Multichannel Order Management Market Size, Share, Trends, & Industry Analysis Report

By Organization Size (SMEs, Large Enterprises), By Component, By Deployment Method, By Vertical, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2634

- Base Year: 2024

- Historical Data: 2020-2023

Overview

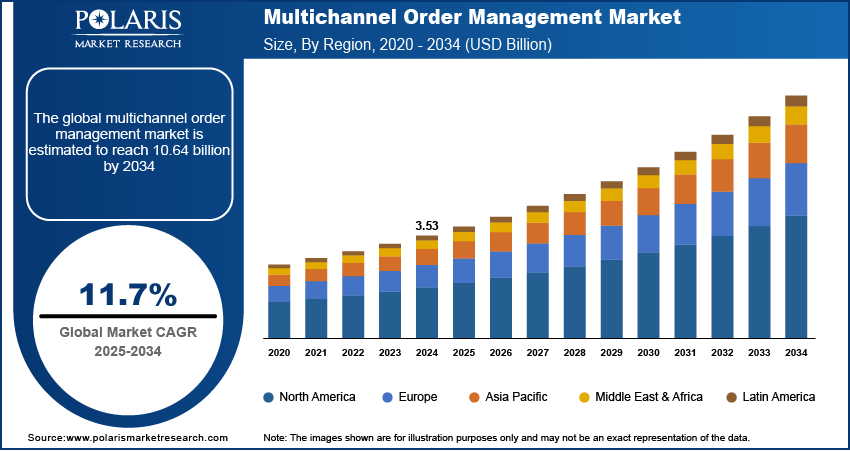

The multichannel order management market was valued at USD 3.53 billion in 2024 and is expected to grow at a CAGR of 11.7% during the forecast period. The growing retail and online shopping industries, particularly in the emerging market, are anticipated to propel the global multichannel order management market. Technical improvement in digital transformation, increasing utilization of smartphone worldwide, growing internet users, and use of various sales channels by several enterprises is expected to accelerate the market’s growth.

Key Insights

- The services segment is expected to experience significant growth during the forecast period due to rising demand for professional consulting and support.

- Order fulfilment accounted for the largest share in 2024 as it automates labor-intensive processes.

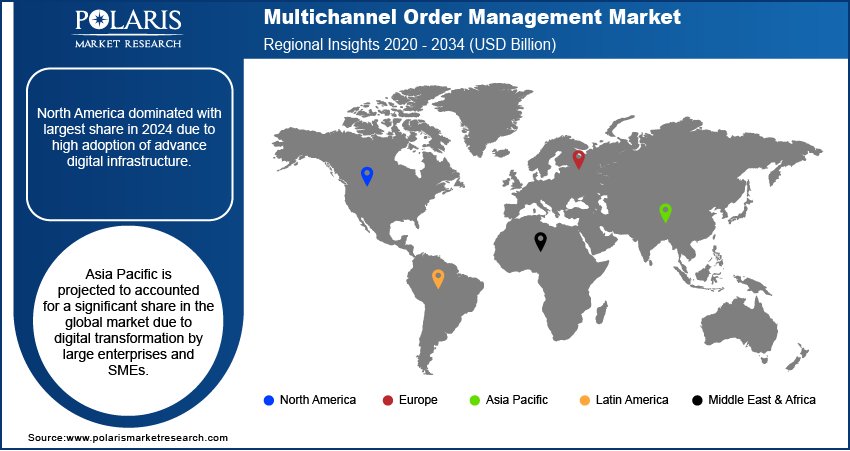

- North America dominated with largest share in 2024 due to high adoption of advance digital infrastructure.

- Asia Pacific is projected to accounted for a significant share in the global market due to digital transformation by large enterprises and SMEs.

Industry Dynamics

- The digital transformation in major sectors is fueling the growth.

- The rising penetration of smartphone and increasing number of internet users is boosting the industry.

- Technological advancement is driving the growth.

- High complexity and cost of integrating multiple sales channels with legacy systems is limiting the growth.

Market Statistics

- 2024 Market Size: USD 3.53 Billion

- 2034 Projected Market Size: USD 10.64 Billion

- CAGR (2025-2034): 11.7%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- AI helps to improve demand forecasting by analyzing sales data and trend.

- AI algorithms optimize order fulfillment by selecting the best warehouse or store location.

- Routine processes like order confirmation, invoicing, and returns are automated through AI-powered bots.

Multichannel order management allows retailers to keep the entire order and inventory management from multiple sales channels under one roof. With significant technological breakthroughs and an ever-changing legal environment, businesses and government organizations are entering a new phase of consumer engagement in which the emergent revolution plays an important role.

Advanced technologies, including cloud computing and big data, are changing modern business strategies from previous business model approaches. Additionally, advanced technologies open up many possibilities and enable companies to implement customer-focused marketing strategies, which have driven the demand for multichannel order management solutions.

Industry Dynamics

Growth Drivers

The number of internet users are increasing worldwide. This growth in the number is driven by rising government efforts to improve internet access to rural parts of countries. According to the World Bank Group, as of 2024, 68% of world’s population has access to the internet or has an active internet connection. This rise in the number is driving the online shopping activity globally. This growth in the online shopping activity is driving the demand for the multichannel order management solutions. Online shopping activity needs multichannel order management because today’s consumers shop across multiple platforms, and managing these orders effectively requires centralized, automated control. Moreover, expanding logistics industry is enabling deliveries in rural parts of country which is encouraging online shopping, which further drives the growth.

Development of digital technologies, the internet ecosystem, the utilization of smartphones and social media, and next-generation networks are actively making customers use online channels globally. To attract more customers and increase revenue, the company is rapidly expanding its distribution channels, including its website, social media, commerce, marketplaces, and offline stores, which is expected to stimulate the market’s growth.

Report Segmentation

The market is primarily segmented based on component, application, organization size, deployment mode, verticals, and region.

|

By Component |

By Application |

By Organization Size |

By Deployment Mode |

By Verticals |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

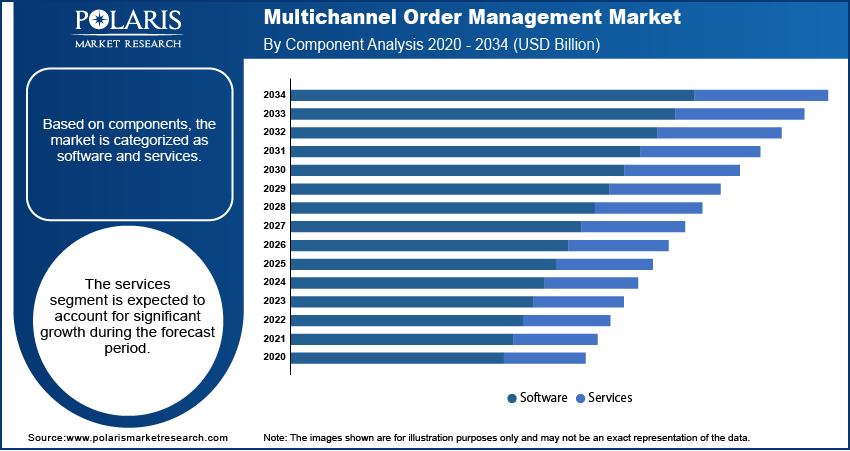

Services segment is expected to have significant share

Based on components, the market is categorized as software and services. The services segment is expected to account for significant growth during the forecast period. The segment consists of various professional services, integration, consulting services, training & support, and deployment services. The services are essential for the optimal functioning of multichannel order management solutions. Furthermore, it ensures faster and easier deployment and minimizes the value of corporate investments. The growth of managed services and professionals is attributed to the high adoption rate of multichannel order management software.

Order Fulfilment segment accounted for largest market share

Order fulfillment accoounted for largest market revenue in 2024. Order fulfillment technology automates labor-intensive processes of picking, processing, and shipping orders. In today's online culture, customers expect their suppliers to fulfill their orders quickly and accurately. The multichannel order management system automates order fulfillment according to the company's operations. For instance, GNC selected the SalesWrap order management solution for optimizing order management technology for future experiences to enhance the relationship with vendors and franchisees. Additionally, inventory is allotted based on a priority profile in case of multiple demand sources. The inventory pooling effect is exploited to improve cost performance and service level.

Large enterprises segment is expected to hold the significant revenue share

The large enterprise segment is expected to witness significant revenue share during the forecast period. Large enterprises receive orders from multiple channels as they focus on various channels to reach and meet the expectations of large numbers of customers. Furthermore, these organizations use multichannel order management solutions to avoid issues related to inventory management and omnichannel which further drives the segment growth.

Cloud segment is expected to grow fastest over the forecast

The cloud segment is anticipated to grow fastest over the forecast period as it is an agile, cost-effective, and comprehensive suite of software and services for accurate, real-time shipping and on-time order fulfillment from global inventory channels. This software synchronizes all sales channels, whether online or in-store, to improve the fulfillment process. Enabling sellers of all sizes for expanding their business while providing excellent service to consumers.

Retail, E-commerce, and wholesale is expected to register fastest growth rate

Retail, e-commerce, and wholesale register fastest growth rate during the forecast period. The expansion of the retail vertical is attributed to increased utilization of ML, IoT, and cognitive computing. Retails and e-commerce companies must manage their customer data to improve customer experiences. For consumer satisfaction, retailers are now focusing on developing a 360-degree view of their customers by providing multichannel order management services and software to meet the demands of e-commerce, wholesale and retail businesses. Additionally, multichannel order management service providers and software vendors are increasingly playing a crucial role.

North America accounted for largest market share

North America accounted for the largest market share in 2024, as this region's multichannel order management market is well-established, mature, and prone to technological advancement. It offers many opportunities for multichannel order management vendors and service providers. The majority of multichannel order management providers are well represented in this region. These vendors are increasing their regional market share through several acquisitions, agreements, and collaborations with system integrators, distributors, and resellers. Multichannel order management is expected to drive the growth potential for vendors operating in this region due to massive investment in e-commerce, retail, and manufacturing companies for adopting advanced technologies.

Asia Pacific is expected to record significant growth

The Asia Pacific is expected to witness significant growth during the forecast period due to growth in the e-commerce sector. This growth in the e-commerce sector is driven by rising smartphone penetration and internet access in the region. Developing countries in the region such as India, Vietnam and Bangladesh are improving internet access in the urban as well as rural areas, which is driving the online shopping in the region. This rise is driving the demand for the multichannel order management software. Moreover, to target large internet user base in the region companies are expanding to the multiple channels for brand visibility, which further drives the demand, thereby boosting the growth in the region.

Which Country Dominated the North America Multichannel Order Management Market in 2024?

The U.S held the largest share in 2024. The rising adoption of online shopping and smartphone usage propelled the demand for efficient order management systems. These systems help handle orders across multiple channels. The adoption of cloud-based solutions and automation transforms the way businesses manage orders. It enables better scalability and efficiency. Thus, the rising penetration of e-commerce and the increasing adoption of technological advancements boost the U.S. market share. The presence of key players also drives the U.S. multichannel order management market. The following table comprises leading MOM solutions in the U.S. with their key features:

|

Platform |

Users |

Features |

|

NetSuite (Oracle) |

Mid-to-large enterprises |

Integrated ERP, real-time inventory, omnichannel order orchestration |

|

Shopify Plus |

High-growth e-commerce businesses |

Unified inventory control, automated workflows, third-party logistics integration, multi-channel support |

|

Brightpearl |

Retailers and wholesalers |

Multichannel order management, real-time reporting and inventory planning, multi-currency support, integrated accounting |

|

Zoho Inventory |

Small to mid-sized businesses |

Multi-channel order and inventory management, real-time tracking, integration with Zoho suite |

|

Multiorders |

E-commerce sellers across platforms |

Centralized order dashboard, automated invoicing and repetitive tasks, multi-channel integration |

|

DELMIA MOM (Dassault Systèmes) |

Manufacturers with complex operations |

Real-time production tracking, maintenance scheduling, synchronized inventory management, quality management |

Competitive Insight

Some of the major players operating in the global market Algopix Holdings Ltd., Browntape Technologies Pvt. Ltd., Cloud Commerce Group Ltd., Constellation Software Inc., Delhivery Pvt. Ltd., GeekSeller LLC, HCL Technologies Ltd., International Business Machines Corp., Linnworks Software Inc., ManageEcom, nChannel, Newfold Digital Inc., Oracle Corp., Sage Group Plc, Salesforce.com Inc., SalesWarp, SellerActive Inc., Selro Ltd., Vinculum Solutions Pvt. Ltd., and Zoho Corp. Pvt. Ltd.

Recent Developments

In July 2022, Oracle collaborated with Big Ray's, in which Big Ray's will be able to handle its inventory and order management, financial operations, e-commerce operations, and point-of-sale operations on a single platform by Oracle NetSuite.

In February 2021, SAP collaborated with Virgin Megastore and Sundiro Honda for delivering an exceptional shopping experience with SAP Commerce Cloud solution offering the clients a top-notch e-commerce experience.

Multichannel Order Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.53 billion |

| Market size value in 2025 | USD 3.93 billion |

|

Revenue forecast in 2034 |

USD 10.64 billion |

|

CAGR |

11.7% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Application, By Organization Size, By Deployment Mode, By Verticals, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Algopix Holdings Ltd., Browntape Technologies Pvt. Ltd., Cloud Commerce Group Ltd., Constellation Software Inc., Delhivery Pvt. Ltd., GeekSeller LLC, HCL Technologies Ltd., International Business Machines Corp., Linnworks Software Inc., ManageEcom, nChannel, Newfold Digital Inc., Oracle Corp., Sage Group Plc, Salesforce.com Inc., SalesWarp, SellerActive Inc., Selro Ltd., Vinculum Solutions Pvt. Ltd., Zoho Corp. Pvt. Ltd. |

FAQ's

• The market size was valued at USD 3.53 Billion in 2024 and is projected to grow to USD 10.64 Million by 2034.

• The market is projected to register a CAGR of 11.7% during the forecast period.

• A few of the key players in the market are Algopix Holdings Ltd., Browntape Technologies Pvt. Ltd., Cloud Commerce Group Ltd., Constellation Software Inc., Delhivery Pvt. Ltd., GeekSeller LLC, HCL Technologies Ltd., International Business Machines Corp., Linnworks Software Inc., ManageEcom, nChannel, Newfold Digital Inc., Oracle Corp., Sage Group Plc, Salesforce.com Inc., SalesWarp, SellerActive Inc., Selro Ltd., Vinculum Solutions Pvt. Ltd., Zoho Corp. Pvt. Ltd.

• The order fulfilment accounted for the largest market share in 2024.

• The service segment is expected to record significant growth.