Metering Pump Market Share, Size, Trends, Industry Analysis Report

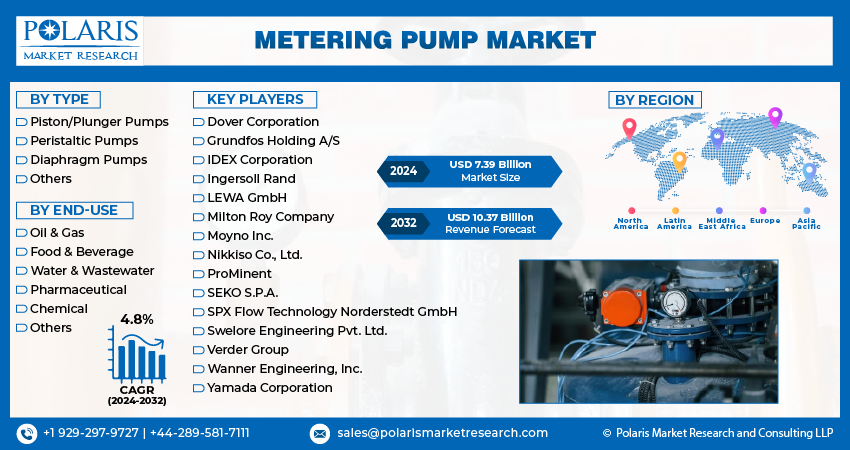

By Type (Piston/Plunger Pumps, Peristaltic Pumps, Diaphragm Pumps, Others); By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4309

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

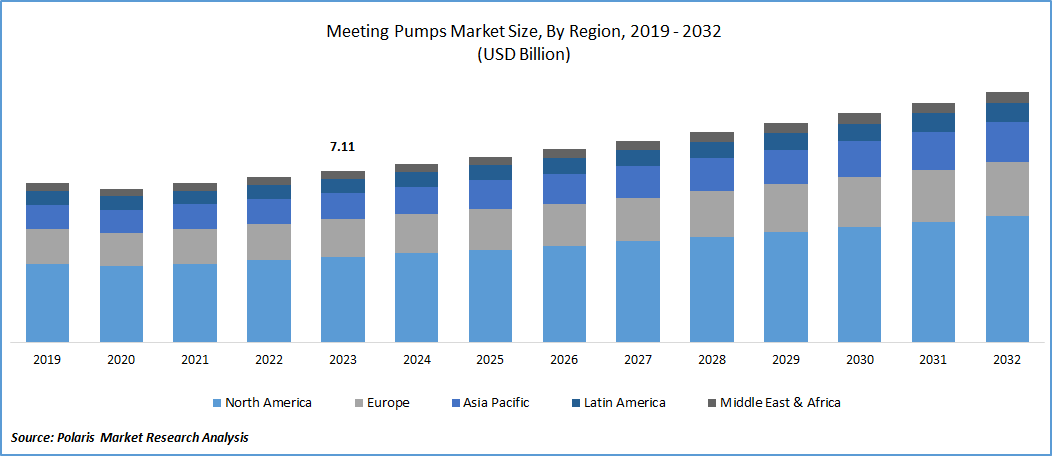

The global metering pump market size and share was valued at USD 7.11 billion in 2023 and is expected to grow at a CAGR of 4.8% during the forecast period.

Market expansion is expected to be propelled by technological advancements and the increasing prominence of end-use industries, including water & wastewater treatment, chemicals, and pharmaceuticals. Additionally, the rising demand for precise chemical dosing in various industries to ensure quality manufacturing and the increasing focus on process improvement are foreseen as key factors driving market growth.

Metering pumps are positive displacement devices that deliver a fixed quantity of fluid under pressure, exhibiting versatility in handling a broad spectrum of viscosities and pressures. These pumps are engineered to transfer a precisely predetermined volume of fluid within a specified timeframe, ensuring a consistent fluid flow rate crucial for applications demanding precision. Widely employed across commercial and industrial sectors, metering pumps are utilized for the transfer of gases and liquids.

The research report offers a quantitative and qualitative analysis of the metering pump market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

To Understand More About this Research: Request a Free Sample Report

Given their characteristics, metering pumps are especially tailored to meet the distinct requirements of diverse end-use industries, notably the chemical and water & wastewater treatment sectors. As these industries experience global growth, the demand for metering pumps is anticipated to escalate.

The surge in the water & wastewater treatment industry in the U.S. stands out as a pivotal driver behind the heightened demand for metering pumps. These pumps play a crucial role in the water & wastewater treatment sector by facilitating precise chemical dosing, a critical process for purifying water by eliminating harmful contaminants, microorganisms, and impurities. Additionally, as chemical processing industries like petrochemicals and food processing witness advancements in the U.S., the market for metering pumps is poised for substantial growth over the forecast period.

The emerging emphasis on energy efficiency and sustainability is indicative of future trends in the market. To address these priorities, leading market entities are innovating by creating pumps that are more energy-efficient and possess a reduced carbon footprint. These newly engineered pumps feature variable frequency drivers (VFDs) for enhanced control over pump speed and flow. Additionally, recently introduced metering pumps are equipped with Industrial Internet of Things (IIoT) integration and a digital control system, augmenting their overall effectiveness.

Industries such as chemical processing demand specialized metering pumps capable of handling highly corrosive, viscous, and acidic fluids. In response, manufacturers are providing customization options and expertise to meet these specific requirements. Furthermore, a modular design approach has been adopted by most key market players in the development of metering pump market, with a particular focus on optimizing performance through VFDs.

The metering pump industry is marked by intense competition and concentration, with numerous players excelling in product design and development. Global market participants are actively investing in research and development activities, particularly for diaphragm pumps and other pump types, as a strategic initiative to maintain their market share and foster further market growth.

Industry Dynamics

Growth Drivers

Increasing Demand for Accurate and Controlled Dispensing of Diverse Food Ingredients

The market is experiencing growth due to the increasing demand for precise and controlled dosing in the food and beverage (F&B) sector. These pumps play a crucial role in accurately dispensing various ingredients, additives, and flavorings during food and beverage production. Furthermore, they contribute to maintaining consistency in the taste, texture, and quality of food products. The rising consumer preference for customized and unique products, such as sauces, and processed foods, beverages, further fuels the market. These pumps provide manufacturers with the capability to explore new flavors and ingredients, offering versatility in product development. Additionally, the implementation of stringent hygiene and food safety regulations emphasizes the importance of accurate dosing of preservatives to minimize waste.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Diaphragm Pumps Segment Held the Largest Revenue Share in 2023

Instead of using a piston, a diaphragm pump employs a diaphragm crafted from flexible materials like rubber or plastics to convey fluids. Depending on the pressure and flow rate requirements of the specific end-use application, diaphragm pumps can be actuated either mechanically or by motors.

Diaphragm pumps offer several key advantages, including their capability to manage a broad spectrum of fluids, encompassing viscous and abrasive ones. Their versatility, reliability, and effectiveness in handling challenging fluids make them a valuable option for various applications across industries such as water & wastewater treatment, pharmaceuticals, and chemical processing.

The piston/plunger pump segment is expected to exhibit the most rapid growth. This type of positive displacement pump utilizes the reciprocating motion of a piston inside a cylinder to transfer fluids. These pumps are adept at achieving precise and accurate flow rates, thanks to their capability to operate within predetermined fixed stroke lengths.

Renowned for their capacity to generate exceptionally high pressures, piston/plunger pumps find extensive use in applications demanding elevated pressures, such as high-pressure fluid flow within hydraulic systems and pressure testing. Furthermore, these pumps prove more effective in handling highly viscous fluids compared to other metering pumps. The piston design is less prone to wear and damage when dealing with fluids containing solid particles or possessing high viscosity, making them a preferred choice in the oil & gas extraction industries for upstream exploration and production (ExoPE).

By End-Use Analysis

The Water & Wastewater Segment Accounted for the Highest Market Share During the Forecast Period

Water treatment encompasses multiple processes that necessitate precise dosing of specific chemicals to eliminate impurities. It entails the injection of chemicals like chlorine and pH adjusters to render water safe and potable. The increasing urbanization and industrialization have led to a substantial rise in the demand for potable water supply that maintains stable pH levels. Metering pumps play a fundamental role in water treatment operations by dosing the exact required quantity of chemicals to optimize the quality of drinking water. The anticipated growth in urbanization, population, and the food processing industry is expected to drive a significant increase in demand for metering pumps in the forecast period.

The chemical segment is poised to experience the fastest CAGR during the forecast period. Metering pumps play a vital role in the chemical industry due to their capability to handle a diverse range of chemicals with varying pH levels. In the chemical sector, the corrosive nature of acidic fluids can lead to corrosion of internal pump components. To counteract this issue, diaphragm pumps are employed to minimize the corrosive impact of acidic fluids on the pump's inner components. Moreover, these pumps ensure precise control over fluid discharge rates and demonstrate reliable operation under various conditions.

The increasing standards of living and a growing middle class in emerging markets are contributing to a rise in end-users purchasing electronics, consumer goods, automobiles, and other products that require the use of chemicals and plastics. Maintaining quality in chemical processing often involves the metering of chemicals for accurate dosing, and enhancing product quality by controlling process variables such as discharge rates and fluid pressure. Metering pumps are adept at controlling these process variables, making them a preferred choice for injecting catalysts with precision and producing high-quality compounds in the chemical processing industry.

Regional Insights

Asia Pacific Dominated the Largest Market in 2023

The potential of the market is anticipated to receive a boost due to rapid industrialization and urbanization, coupled with an increasing demand for fluid handling and safe drinking water in several countries, particularly China and India. The Asia Pacific region is witnessing significant growth in water and wastewater treatment, chemical, and food processing industries, driven by the rise in urbanization and per capita income. Additionally, economies in the Asia Pacific region are expected to thrive in the forecast period, supported by increased government investments in pharmaceuticals, food and beverage, and water and wastewater treatment industries. The continuous expansion of end-use industries such as the chemical and oil & gas exploration industry is likely to generate more demand for fluid handling equipment, thus propelling market growth.

The Middle East and Africa region are poised for significant growth, showing the fastest CAGR over the forecast period, primarily driven by high-growth industries such as oil & gas and water & wastewater treatment. The Middle East & Africa serves as a major production hub for oil & gas, where metering pumps play a crucial role in crude oil transfer and refining processes. Furthermore, the region has seen substantial investments in desalination facilities aimed at producing potable water from saline sources. Metering pumps are integral to processes such as seawater intake, reverse osmosis, and brine disposal in the water desalination process.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Dover Corporation

- Grundfos Holding A/S

- IDEX Corporation

- Ingersoll Rand

- LEWA GmbH

- Milton Roy Company

- Moyno Inc.

- Nikkiso Co., Ltd.

- ProMinent

- SEKO S.P.A.

- SPX Flow Technology Norderstedt GmbH

- Swelore Engineering Pvt. Ltd.

- Verder Group

- Wanner Engineering, Inc.

- Yamada Corporation

Recent Developments

- In April 2022, Dover Corporation successfully finalized the acquisition of Neptune Chemical Pump Company, now integrated into Dover's newly established Pump Solutions Group (PSG) within the Fluid Management segment. Recognized for its product lines specializing in chemical metering, dosing, and injection, Neptune plays a crucial role in water and wastewater treatment. The acquisition aligns seamlessly with Dover's existing pump portfolio, presenting valuable synergy prospects within the PSG. Neptune's agile and cost-effective business model, coupled with its emphasis on prompt market delivery, provides a competitive edge within its peer group.

- In April 2022, SEKO introduced an enhanced version of its WareDose warewash dosing pump systems featuring an integrated Wi-Fi hub. This innovation allows operators to establish a 24/7 connection to their systems through smartphones. The peristaltic WareDose range is compatible with SekoWeb, SEKO's specialized smartphone app and online portal. Users can benefit from real-time and historical data, gaining insights into their dosing systems and analyzing chemical costs per load.

Metering Pump Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.39 billion |

|

Revenue Forecast in 2032 |

USD 10.37 billion |

|

CAGR |

4.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of metering pump in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The Metering Pump Market report covering key segments are type, end-use, and region.

The global Metering Pump market size is expected to reach USD 10.37 billion by 2032

The global Metering Pump market is expected to grow at a CAGR of 4.8% during the forecast period.

Asia Pacific regions is leading the global market.

Increasing demand for accurate and controlled dispensing of diverse food ingredients.