Mood Support Supplements Market Share, Size, Trends, Industry Analysis Report

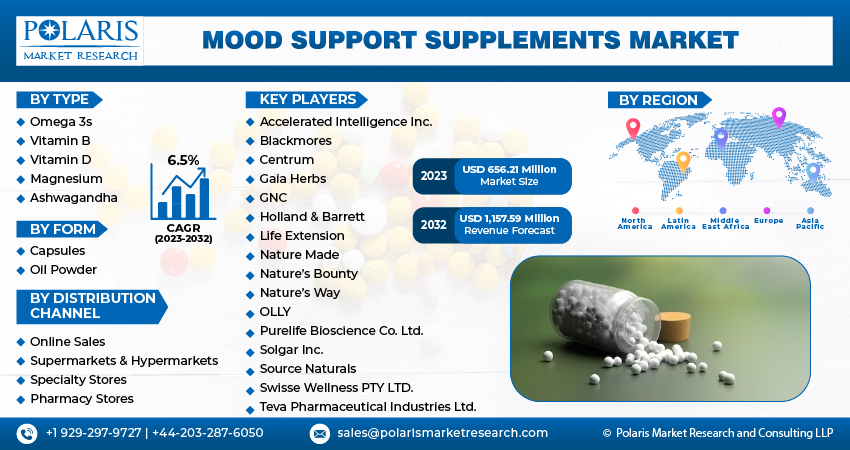

By Type (Omega 3s, Vitamin B, Vitamin D, Magnesium, Ashwagandha, and S-Adenosyl-L-Methionine); By Form: By Distribution Channel; By Region; Segment Forecast, 2023 – 2032

- Published Date:Dec-2023

- Pages: 116

- Format: PDF

- Report ID: PM4089

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

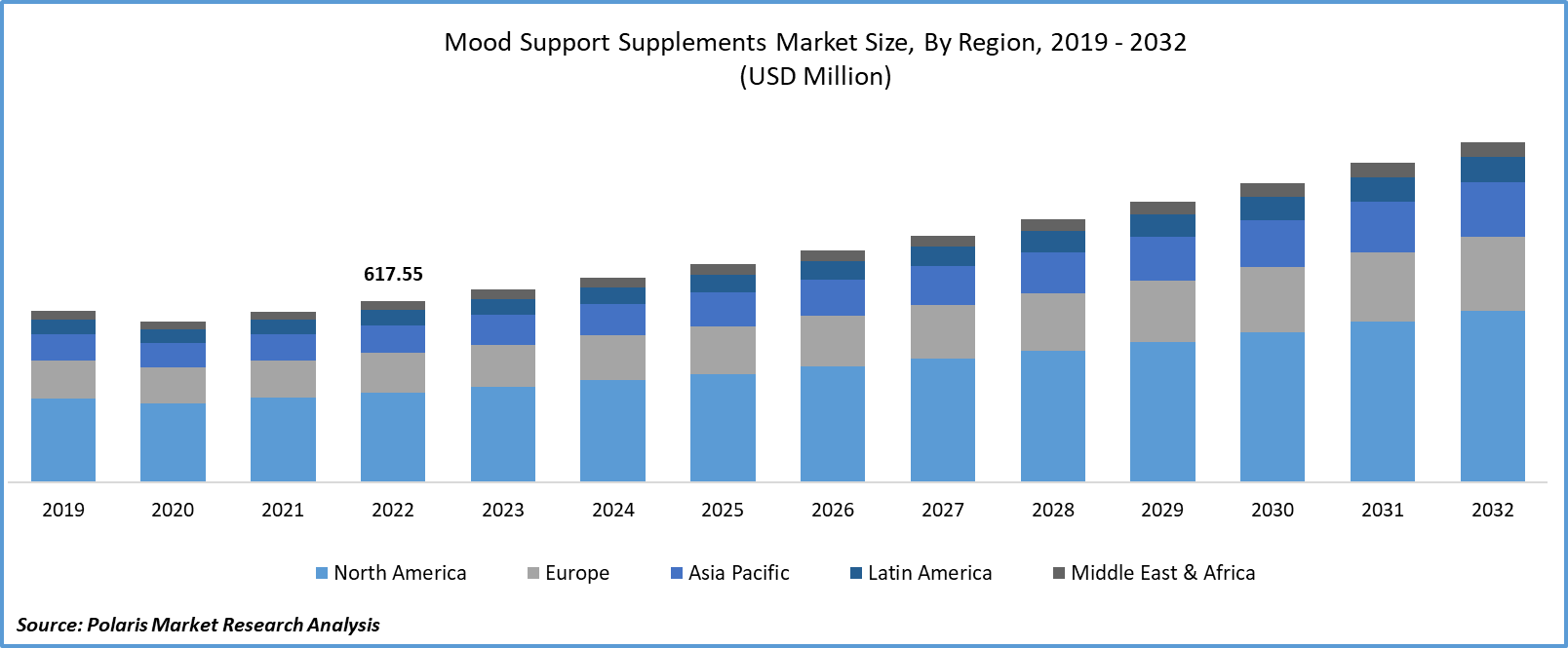

The global mood support supplements market was valued at USD 617.6 million in 2022 and is expected to grow at a CAGR of 6.5% during the forecast period.

The rapidly increasing awareness among people regarding several mental health issues like lack of attention and focus, anxiety, depression, and declining memory, among others, along with the growing popularity of mood support supplements as a complementary or alternative approach to traditional pharmaceutical treatments for mental issues, are major factors propelling the market growth. Apart from this, the increase in the number of people or individuals seeking herbal and natural solutions for various health concerns, including mood disorders, boosts the demand for mood support supplements as they often contain herbal ingredients like ashwagandha and Ginkgo Biloba.

To Understand More About this Research: Request a Free Sample Report

- For instance, according to the World Health Organization, 1 out of every 8 people, or 970 million people across the world, currently live with a mental disorder, including anxiety and depression. In 2019, over 301 million were living with anxiety, and approx. 280 million were living with depression, and the number has drastically increased with the growing prevalence of hectic lifestyles.

In the last few decades, several manufacturers around the world are continuously researching and developing new advanced formulations combining several different natural ingredients with proven mood-boosting properties that basically include adaptogens, nootropics, and other botanical extracts to enhance mood and reduce stress, which in turn, influencing the overall market growth and creating lucrative growth opportunities over the coming years.

For Specific Research Requirements: Request for Customized Report

However, the lack of comprehensive clinical trials and conclusive evidence for various natural and herbal ingredients and the high complexity associated with maintaining consistent quality and purity in supplement production are among the key factors likely to hamper the growth of the global market.

Industry Dynamics

Growth Drivers

- Growing awareness about the importance of mental health and mood management driving the market growth

There is an increasing awareness regarding the importance of mental health and mood management due to the growing proliferation of unhealthy lifestyle choices among people, including poor diet, lack of exercise, and insufficient sleep, which leads to an increased number of people seeking mood support supplements as an effective and complementary alternative approach to the traditional mental health treatments, which are key factors projected to influence the global mood support supplements market growth.

- For instance, as per a report published by the Sleep Foundation, more than one-third of adults worldwide sleep less than seven hours per night, which is required for an adult. And around 50 to 70 million people worldwide have ongoing sleep disorders.

Report Segmentation

The market is primarily segmented based on type, form, distribution channel, and region.

|

By Type |

By Form |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Ashwagandha segment accounted for the largest market share in 2022

The ashwagandha segment accounted for the largest market. The growth of the segment market can be mainly attributed to the significant and widespread use of ashwagandha in various traditional medicines like Ayurveda for reducing stress and anxiety and also for improving overall well-being. Besides this, there is an ongoing demand for natural supplements with the ability to help improve mood management and stress levels, which makes Ayurveda an effective and attractive option for individuals seeking natural alternatives.

The omega-3s segment is projected to exhibit the highest growth over the next coming years, mainly driven by growing consumer interest and trust in omega-3 supplements for mood support and the adoption of omega-3 supplements as a complementary or adjunctive approach to conventional treatments.

By Form Analysis

- Capsules segment held the majority market share in 2022

The capsules segment held the maximum market share in terms of revenue in 2022, which is majorly driven by its popularity and adoption as a major and most common form of mood support supplements, as they are easy to consume and more convenient for consumers to adopt them as a part of their daily routine. In adoption, capsules are also highly preferred by consumers due to their ability to allow for accurate dosing while ensuring that you receive the intended amount of the supplement with each capsule, which is especially important for supplements with specific recommended doses.

The oil powder segment is projected to grow at the highest growth rate during the study period on account of a wide range of benefits associated with this product type, including improved nutrient absorption, better stability and shelf life, precise dosage control, portability, and reduced risk of spills & leaks, among many others.

By Distribution Channel Analysis

- Online sales segment is projected to witness highest growth

The online sales segment is projected to grow at the highest growth rate during the projected period, mainly due to the increasing number of companies worldwide focusing on the establishment of their strong online presence and catering to a wider customer base from around the world and a surge in the adoption of social media marketing to make the consumer aware about the potential benefits of product consumption.

Besides this, the surge in the number of people shifting from offline stores to online stores due to their numerous benefits, including availability of diverse product ranges, convenience & accessibility, and education content and feedback from customers, leading to significant segment market growth. The specialty stores segment led the industry market with substantial revenue share in 2022, which is mainly attributable to the easy availability of mood support supplements from various reputable brands that are known for their quality and effectiveness.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market. The regional market growth is highly attributable to significant changes in consumer lifestyles such as irregular sleep patterns, sedentary habits, and poor nutrition that negatively impact the mood and continuous increase in the region’s aging population who are more prone to mood disorders like anxiety and depression.

- For instance, according to the United States Census Bureau, the total aging or older population in the United States reached over 55.8 million, which accounts for approx. 16.8% of the country’s total population. In 2020, 1 in every 6 people in the United States were aged 65 years or above.

The Asia Pacific region is anticipated to emerge as the fastest growing region with a healthy CAGR over the forecast period, owing to a significant increase in consumer awareness and knowledge about the importance of mood enhancement and boosting solutions and growing investments in R&D activities to create more innovative solutions to cater to emerging market trends. Several regulatory bodies in the APAC region have taken steps to ensure the safety and quality of dietary supplements, which has bolstered consumer interest in these kinds of products.

Key Market Players & Competitive Insights

The mood support supplements market is highly fragmented in nature, with the presence of several global or regional market players. The top companies in the market are continuously expanding their product offerings with new and enhanced properties to meet emerging consumers' demands. They are also adopting business development strategies, including collaboration, partnerships, and acquisitions, to increase their geographical presence.

Some of the major players operating in the global market include:

- Accelerated Intelligence Inc.

- Blackmores

- Centrum

- Gaia Herbs

- GNC

- Holland & Barrett

- Life Extension

- Nature Made

- Nature’s Bounty

- Nature’s Way

- OLLY

- Purelife Bioscience Co. Ltd.

- Solgar Inc.

- Source Naturals

- Swisse Wellness PTY LTD.

- Teva Pharmaceutical Industries Ltd.

Recent Developments

- In August 2022, KaraMD announced the launch of its Total Clarity, which will support cognitive health, energy & immunity, help to relieve stress and promote general health. It is a unique blend of ashwagandha, lemon balm, I-theanine, and long jack, which help improve overall mood and reduce stress levels.

- In May 2023, GNC introduced its new mental wellness support supplements that include Preventive Nutrition, Sleep Support, Stress Relief, and Focus and memory. With the launch of new preventive nutrition products, the company is focusing on the expansion of its market beyond the raw portfolio.

Mood Support Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 656.21 million |

|

Revenue forecast in 2032 |

USD 1,157.59 million |

|

CAGR |

6.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |