Molecular Sieve Desiccants Market Size, Share, & Industry Analysis Report

: By Form (Beads, Pellets, and Powder), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5722

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

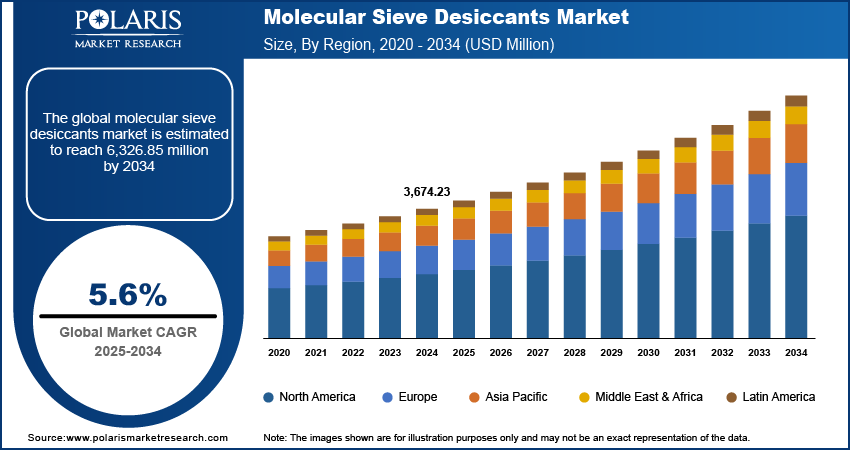

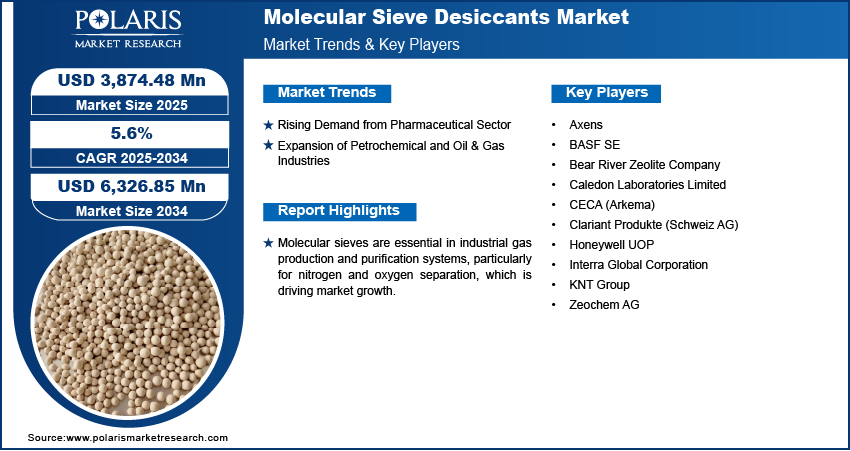

The global molecular sieve desiccants market size was valued at USD 3,674.23 million in 2024 and is projected to register a CAGR of 5.6% during 2025–2034. Rapid growth in the electronics sector, where even trace moisture cause damage, is fueling demand.

The market focuses on the production, distribution, and application of molecular sieves, crystalline aluminosilicates with a uniform pore structure. It is primarily used for moisture removal and gas separation. These desiccants function through selective adsorption, effectively trapping water molecules and other impurities based on molecular size and polarity. They are widely used across various industries, including pharmaceuticals, packaging, chemicals, electronics, and oil & gas, where strict moisture control is essential for product stability and process efficiency. Molecular sieves are essential in industrial gas production and purification systems, particularly for nitrogen and oxygen separation, which is driving overall growth.

To Understand More About this Research: Request a Free Sample Report

Increasing use in automotive air conditioning and air brake systems contributes to sustained demand. Additionally, increasing use in moisture-sensitive consumer goods and industrial packaging is driving adoption.

Market Dynamics

Rising Demand from Pharmaceutical Sector

Rising demand from the pharmaceutical sector is significantly propelling the demand for molecular sieve desiccants. According to the National Library of Medicine, in 2023, pharmaceutical expenditures in the US rose by 13.6% compared to 2022, totaling USD 722.5 billion. Pharmaceutical manufacturing and packaging require a highly controlled environment to ensure product integrity, safety, and shelf life. Moisture can degrade active pharmaceutical ingredients (APIs), cause clumping in powders, and lead to microbial growth in formulations. Molecular sieve desiccants offer superior moisture adsorption capabilities compared to traditional desiccants, maintaining ultra-low humidity levels even at high temperatures. Their uniform pore structure enables precise water molecule trapping without affecting surrounding substances, making them ideal for both primary and secondary packaging. The increasing focus on global regulatory compliance and quality assurance is further driving pharmaceutical companies to adopt advanced desiccation technologies, solidifying molecular sieves as a preferred solution.

Expansion of Petrochemical and Oil & Gas Industries

Expansion of the petrochemical and oil & gas industry continues to be a strong growth catalyst for molecular sieve desiccants. For instance, according to the US Energy Information Administration, in December 2022, oil production in the US averaged 12.2 million barrels per day, and natural gas production averaged 121.1 billion cubic feet per day. By December 2023, oil production rose to 13.3 million b/d, and natural gas production increased to 128.8 Bcf/d, reflecting overall growth in production and well-level productivity for both fuels. In natural gas processing and petroleum refining, the removal of water and other contaminants is essential to maintain equipment efficiency, prevent corrosion, and meet strict product specifications. Molecular sieves are indispensable in gas dehydration units and hydrocarbon purification systems due to their high thermal stability and selective adsorption of moisture and impurities. Their application extends to drying cracked gas, separating olefins, and removing sulfur compounds, which are critical in refining operations. Growing global energy demand, along with increasing investments in downstream infrastructure and gas processing facilities, is driving the adoption of molecular sieves in these industries, ensuring operational reliability and product purity.

Segment Insights

Market Assessment by Form

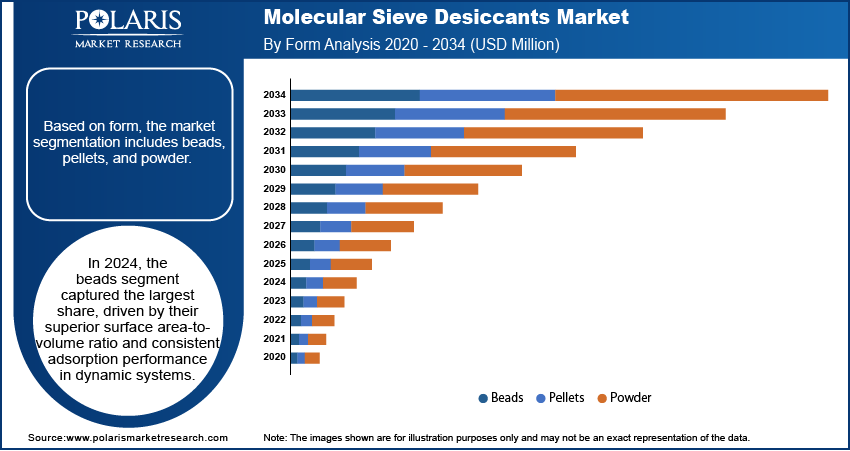

Based on form, the segmentation includes beads, pellets, and powder. In 2024, the beads segment captured the largest share, driven by their superior surface area-to-volume ratio and consistent adsorption performance in dynamic systems. Beads offer enhanced mechanical strength and uniformity, which are critical in high-throughput industrial applications such as gas dehydration units and pharmaceutical packaging lines. Their spherical form facilitates low-pressure drops and efficient mass transfer in packed columns, making them ideal for continuous operations in the oil & gas and petrochemical sectors. The ability to regenerate beads effectively over multiple cycles without significant degradation further supports their dominance. End users prefer beads for their reliability in maintaining ultra-low humidity levels under varying temperature and pressure conditions, particularly in regulated, high-performance environments.

The pellets segment is projected to register the highest CAGR during the forecast period due to increasing deployment in compact gas drying and specialty chemical applications where structural integrity under high-pressure conditions is essential. Pellets exhibit enhanced crush strength and low attrition rates, making them suitable for demanding systems such as adsorption towers in high-pressure natural gas processing plants. Their cylindrical shape promotes efficient flow distribution and resistance to caking or clogging, particularly in batch processing or intermittent flow environments. Demand for pellets is accelerating in sectors requiring customized adsorption configurations, such as high-purity gas production and cryogenic air separation units. Additionally, technological advancements enabling precise pellet formulation tailored to specific adsorption profiles are gaining traction, particularly in niche industrial applications where operational consistency and material longevity are critical.

Market Evaluation by End Use

Based on end use, the segmentation includes pharmaceutical, electronics, oil & gas, food & beverage, and others. In 2024, the oil & gas segment held the largest share, fueled by the critical need for efficient gas dehydration and contaminant removal across upstream and midstream operations. Molecular sieves are essential in removing water vapor, carbon dioxide, and hydrogen sulfide from natural gas and other hydrocarbons to meet pipeline quality standards and prevent hydrate formation. Their role in extending catalyst life and maintaining throughput in refining units and LNG facilities further reinforces demand. Increasing global LNG trade, combined with investments in gas treatment infrastructure, is intensifying the use of high-performance desiccants. Operational reliability, long service life, and minimal downtime are pivotal in oil & gas applications, placing molecular sieves at the forefront of separation and purification processes.

The electronics segment is projected to grow significantly over the forecast period, driven by the industry's escalating precision requirements in component protection and cleanroom manufacturing. Moisture-sensitive electronic components such as semiconductors, OLED displays, and MEMS sensors require strict environmental control to prevent corrosion, oxidation, and performance degradation. Molecular sieve desiccants are increasingly integrated into microelectronics packaging, including hermetic seals and desiccant canisters, where traditional desiccants fail to meet ultra-low humidity thresholds. Furthermore, rising production of high-value electronics and miniaturized devices is amplifying the demand for molecular sieves that provide localized, stable adsorption in confined spaces. Innovations in electronics packaging materials and increased deployment of 5G infrastructure and advanced sensors further amplify the market potential of molecular sieves in this segment.

Regional Analysis

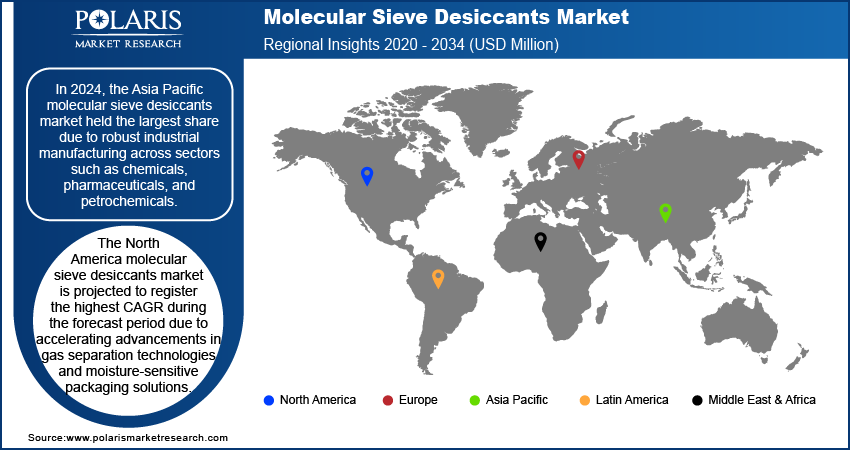

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific molecular sieve desiccants market held the largest share due to robust industrial manufacturing across sectors such as chemicals, pharmaceuticals, and petrochemicals. For instance, according to the India Brand Equity Foundation, the National Manufacturing Policy of the Government of India seeks to boost the manufacturing sector's contribution to the GDP to 25% by 2025. High regional demand for moisture-sensitive products and the prevalence of humid climates necessitate effective desiccation solutions. Regulatory emphasis on quality and safety in pharmaceutical production and food packaging has further increased the adoption of high-performance molecular sieves. In addition, regional infrastructure projects, including natural gas pipelines and LNG terminals, have driven demand for molecular sieve desiccants in gas dehydration and purification systems. Competitive production costs, strong domestic demand, and favorable government policies supporting chemical and electronics industries collectively position Asia Pacific as the dominant region for molecular sieve consumption and capacity expansion.

The China molecular sieve desiccants market held the dominant share in Asia Pacific, due to the country’s expansive industrial base and self-sufficient manufacturing ecosystem. Local demand is boosted by rapid growth in the pharmaceutical and specialty chemicals sectors, where stringent moisture control enhances product quality and shelf life. China's focus on LNG imports and the development of gas processing infrastructure has intensified the use of molecular sieves in purification and drying operations. Government-led environmental mandates are also steering the adoption of high-efficiency desiccants in emissions control and industrial waste treatment. Strong domestic production capacity, coupled with export-oriented strategies of local manufacturers, has allowed China to influence global pricing and supply dynamics across the molecular sieve value chain.

The North America molecular sieve desiccants market is projected to register the highest CAGR during the forecast period due to accelerating advancements in gas separation technologies and moisture-sensitive packaging solutions. Increased shale gas exploration and LNG export infrastructure in the US and Canada are driving molecular sieve usage in natural gas treatment and cryogenic processes. For instance, according to the US Energy Information Administration, in 2023, ∼78% of the total US dry natural gas production, about 37.87 trillion cubic feet, originated from shale formations. Stringent FDA and EPA regulations are prompting pharmaceutical and food industries to implement highly controlled environments, boosting the adoption of high-purity desiccants. Growth in the region is also supported by rising R&D investments in specialty applications such as biotechnology and precision electronics, where material stability under ultra-dry conditions is critical. The market is further strengthened by the presence of technologically advanced manufacturers offering tailored, application-specific molecular sieve products.

The US molecular sieve desiccants market held the dominant share in North America, characterized by high-value applications and innovation-led demand. Widespread use in oil refineries, petrochemical facilities, and advanced gas separation units underpins the market's strong foundation. In the pharmaceutical sector, the need to meet stringent cGMP standards and ensure extended shelf life for moisture-sensitive formulations drives consistent consumption. Emerging areas such as medical devices, aerospace electronics, and clean energy systems require controlled environments where molecular sieves are integrated at both the material and device levels. Domestic manufacturers are leveraging process automation and next-generation desiccant formulations to deliver higher efficiency and sustainability, positioning the US as a technological leader in this industry.

The Europe molecular sieve desiccants market is supported by strong regulatory frameworks, advanced industrial capabilities, and increasing demand for environmental sustainability. The region’s advanced pharmaceutical sector emphasizes moisture-sensitive drug development, especially in biologics and parenteral formulations. Strict quality and safety standards across the EU, combined with a growing push for eco-friendly materials, are encouraging the adoption of regenerable and high-performance desiccants. Energy-efficient gas separation and industrial drying systems are in high demand due to the continent’s decarbonization targets. Moreover, the presence of leading automotive, aerospace, and specialty electronics manufacturers in countries such as Germany and France is driving application-specific molecular sieve innovation. Investments in circular economy models are also encouraging the development of reusable and low-emission desiccant technologies.

Key Players and Competitive Analysis

The competitive landscape of the molecular sieve desiccants market is characterized by dynamic industry analysis and strategic positioning focused on capacity expansion, innovation, and global distribution efficiency. Key players are deploying expansion strategies such as joint ventures and cross-border collaborations to strengthen regional footholds and secure access to raw materials. Technology advancements in pore structure customization and adsorption efficiency are driving product differentiation, particularly in high-precision applications such as pharmaceuticals and electronics. Mergers and acquisitions are being pursued to consolidate market presence and integrate complementary capabilities across the value chain. Strategic alliances with packaging and gas processing companies are enabling tailored solutions and accelerating time-to-market.

Post-merger integration efforts are streamlining manufacturing and R&D operations for enhanced productivity. Continuous product launches targeting low-dust formulations, high thermal stability, and reusable variants are shaping competitive intensity. This evolving landscape reflects a clear trend toward sustainability, regulatory compliance, and performance-driven molecular sieve desiccant solutions.

BASF, a chemical corporation operating across the world, operates through seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. BASF, the world’s largest chemical manufacturer, is a leading producer of molecular sieve desiccants and synthetic zeolites engineered for high-performance moisture removal in industrial applications. These molecular sieves, based on synthetic aluminosilicates, feature a uniform microporous structure that enables selective adsorption of water and other polar molecules, even at very low humidity or when deep pressure dew points (as low as -100°C) are required. BASF molecular sieves are widely used for drying compressed air, technical gases, and polar liquids, especially in industries demanding stringent air quality standards, such as food, pharmaceuticals, electronics, and automotive.

Honeywell UOP, formerly known as Universal Oil Products, is a global leader in developing and delivering technologies for petroleum refining, gas processing, petrochemical production, and major manufacturing industries. UOP pioneered key innovations such as the Dubbs thermal cracking process and the first synthetic zeolites for molecular sieves. The company’s technologies are integral to producing fuels, plastics, and renewable energy solutions, including Honeywell Green Diesel and Green Jet Fuel. UOP supports the entire plant lifecycle with advanced process technologies, catalysts, adsorbents, digital tools, and lifecycle solutions, driving efficiency, sustainability, and profitability for industrial customers worldwide. Honeywell UOP's molecular sieve products are widely used for drying and purifying gases and liquids in various industries, offering high water adsorption capacity, selectivity, and regeneration capability for efficient dehydration and contaminant removal.

List of Key Companies

- Axens

- BASF SE

- Bear River Zeolite Company

- Caledon Laboratories Limited

- CECA (Arkema)

- Clariant Produkte (Schweiz AG)

- Honeywell UOP

- Interra Global Corporation

- KNT Group

- Zeochem AG

Molecular Sieve Desiccants Industry Developments

In May 2025, Electrotech Systems Inc. launched the M-5461-24 Molecular Sieve Desiccant Dehumidifier System, designed to provide precise, low-humidity environments essential for critical industrial and manufacturing processes. Its advanced engineering ensures optimal performance and reliability in dehumidification.

In January 2021, Safic-Alcan, a global specialty chemicals distributor, partnered with Arkema for the distribution of the SILIPORITE molecular sieve product line, enhancing access to high-performance adsorbents in the industry.

Molecular Sieve Desiccants Market Segmentation

By Form Outlook (Revenue, USD Million, 2020–2034)

- Beads

- Pellets

- Powder

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical

- Electronics

- Oil & Gas

- Food & Beverage

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Molecular Sieve Desiccants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,674.23 million |

|

Market Size Value in 2025 |

USD 3,874.48 million |

|

Revenue Forecast by 2034 |

USD 6,326.85 million |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3,674.23 million in 2024 and is projected to grow to USD 6,326.85 million by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

In 2024, the Asia Pacific molecular sieve desiccants market held the largest share due to robust industrial manufacturing across sectors such as chemicals, pharmaceuticals, and petrochemicals.

A few of the key players include Axens, BASF SE, Bear River Zeolite Company, Caledon Laboratories Limited, CECA (Arkema), Clariant Produkte (Schweiz AG), Honeywell UOP, Interra Global Corporation, KNT Group, and Zeochem AG.

In 2024, the beads segment captured the largest share, driven by their superior surface area-to-volume ratio and consistent adsorption performance in dynamic systems.

In 2024, the oil & gas segment held the largest share, fueled by the critical need for efficient gas dehydration and contaminant removal across upstream and midstream operations.