is utilized to uphold a patient's airway, typically when mechanical ventilation is deemed necessary.

The rising incidence of chronic respiratory ailments, including obstructive sleep apnea, asthma, acute respiratory distress syndrome, pulmonary embolism, exertional dyspnea, and chronic obstructive pulmonary disease (COPD), is driving the mechanical ventilator market size growth. For instance, in October 2023, the data from the National Council on Aging reveals that Obstructive Sleep Apnea (OSA), marked by irregular breathing and diminished oxygen supply to the brain, impacts approximately 39 million adults in the U.S. and an estimated 936 million globally.

To Understand More About this Research: Request a Free Sample Report

Moreover, substantial research and development endeavors concentrating on respiratory interventions, coupled with the introduction of cutting-edge devices, are expected to present profitable growth prospects for the mechanical ventilator market in the foreseeable future. The mechanical ventilator market’s key players are channeling investments into the creation of cost-effective mechanical ventilators, with a supportive regulatory environment aiding in the expansion of the mechanical ventilator market revenue.

For instance, in July 2022, Nihon Kohden OrangeMed, Inc. secured clearance from the U.S. FDA for the NKV-330 Ventilator System, a non-invasive solution crafted to provide respiratory support in emergencies.

Within the market, there is a notable focus on innovation to improve patient overall treatment results, comfort, compliance, and efficacy. The incorporation of smart technology and digital sensors is a key factor in enhancing therapy management, contributing significantly to the mechanical ventilator market's growth.

The mechanical ventilator industry is experiencing an increase in mergers and acquisitions, with companies strategically employing multiple acquisitions to integrate technologies, fortify their position, enhance product portfolios, expand global reach, and diversify offerings within the industry.

mechanical ventilator Market Dynamics

Market Drivers

Increasing Incidence of Respiratory Conditions Bolstering the Growth of the Mechanical Ventilator Market Share

The rising incidence of chronic obstructive pulmonary disease (COPD) and other respiratory conditions, including hypoxemia, sleep apnea, and acute lung injury, serves as a primary driver for mechanical ventilator market growth. Additionally, the increasing rates of premature births and the rapidly growing elderly population are expected to contribute to overall market expansion. The prevalence of smoking, a significant factor leading to respiratory diseases, is anticipated to boost the mechanical ventilator market's CAGR.

Additionally, with the benefits of home healthcare, including convenience, comfort, and cost advantages, the mechanical ventilator market trends is poised to increase the mechanical ventilator market size. Moreover, the expanding healthcare infrastructure and rising disposable income are set to drive the demand for home healthcare, emerging as a major market driver. Furthermore, the growing awareness of respiratory diseases among patients is a key factor fueling market growth during the forecast period.

Market Restraints

Threats Linked to the Utilization of Mechanical Ventilators are Likely to Hamper the Growth of the Market

The utilization of mechanical ventilators poses several hazards and risks in medical settings. One significant risk is barotrauma, wherein excessive air pressure during mechanical ventilation can cause lung damage, leading to conditions like pneumothorax. Infections are another concern, as the use of ventilators may introduce bacteria, increasing the likelihood of ventilator-associated pneumonia. Prolonged exposure to high levels of oxygen, a common component in mechanical ventilation, may result in oxygen toxicity, causing lung inflammation. Ventilator-induced lung injury (VILI) can occur due to the mechanical forces exerted on delicate lung tissues. Cardiovascular effects, such as changes in blood pressure and the risk of ventilator-associated events, further contribute to the complexity of managing patients on mechanical ventilation. Technical issues, disconnection problems, and complications during weaning off ventilation add to the array of challenges associated with ensuring patient safety during mechanical ventilation procedures. Healthcare professionals need to vigilantly monitor patients, implement preventive measures, and address potential issues promptly to mitigate these hazards.

Report Segmentation

The market is primarily segmented based on ventilation, product, end-use, and region.

|

By Ventilation |

By Product |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Mechanical Ventilator Market Segmental Analysis

By Product Analysis

In 2023, the largest mechanical ventilator market share was held by the transport and portable mechanical ventilator segment, which is expected to exhibit the fastest CAGR. The effectiveness of mechanical ventilators in diverse applications across various care delivery settings drives the growth of this segment. The development of portable devices that are cost-effective and patient-friendly contributes to their growing adoption.

Portable ventilators find varied applications, extending from ambulatory centers to home care. The expanding point-of-care treatment market is fueled by a rise in emergencies of medical, a pivotal factor contributing to the segment's growth. Hospitals are actively endorsing movable ventilators that enable convenient and rapid care of patients, ensuring smooth transitions from hospital beds to ambulances. Additionally, the trend toward home care, gaining popularity among patients seeking flexible healthcare options, is fostered by the availability of portable ventilators.

By Ventilation Analysis

The non-invasive ventilation segment, expected to experience the fastest growth, dominated the market share in the forecast period. This growth is credited to its extensive applications and its capability to deliver precise and elevated oxygen concentrations. The non-invasive ventilation supply is facilitated by intensive advanced-care ventilators equipped with various respiratory support modes.

Substantial investments in R&D, coupled with increasing per capita income, are propelling the expansion of the healthcare industry. The escalation in the incidence of respiratory disorders emerges as a pivotal factor driving the market growth for Continuous Positive Airway Pressure (CPAP) devices. These devices play a critical role in emergency scenarios and hospital settings, acting as an effective source of oxygen for individuals grappling with respiratory challenges. Moreover, for patients who are seeking heart treatments, these CPAP devices provide oxygen. These combined factors contribute significantly to the projected market growth throughout the forecast period.

Mechanical Ventilator Market Regional Insights

The North American Region Dominated the Global Market with the Largest Market Share in 2023

It is ascribed to elements such as the increasing incidence of COPD (chronic obstructive pulmonary disease) and respiratory disorders, a robust healthcare infrastructure, and prominent market participants in the region; the growth of the North American market is notable. Players in the North American market consistently prioritize product development and partnership strategies to broaden their business offerings in the region. Moreover, the United States medical ventilator market dominated with the largest market share, while the Canadian Medical Ventilator market exhibited the fastest growth in the North American region.

The Asia Pacific region is poised to experience substantial growth at the fastest CAGR during the forecast period. This growth is linked to the elevated prevalence of respiratory disorders and increased risk due to lifestyle factors like allergies and smoking, leading to various respiratory conditions. Additionally, government initiatives aimed at bolstering ventilator production and collaborative efforts among manufacturers to create advanced ventilators to meet heightened demand are contributing to the region's growth.

Competitive Landscape

The mechanical ventilator market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Abbott

- Air Liquide

- Airon Corporation

- Allied Medical LLC (A Flexicare Company)

- Avasarala Technologies Limited

- aXcent Medical GmbH

- Bio-Med Devices

- BIOTRONIK

- Boston Scientific Corporation

- CSchiller AG

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Limited

- GE Healthcare

- Getinge AB

- Hamilton Medical

- HEYER Medical AG

- Hill-Rom (Baxter)

- Koninklijke Philips N.V.

- Leistung Engineering Pvt. Ltd.

- MAGNAMED

- Medtronic

Recent Developments

- In January 2023, Getinge introduced its newest mechanical ventilator, the Servo-c, designed to offer lung-protective therapeutic features for both pediatric and adult patients. The Servo-c employs modular components, enabling intelligent fleet management to ensure maximum uptime and cost reduction, eliminating the need for proprietary disposables. Furthermore, the Servo-c is equipped with CO2 monitoring and Servo Compass technology.

- In January 2023, OES Medical unveiled a novel mains-powered ICU ventilator at the ABHI UK Pavilion during Arab Health 2023, aiming to assist hospitals in managing oxygen demand.

- In May 2022, CorVent Medical secured CE Mark clearance and commenced the sale of their RESPOND-19 Ventilator in Europe. This system is designed to enable hospitals to improve the management of critically ill patients with acute respiratory distress syndrome, offering a user-friendly and adaptable augmentation of critical care ventilation capacity (ARDS).

Report Coverage

The mechanical ventilator market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, ventilation, product, end-use, and futuristic growth opportunities.

Mechanical Ventilator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.11 billion |

|

Revenue Forecast in 2032 |

USD 4.49 billion |

|

CAGR |

4.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Ventilation, By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Medical Ventilators market size is expected to reach USD 4.49 billion by 2032

Key players in the market are Abbott, Air Liquide, Airon Corporation, Allied Medical LLC (A Flexicare Company), Avasarala Technologies Limited

North American contribute notably towards the global Medical Ventilators Market

Medical Ventilators Market exhibiting a CAGR of 4.7% during the forecast period

The Medical Ventilators Market report covering key segments are ventilation, product, end-use, and region.