Medical Device Cleaning Market Size, Share, Trends, Industry Analysis Report

: By Device, Technique, EPA Classification (High Level, Intermediate Level, and Low Level), Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM1885

- Base Year: 2024

- Historical Data: 2020-2023

Medical Device Cleaning Market Overview

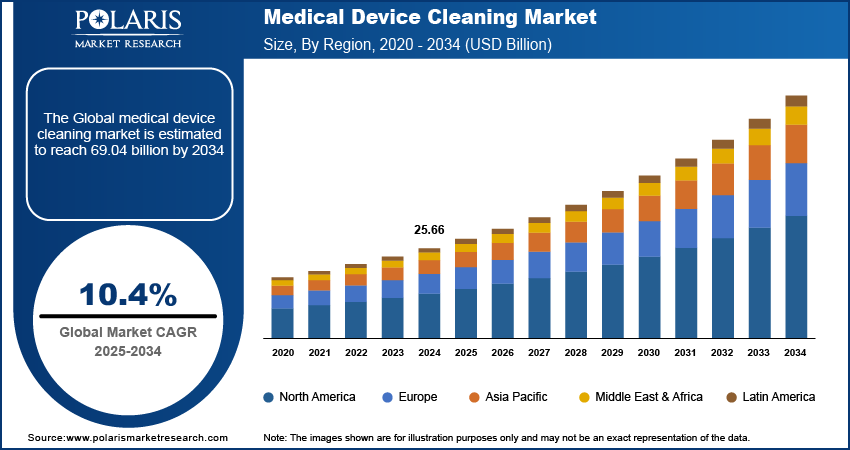

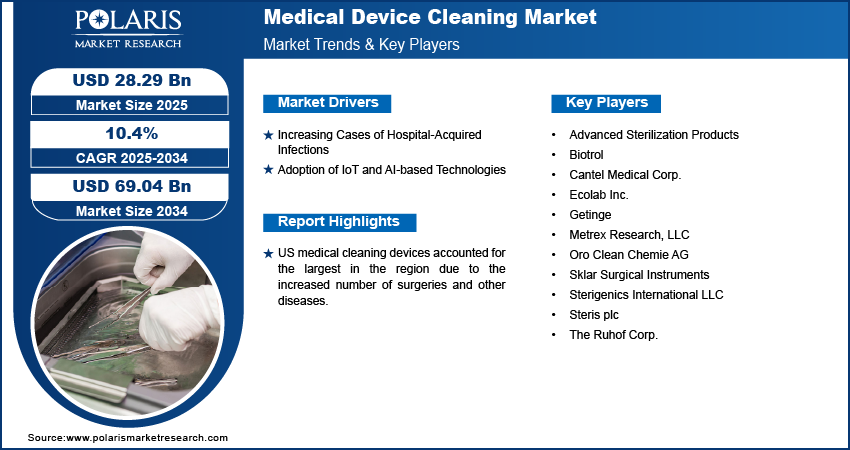

The medical device cleaning market size was valued at USD 25.66 billion in 2024. The market is projected to grow from USD 28.29 billion in 2025 to USD 69.04 billion by 2034, exhibiting a CAGR of 10.4% from 2025 to 2034.

Medical device cleaning is crucial for ensuring devices such as surgical equipment, ventilators, oxygen masks, and others are thoroughly cleaned and disinfected.

There is a growing demand for cleaning services to improve patient health with the increasing prevalence of infectious diseases such as tuberculosis and diarrhea. This increases the adoption of medical cleaning devices. Moreover, rising concerns about individual health are driving growth in the medical device cleaning market.

To Understand More About this Research: Request a Free Sample Report

The increasing frequency of pandemics has led to a substantial rise in demand for cleansing devices. For instance, the COVID-19 pandemic has driven growth in the medical device cleaning market. In healthcare industries, there was an increased risk of COVID-19 contamination on environmental surfaces, particularly in areas where medical procedures were performed and where COVID-19 patients were treated. Consequently, thorough cleaning and disinfection of the surfaces became essential to prevent further transmission of the virus. Furthermore, the need for cleaning and disinfection extended to isolating COVID-19 patients with mild to moderate symptoms. To mitigate the risk of COVID-19, cleaning devices were significantly used and became a key factor driving market expansion.

Medical Device Cleaning Market Trends and Drivers Analysis

Increasing Cases of Hospital-Acquired Infections

The medical device cleaning market is being driven by the increasing incidence of hospital-acquired infections (HAIs). Conditions such as urinary tract infections (UTIs), surgical site infections (SSIs), and methicillin-resistant Staphylococcus aureus (MRSA) infections represent the most prevalent HAIs. The heightened susceptibility to infections caused by drug-resistant pathogens, bloodborne pathogens, and other infectious agents in operating rooms is a major area of concern for healthcare facilities. For example, the frequent use of urinary catheters raises the risk of UTIs and may lead to catheter-associated urinary tract infections (CAUTIs).

According to the European Centre for Disease Prevention and Control, Europe witnesses 3.5 million cases of HAIs annually, resulting in 90,000 fatalities. However, the implementation of preventive measures has led to a significant increase in the demand for medical device cleaning and is driving market growth.

Adoption of IoT and AI-based Technologies

The medical device cleaning market is experiencing significant growth, driven by the adoption of Internet of Things (IoT) and artificial intelligence (AI)-based technologies. The rapid pace of technological progress is facilitating the integration of IoT into medical devices to improve cleanliness and safety. Furthermore, the utilization of IoT in sterilization equipment is notably propelling the market forward. Advanced technologies are transforming traditional cleaning devices, offering more efficient, precise, and sustainable solutions. For instance, the introduction of mobile, intelligent networking, and highly efficient ultraviolet light machines for environmental disinfection demonstrates the effectiveness of these machines in maintaining clean and safe environments.

In the medical field, UV robots are employed as automated systems to oversee and maintain a safe environment. These robots serve to enhance current cleaning protocols and elevate general hygiene standards. Therefore, innovations in medical cleaning devices are driving medical device cleaning market growth.

Medical Device Cleaning Market Segment Analysis

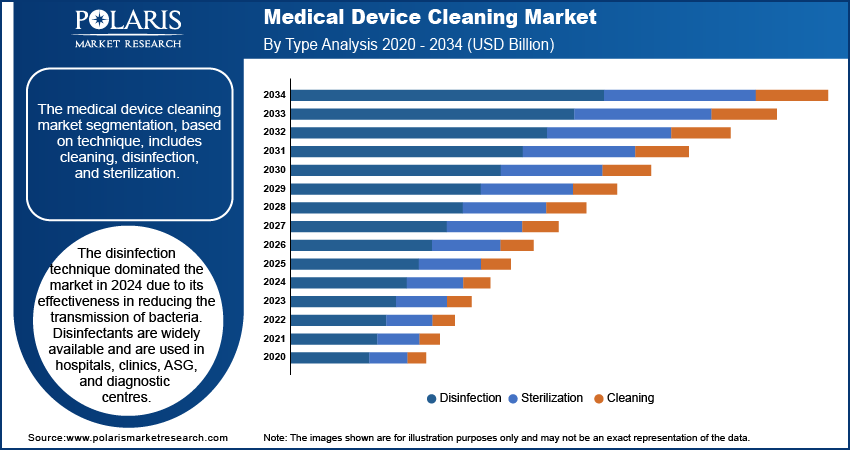

Medical Device Cleaning Market Assessment by Technique

The medical device cleaning market segmentation, based on technique, includes cleaning, disinfection, and sterilization. The disinfection technique dominated the market in 2024 due to its effectiveness in reducing the transmission of bacteria. Disinfectants are widely available and are used in hospitals, clinics, ASG, and diagnostic centers. The different variants of disinfectants, such as disinfectant solutions, sprays, and others, are driving segment growth. Further, large medical devices like patient’s beds require regular cleaning, which is clenaed by disinfectant solutions, thereby contributing to the segments dominant position.

Medical Device Cleaning Market Breakdown by Application Insights

The medical device cleaning market segmentation, based on application, includes surgical instruments, endoscopes, ultrasound probes, dental instruments, and other. The surgical instruments segment is expected to dominate the market due to the rising number of surgeries and increased risk of disease transmission. Surgical instruments are reusable devices that can contain blood, tissues, bacteria, microorganisms, and other fluids. Consequently, the transmission of diseases, bacteria, or blood can lead to infections in other patients' bodies. Henceforth, surgical instruments require high-level disinfection and sterilization, which is driving the medical device cleaning market growth.

Improper cleaning of surgical instruments leads to an increased number of surgical site infections. The Centers for Disease Control (CDC) states that surgical site infection occurs in 2% of surgeries. Hence, to prevent SSI, various cleaning devices, such as ultrasonic cleaning devices, disinfectors, and others, are used. This, in turn, drives market growth.

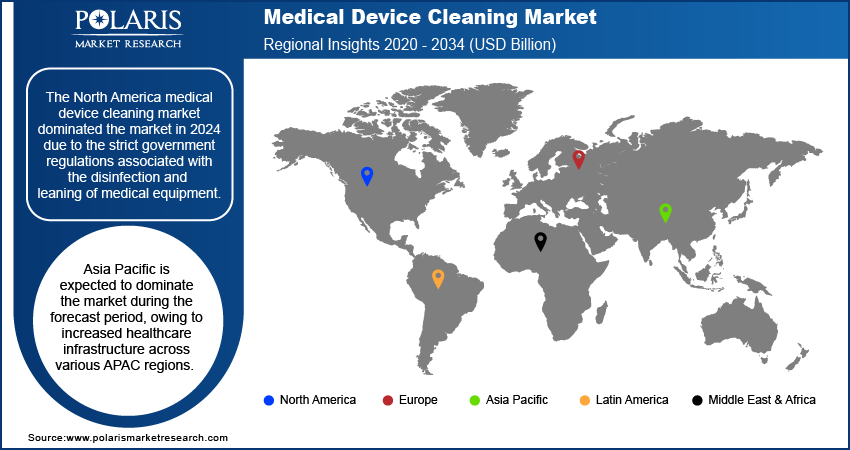

Medical Device Cleaning Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The North America medical device cleaning market dominated the market in 2024 due to the strict government regulations associated with the disinfection and cleaning of medical equipment. In addition, the presence of major companies such as Steris PLC, Ecolab Inc., Cantel Medical Corporation, and others offering their services further strengthens the market landscape in North America. The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

US medical cleaning devices accounted for the largest in the region due to the increased number of surgeries and other diseases. In addition, the rising cancer cases have created a greater demand for a healthy and clean environment in hospitals and clinics, which is rising market growth. For instance, the American Cancer Society recorded 287,850 cases of cancer in the United States in 2022. Furthermore, the US government has introduced initiatives and policies to encourage the use of medical cleaning devices and maintain hygiene across areas. The training programs organized by the government to encourage cleanliness in hospitals are also contributing to the market expansion. For instance, the WASH (water, sanitation, and hygiene) initiative was introduced to facilitate water and sanitation infrastructure, which has increased demand for automated sanitation devices and consequently boosted market revenue.

Asia Pacific is expected to dominate the market during the forecast period, owing to increased healthcare infrastructure across various APAC regions. China is significantly driving the market due to increased expenditure on research & development, which leads to innovation in the healthcare sector. The rise of the pandemic in China has increased the demand for medical cleaning devices. Moreover, the integration of technology has created various automated devices that are used for cleaning medical equipment. Government licensing to manufacture medical cleaning devices or disinfectant solutions has also enhanced the production of high-quality disinfectants. For instance, policies for government registrations, including Measures on Disinfectant Administration issued by the Ministry of Health (MOH) and others, are aimed at manufacturing harmless medical cleaning solutions. Therefore, China is significantly boosting thee medical device cleaning market revenue.

Medical Device Cleaning Market – Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their product lines, which will help the medical device cleaning market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the medical device cleaning market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the medical device cleaning market to benefit clients and increase the market sector. In recent years, the market for medical device cleaning has offered some technological advancements. Major players in the medical device cleaning market include Steris plc; Sklar Surgical Instruments; GetingeAB; Advanced Sterilization Products; The Ruhof Corp.; Biotrol, Metrex Research, LLC; Oro Clean Chemie AG; Sterigenics International LLC; Cantel Medical Corp.; and Getinge Group, Ecolab Inc.

STERIS is a US-based company that specializes in providing advanced medical products and services with a focus on infection control. Their offerings encompass a wide range of products and services, including sterilization and washing equipment, surgical tables, lights, equipment management systems, instrument and scope repair solutions, as well as surface disinfectants, cleaners, alcohol, and other related items. The pharmaceutical disinfectants produced by the company include Coverage Plus NPD Disinfectant, LpH III st Phenolic Disinfectant, and others.

Sterigenics, a US-based company, is a prominent manufacturer of sterilization solutions. They specialize in developing advanced technology products such as Ethylene Oxide Sterilization, Gamma Irradiation, Electron Beam Sterilization, and Noxilizer (NO2 Sterilizer). Their services extend across diverse industries, including medical devices, pharmaceutical and bioprocessing, food and commercial products, packaging, and advanced radiation processing. In May 2022, Sterigenics announced increased electron beam sterilization capacity to support industry needs.

Key Companies in the Medical Device Cleaning Market

- Advanced Sterilization Products

- Biotrol

- Cantel Medical Corp.

- Ecolab Inc.

- Getinge

- Metrex Research, LLC

- Oro Clean Chemie AG

- Sklar Surgical Instruments

- Sterigenics International LLC

- Steris plc

- The Ruhof Corp.

Medical Device Cleaning Market Developments

June 2024: Ecolab with Repligen Corporation announced the commercial launch of Purolite’s DurA Cycle, a protein A chromatography resin for large-scale purification processes.

July 2024: Gentige partnered with Universeum to initiate sustainable development and research activities. The partnership aims to provide knowledge about sustainable development and expand its customer base.

October 2023: Advanced Sterilization Products expanded its sterilization monitoring portfolio with new Steam Monitoring products aimed at enhancing sterility with greater efficiency.

Medical Device Cleaning Market Segmentation

By Device Outlook (Revenue – USD Billion, 2020–2034)

- Non-Critical

- Semi-Critical

- Critical

By Technique Outlook (Revenue – USD Billion, 2020–2034)

- Cleaning

- Disinfection

- Sterilization

By EPA Classification Outlook (Revenue – USD Billion, 2020–2034)

- High Level

- Intermediate Level

- Low Level

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Surgical Instruments

- Endoscopes

- Ultrasound Probes

- Dental Instruments

- Other

By End Users Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals and Clinics

- Diagnostic Centers

- Dental Clinics and Hospitals

- Other

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Device Cleaning Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.66 billion |

|

Market Size Value in 2025 |

USD 28.29 billion |

|

Revenue Forecast in 2034 |

USD 69.04 billion |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The medical device cleaning market size was valued at USD 25.66 billion in 2024 and is projected to grow to USD 69.04 billion by 2034.

The market is projected to grow at a CAGR of 10.4% from 2025 to 2034.

North America had the largest share of the market.

The key players in the market are Steris plc; Sklar Surgical Instruments; GetingeAB; Advanced Sterilization Products; The Ruhof Corp.; Biotrol, Metrex Research, LLC; Oro Clean Chemie AG; Sterigenics International LLC; Cantel Medical Corp.; Getinge Group; and Ecolab Inc.

The disinfection technique dominated the market in 2024.

The surgical instruments had the largest share in the market.