Metallic Stearates Market Share, Size, Trends, Industry Analysis Report

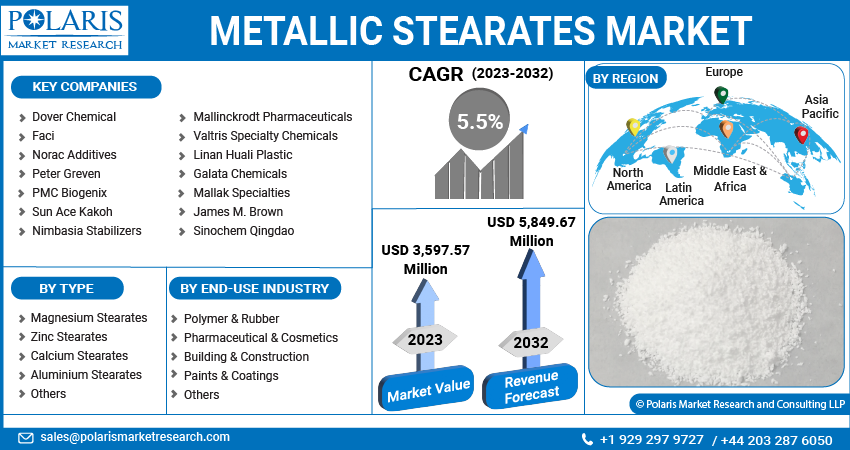

By Type (Magnesium Stearates, Zinc Stearates, Calcium Stearates, Aluminium Stearates); By End Use Industry; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3636

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

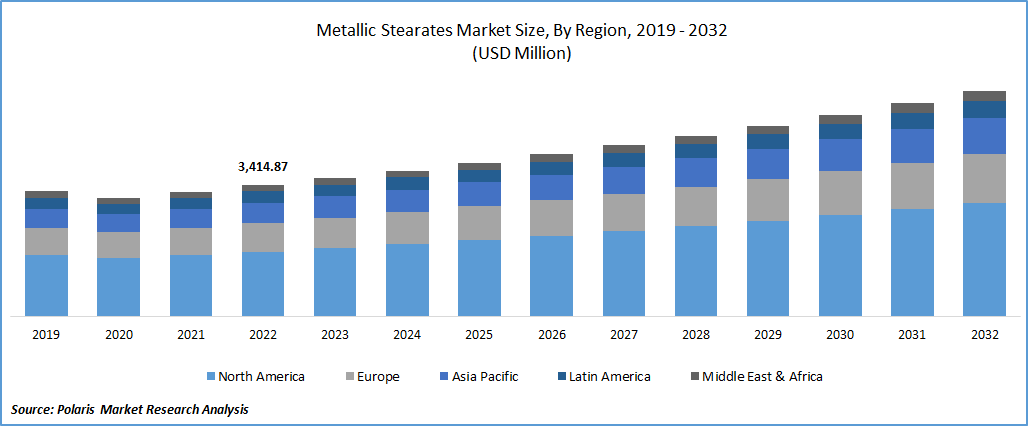

The global metallic stearates market was valued at USD 3,414.87 million in 2022 and is expected to grow at a CAGR of 5.5% during the forecast period.

The global shortage of natural rubber, resulting from the blight and diseases decimating rubber trees in growing regions, is driving the market's growth. The International Tripartite Rubber Council has predicted a global shortage of 1 million tons of natural rubber this year, primarily due to the devastating effects of blight and diseases on rubber tree plantations across different regions.

To Understand More About this Research: Request a Free Sample Report

This shortage of natural rubber is fueling the growth of the metallic stearates market. As a result, manufacturers and industries increasingly turn to synthetic rubber as an alternative, increasing demand for metallic stearates as additives in artificial rubber production. Furthermore, the industry is exploring alternative materials and formulations without an adequate natural rubber supply, including blending various rubber compounds. Metallic stearates

These diversified rubber compound formulations are crucial in optimizing their properties and performance, further driving their demand.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Metallic stearates are often preferred over traditional additives due to their low toxicity, biodegradability, and environmental compatibility. As sustainability becomes a priority, there is a growing inclination towards eco-friendly solutions, benefiting the market. Baerlocher's Baeropol T-Blends services are crucial in driving the market's growth. These innovative solutions significantly enhance the re-cyclability of virgin polyolefin resins & improving the quality of recycled high-density polyethylene resins specifically used in extrusion blow molding applications. By improving the sustainability and quality of HDPE, Baerlocher's stabilization technology is fueling the development of high-quality and environmentally friendly solutions in the EBM sector, thereby driving the overall growth of the metallic stearates market.

Report Segmentation

The market is primarily segmented based on type, end-use industry, and region.

|

By Type |

By End-Use Industry |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Zinc Segment is Expected to Witness Fastest Growth During the Forecast Period

The zinc segment is expected to grow faster as they find extensive applications across various industries, including plastics, rubber, paints, coatings, cosmetics, and pharmaceuticals. These industries use them as lubricants, release agents, anti-blocking agents, and stabilizers. Zinc stearates' versatility and ability to enhance processing, improve surface properties, and provide thermal stability make them indispensable in many applications. One of the primary reasons for the widespread use of zinc stearates is their excellent lubricating properties. When added to materials like plastics and rubber, zinc stearates reduce friction and improve the flowability and processability of these materials. They help prevent sticking and enable smooth processing during manufacturing operations.

They act as processing aids and release agents in various industries. In plastics and rubber processing, they facilitate mold release and prevent adhesion between the materials and the processing equipment. Zinc stearates help achieve a uniform and defect-free molded products, reduce downtime, and improve production efficiency. The growth of industries such as plastics, rubber, paints, coatings, and cosmetics has also contributed to the increased demand for zinc stearates. These industries have witnessed significant global expansion, driven by urbanization, increasing disposable incomes, and demand for innovative, high-quality products. As a result, the need for additives like zinc stearates has risen to meet the requirements of these expanding industries.

Polymer & Rubber Segment is Expected to Hold the Larger Revenue Share During Forecast Period

Polymer & Rubber segment is projected to witness a larger revenue share in the coming years. The growth of end-use industries relying on polymer and rubber products has driven the demand for metallic stearates. Initiatives such as automotive, construction, packaging, consumer goods, and healthcare have significantly expanded. Metallic stearates are used in various applications within these industries, including automotive parts, building materials, films, cables, wires, adhesives, and sealants. The growing demand for high-quality, durable, and functional polymer and rubber products has directly translated into increased usage of metallic stearates. They offer eco-friendly advantages in the polymer and rubber sectors. They are non-toxic, biodegradable, and do not pose significant environmental risks. With increasing emphasis on sustainability and regulatory compliance, metallic stearates as alternatives to conventional additives are gaining momentum in the industry.

APAC Registered with the Highest Growth Rate in the Study Period

APAC is projected to witness a higher growth rate for the market. This region offers a favorable manufacturing environment with lower labor and production costs than other regions. This has attracted foreign investments and led to the establishment of manufacturing facilities by multinational companies. A robust manufacturing base has created a substantial market for metallic stearates in the Asia Pacific, as these additives are essential for enhancing product quality, performance, and processing efficiency.

The remarkable growth of India's manufacturing exports in FY22, surpassing US$ 418 billion and experiencing a significant increase of over 40% compared to the previous year's US$ 290 billion, is driving the growth of the metallic stearates market. This region is experiencing rapid industrialization, particularly in countries such as China, India, and Southeast Asian nations. This industrial growth has increased demand for metallic stearates in various industries, including plastics, rubber, paints, coatings, textiles, and pharmaceuticals. The region's expanding manufacturing base and infrastructure development have created a favorable environment for metallic stearates.

North America is expected to witness a larger revenue share in the market. It has well-established industries heavily rely on metallic stearates, such as plastics, rubber, paints, coatings, and pharmaceuticals. These industries have a significant presence in the region and contribute to the demand for metallic stearates for applications like lubrication, release agents, stabilizers, and more. The steady growth of these industries fuels the overall growth of the region.

The significant petroleum consumption in the United States is driving the region's growth. This high petroleum consumption is closely linked to the lubricants industry, which relies on petroleum-based oil for lubricant production. It has a growing emphasis on sustainability and environmental consciousness. As versatile and sustainable additives, metallic stearates align with the region's focus on eco-friendly solutions. The demand for metallic stearates in North America is influenced by the preference for additives that are environmentally friendly, non-toxic, and comply with sustainable practices.

Competitive Insight

Some of the major players operating in the global market include Dover Chemical, Faci, Norac Additives, Peter Greven, PMC Biogenix, Mallinckrodt Pharmaceuticals, Valtris Specialty Chemicals, Sun Ace Kakoh, Nimbasia Stabilizers, James M. Brown, Linan Huali Plastic, Galata Chemicals, Mallak Specialties, SINOCHEM QINGDAO.

Recent Developments

- In January 2023, Albemarle established its new subsidiary “Ketjen”. It specializes in developing customized & catalyst solutions for the petrochemical, refining, & specialty chemicals sectors.

- In April 2022, Peter Greven initiated a new esterification line operation at their Bad Munstereifel facility (DE). This strategic move is expected to enhance its ester production capacity by approximately 50%.

Metallic Stearates Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3,597.57 million |

|

Revenue forecast in 2032 |

USD 5,849.67 million |

|

CAGR |

5.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Dover Chemical, Faci, Norac Additives, Peter Greven, PMC Biogenix, Mallinckrodt Pharmaceuticals, Valtris Specialty Chemicals, Sun Ace Kakoh, Nimbasia Stabilizers, James M. Brown, Linan Huali Plastic, Galata Chemicals, Mallak Specialties, SINOCHEM QINGDAO. |

FAQ's

The metallic stearates market report covering key segments are type, end-use industry and region.

Metallic Stearates Market Size Worth $5,849.67 Million By 2032.

The global metallic stearates market is expected to grow at a CAGR of 5.5% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in metallic stearates market are rising concerns about sustainability.