Middle East Printing Inks Market Size, Share, Trend & Industry Analysis Report

: By Product (Gravure, Flexographic, Lithographic, Digital, and Others), By Resin, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1583

- Base Year: 2024

- Historical Data: 2020-2023

Overview

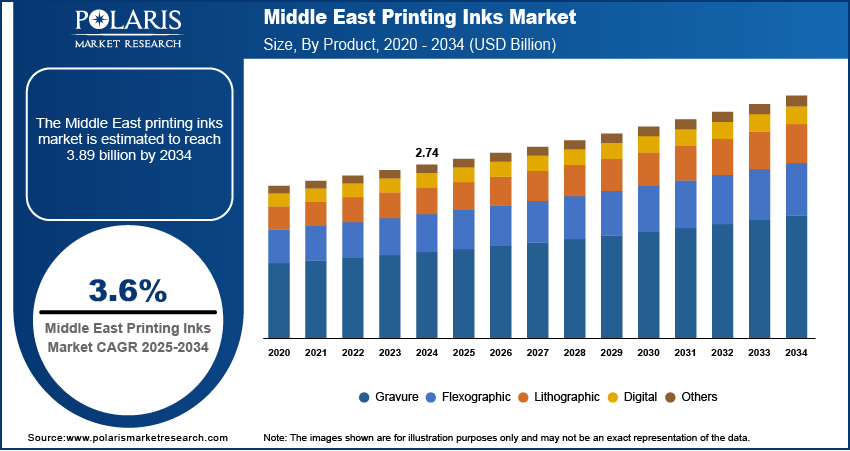

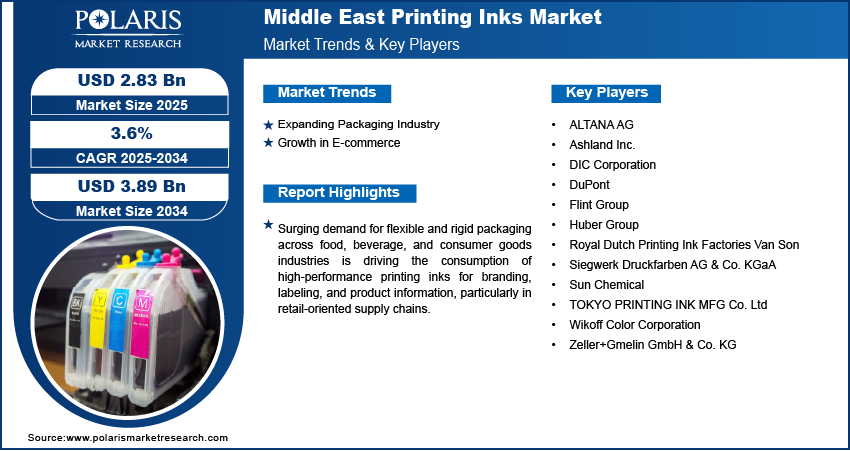

The Middle East printing inks market size was valued at USD 2.74 billion in 2024, growing at a CAGR of 3.6% from 2025–2034. Surging demand for flexible and rigid packaging across food, beverage, and consumer goods industries is driving the demand for high-performance printing inks. In these industries, the printing inks are used for branding, labeling, and product information, particularly in retail-oriented supply chains.

Key Insights

- The lithographic segment held ~44% of the market share in 2024, driven by widespread use in high-volume commercial printing and packaging across the Middle East.

- The acrylic segment captured ~31% of the revenue share in 2024, due to excellent color retention, gloss, and durability on diverse substrates.

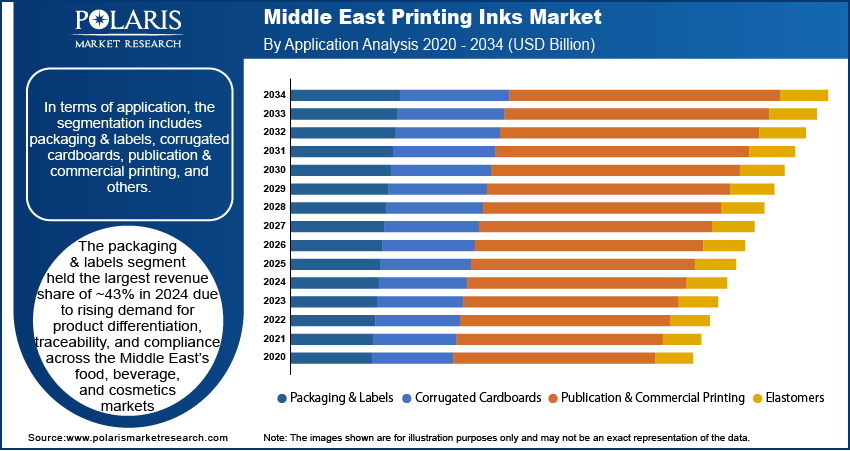

- The packaging & labels segment led with ~43% share in 2024, fueled by demand for branding, traceability, and regulatory compliance in food, beverage, and cosmetics.

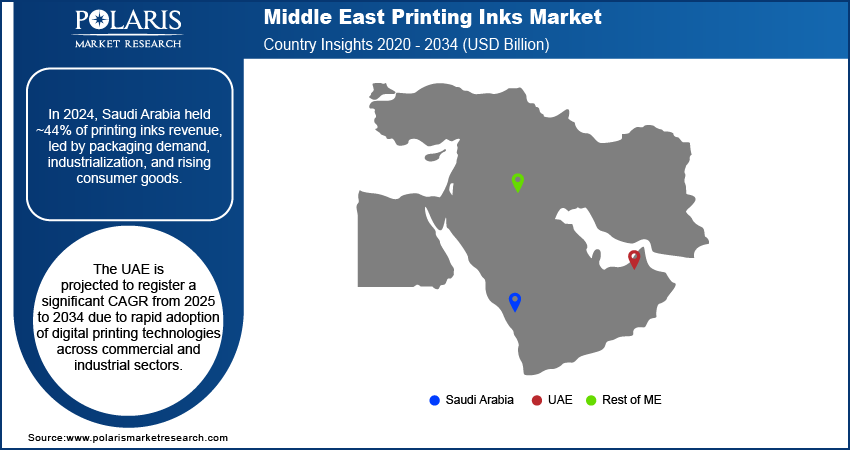

- Saudi Arabia accounted for ~44% of the regional market in 2024, supported by industrial growth and rising consumer goods production.

- The UAE market is projected to grow significantly from 2025 to 2034, driven by the rapid adoption of digital printing in commercial and industrial applications.

- The market in Egypt is experiencing strong growth due to rising demand for flexible packaging in the food, pharmaceutical, and textile industries.

Industry Dynamics

- Rising demand for packaged food and beverages is driving the requirement for printing inks for labels and flexible packaging across the Middle East.

- Expanding e-commerce and retail sectors are increasing the need for branded, high-quality printed packaging in the Middle East.

- Adoption of digital printing enables faster, on-demand packaging production with reduced waste and greater design flexibility.

- Limited availability of skilled technicians and high import dependency for raw materials hinder local ink manufacturing and innovation.

Market Statistics

- 2024 Market Size: USD 2.74 billion

- 2034 Projected Market Size: USD 3.89 billion

- CAGR (2025–2034): 3.6%

- Saudi Arabia: Largest market in 2024

AI Impact on Middle East Printing Inks Market

- AI enhances performance optimization in printing inks by analyzing print quality metrics, substrate characteristics, and environmental conditions to ensure consistent and high-fidelity output across applications.

- Integration of AI enables adaptive ink formulation, dynamically adjusting viscosity, color intensity, and drying time based on print job specifications, ambient temperature, and machine speed.

- AI-powered monitoring systems assist in early detection of pigment sedimentation, chemical degradation, or nozzle clogging, supporting predictive maintenance and reducing downtime in printing operations.

- AI improves operator efficiency by enabling automated calibration, real-time color matching, and intelligent process feedback, boosting print accuracy, waste reduction, and overall productivity in commercial and industrial printing environments.

The printing inks market comprises the production and supply of colored fluids used in printing applications across packaging, publishing, commercial, and industrial sectors. These inks, based on various formulations such as solvent-based, water-based, or UV-curable, are essential for delivering text, images, and graphics onto diverse substrates such as paper, plastics, and metals. Increasing adoption of digital printing in the textile, ceramic, and promotional product sectors is propelling the demand for specialized inks that offer superior adhesion, chemical resistance, and color vibrancy for diverse substrates.

Development of eco-friendly, low-VOC, and UV-curable inks is enhancing performance while aligning with regulatory requirements and sustainability targets, making them attractive across industrial and commercial printing segments. Moreover, surging investments in construction and infrastructure projects are boosting the demand for printed signage, commercial display boards, and decorative materials, driving ink consumption in wide-format and architectural printing.

Drivers & Opportunities

Expanding Packaging Industry: Rising demand for both flexible and rigid packaging formats across food, beverage, personal care product, and consumer goods sectors is significantly fueling the printing inks market in the Middle East. According to the Gulf Packaging Forum, in 2023, packaging demand in the Middle East grew by 8.2% year-on-year, driven by rising consumption in the food, beverage, and personal care sectors across Saudi Arabia, the UAE, and Egypt. Brands are placing greater emphasis on packaging aesthetics, product differentiation, and consumer engagement, which requires high-quality inks capable of delivering sharp visuals and long-lasting finishes. The shift toward retail-ready and shelf-attractive packaging formats is prompting converters and manufacturers to invest in advanced ink formulations that ensure print durability, color consistency, and substrate versatility. In retail-dominated supply chains, especially in urban commercial zones, clear and attractive packaging has become a critical factor influencing consumer purchasing behavior. Hence, the expanding packing industry supports the ink demand across the Middle East.

Growth in E-commerce: Rising e-commerce activity across the Middle East is reshaping packaging requirements and driving demand for high-quality printing inks. According to Dubai Chamber of Commerce, in 2024, e-commerce sales in the UAE reached USD 14.7 billion, a 15% increase from 2023. The surge in online retail transactions has increased the volume of printed corrugated boxes, shipping labels, and personalized packaging used in order fulfillment. This shift calls for inks that can deliver sharp imagery, barcoding clarity, and high-speed print compatibility for automated logistics systems. Custom branding and interactive packaging are also gaining popularity in e-commerce, requiring inks that support variable data printing and short-run customization. Local fulfillment centers and digital printing setups are growing in response, creating a dynamic demand for quick-drying, eco-friendly inks that offer consistent performance across diverse packaging substrates.

Segmental Insights

Product Analysis

Based on product, the segmentation includes gravure, flexographic, lithographic, digital, and others. The lithographic segment accounted for the largest revenue share of ~44% in 2024 due to its strong adoption in high-volume commercial printing and packaging across the Middle East. This process supports precise image reproduction, fast output, and lower unit costs, making it ideal for producing brochures, labels, and cartons in bulk. The method is widely preferred for its ability to handle diverse surfaces while maintaining consistent quality. Lithographic inks also offer excellent adhesion and vibrant color, meeting the branding requirements of regional FMCG and pharmaceutical companies. The segment’s growth is reinforced by its compatibility with both paper and metal substrates used in local manufacturing

The flexographic segment is expected to register the highest CAGR from 2025 to 2034 due to their increasing application in flexible packaging, especially for food, cosmetics, and personal care products. The technology's ability to handle a variety of substrates, including plastic films, metallic foils, and paper, aligns well with regional packaging innovations. Flexographic printing supports faster drying, reduced waste, and higher efficiency in large-scale production environments, which is attracting investment from converters in the Gulf region. The shift toward sustainable packaging is also boosting the use of water-based and UV-flexo inks, making this segment a preferred choice for brands seeking cost-effective and eco-friendly print solutions.

Resin Analysis

In terms of resin, the segmentation includes modified rosin, modified cellulose, acrylic, polyurethane, and others. The acrylic segment held the largest revenue share of ~31% in 2024. The dominance is attributed to their superior color retention, gloss, and weather resistance across a wide range of substrates. These resins offer fast-drying properties and strong adhesion, making them well-suited for high-speed printing on flexible packaging and labels. Acrylic-based inks are increasingly used for their compatibility with water-based systems, aligning with the region’s growing focus on low-VOC and non-toxic solutions. Demand remains high from converters looking for durable inks that perform reliably under various environmental conditions, especially in sectors such as beverage and personal care where visual appeal and product durability are essential.

The polyurethane segment is expected to register the highest CAGR from 2025 to 2034 due to their exceptional flexibility, abrasion resistance, and suitability for high-performance packaging. This resin type is gaining attention in the Middle East’s expanding food and industrial packaging sectors, where inks must withstand handling, transportation, and exposure to moisture or chemicals. Polyurethane inks also offer excellent adhesion to non-porous substrates such as plastic films, which are widely used in multilayer and retort packaging formats. As packaging designs become more complex and functional, these inks are meeting the demand for durability without compromising print clarity, supporting a surge in adoption among converters and printers.

Application Analysis

In terms of application, the segmentation includes packaging & labels, corrugated cardboards, publication & commercial printing, and others. The packaging & labels segment held the largest revenue share of ~ 43% in 2024 due to rising demand for product differentiation, traceability, and compliance across the Middle East’s food, beverage, and cosmetics markets. High-quality inks are essential for printing vibrant graphics, barcodes, and regulatory information, especially on flexible films and rigid containers. The retail sector’s shift toward premium packaging and branded labeling has intensified the use of specialty inks that ensure durability, clarity, and resistance to fading. Regional packaging converters are increasingly relying on advanced ink formulations to meet client-specific needs, further boosting consumption. Growth in exports of packaged goods also supports continued demand for printed packaging.

The publication & commercial printing segment is expected to register a significant CAGR from 2025 to 2034. The growth is driven by the region’s expanding print media, education, and corporate communication needs. Despite digitalization, printed materials such as magazines, catalogues, business reports, and educational content remain in high demand across Gulf countries. Governments and private institutions continue to invest in print campaigns for cultural, tourism, and educational outreach, supporting consistent ink usage. The adoption of high-speed offset and digital presses allows printers to deliver visually appealing outputs at competitive prices, further sustaining this segment. Growth in commercial printing is also supported by the hospitality and event sectors requiring printed marketing collateral.

Country Analysis

The Saudi Arabia printing inks market accounted for ~44% of the revenue share in 2024 due to strong demand from the packaging and labeling sector, driven by rapid industrialization and rising consumer goods production. High-volume manufacturing of food, beverages, and personal care items has created a steady requirement for advanced printing solutions. The government’s focus on expanding non-oil industries under its Vision 2030 plan has further supported investments in printing and packaging infrastructure. Increasing adoption of lithographic and flexographic printing methods by local manufacturers has enhanced efficiency and print quality. Growth in retail chains and e-commerce is also creating sustained demand for high-quality packaging, reinforcing Saudi Arabia’s market dominance.

UAE Printing Inks Market Insights

The UAE market is projected to register a significant CAGR from 2025 to 2034. The market expansion is attributed to rapid adoption of digital printing technologies across commercial and industrial sectors. Expansion of luxury retail, tourism, and high-end product packaging has increased the need for premium, customized print applications. The country’s position as a regional logistics and re-export hub boosts packaging activity, which in turn supports ink consumption. Investments in sustainable printing solutions and eco-friendly inks are gaining momentum, particularly among global brands operating in the UAE. A growing number of trade shows and exhibitions in the region have pushed demand for high-quality display printing, supporting strong growth projections over the forecast period.

Egypt Printing Inks Market Trends

The market in Egypt is growing significantly due to rising domestic demand for flexible packaging in the food, pharmaceutical, and textile sectors. Local manufacturers are upgrading their printing technologies to meet higher quality and volume requirements, creating opportunities for advanced ink formulations. Government initiatives to attract foreign investments in industrial parks and export zones are helping develop printing and packaging capacities. Increasing consumption of packaged goods, particularly among the expanding urban population, is contributing to steady market growth. The shift from traditional offset printing toward flexographic and digital formats is also boosting ink consumption across various end-use applications.

Key Players & Competitive Analysis

The competitive landscape of the Middle East printing inks market is shaped by robust industry analysis and focused market expansion strategies aimed at capturing emerging opportunities across sectors such as packaging, publishing, and commercial printing. Leading manufacturers are emphasizing joint ventures and strategic alliances with regional players to gain a strong foothold in high-demand areas such as Saudi Arabia and the UAE. Mergers and acquisitions continue to play a central role, allowing firms to diversify product portfolios and enhance distribution capabilities.

Post-merger integration is streamlined to ensure operational synergy and supply chain efficiency. Technology advancements in eco-friendly inks and digital printing are influencing innovation cycles, enabling companies to address the growing demand for sustainable and high-performance formulations. Investments in R&D are rising as players aim to differentiate through product customization and resin innovation, particularly in fast-growing segments such as flexographic and polyurethane-based inks. Strategic collaborations with local packaging converters and print service providers are strengthening relationships with end users. Further, expansion into e-commerce packaging and flexible substrates is unlocking new revenue streams.

Key Players

- ALTANA AG

- Ashland Inc.

- DIC Corporation

- DuPont

- Flint Group

- Huber Group

- Royal Dutch Printing Ink Factories Van Son

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical

- TOKYO PRINTING INK MFG Co. Ltd

- Wikoff Color Corporation

- Zeller+Gmelin GmbH & Co. KG

Middle East Printing Inks Industry Developments

June 2025: Siegwerk, engaged in printing inks and coatings for packaging and labeling applications, announced that it is enhancing its regional footprint in the Middle East with the establishment of a new facility in Dubai.

Middle East Printing Inks Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

By Resin Outlook (Revenue, USD Billion, 2020–2034)

- Modified Rosin

- Modified Cellulose

- Acrylic

- Polyurethane

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Packaging & Labels

- Corrugated Cardboards

- Publication & Commercial Printing

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Saudi Arabia

- UAE

- Egypt

- Morocco

- Qatar

- Kuwait

- Rest of Middle East

Middle East Printing Inks Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.74 billion |

|

Market Size in 2025 |

USD 2.83 billion |

|

Revenue Forecast by 2034 |

USD 3.89 billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.74 billion in 2024 and is projected to grow to USD 3.89 billion by 2034.

The market is projected to register a CAGR of 3.6% during the forecast period.

Saudi Arabia accounted for ~44% of the revenue share in 2024 due to strong demand from the packaging and labeling sector, driven by rapid industrialization and rising consumer goods production.

A few of the key players in the market are ALTANA AG; Ashland Inc.; DIC Corporation; DuPont; Flint Group; Huber Group; Royal Dutch Printing Ink Factories Van Son; Siegwerk Druckfarben AG & Co. KGaA; Sun Chemical; TOKYO PRINTING INK MFG Co. Ltd; Wikoff Color Corporation; and Zeller+Gmelin GmbH & Co. KG.

The lithographic segment accounted for the largest revenue share of ~44% in 2024 due to its strong adoption in high-volume commercial printing and packaging across the Middle East.

The acrylic segment held the largest revenue share of ~31% in 2024 due to their superior color retention, gloss, and weather resistance across a wide range of substrates.