Men’s Jewelry Market Size, Share, Trends, Industry Analysis Report

By Product (Necklace, Ring, Earrings), By Material, By Category, By Distribution Channel, By Age, By Type, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM4859

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global men’s jewelry market size was valued at USD 48.56 billion in 2024, growing at a CAGR of 9.9% from 2025 to 2034. Key factors driving demand for men’s jewelry include expansion in categories such as material options and designs, increasing disposable income, and rising inclination toward cross-cultural complement.

Key Insights

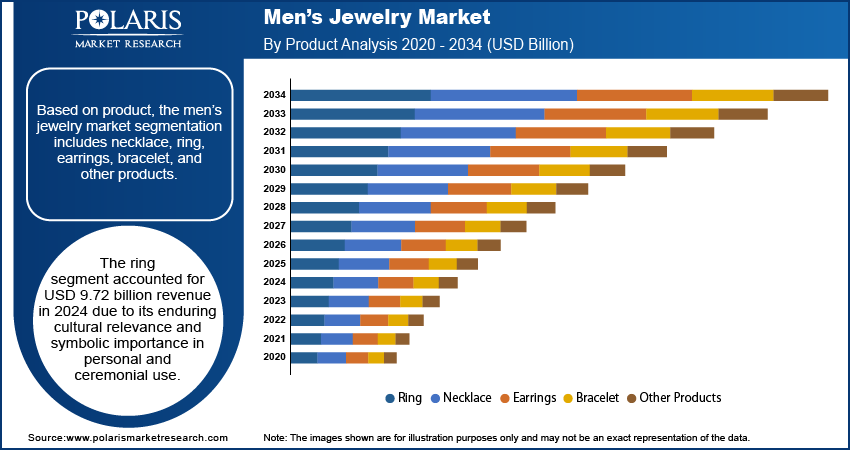

- The ring segment accounted for USD 9.72 billion revenue share in 2024.

- The platinum segment is projected to register a CAGR of 10.0% during the forecast period.

- The offline segment dominated with a valuation of USD 26.30 billion in 2024

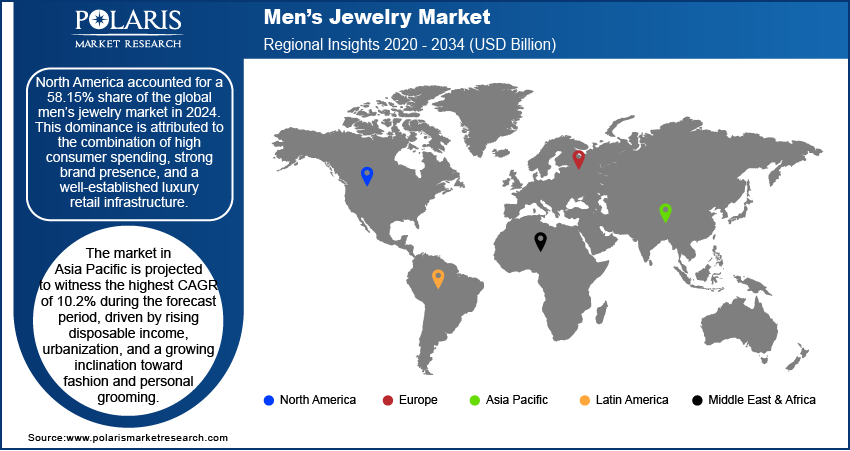

- North America accounted for a 58.15% share of the global men’s jewelry market revenue in 2024.

- The U.S. held a 20.76% share in North America market in 2024.

- The market in Asia Pacific is projected to register a CAGR of 10.2% during the forecast period.

- The India men’s jewelry industry is expanding, driven by evolving cultural norms and increasing fashion consciousness among urban male consumers.

To Understand More About this Research: Request a Free Sample Report

Men's jewelry includes various items such as rings, bracelets, necklaces, cufflinks, and earrings. It blends style with personal expression and range from classic and understated to bold and contemporary designs. The men's jewelry sector has witnessed a significant transformation in recent years. Traditionally associated with wedding bands and cufflinks, it is now a booming market catering to a wider range of styles and preferences. The key trends contributing to growth include increasing fashion awareness, versatility in design, and a shifting portrayal of male masculinity in society. In addition, men are increasingly getting interested in fashion and accessories to elevate their look in public places such as offices, parties, and outdoor recreational activities.

Fashion companies are offering a wide range of product choices for the men's segment, such as bracelets, rings, necklaces, and chains. For instance, in November 2023, Kalyan Jewellers, an Indian jewelry brand, launched its new men's jewelry line called Senhor. This collection was specifically crafted to serve the growing demand for men's jewelry that complements modern fashion styles. Rings such as wedding bands and signet rings engraved with gemstones are increasingly becoming popular among men. Leather bracelets, beaded bracelets, chain bracelets, and cuffs are also offering a variety of options depending on the desired design and occasion. In addition, chains, pendants with religious symbols or personal engravings, and layered necklaces are all gaining traction among men, which is further fueling growth opportunities.

Increasing inclination toward cross-cultural complement is poised to boost market expansion opportunities. Improved advertising investments and international initiatives facilitate widespread global distribution of a diverse group of men jewelry products over the anticipated timeframe. In addition, e-commerce is anticipated to have substantial influence in boosting the sales volumes during the forecast period. According to a 2024 International Trade Administration report, global B2B ecommerce sales are projected to reach USD 36 trillion by 2026, reflecting sustained expansion in digital payments worldwide. Broadening of consumer awareness regarding the excellence of metals utilized in crafting upscale ornaments is forecasted to boost the global jewelry sector expansion.

Industry Dynamics

- The men's jewelry segment, traditionally limited to signet rings and chains, has expanded to include contemporary designs such as beaded bracelets, gemstone pendants, and layered necklaces, driven by evolving fashion trends.

- Increased disposable income has boosted the industry growth, encouraging spending on luxury pieces, investment-worthy items, and self-expressive designs, reflecting shifting consumer priorities.

- The sector faces a downturn in traditional designs, limiting appeal to younger consumers seeking contemporary, versatile styles that align with evolving fashion trends.

- The growing acceptance of gender-fluid fashion and rising disposable income present untapped potential for innovative designs such as minimalist pendants and mixed-material bracelets.

Expansion in Categories Such as Material Options and Designs: The men's fashioned jewelry segment had limited designs, such as signet rings and chains. The introduction of new fashion trends has promoted new designs, such as beaded bracelets, gemstone pendants, and layered necklaces, among others. The men's jewelry segment is now available with more options to opt for jewelry based on individual personality.

The wide availability of material alternatives to traditionally used metals such as gold and silver is providing better options for men's products. Gold and silver, infused with other metals to form white gold and sterling silver, respectively, enable jewelry manufacturers to introduce a wide range of jewelry in various segments.

A wide range of options available with jewelers in terms of design and materials to target their products to the men's category will promote growth opportunities during the forecast period.

Increasing Disposable Income: The increasing disposable income of individuals greatly influences the growth opportunities. Rising disposable income has led to high expenditure on high-quality and luxury products, a rise in investment potential, shifting of priorities, and increasing confidence and self-expression. According to a June 2025 report from the U.S. Bureau of Economic Analysis (BEA), disposable personal income (DPI) increased by 0.6% in March 2025. Jewelry made of precious metals such as gold and platinum is attracting all segments of society, such as the men's category of jewelry products, with higher disposable income. Investments in precious metals are considered one of the best and safest due to the rising prices of precious metals. Moreover, the rise in disposable income provides an opportunity for men to afford higher-quality jewelry pieces made of premium materials such as diamonds, sapphires, or platinum. These materials elevate the look and feel of the jewelry, making it a more influential and long-lasting purchase. Additionally, increased disposable income allows men to explore luxury brands that specialize in men's jewelry. These brands often offer unique designs, exceptional craftsmanship, and prestige associated with the brand name.

Segmental Insights

Product Analysis

Based on product, the segmentation includes necklace, ring, earrings, bracelet, and other products. The ring segment accounted for USD 9.72 billion revenue in 2024 due to its enduring cultural relevance and symbolic importance in personal and ceremonial use. Rings are often associated with milestones such as engagements, weddings, or achievements, making them a staple accessory for men across various age groups. Additionally, modern ring designs now incorporate minimalistic aesthetics, masculine patterns, and luxury materials, which serve the evolving fashion preferences of male consumers. The rising acceptance of rings as daily wear accessories further supports consistent demand, especially within urban and fashion-conscious demographics.

The bracelet attachments segment is projected to grow at a robust pace in the coming years, owing to increasing consumer preference for customizable and modular jewelry. These attachments offer versatility in style, allowing men to switch between casual and formal looks seamlessly. The trend toward personalization and self-expression through accessories has accelerated demand for such interchangeable components. Moreover, brands are launching innovative attachment designs with symbolic, sporty, or statement elements, which resonate well with younger audiences seeking unique fashion identifiers.

Material Analysis

In terms of material, the segmentation includes silver, gold, platinum, diamond, titanium, steel, tungsten, forged carbon, and other types. The gold segment dominated the market share valued at 59.81% in 2024 driven by its strong heritage value, aesthetic appeal, and perceived status symbol. Gold jewelry continues to be favored for its timeless elegance, investment potential, and cultural associations with prestige and prosperity. The material’s versatility enables detailed craftsmanship in both traditional and contemporary styles, making it highly adaptable to changing fashion trends. Additionally, gold's hypoallergenic properties and durability further enhance its desirability among consumers seeking both style and quality.

The platinum segment is projected to register a CAGR of 10.0% during the forecast period due to rising consumer interest in rare, high-end materials with understated elegance. Platinum’s natural white sheen, exceptional durability, and resistance to tarnish make it particularly appealing for luxury jewelry. Its association with exclusivity and premium branding aligns with the preferences of affluent male buyers seeking long-lasting, refined accessories. Furthermore, the increasing incorporation of platinum in minimalist and sleek jewelry designs is driving its popularity in both everyday wear and high-fashion segments.

Category Analysis

The segmentation, based on category, includes branded and unbranded. The unbranded segment is expected to reach USD 62.70 billion revenue share by 2034 primarily due to the affordability and accessibility it offers across a wide consumer base. These products often appeal to price-sensitive buyers who prioritize design variety and immediate availability over brand prestige. In many regional sectors, unbranded jewelry remains a popular choice due to its wide distribution through local artisans, informal retail networks, and flexible customization options. This segment continues to thrive as it meets the needs of consumers seeking fashionable jewelry at competitive price points.

The growth of the branded segment is supported by increasing consumer trust in quality, authenticity, and craftsmanship. Men are gravitating toward recognized labels that offer designer collections, certification, and after-sales services as they become more brand-conscious and style-aware. Branded jewelry also benefits from effective marketing strategies, celebrity endorsements, and a strong digital presence, all of which contribute to a stronger emotional connection and aspirational value among consumers. The ability of brands to convey exclusivity and lifestyle appeal further drives demand in this segment.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes offline and online. The offline segment dominated the market with a valuation of USD 26.30 billion in 2024 due to the tactile and experiential nature of jewelry shopping. Physical stores provide consumers with the opportunity to assess product quality, fit, and finish firsthand, which remains a critical factor in jewelry purchases. Additionally, the presence of trained staff, personalized consultations, and immediate after-sales services enhances the customer experience. High-value items such as luxury rings and bracelets are often preferred to be purchased through trusted brick-and-mortar outlets, reinforcing the dominance of offline retail.

The online segment is expected to witness significant growth during the forecast period fueled by the increasing digital literacy and convenience of e-commerce platforms. Consumers are increasingly drawn to the variety, competitive pricing, and ease of comparison that online channels provide. The integration of virtual try-on technologies, secure payment gateways, and flexible return policies is enhancing customer confidence in purchasing jewelry online. Additionally, the digital presence of both global brands and local artisans has expanded greatly, providing access to a broader range of designs and price points.

Age Analysis

Based on age, the segmentation includes below 18 years, 18–30 years, 30–50 years, and above 50 years. The 30–50 years segment captured 40.25% share in 2024 due to higher disposable income and a greater inclination toward purchasing luxury lifestyle products. This demographic typically values sophistication, status, and quality, which aligns well with high-end jewelry offerings. Men in this age often seek timeless, versatile accessories that complement professional and social settings. Their purchasing decisions are also influenced by life events such as weddings, anniversaries, or career milestones, further supporting sustained demand within this segment.

The 18–30 years segment is projected to register a CAGR of 9.3% during the forecast period, driven by evolving fashion trends and increasing self-expression through accessories. Younger men are more experimental with style and are more likely to embrace contemporary and personalized jewelry pieces. The influence of social media, celebrity culture, and fashion-forward content has elevated jewelry from an occasional accessory to an integral part of everyday wear for this demographic. Their openness to exploring new materials, designs, and digital shopping avenues also contributes to the growing potential of this segment.

Type Analysis

The segmentation, based on type, includes traditional and luxury. The luxury segment was valued at USD 26.03 billion in 2024. The growth is driven by the rising demand for premium, statement jewelry among affluent male consumers. High-end pieces crafted from precious metals and stones are increasingly perceived as symbols of success, identity, and refined taste. This segment benefits from exclusive craftsmanship, limited-edition collections, and designer branding, which appeal to customers seeking distinction and heritage value. The integration of luxury jewelry into men’s fashion lines and the rise of luxury gifting culture are further propelling growth in this category.

Cultural preferences, ceremonial relevance, and intergenerational purchasing behavior support the growth of the traditional segment. Traditional jewelry remains significant in many communities where it holds symbolic or religious meaning, particularly during weddings and festivals. Its continued relevance is reinforced by its sentimental value and status as a legacy asset. Consumers also favor traditional designs that reflect heritage and identity, often customizing pieces for personal or cultural expression, which sustains the growth for this type.

Regional Analysis

The North America men’s jewelry market accounted for a 58.15% revenue share in 2024. This dominance is attributed to the combination of high consumer spending, strong brand presence, and a well-established luxury retail infrastructure. According to the U.S. Bureau of Labor Statistics (BLS) in September 2024, average annual consumer spending reached USD 77,280 in 2023, a 5.9% increase compared to 2022. The region’s fashion-forward male population is increasingly open to accessorizing, driving demand for both classic and contemporary designs. Robust marketing efforts by premium and designer brands, combined with the presence of multichannel retail formats, continue to enhance visibility and accessibility. Additionally, the cultural shift toward individual style expression has normalized jewelry as a mainstream fashion element among men.

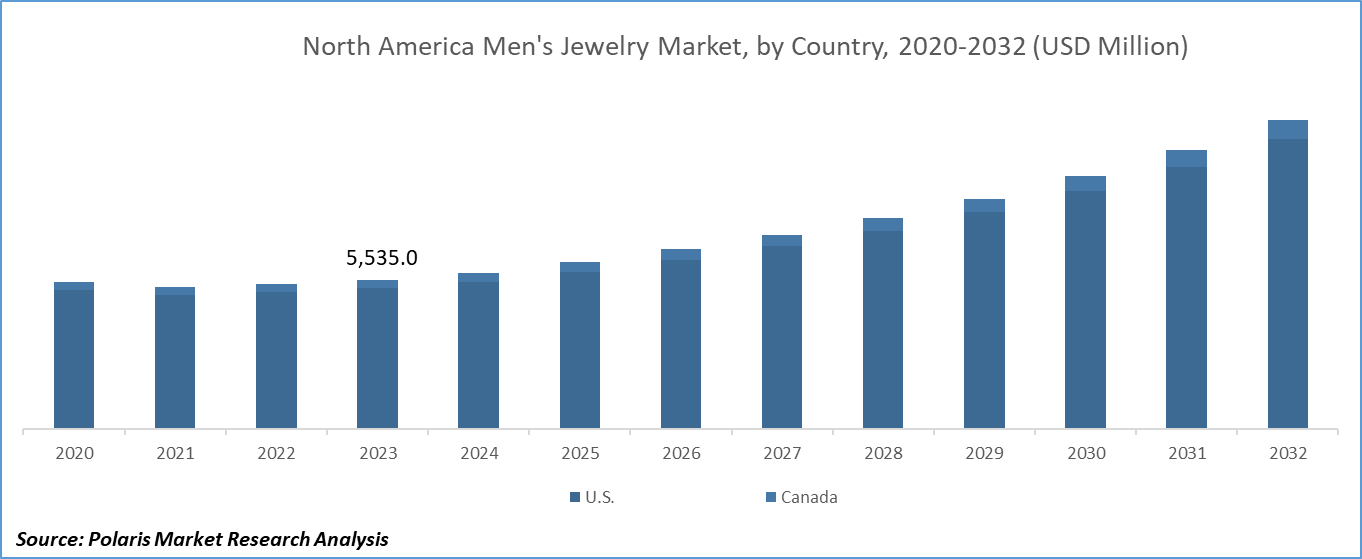

U.S. Men’s Jewelry Market Insights

The U.S. held a 20.76% share of North America men’s jewelry landscape in 2024, due to its well-established fashion industry, high brand penetration, and strong consumer inclination toward luxury and designer accessories. The country’s diverse cultural landscape also supports varied jewelry preferences, from minimalistic pieces to bold statement styles. Additionally, the growing trend of men’s self-grooming and fashion-forward attitudes has normalized jewelry as an essential part of modern male styling.

Asia Pacific Men’s Jewelry Market Trends

The market in Asia Pacific is projected to witness the highest CAGR of 10.2% during the forecast period, driven by rising disposable income, urbanization, and a growing inclination toward fashion and personal grooming. According to an April 2025 report by India's Ministry of Commerce and Industry, the country's e-commerce sector reached a Gross Merchandise Value (GMV) of USD 60 billion in FY23, a 22% year-on-year growth. The younger demographic is particularly responsive to global fashion trends and exhibits a strong appetite for innovation and customization. E-commerce penetration is rapidly increasing in the region, enabling greater access to a diverse range of jewelry options. Moreover, cultural traditions involving jewelry gifting and ceremonial use continue to contribute to consistent demand across key countries in the region.

India Men’s Jewelry Market Overview

The market in India is expanding due to evolving cultural norms and increasing fashion consciousness among urban male consumers. Traditional jewelry continues to play a key role in religious and ceremonial practices, while contemporary designs are gaining popularity among younger generations. The presence of a large artisanal jewelry sector and the growing appeal of gold and silver ornaments further support the segment’s domestic growth momentum.

Europe Men’s Jewelry Market Analysis

The men’s jewelry landscape in Europe is projected to hold a substantial share in 2034 supported by the region’s longstanding tradition of fine craftsmanship and design excellence. European consumers value high-quality, artisanal jewelry with timeless appeal, driving consistent demand for both traditional and avant-garde styles. The region’s developed fashion industry, coupled with growing male participation in fashion consumption, supports the expansion of premium and designer jewelry offerings. Additionally, increased awareness around ethical sourcing and sustainable production is influencing brand preferences and reinforcing stability.

UK Men’s Jewelry Market Outlook

The growth of the UK men’s jewelry industry is driven by the rising consumer awareness of personal style and increasing acceptance of accessories in mainstream male fashion. British consumers exhibit a preference for refined, minimalist, and ethically crafted pieces, aligning with the country's focus on sustainable fashion. The presence of renowned designers and strong retail networks further fosters demand across both luxury and mid-range segments.

Key Players and Competitive Analysis

The men’s jewelry industry is witnessing revenue growth driven by shifting fashion trends and increasing disposable income. Competitive intelligence and strategy reveal that brands are leveraging emerging segments, such as sustainable and personalized jewelry, to capture latent demand and opportunities. These trends highlight a rise in minimalist and luxury designs, with small and medium-sized businesses adopting future development strategies to compete with established players. Technological advancements, such as 3D printing and blockchain for authenticity, are reshaping product offerings. Revenue opportunity lies in targeting younger demographics through digital platforms, while supply chain disruptions challenge production efficiency. Additionally, expert insights highlight strategic investments in omnichannel retail and influencer collaborations to strengthen competitive positioning. Brands must align with sustainability strategy and transformation to ensure long-term revenue share and relevance as consumer preferences evolve.

A few major companies operating in the men’s jewelry industry include Bernard James, Bulgari, Clocks + Colours, Completedworks, David Yurman, Hatton Labs, Jaxxon, John Hardy, le gramme, Miansai, Shaun Leane, Spinelli Kilcollin, T&CO. (LVMH Moët Hennessy Louis Vuitton SE), The Great Frog, and TOM WOOD.

Key Players

- Bernard James

- Bulgari

- Clocks + Colours

- Completedworks

- David Yurman

- Hatton Labs

- Jaxxon

- John Hardy

- le gramme

- Miansai

- Shaun Leane

- Spinelli Kilcollin

- T&CO. (LVMH Moët Hennessy Louis Vuitton SE)

- The Great Frog

- TOM WOOD

Industry Developments

- November 2024, Cartier launched archival Double C cufflinks inspired by its festive campaign. Featuring black and silver lacquer, the design mirrors vinyl records' aesthetic, celebrating musical inspiration through contrasting textures and miniature craftsmanship.

Men’s Jewelry Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Necklace

- Ring

- Wedding Band

- Earrings

- Bracelet

- Other Products

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Silver

- Gold

- Platinum

- Diamond

- Titanium

- Steel

- Tungsten

- Forged Carbon

- Other Types

By Category Outlook (Revenue, USD Billion, 2020–2034)

- Branded

- Unbranded

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Age Outlook (Revenue, USD Billion, 2020–2034)

- Below 18 Years

- 18–30 Years

- 30–50 Years

- Above 50 Years

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Traditional

- Luxury

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Men’s Jewelry Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 48.56 Billion |

|

Market Size in 2025 |

USD 53.23 Billion |

|

Revenue Forecast by 2034 |

USD 124.13 Billion |

|

CAGR |

9.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Men’s Jewelry Market report covering key segments are product, type, category, distribution channel, age, and region.

Men’s Jewelry Market Size Worth USD 71,809.77 Million by 2032

Men’s Jewelry Market exhibiting the CAGR of 8.4% during the forecast period

Asia Pacific is leading the global market

key driving factors in Men’s Jewelry Market are rising popularity of gold jewelry for men