Medical Image Analysis Software Market Size, Share, Trends, Industry Analysis Report

: By Software Type, By Imaging Type, By Application, By Modality (C.T., X-Ray, MRI, PET, SPECT, Ultrasound, and Radiographic imaging), and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2773

- Base Year: 2024

- Historical Data: 2020-2023

Overview

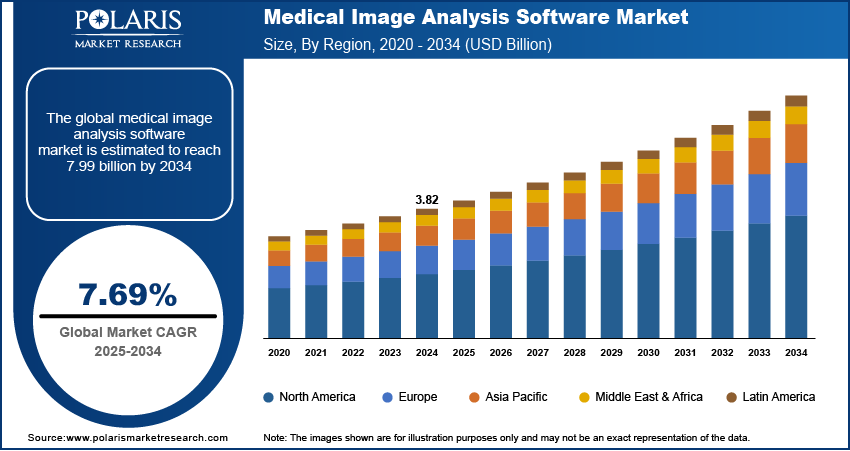

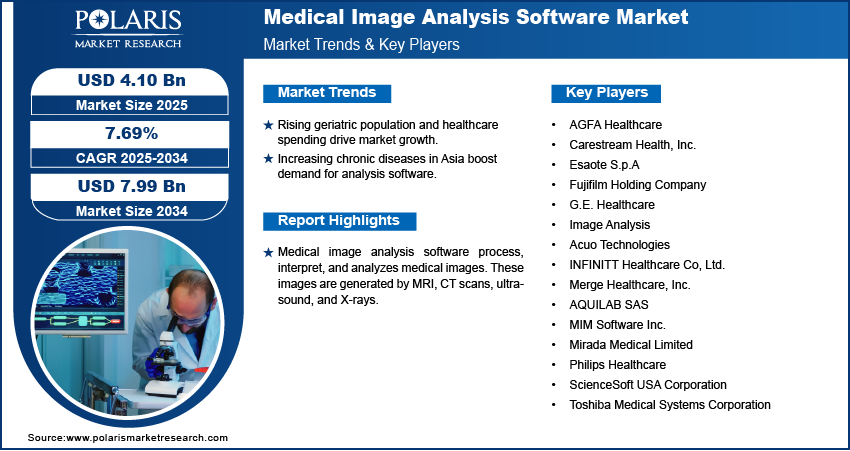

The global medical image analysis software market size was valued at USD 3.82 billion in 2024. The market is projected to grow at a CAGR of 7.69% during 2025 to 2034. Key factors driving demand for medical image analysis software include the rising prevalence of chronic diseases, technological advancements such as AI, and growing healthcare digitization.

Key Insights

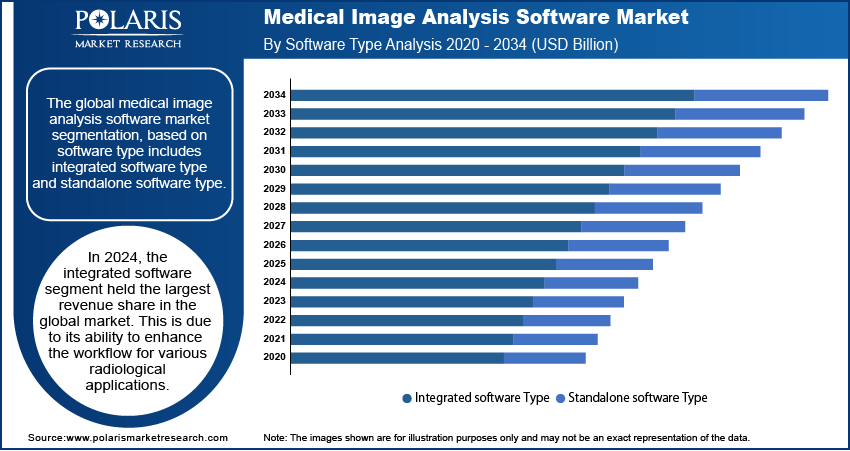

- In 2024, the integrated software segment held the largest revenue share due to its ability to enhance the workflow for various radiological applications.

- In 2024, the X-Ray segment accounted for a major revenue share, due to technological developments and increased use of X-rays for diagnostic purposes.

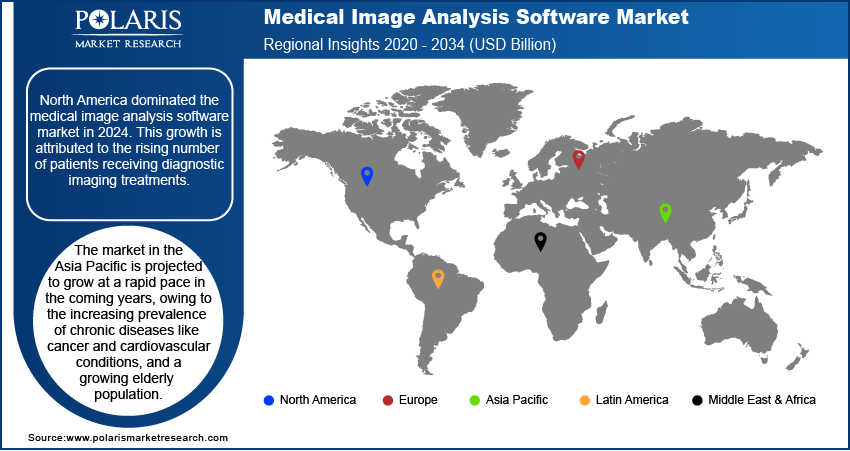

- North America dominated the medical image analysis software market in 2024. This growth is attributed to the rising number of patients receiving diagnostic imaging treatments.

- The market in the Asia Pacific is projected to grow at a rapid pace in the coming years, owing to the increasing prevalence of chronic diseases like cancer and cardiovascular conditions, and a growing elderly population.

Industry Dynamics

- The global medical image analysis software market is fueled by a rapid rise in the geriatric population and increasing healthcare spending across the globe

- The growth of chronic conditions across countries such as China, Japan, and India is also anticipated to increase demand for medical image analysis software.

- Rapid technological developments in medical imaging systems and analytic software are creating a lucrative market opportunity.

- Unavailability of skilled professionals may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 3.82 Billion

- 2034 Projected Market Size: USD 7.99 Billion

- CAGR (2025-2034): 7.69%

- North America: Largest Market Share

AI Impact on the Medical Image Analysis Software Market

- Improves accuracy in detecting anomalies such as tumors and lesions.

- Reduces manual interpretation time and allows faster clinical decision-making.

- Streamlines image processing, storage, and reporting.

- Allow seamless use of multimodal imaging for comprehensive analysis.

Medical image analysis software process, interpret, and analyzes medical images. These images are generated by MRI, CT scans, ultrasound, and X-rays. Artificial intelligence and machine learning are used in medical image analysis software. These technologies improve image quality, extract meaningful information, and assist healthcare professionals. This software helps in organ or tissue segmentation, measuring structures, and tracking disease progression. Radiologists use this software for various purposes. This includes detecting tumors, lesions, and fractures.

The software even supports early cancer detection, tumor size measurement, and treatment monitoring. It also helps in heart structure, blockage detection, and blood flow pattern analysis. Moreover, the software is widely used in surgical planning as it provides detailed 3D reconstructions of organs and tissues.

The COVID-19 pandemic had a significant effect on the global market. Due to the value of medical imaging in diagnosing and treating severe COVID-19 infections, the medical imaging sector experienced tremendous growth during the COVID-19 pandemic. The care of patients following COVID-19 also includes medical imaging software techniques. Chest X-rays, ultrasonography, and C.T. scans are frequently performed to evaluate the severity of COVID-19 infections and find the disease's spread in the lungs. These elements contributed to an increase in worldwide market demand.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growth Drivers

One of the most significant factors accelerating the growth and demand for the market is the increasing utilization of imaging equipment due to the increasing prevalence of chronic diseases. The global market is expected to expand in the coming years, due to the rapid technological developments in medical imaging systems and analytic software. Moreover, the market is also expanding due to rising public and private sector investment in medical imaging and the global fusion of imaging technologies. The growing aging population globally is further leading the market growth. Aging population are more prone to chronic conditions, which encourages hospitals and clincs to invest in medical image analysis software, contributing to an increase in market revenue.

Report Segmentation

The market is primarily segmented based on software type, imaging type, modality, application, and region.

|

By Software Type |

By Imaging Type |

By Application |

By Modality |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Integrated Software Segment Held the Largest Revenue Share in 2024

In 2024, the integrated software segment held the largest revenue share in the global market. This is due to its ability to enhance the workflow for various radiological applications. For instance, the integrated image management software offers single-point access to cutting-edge clinical applications and improves clinical workflow. This propelled many radiologists all across the globe to adopt integrated medical image analysis software.

The X-Ray Segment Accounted for a Major Revenue Share in 2024

In 2024, the X-Ray segment accounted for a major revenue share, due to technological developments and increased use of X-rays for diagnostic purposes. Additionally, several companies are releasing analysis software for X-ray machinery, which contributed to the segment's expansion. For instance, Carestream Health introduced the DRX compass X-Ray system in February 2022. This digital radiology solution is precise, practical, and adjustable and was created to give radiologists a new level of efficiency..

North America Dominated the Revenue Share in 2024

North America dominated the revenue share in 2024, due to the rising number of patients receiving diagnostic imaging treatments. The established healthcare facilities and the growing need for advanced healthcare systems among the aging population in the region also contributed to the regional dominance in the market. Companies operating in the region are further increasingly selling better visualization software along with imaging analysis software. This led the market dominance in the region. For instance, in October 2021, Subtle Medical teamed with HALO Diagnostics to provide better imaging services based on its capabilities of AI-enabled imaging solutions. The high healthcare spending along with growing chronic conditions made North America a dominant region.

The market in the Asia Pacific is projected to grow at a robust pace in the coming years, owing to increasing healthcare spending by governments across the emerging countries such as India and Thailand. The high population suffering from chronic conditions in the region are also leading the market growth as this software is extensively used in the diagnosis of chronic conditions. The growth of medical tourism particulary in India is further leading to an increase in demand for medical image analysis software.

Competitive Insight

There are numerous significant players in the global market, such as AGFA Healthcare, Carestream Health., Esaote, G.E. Healthcare, Image Analysis, Acuo Technologies, INFINITT Healthcare, Merge Healthcare, AQUILAB, MIM Software, ScienceSoft, Mirada Medical, Philips Healthcare, Fujifilm Holding, Toshiba Medical Systems, and others.

Recent Developments

In July 2022, Subtle Medical's SubtleMR image-enhancement software was formally incorporated by Siemens Healthineers into its recently created reconstruction pipeline, Open Recon. Faster MRI sequences can benefit from SubtleMR's DL (deep learning) post-processing for denoising and more outstanding sharpness, which enhances image quality, streamlines workflow and improves patient satisfaction.

In March 2020, Philips introduced “Cloud-enabled Enterprise Imaging Informatics and Analytics Solutions” to address various workflow requirements across its imaging offerings.

Medical Image Analysis Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.82 billion |

| Market size value in 2025 | USD 4.10 billion |

|

Revenue forecast in 2034 |

USD 7.99 billion |

|

CAGR |

7.69% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025– 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Key Companies |

AGFA Healthcare, Carestream Health, Inc., Esaote S.p.A, G.E. Healthcare, Image Analysis, Acuo Technologies, INFINITT Healthcare Co, Ltd., Merge Healthcare, Inc., AQUILAB SAS, MIM Software Inc., ScienceSoft USA Corporation, Mirada Medical Limited, Philips Healthcare, Fujifilm Holding Company, Toshiba Medical Systems Corporation, and others. |

FAQ's

• The global market size was valued at USD 3.82 billion in 2024 and is projected to grow to USD 7.99 billion by 2034.

• The global market is projected to register a CAGR of 7.69% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market include AGFA Healthcare, Carestream Health, Inc., Esaote S.p.A, G.E. Healthcare, Image Analysis, Acuo Technologies, INFINITT Healthcare Co, Ltd., Merge Healthcare, Inc., AQUILAB SAS, MIM Software Inc., ScienceSoft USA Corporation, Mirada Medical Limited, Philips Healthcare, Fujifilm Holding Company, Toshiba Medical Systems Corporation, and others.

• The integrated software segment dominated the market revenue share in 2024.