Naltrexone and Buprenorphine Market Size, Share, Trends, Industry Analysis Report

By Product (Naltrexone, Buprenorphine), By Route of Administration, By Application, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5962

- Base Year: 2024

- Historical Data: 2020-2023

Overview

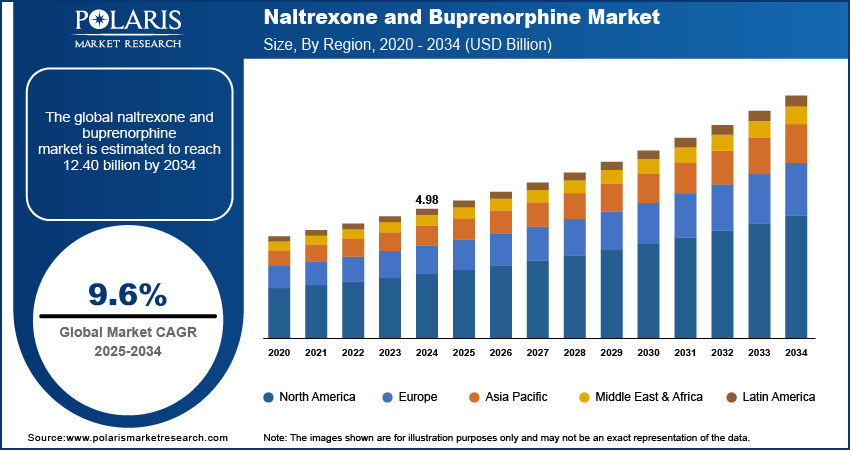

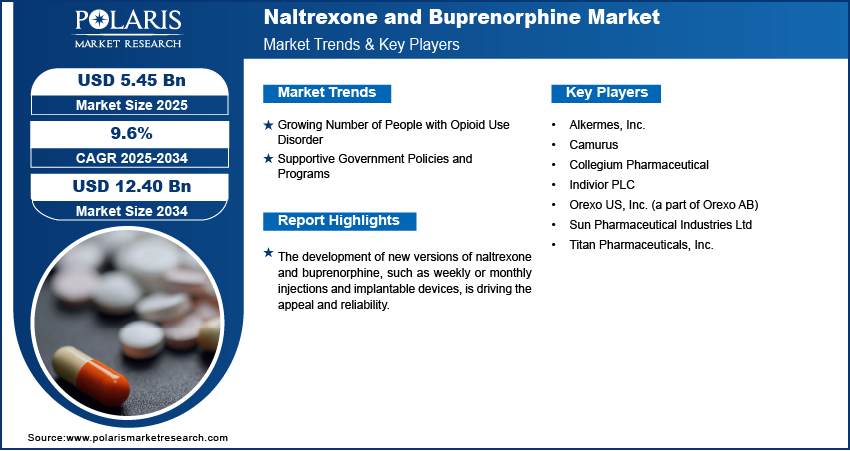

The global naltrexone and buprenorphine market size was valued at USD 4.98 billion in 2024, growing at a CAGR of 9.6% from 2025 to 2034. The growth is driven by growing number of people with opioid use disorder and supportive government policies and programs.

Key Insights

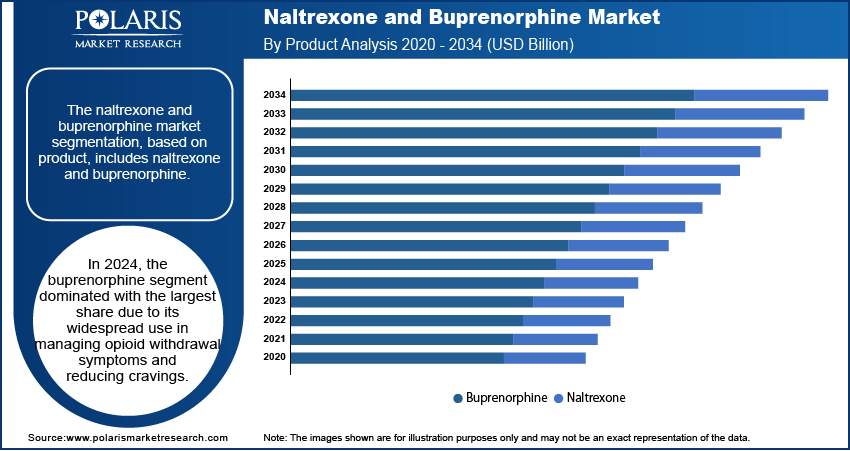

- In 2024, the buprenorphine segment dominated with the largest share due to its widespread use in managing opioid withdrawal symptoms and reducing cravings.

- The injectable administration segment dominated in 2024, driven by the growing preference for long-acting treatments.

- The opioid use disorder segment is expected to experience significant growth during the forecast period due to the continued rise in opioid misuse, addiction, and related deaths.

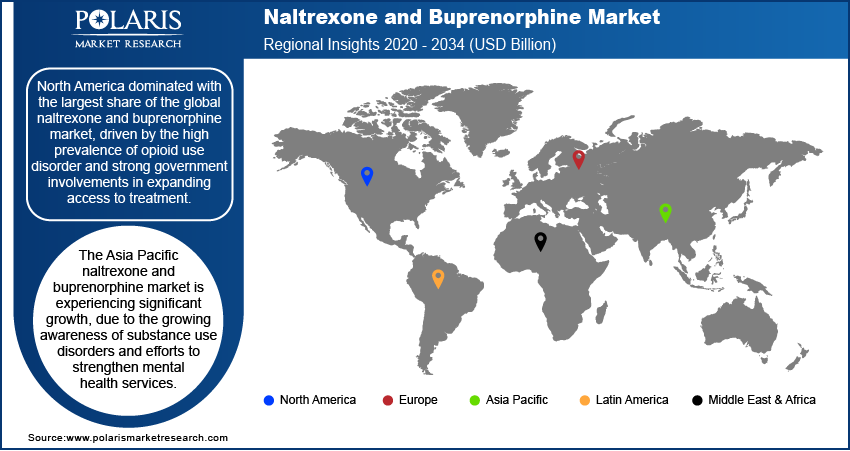

- The market in North America dominated with the largest share in 2024, due to the high number of opioid use disorder (OUD) cases and well-established healthcare infrastructure.

- The market in the U.S. is expected to witness significant growth due to the scale of the opioid crisis and the country’s active approach to addressing it.

- The naltrexone and buprenorphine market in Asia Pacific is projected to witness substantial growth in the coming years due to growing awareness of substance use disorders and efforts to strengthen mental health services.

Naltrexone and buprenorphine are medications used to treat opioid use disorder by reducing cravings and preventing relapse. Naltrexone blocks the effects of opioids, while buprenorphine partially activates opioid receptors to ease withdrawal without causing a high.

The rise in overdose deaths has led to stronger efforts from public health organizations to expand the use of proven treatments. Naltrexone and buprenorphine are both part of the recommended approach to reduce opioid-related harm. Programs focused on overdose prevention are encouraging early diagnosis and timely treatment, which includes starting medication right away. Outreach teams, harm reduction programs, and emergency departments are increasingly using these medications as first-line treatment. The need for medications such as naltrexone and buprenorphine is rising as more institutions and communities prioritize fast, evidence-based responses to opioid use, thereby driving the growth.

To Understand More About this Research: Request a Free Sample Report

The development of new versions of naltrexone and buprenorphine, such as weekly or monthly injections and implantable devices, are driving the appeal and reliability. These new options make it easier for patients to stay on their treatment plans by reducing the need for daily dosing. Some people may forget or choose not to take daily pills, which can lead to relapse. Long-acting versions help avoid this problem and improve treatment adherence. The demand for innovative, extended-release formulations is increasing as more people and healthcare experts recognize the benefits of these options, thereby driving the growth.

Industry Dynamics

- Growing number of people with opioid use disorder is driving the demand for naltrexone and buprenorphine.

- Supportive government policies and programs drive the market expansion.

- Advancements in formulation are fueling the reliability and appeal of products.

- The stigma surrounding opioid use disorder discourages patients from seeking treatment or adhering to medication-assisted therapy, limiting the growth.

Growing Number of People with Opioid Use Disorder:

The increasing number of people affected by opioid use disorder (OUD) is one of the main reasons for the demand for medications such as naltrexone and buprenorphine. Many communities across the globe are facing high rates of opioid addiction, leading to more hospitalizations, overdoses, and deaths. According to the Center for Disease Control, in 2022, 82,000 people died due to opioid overdose in the U.S. alone. More individuals are seeking medical treatment as awareness about OUD grows. Since naltrexone and buprenorphine are approved and proven to help manage withdrawal and reduce cravings, healthcare systems are using them more often to support recovery. This growing patient population is fueling the demand for these medications.

Supportive Government Policies and Programs:

Government support plays a major role in expanding the use of medications such as naltrexone and buprenorphine. Laws and programs at both the federal and state levels are helping make these treatments more available in clinics, hospitals, and addiction treatment centers. The removal of barriers, such as the X-waiver requirement for buprenorphine prescribing, has allowed more healthcare providers to treat patients. Public health agencies are further funding awareness campaigns and grant programs to encourage treatment access. These actions have helped integrate medication-assisted treatment into mainstream healthcare, which has increased demand and availability of naltrexone and buprenorphine, thereby driving the growth.

Segmental Insights

Products Analysis

The segmentation, based on products, includes naltrexone and buprenorphine. In 2024, the buprenorphine segment dominated with the largest share due to its widespread use in managing opioid withdrawal symptoms and reducing cravings. Buprenorphine is approved for use in various forms, including daily tablets, films, and long-acting injections, making it flexible for different treatment settings. Its partial opioid activity helps manage dependence with a lower risk of misuse, which makes it a preferred choice among healthcare providers. Its broader acceptance and earlier availability drive the segment growth.

Route of Administration Analysis

The segmentation, based on route of administration, includes oral administration, injectable administration, and implantable administration. The injectable administration segment dominated in 2024, driven by the growing preference for long-acting treatments. Many healthcare providers and patients favor injections because they reduce the need for daily medication and improve treatment consistency. Monthly and weekly injectable formulations lower the chances of missed doses, which is important for managing opioid dependence over time. These formulations are administered in clinical settings, allowing medical supervision and reducing the risk of misuse, thereby driving the segment growth.

Application Analysis

Based on application, the segmentation includes opioid use disorder (OUD) and alcohol use disorder (AUD). The opioid use disorder segment is expected to experience significant growth during the forecast period due to the continued rise in opioid misuse, addiction, and related deaths. Treatments involving naltrexone and buprenorphine are widely recognized as essential for managing this condition. Healthcare systems, correctional facilities, and community programs are all expanding access to these medications to help prevent overdose and support long-term recovery. The use of these drugs for OUD is projected to grow significantly in the coming years as awareness increases and more treatment centers adopt medication-assisted approaches, thereby driving the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes hospitals pharmacies, retail pharmacies, and others. The hospitals pharmacies segment is expected to experience significant growth during the forecast period as hospitals are the first point of care for individuals experiencing overdose or withdrawal, and they are increasingly offering medication-assisted treatment at the point of discharge. Hospital pharmacies ensure quick access to injectable and oral formulations, especially in emergency settings. The growing role of hospitals in initiating OUD treatment, combined with structured treatment programs within these institutions, is increasing the demand for these medications through their in-house pharmacies, thereby driving the segment growth.

Regional Analysis

North America Naltrexone and Buprenorphine Market Trend

The market in North America dominated with the largest share in 2024, due to the high number of opioid use disorder (OUD) cases and well-established healthcare infrastructure. The region has seen strong support from government policies aimed at expanding access to medication-assisted treatment (MAT). Increased funding, awareness programs, and changes in prescribing rules have made treatment more accessible. Long-acting formulations and greater involvement of primary care providers further fuel the growth, thereby driving the growth of region.

U.S. Naltrexone and Buprenorphine Market Insight

The market in the U.S. is expected to witness significant growth during 2025–2034 due to the scale of the opioid crisis and the country’s active approach to addressing it. Policies such as removing the X-waiver for buprenorphine prescribing and expanding Medicaid coverage for addiction treatment have improved access. Hospitals, clinics, and community programs widely use these medications to manage OUD. The availability of both daily and extended-release formulations supports flexible treatment options. Additionally, increased use in emergency departments and primary care settings is driving growth in the U.S.

Asia Pacific Naltrexone and Buprenorphine Market Analysis

The Asia Pacific market is projected to witness substantial growth in the coming years, due to growing awareness of substance use disorders and efforts to strengthen mental health services are driving the demand for naltrexone and buprenorphine. Rising opioid misuse in parts of the region has led to increased focus on treatment solutions. Governments are beginning to develop national strategies and pilot programs for managing opioid addiction, especially in urban areas. Improving healthcare infrastructure and increasing training for medical professionals on addiction care are supporting gradual uptake, thereby driving growth in North America.

China Naltrexone And Buprenorphine Market Outlook

The market in China is expected to experience rapid growth during the forecast period as the country takes initiatives to address opioid dependence through policy and healthcare reforms. Government efforts to control prescription opioid use and expand access to rehabilitation services are creating a supportive environment for medication-assisted treatment. Pilot programs in major cities have started to introduce these medications, especially in supervised clinical settings. The demand is expected to rise as awareness of opioid use disorder increases and more trained providers become available, thereby driving the growth in China.

Europe Naltrexone and Buprenorphine Market Insight

The market in Europe is expected to experience substantial growth during the forecast period, driven by the rising concern over opioid misuse, particularly with prescription drugs. Several European countries have integrated medication-assisted treatment into their public healthcare systems, making access more consistent. Strong support from government health agencies and the European Medicines Agency (EMA) has helped increase the availability of these medications. Public health campaigns aimed at harm reduction, along with investments in addiction treatment infrastructure, are contributing to growth. The presence of national guidelines supporting long-term care with buprenorphine or naltrexone, combined with increasing awareness among healthcare providers, fuels the growth in Europe.

Germany Naltrexone And Buprenorphine Market

Germany is one of the leading European countries in adopting medication-assisted treatment for opioid use disorder. Government-funded health insurance covers both buprenorphine and naltrexone therapies, improving access for patients. There is a strong network of addiction treatment centers and trained professionals, which helps integrate these medications into routine care. Germany has further implemented strict prescription controls and monitoring programs, encouraging safe and regulated use. Public health strategies focusing on long-term recovery and relapse prevention have made these medications a standard part of care, thereby driving the growth in Germany.

Key Players and Competitive Analysis

The competitive landscape is shaped by a mix of established pharmaceutical companies and specialized firms focusing on treatments for opioid use disorder (OUD). Key players such as Indivior PLC and Alkermes, Inc. have strong market presence with leading products such as Suboxone (buprenorphine/naloxone) and Vivitrol (extended-release naltrexone), respectively. Camurus and Orexo US, Inc. are expanding their foothold through advanced drug delivery technologies and new formulations that enhance treatment adherence. Collegium Pharmaceutical and Titan Pharmaceuticals, Inc. are contributing with targeted therapies and implantable solutions, while Sun Pharmaceutical Industries Ltd adds global manufacturing and distribution strength. Competition centers around product innovation, dosing convenience (e.g., weekly vs. monthly injections), regulatory approvals, and patient access. As the U.S. faces a sustained opioid crisis, companies are increasingly investing in research, partnerships, and expanded indications to differentiate their offerings in this highly regulated, yet urgently needed therapeutic space.

Key Players

- Alkermes, Inc.

- Camurus

- Collegium Pharmaceutical

- Indivior PLC

- Orexo US, Inc. (a part of Orexo AB)

- Sun Pharmaceutical Industries Ltd

- Titan Pharmaceuticals, Inc.

Industry Developments

In December 2024, the FDA approved multiple medications for opioid use disorder, including buprenorphine, methadone, and naltrexone. It expanded access, removed the X-waiver for buprenorphine, and launched awareness campaigns to encourage providers to treat OUD as a chronic condition.

In May 2023, the FDA approved Brixadi, a new extended-release buprenorphine injection, for treating moderate to severe opioid use disorder, expanding dosing options and supporting long-term recovery through weekly and monthly formulations administered by healthcare providers.

Naltrexone and Buprenorphine Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Naltrexone

- Buprenorphine

- BELBUCA

- Sublocade

- Suboxone

- Zubsolv

- Others

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Oral Administration

- Injectable Administration

- Implantable Administration

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Opioid Use Disorder (OUD)

- Alcohol Use Disorder (AUD)

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals Pharmacies

- Retail Pharmacies

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.98 Billion |

|

Market Size in 2025 |

USD 5.45 Billion |

|

Revenue Forecast by 2034 |

USD 12.40 Billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.98 billion in 2024 and is projected to grow to USD 12.40 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Alkermes, Inc.; Camurus; Collegium Pharmaceutical; Indivior PLC; Orexo US, Inc. (a part of Orexo AB); Sun Pharmaceutical Industries Ltd; and Titan Pharmaceuticals, Inc.

The buprenorphine segment dominated the market share in 2024.

The hospital pharmacies segment is expected to witness the significant growth during the forecast period.