MicroRNA Market Share, Size, Trends & Industry Analysis Report

By Product (Instrument, Consumables); By Services; By Application; By Region, And Segment Forecasts, 2025 - 2034

- Published Date:May-2025

- Pages: 119

- Format: PDF

- Report ID: PM1891

- Base Year: 2024

- Historical Data: 2020-2023

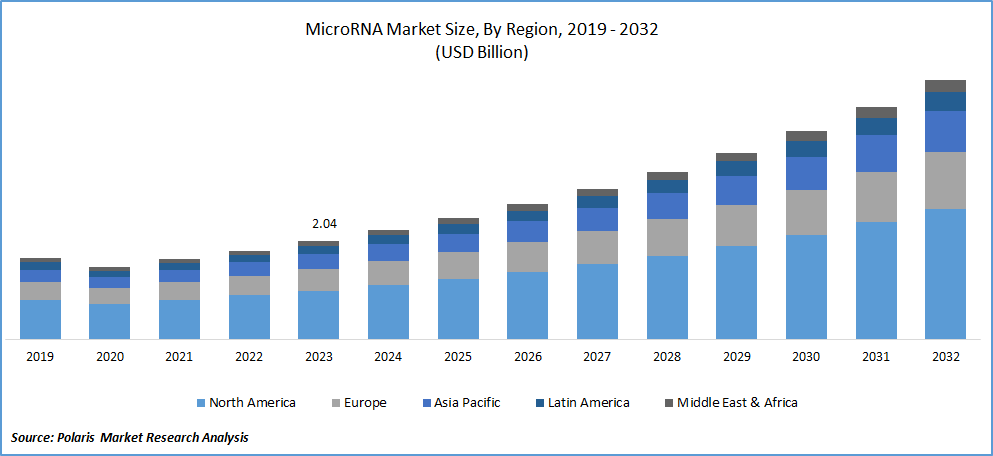

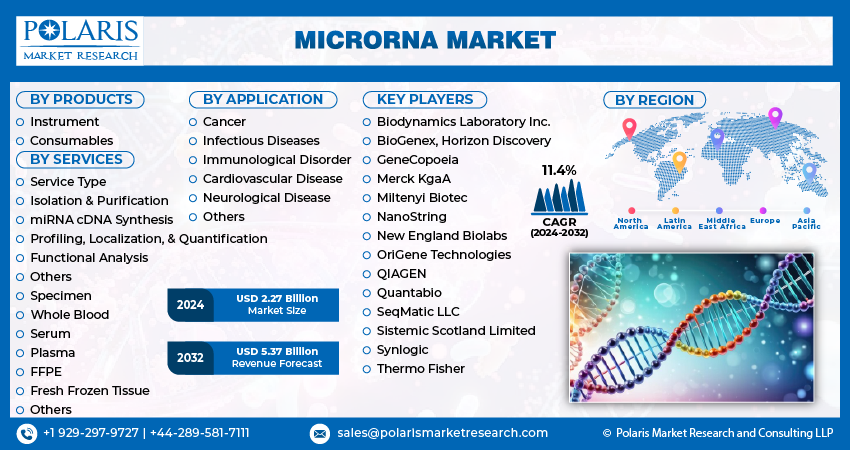

The global microRNA market was valued at USD 2.27 billion in 2024 and is anticipated to grow at a CAGR of 11.50% from 2025 to 2034. Growth is driven by expanding research in gene regulation and increasing applications in diagnostics and therapeutics.

MiRNAs, which are small endogenous RNAs, play a crucial role in the post-transcriptional regulation of gene expression. In allergy research, the study of miRNAs is expanding due to their significance as regulators of gene expression and their potential as biomarkers. The development of miRNA mimics and inhibitors is currently underway in the preclinical stages, offering new and innovative therapeutic avenues for treating allergies.

Emerging microRNA tools for diverse disease-associated applications, the utilization of microRNA in prediction and identification, and its potential as a candidate for future drug development are key market factors shaping the microRNA market's future. Biopharmaceutical companies worldwide are actively involved in developing new molecules, harnessing the potential of microRNA as a promising drug candidate. These factors collectively contribute to the growth of the microRNA market.

To Understand More About this Research: Request a Free Sample Report

Clinical trials are underway for microRNA-based candidates, including anti-microRNA compounds and potential inhibitors, which hold promise for various therapeutic applications. As a result, RNA therapeutics is emerging as a lucrative investment area with the potential to develop profitable drugs. This trend underscores the growing interest and potential profitability of microRNA-based therapeutics in the pharmaceutical industry. The increasing research focus on miRNA biomarkers for therapeutics, diagnosis, and prognosis, is expected to drive market expansion in the coming years.

- For instance, in January 2020, where researchers utilized another-generation sequencing to explore the potential of miRNA as a diagnostic biomarker for Bipolar II disorder (BD-II). It highlights the potential of miRNAs as noninvasive tools for diagnosing various neurodegenerative diseases, opening up new possibilities for improved diagnostic approaches in the field.

Various recently developed methods are available for amplifying microRNA in the market, including enzyme-free amplification, RCA-based, DSN-based, nanoparticle-based, and LAMP-based methods. In January 2020, researchers in the field successfully developed an isothermal amplification technique specifically designed for quantitative measurement of microRNA. This innovative approach offers reduced contamination risks and improved efficiency due to its reliance on signal amplification processes, making it a promising alternative to other existing methods.

The market is experiencing growth due to the expanding use of microRNA as a biomarker. MicroRNA biomarkers offer high robustness and reproducibility, making them valuable in genome-wide population studies and data-driven methods. Their reliability surpasses traditional procedures, making them promising candidates for drug development and biomarker applications. Additionally, the increasing focus on liquid-based biopsies has further underscored the significance of microRNAs in biomarker discovery and development. This growing interest in liquid-based biopsies has contributed to the rising importance and utilization of microRNAs as biomarkers in various research and clinical settings.

Industry Dynamics

- Growth Drivers

- Technological Advancement

The market's wide adoption of microRNA (miRNA) tools can be attributed to a better understanding of miRNAs' roles and functions in various biological processes and diseases. It has increased the demand for miRNA tools that enable researchers to study miRNA expression, regulation, and function. The availability of advanced techniques such as next-generation sequencing and bioinformatics tools has facilitated miRNA research, driving the adoption of miRNA tools.

The clinical significance of miRNAs as potential biomarkers and therapeutic targets has fueled the adoption of miRNA tools. MiRNAs have shown promise as diagnostic markers for diseases such as cancer, cardiovascular disorders, neurodegenerative diseases, and infectious diseases. The ability to detect and measure miRNA expression levels accurately using miRNA tools has contributed to their widespread adoption in clinical research and diagnostics.

The availability of research funding and grants focused on miRNA research has supported adoption of miRNA tools. Funding agencies and research institutions recognize the potential of miRNA research in advancing our understanding of diseases and developing new therapeutic approaches. The availability of financial resources has encouraged researchers to invest in miRNA tools and technologies, driving their adoption in the market.

Report Segmentation

The market is primarily segmented based on products, services, application, and region.

|

By Products |

By Services |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- The consumables segment held the largest market share in 2023

In 2023, the consumables segment held the largest market share, and can be attributed to the wide range of consumables available for microRNA profiling including detection kits, primers, reagents, and other essential components. Consumables play a crucial role in the microRNA profiling procedure as they are quickly consumed and need to be regularly replaced.

Real-time PCR emerged as the dominant instrument in the microRNA detection market segment, considered the gold standard among other techniques. It is widely utilized as a reliable method for detecting microRNA expression due to its exceptionally high specificity, enhanced sensitivity, and dynamic range. Real-time PCR is extensively employed in various research applications, including functional analysis, validation, quantification, and profiling of microRNAs. Its widespread adoption underscores its efficacy and versatility in microRNA research.

The cancer segment held the highest market share in 2023

In 2023, the cancer segment held the highest market share, primarily driven by the growing prevalence of cancer cases and the critical role of microRNAs in cancer pathology. Innovations in the understanding of microRNAs' involvement in cancer diagnosis, particularly through cancer-associated genomic regions, have further contributed to microRNAs' significance in the oncology field.

Numerous tumor suppressor microRNAs are typically downregulated in the presence of oncogenes, inhibiting tumor formation and cancer progression. The dysregulation of microRNAs is well recognized, and efforts are underway to leverage this knowledge for therapeutic interventions targeting various forms of cancer. The market for microRNAs in cancer is thus driven by the potential to develop effective treatments by targeting specific microRNAs implicated in cancer pathways.

The North America accounted for largest revenue share in 2023

In 2023, North America accounted for largest revenue share due to including key market players, extensive research and development activities, and well-established research infrastructure in proteomics, genomics, and oncology.

Furthermore, companies in North America have been successful in obtaining patent approvals for their miRNA biomarkers, further boosting market growth. An example is DiamiR, which got a U.S. Patent license in May 2020 for miRNA-based methods to monitor and detect brain aging. The patent surrounds the application of quantitative analysis of miRNA found in detectable blood plasma and the brain as biomarkers of brain aging. It highlights the innovative research and development ongoing in the region and underscores North America's prominent position in the miRNA market.

The Asia Pacific region is expected to grow at fastest rate in forecast period, due to advancements in genomic studies and the adoption of new research tools. In February 2021, Chinese researchers used miRNA profiling to identify potential biomarkers for HSOS. Such progress and utilization of innovative tools are anticipated to drive the growth of the miRNA market in the region, making it a significant global market player.

Competitive Insight

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

The major global market players include:

- Biodynamics Laboratory Inc.

- BioGenex, Horizon Discovery

- GeneCopoeia

- Merck KgaA

- Miltenyi Biotec

- NanoString

- New England Biolabs

- OriGene Technologies

- QIAGEN

- Quantabio

- SeqMatic LLC

- Sistemic Scotland Limited

- Synlogic

- Thermo Fisher

Recent Developments

- In October 2023, Thermo Fisher Scientific acquired Olink for USD 26.00 per share, valuing the company at USD 3.1 billion. This acquisition enhanced Thermo Fisher’s proteomics capabilities, accelerating and expanding life sciences solutions for customers.

- In February 2022, a team of researchers at the University of Illinois Urbana made a breakthrough by developing a novel point-of-care test for cancer detection using microRNAs (miRNAs). This innovative test utilizes nanoparticles to capture tumor-specific miRNAs present in human serum.

MicroRNA Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2.52 billion |

|

Revenue forecast in 2034 |

USD 6.71 billion |

|

CAGR |

11.50% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By products, services, application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global microRNA market size is expected to reach USD 6.71 billion by 2034

the major players operating in the global market include Biosensors International Group, Abbott Laboratories

The North America contribute notably towards the microRNA Market.

The global microRNA market is expected to grow at a CAGR of 11.50% during the forecast period.

microRNA Market report covering key segments are products, services, application, and region