Mirror Coatings Market Size, Share, Trends & Industry Analysis Report

: By Resin (Polyurethane, Epoxy, Acrylic, and Others), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5854

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

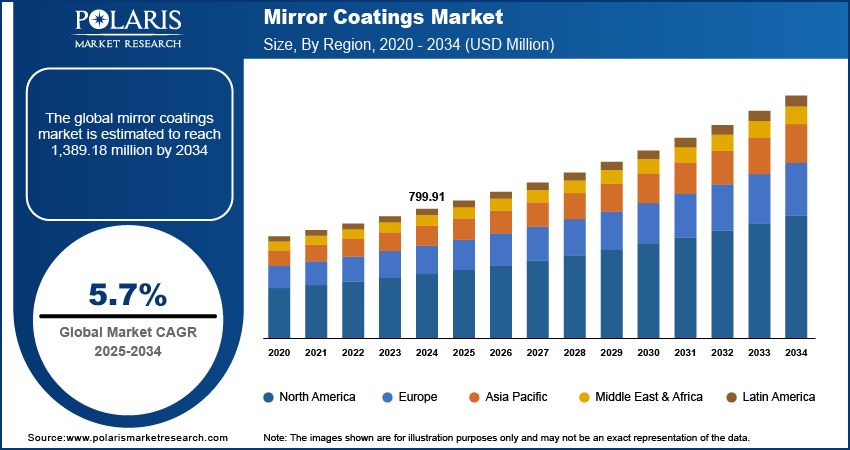

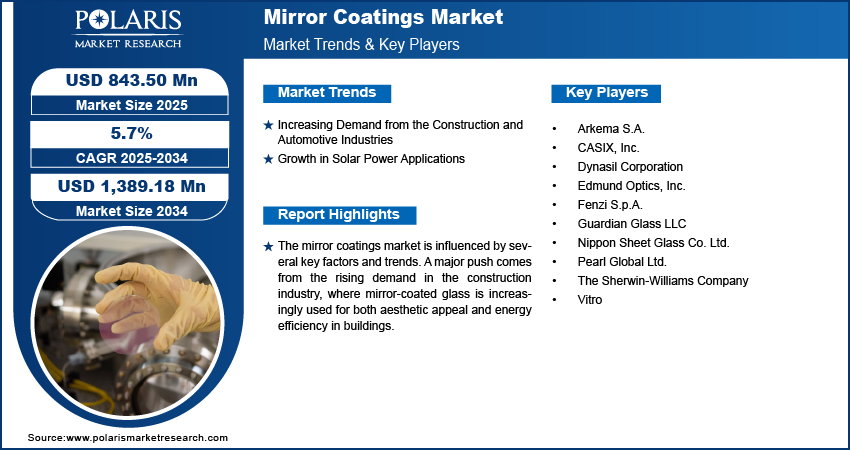

The global mirror coatings market size was valued at USD 799.91 million in 2024, and is anticipated to grow at a CAGR of 5.7% from 2025 to 2034. The demand for mirror coatings is largely driven by their growing use in the construction and automotive industries.

Mirror coatings are specialized layers applied to surfaces to enhance their reflective properties, durability, and often to provide additional functionalities like anti-glare or anti-scratch capabilities. These coatings transform ordinary substrates into effective mirrors suitable for various optical, industrial, and decorative uses.

To Understand More About this Research: Request a Free Sample Report

Ongoing advancements in nanotechnology are significantly driving the mirror coatings industry by enabling the development of coatings with superior and multi-functional properties. Nanoscale engineering allows for precise control over optical, mechanical, and chemical characteristics, leading to mirror coatings that offer enhanced durability, scratch resistance, and improved optical performance.

The growing demand for smart mirrors, particularly in residential, automotive, and retail sectors, is a powerful driver for the mirror coatings market. Smart mirrors, which integrate display screens, sensors, and connectivity features into a reflective surface, require specialized coatings to ensure optimal performance. These coatings need to be highly transparent when the display is active and perfectly reflective when it's off, while also offering durability and clarity.

Industry Dynamics

Increasing Demand from the Construction and Automotive Industries

The construction sector is a significant driver due to the rising use of architectural glass and decorative elements in modern building designs. Mirror-coated glass enhances the aesthetic appeal of buildings and contributes to energy efficiency by reflecting solar heat. Similarly, the automotive sector relies heavily on mirror coatings for various applications, including rearview mirrors and other reflective surfaces, which are crucial for vehicle safety and functionality.

The integration of advanced mirror technologies into smart homes and vehicles further propels demand. For instance, the use of mirror-coated glass in residential and commercial buildings for energy efficiency is gaining traction. According to an article titled "All-optical seasonal energy saving windows" published by PMC in April 2025, thin metal layers in low-emissivity coatings, typically silver, significantly suppress near-infrared transmission of sunlight, providing cooling benefits in summer, highlighting their role in building energy efficiency.

Growth in Solar Power Applications

The global shift towards renewable energy sources, especially solar power, is another major driver for the mirror coatings market. Mirror coatings are crucial components in concentrated solar power (CSP) systems, where they are used to focus sunlight onto a receiver to generate electricity. These coatings are designed to maximize reflectivity and endure harsh environmental conditions, which directly impacts the efficiency and lifespan of solar energy installations.

The increasing focus on sustainable energy solutions globally has led to a rise in demand for highly efficient solar components. An experimental investigation, "Experimental investigation of the effect of reflectors on thermal performance of box type solar cooker," published by PubMed Central in December 2022, showed that mirror glass reflectors could significantly increase the efficiency of solar cookers, by 134% compared to those without reflectors. This underscores the critical role mirror coatings play in enhancing the performance of solar energy systems, thereby significantly driving the mirror coatings market growth.

Segmental Insights

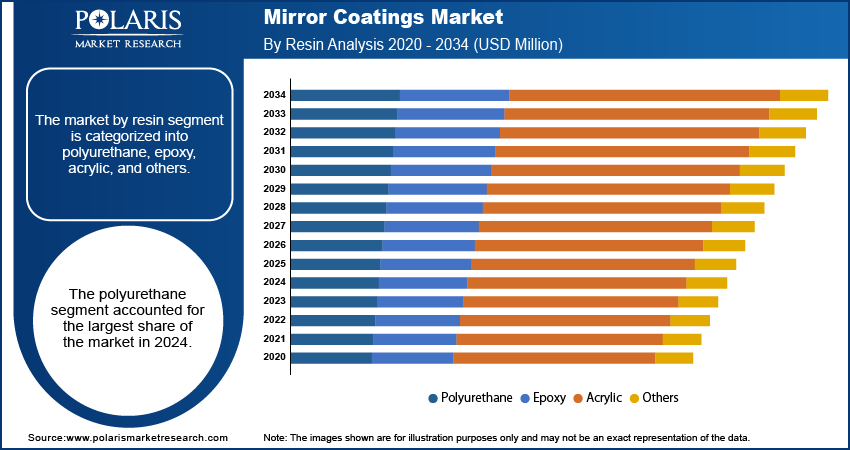

By Resin

The polyurethane segment held the largest share in 2024. This is primarily due to the superior properties of polyurethane, such as its excellent durability, resistance to abrasion, and strong adhesion to various surfaces. These characteristics make polyurethane coatings ideal for applications requiring long-lasting performance and protection against environmental factors. For instance, in the automotive sector, polyurethane is widely used for rearview mirrors because it provides enhanced resistance to scratches and maintains optical clarity over time, which is critical for safety and vehicle lifespan.

The acrylic segment is anticipated to grow at the highest growth rate during the forecast period. Acrylic coatings are becoming increasingly popular due to their cost-effectiveness, good UV resistance, and environmental benefits, often being associated with lower Volatile Organic Compound (VOC) emissions. They are particularly favored in decorative and general-purpose mirror applications where flexibility in design and a balance of performance and affordability are important. The rising demand for eco-friendly building materials also contributes to the increased adoption of acrylic mirror coatings, especially in architectural projects.

By Application

The water-based coatings segment held the largest share in 2024. This dominance is largely due to increasing environmental awareness and stricter regulations concerning Volatile Organic Compound (VOC) emissions. Water-based coatings offer a more eco-friendly alternative to traditional solvent-based options, as they contain significantly lower levels of harmful chemicals. For example, the US Environmental Protection Agency (EPA) has consistently emphasized reducing VOCs to improve air quality, which encourages industries, including mirror manufacturing, to adopt water-based solutions.

The nanotechnology-based coatings segment is anticipated to grow at the highest growth rate during the forecast period. This surge is attributed to the advanced functionalities and superior performance properties that nanotechnology brings to mirror surfaces. These coatings can offer enhanced durability, scratch resistance, anti-fog properties, and even self-cleaning capabilities, which are highly sought after in specialized applications.

By End Use

The architectural segment held the largest share in 2024. This is driven by the widespread use of mirror-coated glass in modern building designs, both for aesthetic appeal and functional benefits such as energy efficiency. These coatings are found in various architectural applications, from large facades to interior decorative elements, enhancing light, space, and thermal performance. The demand for energy-efficient buildings has led to an increased adoption of low-emissivity coatings on glass, which are crucial for managing solar heat gain and reducing heating and cooling costs in structures.

The solar power segment is anticipated to grow at the highest growth rate during the forecast period. This rapid expansion is directly linked to the global push for renewable energy and the increasing investment in solar energy projects, particularly concentrated solar power (CSP) plants. Mirror coatings are indispensable in CSP systems, where they are engineered to maximize sunlight reflection onto receivers, thereby increasing the efficiency of solar energy conversion. Advancements in mirror technology for solar concentrators are continually being researched to enhance their reflectivity and durability under harsh outdoor conditions, significantly contributing to the overall performance of solar farms.

Regional Analysis

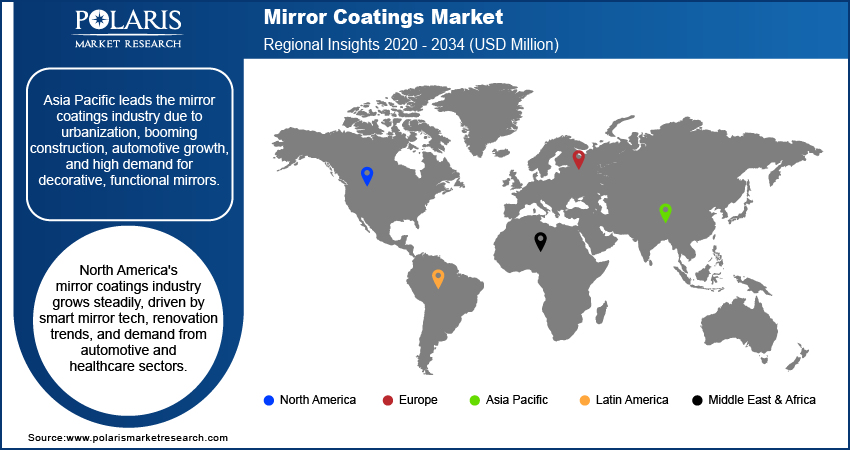

The Asia Pacific mirror coatings market held the largest share in 2024 in the global market, primarily driven by rapid urbanization and significant growth in the construction and automotive sectors. The increasing demand for both decorative and functional mirrors in residential and commercial infrastructure, especially in developing economies, is a key factor. The region's expanding manufacturing capabilities and the growing middle-class population further contribute to the rising adoption of mirror coatings across various end-use applications. Specifically China mirror coatings market is experiencing substantial growth due to its massive construction activities and leadership in solar power generation. The country's ambitious solar energy targets and large-scale solar farm developments create a significant demand for highly reflective and durable mirror coatings used in concentrated solar power systems. Furthermore, China's booming automotive sector and the increasing emphasis on modern infrastructure projects continue to drive the need for advanced mirror coating solutions.

North America Mirror Coatings Market Overview

The North America mirror coatings market is experiencing steady growth, driven by advancements in smart mirror technology, increased renovation activities, and strong demand from the automotive and healthcare sectors. Consumers in the region, with higher disposable incomes, are increasingly opting for modern interior designs and vehicles that incorporate functional and aesthetically pleasing mirror coatings. The focus on enhancing vehicle safety and aesthetics, along with the rising adoption of advanced driver-assistance systems, contributes to the demand for high-performance mirror coatings in the automotive sector.

US Mirror Coatings Market Insight

Within North America, the US is a dominant force in the mirror coatings market, largely due to its well-established construction and automotive sectors, along with significant investments in solar energy. The country's emphasis on smart infrastructure development and premium construction projects is boosting the demand for high-quality mirror-coated glass. In the automotive sector, the US market benefits from continuous innovation in vehicle design and functionality, which includes advanced mirror solutions for enhanced visibility and integrated sensor technologies.

Europe Mirror Coatings Market Trend

The Europe market is showing consistent expansion, propelled by stringent environmental regulations and a strong focus on sustainable building practices. There is a notable trend towards adopting eco-friendly mirror coating formulations with low levels of Volatile Organic Compounds (VOCs), aligning with the region's green initiatives. The increasing use of architectural glass in commercial and residential buildings, combined with the growing demand for energy-efficient solutions, further fuels the development across various European countries. Germany mirror coatings market benefits from a robust automotive sector and a strong commitment to technological innovation. German automotive manufacturers are keen on integrating advanced mirror coatings that provide enhanced durability, anti-glare properties, and improved aesthetics, contributing to vehicle safety and performance. Additionally, the country's initiatives in renewable energy and smart infrastructure projects are creating a favorable environment for the adoption of high-performance mirror coatings.

Key Players and Competitive Insights

The mirror coatings industry features a competitive landscape with several established players and emerging innovators. Competition revolves around product performance, durability, environmental compliance, and cost-effectiveness. Companies strive to differentiate their offerings through advanced research and development, focusing on new coating technologies like nanotechnology to meet evolving demands from various end-use sectors, including automotive, construction, and solar power.

Prominent companies in the industry include The Sherwin-Williams Company, Fenzi S.p.A., Arkema S.A., Guardian Glass LLC, Vitro, Pearl Global Ltd., Nippon Sheet Glass Co. Ltd., Edmund Optics, Inc., CASIX, Inc., and Dynasil Corporation.

Key Players

- Arkema S.A.

- CASIX, Inc.

- Dynasil Corporation

- Edmund Optics, Inc.

- Fenzi S.p.A.

- Guardian Glass LLC

- Nippon Sheet Glass Co. Ltd.

- Pearl Global Ltd.

- The Sherwin-Williams Company

- Vitro

Industry Developments

April 2024: Guardian Glass introduced Guardian CrystalClear. This new glass product has less iron, which makes it 67% more color neutral and allows 90% of visible light to pass through. It can be used with Guardian SunGuard low-emissivity coatings and is available in different thicknesses and large sizes.

March 2024: Guardian Glass and the VELUX Group began a joint project to improve tempered vacuum-insulated glass (VIG) technology. This partnership combines the technical knowledge and patents of both companies to speed up how VIG is used in VELUX roof windows, making them more energy-efficient and sustainable.

Mirror Coatings Market Segmentation

By Resin Outlook (Revenue – USD Million, 2020–2034)

- Polyurethane

- Epoxy

- Acrylic

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Water-based coatings

- Solvent-based coatings

- Nanotechnology-based coatings

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Architectural

- Automotive & Transportation

- Decorative

- Solar power

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Mirror Coatings Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 799.91 million |

|

Market Size in 2025 |

USD 843.50 million |

|

Revenue Forecast by 2034 |

USD 1,389.18 million |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 799.91 million in 2024 and is projected to grow to USD 1,389.18 million by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

Asia Pacific dominated the market share in 2024.

Key players in the market include The Sherwin-Williams Company, Fenzi S.p.A., Arkema S.A., Guardian Glass LLC (Guardian Industries), Vitro (Vitro S.A.B. de C.V.), Pearl Global Ltd., Nippon Sheet Glass Co. Ltd., Edmund Optics, Inc., CASIX, Inc., and Dynasil Corporation.

The polyurethane segment accounted for the largest share of the market in 2024.

The nanotechnology-based coatings segment is expected to witness the fastest growth during the forecast period.