Medical Gas Application & Equipment Market Size, Share, Trends, Industry Analysis Report

By Gas Type (Medical Oxygen, Helium), By Equipment Type, By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6385

- Base Year: 2024

- Historical Data: 2020-2023

Overview

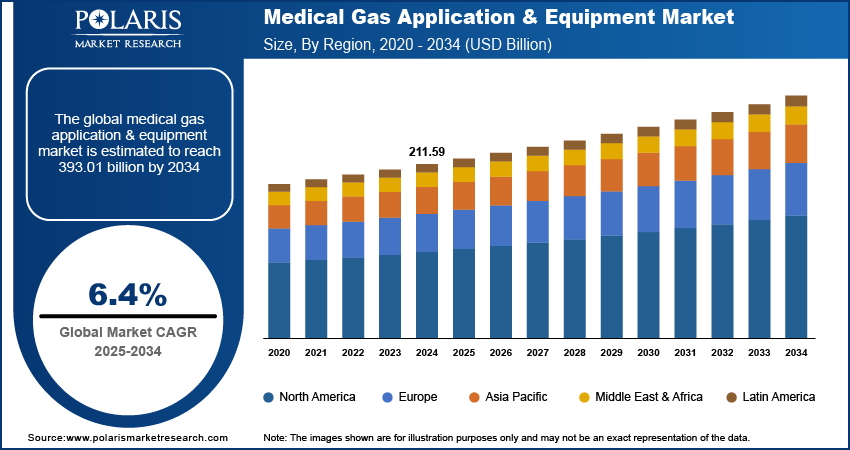

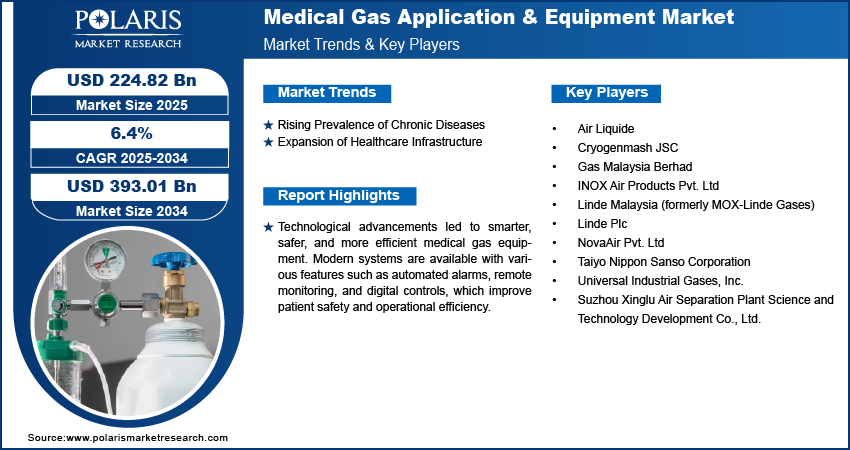

The global medical gas application & equipment market size was valued at USD 211.59 billion in 2024, growing at a CAGR of 6.4% from 2025 to 2034. The market growth is driven by rising prevalence of chronic diseases and expansion of healthcare infrastructure.

Key Insights

- In 2024, the medical oxygen segment held the largest market share, primarily driven by the increasing prevalence of respiratory conditions such as COPD, pneumonia, and COVID-19 complications that have amplified the demand for oxygen therapy.

- The pharmaceutical manufacturing and research segment is anticipated to register notable growth during the forecast period, owing to the critical role medical gases play in drug production processes and laboratory-based applications.

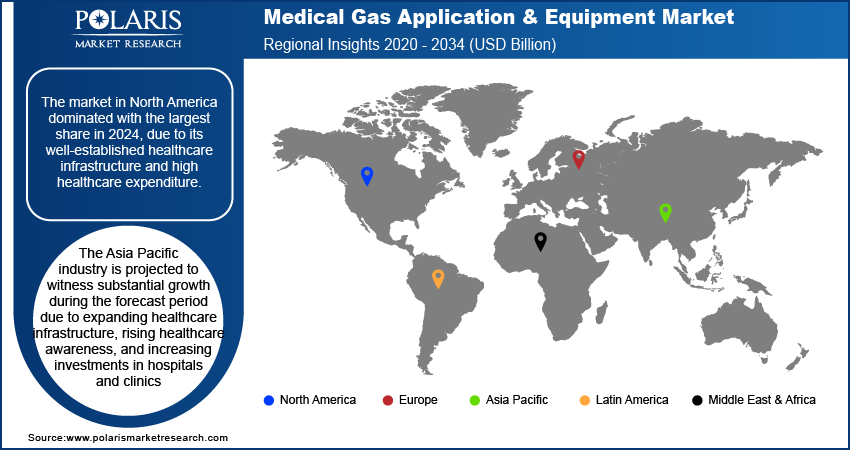

- North America led the global market in 2024, supported by its advanced healthcare infrastructure, high medical spending, and strong adoption of modern gas delivery systems.

- The U.S. market is expected to witness robust growth over the forecast period, fueled by a high demand for medical oxygen and anesthetic gases, along with the presence of sophisticated healthcare facilities.

- The Asia Pacific market is projected to experience rapid expansion during the forecast period. The growth is driven by growing investments in healthcare infrastructure, rising awareness of medical services, and increasing hospital development across the region.

Industry Dynamics

- Rising prevalence of chronic diseases drives the demand for medical gases.

- Expansion of healthcare infrastructure is fueling the industry growth.

- Technological advancement has led to smarter, safer, and more efficient medical gas equipment.

- High implementation costs restrain the growth of the industry.

Market Statistics

- 2024 Market Size: USD 211.59 billion

- 2034 Projected Market Size: USD 393.01 billion

- CAGR (2025–2034): 6.4%

- North America: Largest market in 2024

AI Impact on Medical Gas Application & Equipment Market

Medical gas equipment refers to the devices and systems used to store, regulate, and deliver medical gases such as oxygen, nitrous oxide, and medical air in healthcare settings. This includes cylinders, flowmeters, regulators, manifolds, gas pipelines, and alarm systems. These tools ensure the safe, precise, and continuous delivery of gases for patient care, surgeries, anesthesia, and respiratory therapy.

The number of surgeries performed worldwide is rising due to advancements in medical technology and greater access to healthcare. Surgeries, whether minor or major, require a constant and controlled supply of medical gases such as oxygen, nitrous oxide, and anesthetic gases. Equipment such as flowmeters, vacuum regulators, and anesthesia devices are critical in operating rooms. Hospitals and clinics need to upgrade or expand their gas delivery infrastructure as elective procedures, trauma care, and emergency surgeries increase. This growing volume of surgical procedures fuels the demand for reliable medical gas systems and related equipment, thereby fueling the growth.

Technological advancements led to smarter, safer, and more efficient medical gas equipment. Modern systems are available with various features such as automated alarms, remote monitoring, and digital controls, which improve patient safety and operational efficiency. Portable devices have become lighter and more durable, making them ideal for home or mobile healthcare settings. These advancements reduce human error, ensure consistent gas flow, and improve maintenance scheduling. The demand for upgraded medical gas solutions rises as healthcare providers increasingly adopt these newer technologies. Continuous R&D investments in smart and connected medical gas equipment is driving the growth.

Drivers & Opportunities

Rising Prevalence of Chronic Diseases: The cases of chronic diseases such as asthma, chronic obstructive pulmonary disease (COPD), and cardiovascular conditions are increasing globally. According to the Global Initiative for Asthma, asthma affects 260 million people every year globally. These conditions require long-term oxygen therapy and frequent hospital visits, which boosts the demand for medical gas equipment such as oxygen cylinders, concentrators, and pipeline systems. The burden of chronic illnesses rises, especially in both developed and emerging nations, as populations age and lifestyles become more sedentary. Hospitals, clinics, and home healthcare setups need reliable gas delivery systems to treat these patients, thereby driving the growth.

Expansion of Healthcare Infrastructure: Governments and private sectors worldwide are heavily investing in improving healthcare infrastructure. According to the Commonwealth of Australia, Australia alone invested approximately 33.9 billion in healthcare infrastructure in 2024–2025. New hospitals, surgical centers, and diagnostic labs are being built, especially in developing countries. Every modern medical facility requires gas pipeline systems, manifolds, and gas monitoring equipment to provide essential care. This expansion directly increases the demand for medical gas equipment across regions. Additionally, upgrading old hospitals with advanced gas management systems is further driving growth. The need for safe and efficient medical gas equipment rises significantly as healthcare becomes more accessible and advanced in both rural and urban areas, thereby driving the growth.

Segmental Insights

Gas Type Category Analysis

The segmentation, based on gas type, includes medical oxygen, helium, nitrous oxide, carbon dioxide, nitrogen, and others. In 2024, the medical oxygen segment dominated with the largest share due to rising cases of respiratory diseases such as COPD, pneumonia, and COVID-19 complications, increasing the demand for oxygen therapy. Hospitals and homecare providers rely heavily on oxygen for critical care and emergency treatment, making it essential. Technological improvements in oxygen concentrators and portable oxygen systems further contributed to higher adoption rates. Furthermore, the expanding elderly population requiring long-term respiratory support boosts the growth. Government initiatives to improve healthcare infrastructure and the increasing awareness of oxygen therapy’s benefits in managing respiratory ailments further drive growth in the medical oxygen segment.

Equipment Type Analysis

The segmentation, based on equipment type, includes respiratory devices, gas delivery systems, gas storage and transport, gas monitoring systems, and others. The gas delivery systems segment accounted for significant growth as healthcare facilities upgraded to safer and more efficient delivery technologies. Centralized pipeline systems, automated flow regulators, and monitoring devices are increasingly adopted to ensure a consistent and precise gas supply. Regulatory standards emphasizing patient safety and reducing risks associated with manual handling propel this demand. Additionally, hospitals and clinics focus on reducing gas wastage and improving operational efficiency, which drives investments in advanced delivery systems. The rising number of healthcare facilities in emerging markets further supports the expansion of gas delivery infrastructure, fueling growth in this segment.

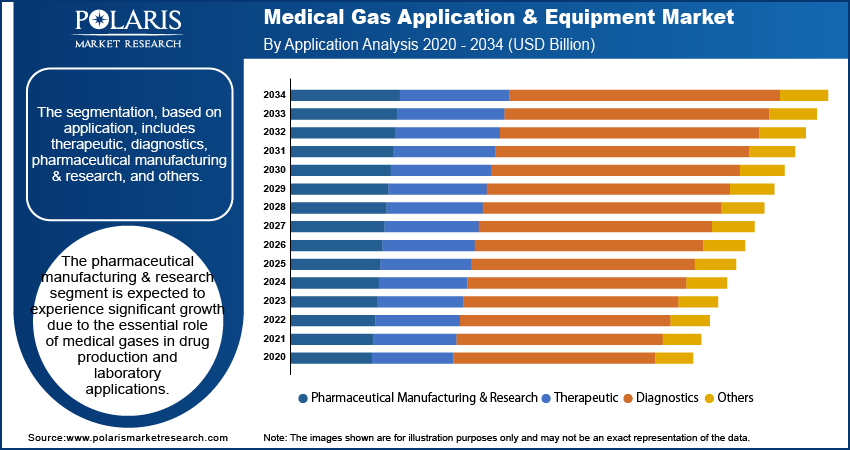

Application Analysis

The segmentation, based on application, includes therapeutic, diagnostic, pharmaceutical manufacturing & research, and others. The pharmaceutical manufacturing & research segment is expected to experience significant growth during the forecast period. The growth is attributed to the essential role of medical gases in drug production and laboratory applications. High-purity gases are required in synthesis, sterilization, and packaging processes to maintain product quality and safety. Increasing investments in pharmaceutical R&D, especially in biologics and personalized medicines, boost demand. Contract manufacturing organizations expanding globally contribute to the rising need for reliable gas supplies. Government support and regulations promoting pharmaceutical innovation further encourage the use of medical gases, thereby boosting the segment growth.

End User Analysis

The segmentation, based on end user, includes hospitals, clinics, ambulatory surgical centers, home healthcare, academic & research institutions, pharmaceutical & biotechnology companies, and others. The hospitals segment dominated with the largest share driven by the critical need for gases in surgeries, anesthesia, respiratory therapies, and emergency care. The increasing number of hospital beds and expanding healthcare infrastructure worldwide, especially in developing regions, fuel demand. Investments in advanced medical equipment that rely on specific gases, such as ventilators and anesthesia machines, further boost this segment. Emphasis on patient safety and compliance with healthcare standards compels hospitals to upgrade and maintain reliable gas supply systems, thereby fueling the segment growth.

Regional Analysis

North America Medical Gas Application & Equipment Market Trends

The market in North America dominated with the largest share in 2024, due to its well-established healthcare infrastructure and high healthcare expenditure. The region benefits from advanced medical technologies and stringent regulatory standards that drive the adoption of high-quality medical gases and equipment. The growing prevalence of chronic diseases such as respiratory disorders and cancer fuels demand for oxygen and anesthetic gases. Additionally, increasing home healthcare services and the rising geriatric population support growth. The presence of major market players investing in R&D and product innovation further fuels the growth in the region.

U.S. Medical Gas Application & Equipment Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, driven by advanced healthcare facilities and high demand for medical oxygen and anesthesia gases. Increasing cases of chronic respiratory diseases and COVID-19-related complications have accelerated oxygen therapy usage. Government initiatives to improve healthcare access and infrastructure further boost growth. The country’s focus on patient safety, compliance with strict regulatory norms, and rapid adoption of smart gas delivery and monitoring systems support the growth. Moreover, investments in medical research and expanding hospital capacities fuel demand for medical gas equipment across the U.S.

Asia Pacific Medical Gas Application & Equipment Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period due to expanding healthcare infrastructure, rising healthcare awareness, and increasing investments in hospitals and clinics. Countries such as India, Japan, and South Korea are expanding their medical facilities to cater to growing populations and rising chronic disease cases. The region’s improving healthcare affordability and government initiatives promoting healthcare access drive demand for medical gases, especially oxygen. Additionally, growing industrial and pharmaceutical sectors in Asia Pacific contribute to increased use of gases for medical research and manufacturing, thereby driving the growth.

China Medical Gas Application & Equipment Market Outlook

The China industry is projected to witness substantial growth during the forecast period, driven by its massive population and expanding healthcare system. Government healthcare reforms and investments in modernizing hospitals increase the demand for medical oxygen and gas delivery systems. The rising prevalence of respiratory and cardiovascular diseases further drives oxygen therapy needs. China’s growing pharmaceutical manufacturing sector further boosts demand for high-purity gases. Additionally, increasing urbanization and awareness about healthcare services encourage the adoption of advanced medical gas equipment, thereby driving the growth.

Europe Medical Gas Application & Equipment Market Overview

The industry in Europe is expected to experience significant growth in the future, due to its advanced healthcare infrastructure and strict regulatory environment that ensures high product standards. The region has a significant aging population, which increases demand for medical oxygen and related therapies. The growing prevalence of chronic respiratory diseases and increasing surgical procedures further boost the use of anesthetics and specialty gases. Investments in hospital modernization and expanding home healthcare services further drive growth. Additionally, Europe benefits from technological advancements in gas delivery systems and monitoring equipment, supporting efficient and safe medical gas usage across hospitals and clinics, thereby driving the growth.

Germany Medical Gas Application & Equipment Market Outlook

The market in Germany is expected to experience significant growth during the forecast period, driven by its robust healthcare system and high healthcare spending. The country’s aging population and rising chronic disease burden, especially respiratory and cardiovascular conditions, significantly drive the demand for medical oxygen. Germany further has a strong pharmaceutical and medical devices industry, contributing to increased use of medical gases in research and manufacturing. Stringent government regulations on product safety and quality ensure widespread adoption of advanced gas delivery and monitoring equipment. Furthermore, continuous investments in hospital infrastructure modernization positively impact the growth of the industry.

Key Players and Competitive Analysis

The medical gas application and equipment market is highly competitive, with a mix of global giants and regional specialists driving innovation and market penetration. A few major players such as Air Liquide, Linde Plc, and Taiyo Nippon Sanso Corporation dominate the landscape with extensive product portfolios that include gas delivery systems, pipeline infrastructure, and advanced monitoring technologies. These companies benefit from strong global distribution networks and continuous investment in R&D. INOX Air Products Pvt. Ltd, Linde Malaysia, and Gas Malaysia Berhad contribute significantly within Asia, offering localized expertise and cost-effective solutions tailored to regional healthcare needs. Cryogenmash JSC and Suzhou Xinglu play critical roles in specific markets with specialized production capabilities. Emerging players such as NovaAir Pvt. Ltd and Universal Industrial Gases, Inc. are also gaining traction by offering flexible, scalable solutions in developing regions. The competitive dynamics are further shaped by strategic partnerships, facility expansions, and technology upgrades aimed at enhancing supply reliability and service efficiency.

Key Players

- Air Liquide

- Cryogenmash JSC

- Gas Malaysia Berhad

- INOX Air Products Pvt. Ltd

- Linde Malaysia (formerly MOX-Linde Gases)

- Linde Plc

- NovaAir Pvt. Ltd

- Suzhou Xinglu Air Separation Plant Science and Technology Development Co., Ltd.

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

Medical Gas Application & Equipment Industry Developments

In May 2023, Luxfer Gas Cylinders introduced the G-Stor Go H2 Type 4 hydrogen cylinder, designed for high-pressure storage up to 350 bar. The lightweight, low-permeation solution targeted fuel cell transit, heavy-duty transport, and bulk hydrogen applications across global markets.

Medical Gas Application & Equipment Market Segmentation

By Gas Type Outlook (Revenue, USD Billion, 2020–2034)

- Medical Oxygen

- Helium

- Nitrous Oxide

- Carbon Dioxide

- Nitrogen

- Others

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Respiratory Devices

- Gas Delivery Systems

- Gas Storage and Transport

- Gas Monitoring Systems

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Therapeutic

- Diagnostics

- Pharmaceutical Manufacturing & Research

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Healthcare

- Academic & Research Institutions

- Pharmaceutical & Biotechnology Companies

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Medical Gas Application & Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 211.59 Billion |

|

Market Size in 2025 |

USD 224.82 Billion |

|

Revenue Forecast by 2034 |

USD 393.01 Billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 211.59 billion in 2024 and is projected to grow to USD 393.01 billion by 2034.

The global market is projected to register a CAGR of 6.4% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Air Liquide, Cryogenmash JSC, Gas Malaysia Berhad, INOX Air Products Pvt. Ltd, Linde Malaysia (formerly MOX-Linde Gases), Linde Plc, NovaAir Pvt. Ltd, Suzhou Xinglu Air Separation Plant Science and Technology Development Co., Ltd., Taiyo Nippon Sanso Corporation, and Universal Industrial Gases, Inc.

The medical oxygen segment dominated the market share in 2024.

The pharmaceutical manufacturing & research segment is expected to witness the significant growth during the forecast period.