Zeolite Market Size, Share, Trends, Industry Analysis Report

: By Product (Natural and Synthetic Zeolite), Pore Size, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1753

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

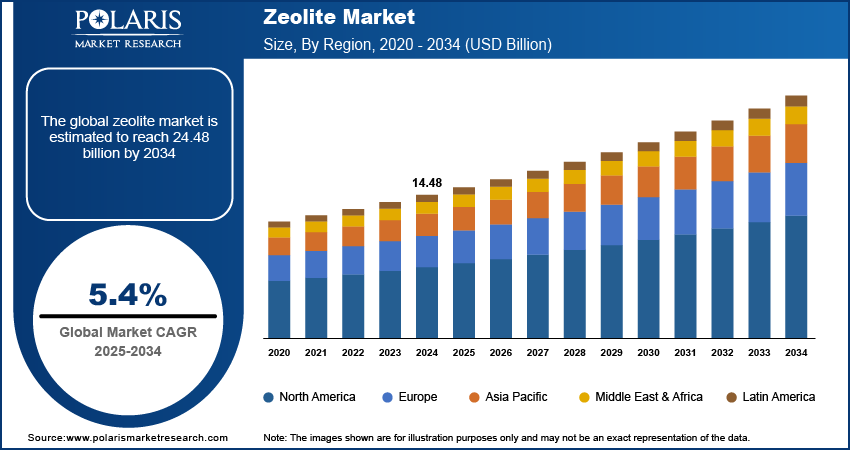

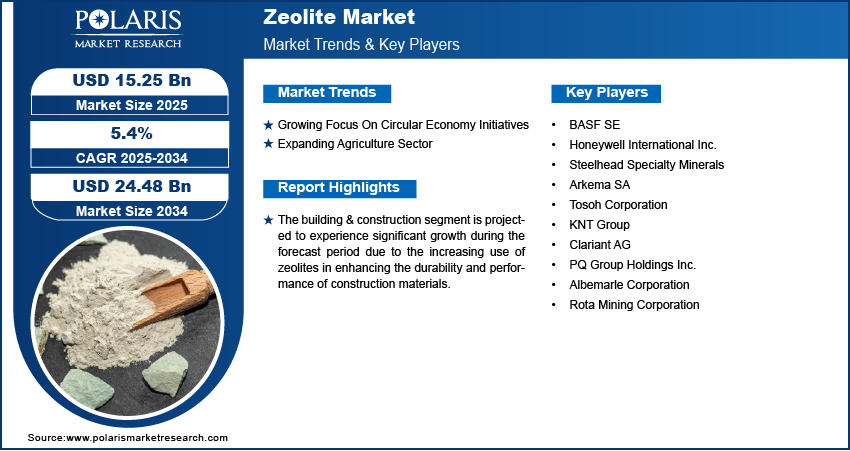

The global zeolite market size was valued at USD 14.48 billion in 2024, growing at a CAGR of 5.4% from 2025 to 2034. The introduction of stringent regulations on water quality, rising demand for clean water, and increased usage of zeolite in gas separation are the key factors driving market growth.

Key Insights

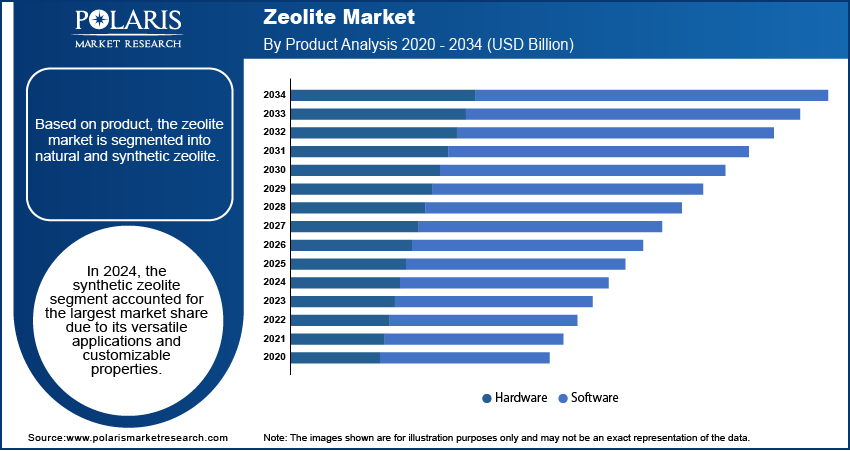

- The synthetic zeolite segment led the market in 2024. The customizable properties and versatile applications of synthetic zeolite contribute to the segment’s leading market share.

- The building & construction segment is poised to register significant growth, owing to the increasing use of zeolite in improving the performance and durability of construction materials.

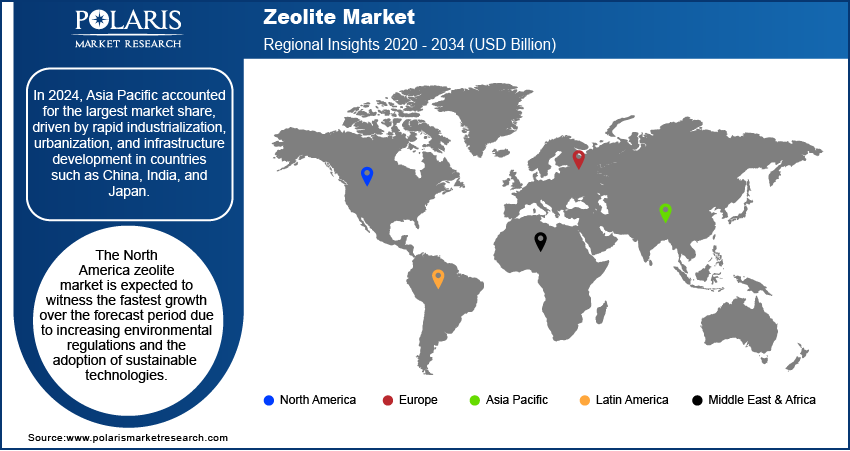

- Asia Pacific accounted for the largest market share in 2024. The regional market dominance is primarily attributed to its rapid industrialization and infrastructure development in major economies like China and India.

- North America is projected to register the fastest growth during the projection period, driven by rising environmental regulations and growing adoption of sustainable technologies.

Industry Dynamics

- Zeolites are being increasingly adopted in waste management. Their use enables effective management of waste water, industrial waste, and nuclear waste.

- The expanding agriculture sector and growing usage of zeolite in soil enhancement and water retention contribute to market development.

- Growing focus on the development of advanced zeolites and customized solutions is expected to provide several market opportunities.

- Competition from alternative treatments may present challenges to market development.

Market Statistics

2024 Market Size: USD 14.48 billion

2034 Projected Market Size: USD 24.48 billion

CAGR (2025-2034): 5.4%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Zeolites are a group of naturally occurring and synthetic microporous aluminosilicate minerals. They are widely used for various industrial, environmental, and scientific applications due to their unique structure and properties.

Increasing demand for clean water and stricter regulations on water quality are driving the adoption of zeolites for filtration, heavy metal removal, and wastewater treatment. Zeolites are also used in catalytic converters and industrial emission controls, driven by government mandates to reduce greenhouse gases and harmful emissions.

Additionally, zeolites are in high demand for their molecular sieving properties, which are used in gas separation (e.g., oxygen enrichment, CO₂ capture) and dehydration processes in industries like natural gas processing. Innovations in synthetic and nano-zeolites, including tailored pore sizes and enhanced chemical properties, are broadening their applications in industries like pharmaceuticals, and electronics.

Market Dynamics

Growing Focus On Circular Economy Initiatives

In November 2024, the United States Environmental Protection Agency (EPA) launched the "National Strategy to Prevent Plastic Pollution," which outlines actions to protect communities from the effects of plastic production and waste. This strategy is part of the EPA's "Building a Circular Economy for All" initiative, which also addresses recycling and food waste reduction. The demand for zeolites in waste management is rising as they are effectively used in waste water treatment and to manage industrial waste and nuclear waste. Additionally, their critical role in recycling processes, where they aid in the separation and purification of components, supports global efforts to adopt environmentally friendly practices. These trends are expected to contribute significantly to market growth, increasing the market size and enhancing the market share of zeolites in applications aligned with sustainability goals.

Expanding Agriculture Sector

In November 2024, the US Department of Agriculture announced over USD 2 billion in funding to strengthen the specialty crops sector and improve crop storage for producers impacted by 2024 natural disasters. This initiative aims to enhance industry resilience and post-harvest management. Zeolites are increasingly used in soil enhancement, where their ability to improve soil aeration, nutrient retention, and water retention makes them invaluable for meeting rising global food demands. Additionally, their incorporation into animal feed as additives improves digestion in livestock and reduces ammonia emissions, aligning with sustainable farming practices. These applications are contributing to the market expansion of zeolites within the agricultural industry, boosting zeolite market size and share.

Segment Insights

Zeolite Market Assessment Based on Product

The global zeolite market, based on product, is segmented into natural and synthetic zeolite. In 2024, the synthetic zeolite segment accounted for the largest zeolite market share due to its versatile applications and customizable properties. Unlike natural zeolites, synthetic variants offer precise control over pore size, chemical composition, and thermal stability, making them highly effective in industries such as detergents, petrochemicals, water treatment, and air purification. Their widespread use in eco-friendly detergents, driven by regulations against phosphate-based alternatives, has further boosted demand. Additionally, the superior performance of synthetic zeolites in catalysis, adsorption, and ion exchange processes has made them indispensable in industrial and environmental applications, solidifying their leading position in the market.

Zeolite Market Evaluation Based on End Use

The global zeolite market, based on end use, is segmented into building & construction, water treatment, animal nutrition, detergent, agriculture, and others. The building & construction segment is projected to experience significant growth during the forecast period due to the increasing use of zeolites in enhancing the durability and performance of construction materials. Zeolites improve the strength, thermal resistance, and sustainability of concrete by acting as supplementary cementitious materials, reducing the environmental impact of construction activities. Additionally, their ability to enhance moisture retention and resist chemical corrosion makes them valuable in modern construction projects. The rising global demand for infrastructure development, particularly in emerging economies, further fuels the adoption of zeolites in the building & construction segment.

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share of the zeolite market due to rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan. For instance, in May 2022, the president Joe Biden launched the Indo-Pacific Economic Framework for Prosperity (IPEF), the US and its thirteen partners Australia, Brunei Darussalam, Fiji, India, Indonesia, Japan, Republic of Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, and Vietnam launched the inaugural IPEF Clean Economy Investor Forum. This Forum aims to catalyze investments in sustainable infrastructure and climate technology while adhering to environmental, social, and governance (ESG) standards. It is part of a broader financing strategy for the IPEF Clean Economy Agreement, resulting in USD 23 billion in investment opportunities for the Indo-Pacific region. These investments, along with robust growth in sectors such as construction, detergents, petrochemicals, and water treatment, have significantly increased the demand for zeolites in North America. Additionally, stringent environmental regulations, coupled with the rising adoption of eco-friendly materials, have further boosted the zeolite market. The presence of a large consumer base, abundant raw materials, and expanding agricultural practices also contribute to the region’s dominant position in the global market.

The China zeolite market holds the largest revenue share due to the country's robust industrial base, rapid urbanization, and expanding infrastructure projects. Its dominance is further supported by significant demand for zeolites in detergents, water treatment, and petrochemical applications. In addition, the government’s stringent environmental regulations and initiatives promoting sustainable development have accelerated the adoption of zeolites in air and water purification systems.

The North America zeolite market is expected to witness the fastest growth during the forecast period due to increasing environmental regulations and the adoption of sustainable technologies. The rising demand for advanced water treatment solutions, eco-friendly detergents, and emission control systems has significantly boosted the use of zeolites in this region. For instance, the US Department of Energy and the National Alliance for Water Innovation have selected 12 projects to enhance the energy efficiency of water reuse technologies and desalination. These initiatives aim to decarbonize the water and wastewater sectors and advance a circular economy, providing the US with resilient and cost-effective water supply solutions. Additionally, ongoing advancements in the petrochemical and agricultural sectors, coupled with growing investments in infrastructure, are fueling rapid market growth. The focus on circular economy initiatives and technological innovation further drives the regional market expansion.

The US is expected to witness the fastest growth in the market during the forecast period. The focus on energy efficiency, water reuse technologies, and emission control systems is driving the adoption of zeolites in the country.

Key Players and Competitive Insights

The competitive landscape of the zeolite market is shaped by a combination of global and regional players focusing on product innovation, strategic partnerships, and geographic expansion to gain a competitive advantage. Leading companies are investing in research and development to create high-performance zeolites with tailored properties, such as customized pore sizes and enhanced ion exchange capacities. The rise of nano-zeolites and specialized variants for niche markets like pharmaceuticals and electronics is further fueling competition. Strategic collaborations with industries such as water treatment, waste management, and environmental sustainability are helping manufacturers tap into growing market demands. Additionally, zeolite producers are expanding their presence in emerging markets, particularly in Asia Pacific, while also strengthening their foothold in North America and Europe. Mergers and acquisitions are also common as companies seek to broaden their product offerings and consolidate market share. Furthermore, the increasing emphasis on sustainability has led many players to offer eco-friendly zeolite products, positioning themselves as leaders in green technologies for applications in water treatment, air purification, and energy efficiency. Key players in the market include BASF SE, Honeywell International Inc., Steelhead Specialty Minerals, Arkema SA, Tosoh Corporation, KNT Group, Clariant AG, PQ Group Holdings Inc., Albemarle Corporation, and Rota Mining Corporation.

BASF is a chemical corporation that operates all over the world. The company operates through seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications, such as isocyanates and polyamides, are available through the Materials section. It also includes inorganic basic products and specialties for the plastic and plastic processing industries. In August 2024, BASF launched Fourtiva, a specialized Fluidized Catalytic Cracking (FCC) catalyst designed to enhance the yield of high-octane gasoline blending feedstocks. This innovative catalyst optimizes the cracking process, allowing for improved hydrocarbon conversion and better performance in fuel formulations.

Honeywell International Inc. is a corporation that specializes in industrial goods and machinery. The company develops and manufactures technology to tackle challenges across a range of industries, including energy, security, safety, productivity, and urbanization on a global scale. Honeywell offers energy-efficient products and solutions, specialty chemicals, process technologies, electrical and advanced materials, as well as technologies for productivity, sensing, safety, and security. Additionally, the company provides spare parts to support its offerings.

List of Key Companies in Zeolite Market

- BASF SE

- Honeywell International Inc.

- Steelhead Specialty Minerals

- Arkema SA

- Tosoh Corporation

- KNT Group

- Clariant AG

- PQ Group Holdings Inc.

- Albemarle Corporation

- Rota Mining Corporation

Zeolite Industry Developments

In May 2025: Honeywell announced the acquisition of Johnson Matthey’s catalyst division. According to Honeywell, the strategic move will broaden its portfolio and enhance its capabilities in zeolite-based catalytic technologies.

In February 2025: The Ethanol-to-Jet (ETJ) technology by Honeywell UOP was selected by Taiyo Oil Co. for integration at its Okinawa refinery. The project aims to make use of advanced zeolite-based catalysts for the production of sustainable aviation fuel (SAF).

In May 2024, Zeolyst International, a joint venture of Ecovyst Inc. and a leader in zeolite production, successfully launched a laboratory-scale thermal pyrolysis reactor and advanced analytical equipment for the efficient recycling of plastic waste.

In June 2021, Honeywell partnered with DRDO and CSIR–IIP to supply zeolite molecular sieve adsorbents, facilitating the rapid establishment of medical oxygen plants (MOPs) in India to meet critical healthcare demands.

Zeolite Market Segmentation

By Product Outlook (Revenue – USD Billion, Volume – Kilotons, 2020–2034)

- Natural

- Clinoptilolite

- Mordenite

- Others

- Synthetic Zeolite

- Zeolite A

- Type X

- Type Y

- USY

- ZSM 5

By Pore Size Outlook (Revenue – USD Billion, Volume – Kilotons, 2020–2034)

- 3A–7A

- 7A–10A

By End Use Outlook (Revenue – USD Billion, Volume – Kilotons, 2020–2034)

- Building & Construction

- Water Treatment

- Animal Nutrition

- Detergent

- Agriculture

- Others

By Regional Outlook (Revenue – USD Billion, Volume – Kilotons, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Zeolite Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.48 billion |

|

Market Size Value in 2025 |

USD 15.25 billion |

|

Revenue Forecast by 2034 |

USD 24.48 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, Volume in kilotons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global zeolite market size was valued at USD 14.48 billion in 2024 and is projected to grow to USD 24.48 billion by 2034.

The global market is projected to register a CAGR of 5.4% from 2025 to 2034.

In 2024, Asia Pacific accounted for the largest market share due to rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan.

A few key players in the market are BASF SE, Honeywell International Inc., Steelhead Specialty Minerals, Arkema SA, Tosoh Corporation, KNT Group, Clariant AG, PQ Group Holdings Inc., Albemarle Corporation, and Rota Mining Corporation.

In 2024, the synthetic zeolite segment accounted for the largest market share due to its versatile applications and customizable properties.

The building & construction segment is projected to experience significant growth during the forecast period due to the increasing use of zeolites in enhancing the durability and performance of construction materials.