Medical Oxygen Concentrators & Oxygen Cylinders Market Share, Size, Trends, Industry Analysis Report

By Product (Portable Concentrator, Stationary Concentrator, Cylinders); By Technology (Continuous Flow, Pulse Flow); By End-users (Homecare, Non-homecare); By Regions; Segment Forecast, 2021 - 2028

- Published Date:Apr-2021

- Pages: 128

- Format: PDF

- Report ID: PM1863

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

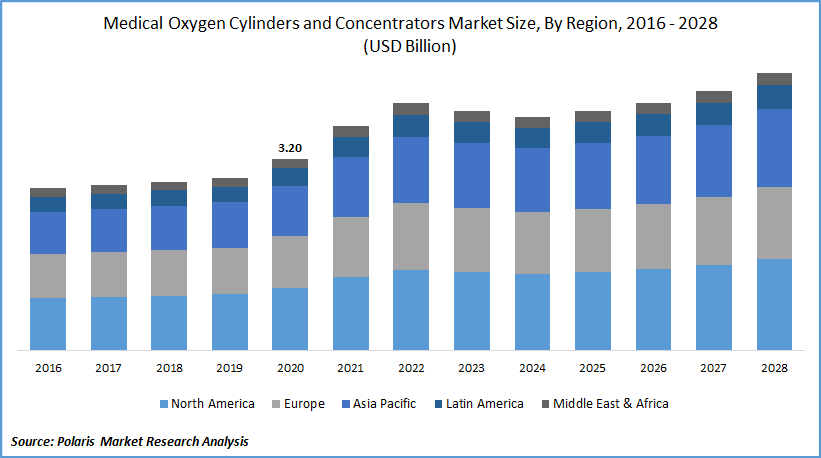

The global medical oxygen concentrators & oxygen cylinders market was valued at USD 3.20 billion in 2020 and is expected to grow at a CAGR of 3.1% during the forecast period. With the growing population, chronic obstructive pulmonary disease (COPD) is on the rise, affecting millions of people and indicating an increase in demand for oxygen concentrators and cylinders in the future. The number of patients with respiratory problems has increased significantly as a result of COVID-19, and the impact of this pandemic is expected to last longer, resulting in rapid market growth.

The medical oxygen concentrators & oxygen cylinders market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The rising prevalence of COPD and other lung disorders is an important factor driving the demand in the market for medical O2 concentrators & O2 cylinders. Tobacco smokers and individuals prone to airborne toxins have a higher prevalence of COPD and other types of lung disorders.

COPD is a major cause of death and morbidity around the world. COPD became the fourth most common cause of morbidity and mortality in 2019, according to the European Respiratory Society, and is forecast to be the third most common cause of morbidity and mortality over the next ten years if prevalence continues to rise at the same rate.

Moreover, the COVID-19 outbreak has a direct effect on the oxygen concentrators & cylinders market, owing to a worldwide scarcity of ventilators. To address this shortage, biomedical engineers and researchers have created improvised devices that mimic the basic functionality of ventilators by repurposing existing devices such as anesthesia machines, oxygen concentrators, manual resuscitators, and PAP devices.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Medical oxygen concentrators & oxygen cylinders are mainly used to treat respiratory complications such as in the case of COPD. COPD is one of the major causes of mortality across the globe with more than 270 million affected globally. Bronchitis affects 8.9 million people in the U.S. alone and 75% of cases are detected in people 45 years of age.

Most COPD will have severe breathing difficulties and they require oxygen support in their treatment regimen. More than 7 million people get admitted to U.S. hospitals in emergency and hence increasing incidence of lung disorders and COPD will be the key factors that will drive the demand for oxygen concentrators and cylinders.

COVID-19 pandemic is expected to significantly accelerate the growth of the global concentrators and cylinders market during the forecast period. Nearly 150 million COVID-19 cases have been diagnosed across the world, by April 2021, and in many regions, there are no signs of slowing down the pandemic. Southeast Asia is witnessing a huge number of cases and there is a lack of health care infrastructure including a shortage of O2.

Coronavirus mainly targets lungs in the affected patients leading to many respiratory complications. This has resulted in an unprecedented level of demand for O2 concentrators and cylinders across the globe. The governments are investing a huge amount of money to increase O2 concentrator and cylinder production. According to WHO, every day over 1 million cylinders of O2 is required to combat the COVID-19 pandemic in low-and middle-income countries of the world.

Many new products have been launched by various players in the market. For instance, the FreeStyle Comfort portable oxygen concentrator was launched CAIRE, in 2019. The system is integrated with autostart technology that will help in delivering oxygen bolus consistently as the patient’s respiratory rate fluctuates throughout their daily routine.

In 2019, iGo2 Portable Oxygen Concentrator was launched by Drive DeVilbiss Healthcare that has the ability to adjust automatically and will provide a dosage of oxygen based on the breath rate of the patient. It is used in the treatment of emphysema, chronic bronchitis, and COPD.

Medical Oxygen Concentrators & Oxygen Cylinders Market Scope

The market is primarily segmented on the basis of product, technology, end-users, and by region.

|

By Product |

By Technology |

By End-users |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The portable medical concentrators generated the highest revenue in 2020, owing to the rising prevalence of respiratory illnesses such as asthma, pneumonia, and COPD is anticipated to increase the use of these devices during the forecast timeframe. Moreover, the segment is expected to be driven by an increase in the number of air travelers and growing approvals for products from the Federal Aviation Administration (FAA).

Stationary medical concentrators market segment is expected to grow at a slower rate than portable devices. These medical devices are preferred by the elderly with limited mobility. As a result, it is becoming more popular in countries with a large elderly population.

Furthermore, since stationary medical concentrators are more cost-effective, their use is increasing in underdeveloped and developing economies. O2 cylinders are predicted to grow significantly during the forecast timeframe. The purity of the O2 supplied by these devices, as well as their compact configuration, are key factors supporting their growth.

Insight by Technology

The continuous flow segment generated the highest market revenue in 2020. Advancement in technology in the development of new products is anticipated to increase the use of medical O2 concentrators. Moreover, the continued use of respiratory equipment for O2 treatments is projected to drive segment market growth.

Continuous flow O2 concentrators are primarily marketed to aged and housebound patients. Furthermore, the devices are not connected with any breath detection technology, making them less expensive than pulse flow technology.

Pulse flow technology is predicted to grow significantly during the forecast timeframe 2021-2028 due to technological advancements. The technology is best suited to users who lead an active lifestyle. As a result, working professionals, frequent air travelers, and athletes suffering from COPD or any other breathing problems are increasingly turning to concentrators relying on this technology.

Geographic Overview

North America accounted for the largest market share of the global medical oxygen concentrators & oxygen cylinders during the forecast period. The region has modern healthcare facilities, and it has resulted in the availability of sophisticated healthcare devices.

In the U.S. alone, over 16 million people are suffering from COPD which is expected to be the main driving factor for the market growth of the medical oxygen concentrators & oxygen cylinders market and the U.S. is the worst COVID-19 hit country across the globe with over 32 million cases detected, by April 2021.

Asia Pacific is expected to be the fastest-growing region for the global medical oxygen concentrators & oxygen cylinders market during the forecast period owing to an increase in respiratory diseases such as COPD. In China, COPD is the third leading cause of mortality and the incidence rate is nearly 70 per 100,000 population. The region is one of the worst-hit places of the COVID-19 pandemic.

India is recording over 100,000 cases per day, as of, April 2021, which is the highest for any country in the world in the pandemic period. The government is investing significantly to procure medical O2 concentrators and cylinders to meet the huge market demand of hospitals. The government has allotted around USD 26 million to set up 162 PSA O2 concentrator plants in 32 states in the country. The government also slashed all the customs duty for the import of medical concentrators.

Competitive Insight

Most of the medical device manufacturing companies are focusing on the production of O2 concentrators and cylinders owing to a huge number of COVID-19 cases being diagnosed every day across the globe. Companies are also focusing to develop innovative devices to treat respiratory disorders to gain a competitive advantage over their market rivals.

Some of the major players operating in the market for medical oxygen concentrators & oxygen cylinders include Koninklijke Philips N.V. (Philips Resipronics), CAIRE INC., Drive DeVilbiss Healthcare Inc., Invacare Corporation, Inogen Inc., Nidek Medical Products, Inc., O2 Concepts, LLC, OxyGo, LLC, Precision medical, Inc., ResMed, Linde plc, GCE Group (GCE Healthcare) and Cramer Decker Medical, Inc.

Want to check out the medical oxygen concentrators & oxygen cylinders market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.