Modified Cassava Starch Market Size, Share, Trends, Industry Analysis Report

By Type (Acetylated Starch, Phosphated Starch, Oxidized Starch, Cationic Starch, Pre-gelatinized Starch, Others), By Application, By Function, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6181

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

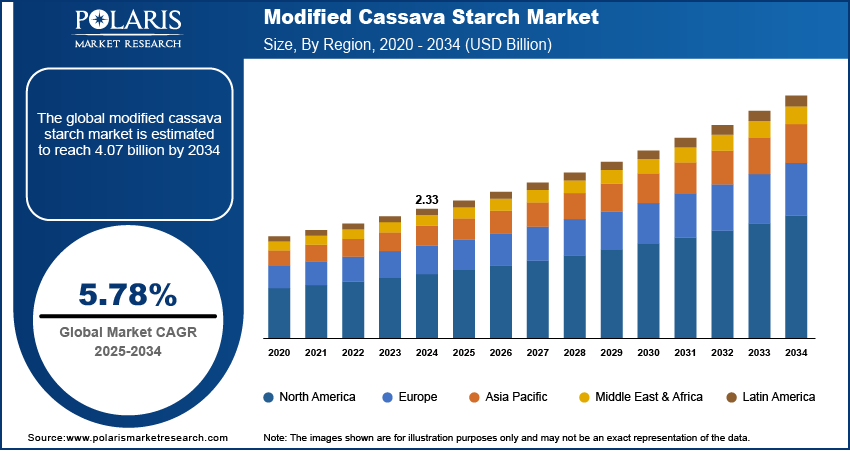

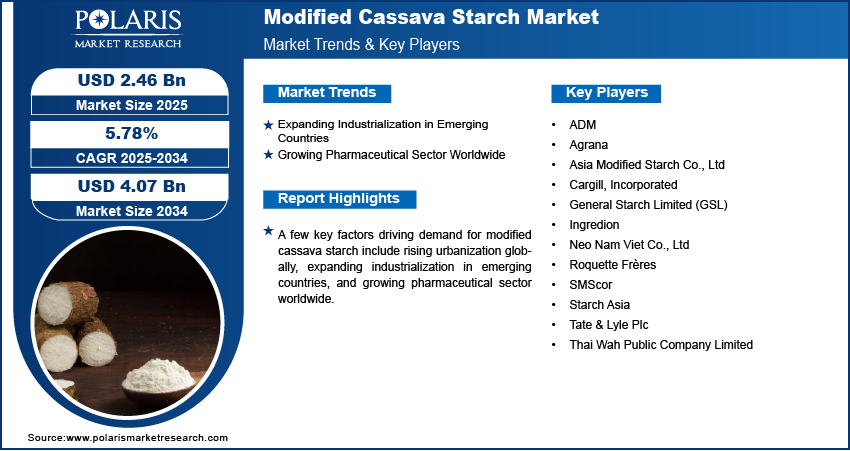

The global modified cassava starch market size was valued at USD 2.33 billion in 2024, growing at a CAGR of 5.78% from 2025 to 2034. Key factors driving demand for modified cassava starch include rising urbanization globally, expanding industrialization in emerging countries, and growing pharmaceutical sector worldwide.

Key Insights

- The acetylated starch segment accounted for a major revenue share in 2024 due to its enhanced freeze-thaw resistance.

- The food & beverages segment held the largest revenue share in 2024 due to increasing demand for packaged food products.

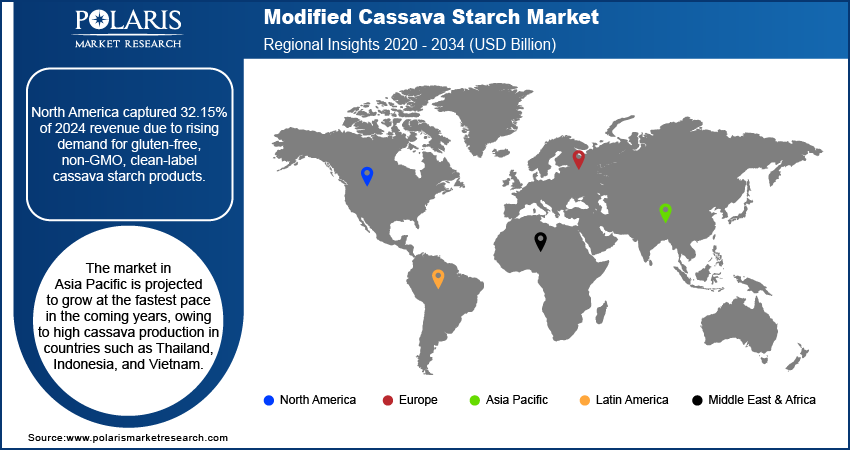

- North America modified cassava starch market accounted for 32.15% of global revenue share in 2024, due to the growing use of modified cassava starch in the food & beverage industry.

- The U.S. held the largest revenue share in North America modified cassava starch landscape in 2024, owing to the rising popularity of gluten-free products.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to high production in countries such as Vietnam, Thailand, and Indonesia.

Industry Dynamics

- The expanding industrialization in emerging countries is driving the demand for modified cassava starch as it is used in industries to enhance product quality, shelf life, and processing efficiency.

- The growing pharmaceutical sector worldwide is fueling the market growth as modified cassava starch serves as a key ingredient in drug formulations.

- The growing adoption of packaged and frozen food is projected to create a lucrative market opportunity during the forecast period.

- Regulatory approvals restrain the usage levels of modified cassava starch based on modification type.

Market Statistics

- 2024 Market Size: USD 2.33 Billion

- 2034 Projected Market Size: USD 4.07 Billion

- CAGR (2025–2034): 5.78%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Modified cassava starch is a derivative of cassava starch that has been chemically, physically, or enzymatically altered to enhance its functional properties for industrial and food applications. The modification process improves characteristics such as stability, texture, solubility, and resistance to heat, acids, or shear forces, making it more versatile than traditional cassava starch. Common modification techniques include cross-linking, oxidation, acetylation, and hydrolysis, each yielding starch with specific traits, such as increased viscosity, improved gel formation, or reduced retrogradation.

Modified cassava starch serves as a thickener, stabilizer, binder, or emulsifier in products such as hot sauces, soups, baked goods, and dairy alternatives. It enhances texture in gluten-free foods, improves shelf life in processed meats, and prevents syneresis in frozen dishes. Its neutral taste and clarity make it ideal for transparent gels and fruit fillings. It is also used in pharmaceuticals as a tablet disintegrant, in textiles for warp sizing, and in paper manufacturing to improve sheet strength. It further acts as an adhesive in biodegradable packaging and as a binder in animal feed.

Modified cassava starch is favored for its cost-effectiveness, biodegradability, and compatibility with clean-label trends. Its ability to function under extreme conditions makes it crucial in processed foods and industrial applications. However, regulatory approvals limit its usage levels based on modification type.

The global modified cassava starch market demand is driven by the rising urbanization globally. The United Nations, in its findings, stated that two-thirds of the world's population is expected to live in urban areas in 2050. This is driving the need for ready-to-eat meals, snacks, and bakery items that rely on modified cassava starch for texture and shelf-life extension. Urban growth is also expanding the food industry, encouraging manufacturers to adopt cost-effective and versatile ingredients such as modified cassava starch to meet higher production demands. Additionally, urbanization raises awareness of gluten-free and clean-label trends, further boosting the popularity of modified cassava starch as a natural alternative in processed foods. Hence, the increasing urbanization globally is propelling the demand for modified cassava starch.

Drivers & Opportunities

Expanding Industrialization in Emerging Countries: The rising industrialization in emerging countries increases the need for cost-effective, locally sourced raw materials across multiple industries. Food processing, textiles, and paper industries in these countries are seeking functional ingredients that enhance product quality, shelf life, and processing efficiency. Modified cassava starch meets these needs by offering thickening, stabilizing, and binding properties at a lower cost compared to other starches. Additionally, governments in these regions are promoting cassava cultivation and processing to reduce import dependency and support rural economies, further encouraging its industrial use. Therefore, the expanding industrialization in emerging countries is driving a continuous demand for modified cassava starch across various applications.

Growing Pharmaceutical Sector Worldwide: In the pharmaceutical sector, modified cassava starch serves as a key ingredient in drug formulations, providing binding, disintegrating, and film-coating properties for tablets and capsules. Modified cassava starch also meets stringent pharmaceutical standards due to its non-GMO, gluten-free, and low-allergen nature, making it a preferable alternative to synthetic additives. Rising health awareness and expanding healthcare access in emerging regions are further accelerating demand, while advancements in starch modification technologies are enhancing its functionality in controlled-release and specialty drug delivery systems. Therefore, with the growing pharmaceutical sector worldwide, modified cassava starch gains prominence as a versatile and reliable ingredient.

Segmental Insights

Type Analysis

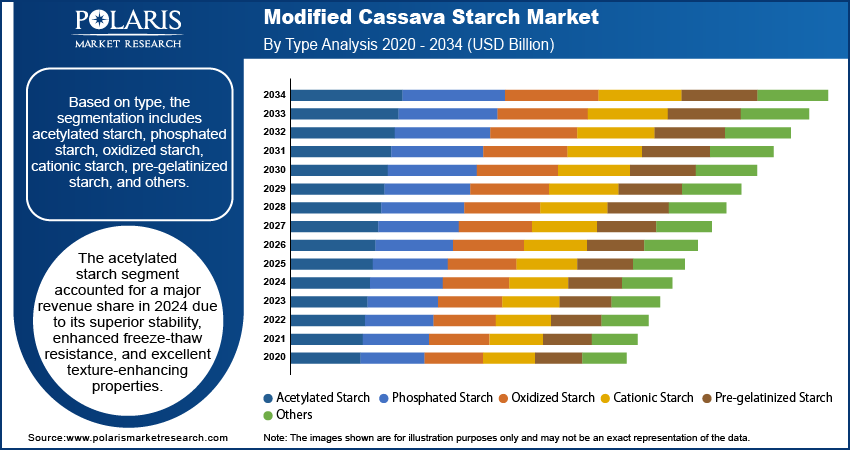

Based on type, the segmentation includes acetylated starch, phosphated starch, oxidized starch, cationic starch, pre-gelatinized starch, and others. The acetylated starch segment accounted for a major revenue share in 2024 due to its superior stability, enhanced freeze-thaw resistance, and excellent texture-enhancing properties. Food and beverage manufacturers widely adopted acetylated starch in frozen foods, bakery items, and sauces, as it improves shelf life and maintains product quality during storage and reheating. The pharmaceutical and paper industries also contributed significantly to the demand by utilizing it for capsule formulation and surface sizing, respectively. Growing urbanization and changing dietary habits increased the consumption of ready-to-eat and convenience foods, which further fueled the use of acetylated variants.

The pre-gelatinized starch segment is projected to grow at a rapid pace in the coming years, owing to the rising demand in instant food and beverage formulations, where quick solubility and ease of use offer critical functional benefits. Manufacturers in the bakery, dairy, and personal care sectors are increasingly opting for this variant due to its cold water solubility, viscosity-building properties, and clean-label appeal. The ongoing shift toward convenience foods, combined with the expanding use of natural thickeners in cosmetic and pharmaceutical products, is projected to sustain strong growth for pre-gelatinized forms throughout the forecast period.

Application Analysis

In terms of application, the segmentation includes food & beverages, industrial, pharmaceuticals, and animal feed. The food & beverages segment held the largest revenue share in 2024 due to increasing demand for processed, convenience, and packaged food products. Manufacturers in this sector adopted cassava-based starch to improve texture, enhance shelf life, and stabilize formulations in products such as dairy desserts, soups, sauces, and baked goods. The rising global population, coupled with a surge in urban lifestyles, significantly boosted the consumption of ready-to-eat meals and cassava-based starch. Additionally, the clean-label movement encouraged food producers to replace synthetic additives with natural alternatives, further increasing the use of modified starches derived from cassava due to their non-GMO, gluten-free, and allergen-free properties.

The pharmaceuticals segment is expected to grow at a rapid pace in the coming years, owing to cassava starch's high purity, stability, and compatibility with active ingredients, which is prompting drug manufacturers to increasingly utilize cassava starch derivatives as binders, disintegrants, and fillers in tablet formulations. The expansion of generic drug manufacturing and the rising demand for plant-based excipients are supporting the growth of the segment.

Function Analysis

In terms of function, the segmentation includes thickening, stabilizing, binding, gelling, texturizing, and emulsifying. The stabilizing segment is expected to grow at the fastest pace in the coming years, driven by the increasing adoption in both food and non-food sectors, where product integrity, shelf stability, and uniformity are crucial. In the food industry, manufacturers use cassava-based stabilizers to prevent ingredient separation and maintain texture in frozen meals, dairy products, and beverages. The cosmetics and pharmaceutical industries also contribute to the rising demand, as these stabilizers ensure consistency in creams, lotions, and medicinal suspensions. The increasing focus on shelf-stable, clean-label products with natural ingredients continues to drive the preference for multifunctional stabilizing agents derived from cassava.

Regional Analysis

The North America modified cassava starch market accounted for 32.15% of global revenue share in 2024. This dominance is attributed to the growing use of modified cassava starch in the food & beverage industry as a gluten-free, non-GMO, and clean-label ingredient. Consumers in the region also increasingly sought healthier and sustainable alternatives to traditional starches, boosting modified cassava starch adoption in various products such as baked goods, snacks, and dairy items. Additionally, the pharmaceutical and textile industries in the region utilized modified cassava starch for its binding and thickening properties. The region’s established food processing sector and rising demand for plant-based and functional ingredients further propelled market growth.

U.S. Modified Cassava Starch Market Insights

The U.S. held the largest revenue share in North America modified cassava starch landscape in 2024, driven by the rising popularity of gluten-free and allergen-free products. The convenience food sector also contributed to demand, as modified cassava starch enhances texture and shelf stability in processed or convenience foods. Moreover, the clean-label movement encouraged manufacturers in the country to replace synthetic additives with modified starches.

Europe Modified Cassava Starch Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to stringent food safety regulations and a strong preference for non-GMO and organic ingredients. The functional food and beverage sector in the region is leveraging the modified cassava starch's thickening and stabilizing properties, while the paper and packaging industry utilizes it as an eco-friendly adhesive. Sustainability concerns and the shift toward biodegradable materials in Europe are further driving its adoption. Countries such as the Netherlands and France are major importers of modified cassava starch, supporting regional market growth.

Germany Modified Cassava Starch Market Overview

The demand for modified cassava starch in Germany is being driven by its technical functionality in meat products, sauces, and bakery items. The country’s strong organic food market and consumer preference for clean-label products are also contributing to its popularity. Additionally, Germany’s bioeconomy strategy is promoting the use of renewable resources, making cassava starch an attractive alternative to petroleum-based additives in industries such as adhesives and textiles.

Asia Pacific Modified Cassava Starch Market Assessment

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to high cassava production in countries such as Thailand, Indonesia, and Vietnam. Rapid urbanization, the expansion of processed food industries, and an increasing demand for convenience foods are further fueling growth. United Nations Human Settlements Programme, in its report, stated that the urban population in Asia is expected to grow by 50% by 2050. In China and India, the textile and paper industries are heavily utilizing modified cassava starch for sizing and coating applications. Additionally, government initiatives promoting bio-based products and the growing animal feed sector drive demand in the region.

Key Players & Competitive Analysis

The modified cassava starch market is highly competitive, with key global and regional players striving to expand their market share through innovation, strategic partnerships, and capacity expansions. Prominent companies such as Cargill, Ingredion, and Tate & Lyle dominate the industry, leveraging their strong R&D capabilities and extensive distribution networks to offer high-performance starch solutions for food, industrial, and pharmaceutical applications. ADM and Roquette Frères focus on sustainable production and clean-label modified starches to cater to the growing demand for natural ingredients. In Asia Pacific, regional players such as Thai Wah Public Company Limited; Asia Modified Starch Co., Ltd; and Neo Nam Viet Co., Ltd compete aggressively by offering cost-effective products tailored to the local food processing and textile industries. Meanwhile, General Starch Limited (GSL) and SMScor specialize in customized starch modifications to meet specific industrial needs, such as those in the adhesives and paper manufacturing industries. Mergers, acquisitions, and collaborations are common strategies, with companies investing in emerging markets such as Africa and Latin America to capitalize on the increasing production of cassava.

A few major companies operating in the modified cassava starch industry include ADM; Agrana; Asia Modified Starch Co., Ltd; Cargill, Incorporated; General Starch Limited (GSL); Ingredion; Neo Nam Viet Co., Ltd; Roquette Frères; SMScor; Starch Asia; Tate & Lyle Plc; and Thai Wah Public Company Limited.

Key Players

- ADM

- Agrana

- Asia Modified Starch Co., Ltd

- Cargill, Incorporated

- General Starch Limited (GSL)

- Ingredion

- Neo Nam Viet Co., Ltd

- Roquette Frères

- SMScor

- Starch Asia

- Tate & Lyle Plc

- Thai Wah Public Company Limited

Modified Cassava Starch Industry Developments

August 2024, Roquette, a global company in plant-based ingredients and a provider of pharmaceutical excipients, announced the expansion of its texturizing solutions range with the addition of four new tapioca-based cook-up starches.

Modified Cassava Starch Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Acetylated Starch

- Phosphated Starch

- Oxidized Starch

- Cationic Starch

- Pre-gelatinized Starch

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food & Beverages

- Industrial

- Pharmaceuticals

- Animal Feed

By Function Outlook (Revenue, USD Billion, 2020–2034)

- Thickening

- Stabilizing

- Binding

- Gelling

- Texturizing

- Emulsifying

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Modified Cassava Starch Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.33 Billion |

|

Market Size in 2025 |

USD 2.46 Billion |

|

Revenue Forecast by 2034 |

USD 4.07 Billion |

|

CAGR |

5.78% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.33 billion in 2024 and is projected to grow to USD 4.07 billion by 2034.

The global market is projected to register a CAGR of 5.78% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are ADM; Agrana; Asia Modified Starch Co., Ltd; Cargill, Incorporated; General Starch Limited (GSL); Ingredion; Neo Nam Viet Co., Ltd; Roquette Frères; SMScor; Starch Asia; Tate & Lyle Plc; and Thai Wah Public Company Limited.

The acetylated starch segment dominated the market revenue share in 2024.

The stabilizing segment is projected to witness the fastest growth during the forecast period.