NAMPT Inhibitors Market Size, Share, Trends, & Industry Analysis Report

By Type of Molecule (Small Molecules and Biologics), By Phase, By Route of Administration, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6100

- Base Year: 2024

- Historical Data: 2020-2023

Overview

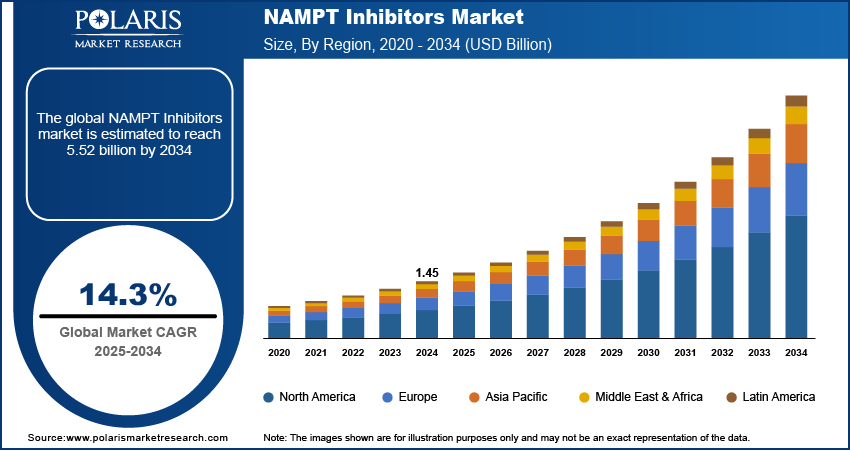

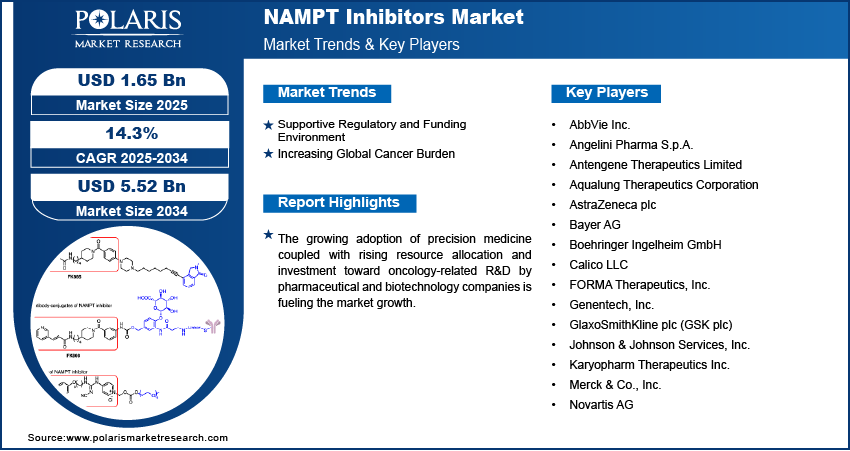

The global NAMPT inhibitors market size was valued at USD 1.45 billion in 2024, growing at a CAGR of 14.3% from 2025–2034. Supportive regulatory and funding environment coupled with increasing global cancer burden is driving the growth of the market.

Key Insights

- The small molecules segment dominated the market share in 2024.

- The biologics segment is projected to grow at the fastest rate over the forecast period, attributed to rising innovation in antibody-drug conjugates and fusion proteins that target NAMPT or modulate NAD⁺ pathways indirectly.

- The North America NAMPT inhibitors market dominated the global market share in 2024.

- The US NAMPT inhibitors market held the largest regional share of the North America market in 2024, driven by the country’s high cancer burden, due to aggressive malignancies such as glioblastoma and triple-negative breast cancer.

- The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, attributed to the expanding regional biotech landscape and greater involvement in international research collaborations.

- The market in China is expanding due to rising investment in oncology-focused R&D infrastructure by leading global pharmaceutical companies.

Industry Dynamics

- Rising global cancer burden is driving the demand for NAMPT inhibitors as a novel class of therapeutics targeting cancer metabolism, in hematologic malignancies and solid tumors.

- Supportive regulatory frameworks and increased government and private funding for oncology research are accelerating the clinical development of NAMPT-targeted therapies.

- Toxicity and safety concerns associated with NAMPT inhibition continue to restrain clinical progression.

- Adoption of AI-driven drug discovery platforms and advanced computational modeling tools is creating opportunities for designing next-generation NAMPT inhibitors with improved selectivity, reduced toxicity, and optimized pharmacokinetic profiles.

Market Statistics

- 2024 Market Size: USD 1.45 billion

- 2034 Projected Market Size: USD 5.52 billion

- CAGR (2025-2034): 14.3%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

NAMPT inhibitors are a class of targeted small-molecule compounds designed to block nicotinamide phosphoribosyltransferase (NAMPT), a crucial enzyme involved in cellular energy metabolism and NAD+ biosynthesis. These inhibitors exhibit promising potential in disrupting cancer cell survival, in tumors dependent on enhanced NAD+ pathways for growth and resistance. Selective impairment of NAD+ production through NAMPT inhibitors promotes apoptosis and enhances the sensitivity of cancer cells to other therapeutic agents, presenting a novel approach for treating resistant malignancies.

The growing adoption of personalized medicine is significant rising demand for NAMPT inhibitors. Precision oncology aims to tailor treatment strategies based on individual tumor genetics, and NAMPT inhibition is emerging as a promising avenue for targeting specific metabolic vulnerabilities in genetically defined cancer subtypes. Researchers and pharmaceutical developers are increasingly evaluating NAMPT inhibitors in biomarker-selected patient groups, such as those exhibiting overexpression of NAMPT or mutations that alter NAD⁺ metabolism. The growing clinical relevance of molecular diagnostics and companion biomarkers is propelling the application of NAMPT inhibitors within precision medicine frameworks.

Pharmaceutical and biotechnology companies are increasing resources toward oncology-related research and development, boosting the growth of the NAMPT inhibitors market. This growing focus is pushing preclinical and clinical exploration of NAMPT-targeted therapies across multiple indications, including cancer, inflammation, and immuno-metabolic disorders. For instance, in June 2024, TVM Capital Healthcare invested USD 35 million in Boston Oncology Arabia to support its transition to full formulation and fill–finish production at a GMP facility in Sudair Industrial City. The move meets with Saudi Arabia’s Vision 2030 and enables expansion of its oncology pipeline to over 175 drugs and biosimilars. Increased investment is fueling innovation, strengthening the early-stage pipeline, and supporting strategic collaborations aimed at advancing NAMPT-based drug candidates.

Drivers and Opportunities

Increasing Global Cancer Burden: The global rise in cancer cases is increasing the demand for innovative therapies such as NAMPT inhibitors. According to the World Health Organization (WHO), the number of new cancer cases is projected to reach over 35 million by 2050, marking a 77% rise compared to 20 million cases in 2022. NAMPT inhibitors target the nicotinamide phosphoribosyltransferase (NAMPT) enzyme, which is crucial in replenishing NAD+ levels essential for cancer cell metabolism and survival. This trend highlights the rising need for advanced therapies capable of addressing common and treatment-resistant cancers.

Supportive Regulatory and Funding Environment: Government institutions and international health organizations are increasing funding and regulatory incentives to accelerate the development of new oncology treatments. Regulatory frameworks such as the US FDA’s Fast Track and Orphan Drug programs are supporting early-stage research for metabolic pathway inhibitors such as NAMPT. For example, in 2024, the FDA Oncology Center of Excellence funded multiple extramural research projects under the Centers of Excellence in Regulatory Science and Innovation (CERSI) program, supporting precision oncology studies at Johns Hopkins University. These projects focus on integrative liquid biopsy techniques for detecting minimal residual disease and on non-invasive methods for managing colorectal cancer. These favorable regulatory environment and financial support are crucial in strengthening the clinical pipeline and commercial outlook of NAMPT inhibitors.

Segmental Insights

Type Of Molecule Analysis

Based on type of molecule, the segmentation includes small molecules and biologics. The small molecules segment holds the dominant share in the NAMPT inhibitors market in 2024, due to its favorable pharmacokinetics, ease of formulation, and established history in oncology drug development. Several NAMPT-targeting small molecules demonstrated strong efficacy in preclinical and early clinical studies, particularly in hematological malignancies and solid tumors. These agents are designed for oral or IV administration and modified for better target selectivity and safety profiles, propelling its use as a preferred modality in first-in-class drug candidates.

The biologics segment is projected to register the fastest growth over the forecast period. This is attributed to rising innovation in antibody-drug conjugates and fusion proteins that target NAMPT or modulate NAD⁺ pathways indirectly. The adoption for biologics are growing in precision oncology and immuno-metabolism due to enhanced specificity and broader therapeutic window. This growing interest is increasing its demand for innovation in NAMPT-targeted therapies.

Phase Analysis

By phase, the segmentation includes phase I, phase II, phase I/II, and preclinical. The preclinical segment accounts for the largest share in the market in 2024. This is due to the early stage of most NAMPT inhibitor programs, which are undergoing rigorous in vitro and in vivo testing for efficacy, toxicity, and pharmacodynamics. The growing complexity of targeting metabolic pathways and the requirement for biomarker validation, companies and academic institutions are heavily investing in preclinical pipeline development before proceeding to human trials.

The phase I segment is anticipated to grow at the fastest rate over the next few years. Several early-phase trials are initiated evaluating novel NAMPT inhibitors, in combination with other therapies such as PARP inhibitors or immune checkpoint inhibitors. The rise in first-in-human dosing, pharmacokinetic profiling, and safety assessments in phase I settings reflects growing reliance in moving these candidates into clinical validation and expanding therapeutic use beyond oncology.

Route of Administration Analysis

Based on route of administration, the segmentation includes oral and intravenous. The Intravenous (IV) administration segment accounted for the highest market share in 2024. This is due to its ability to ensure controlled drug delivery, consistent bioavailability, and rapid systemic exposure. Most current investigational agents particularly those tested in early-phase trials are administered intravenously in clinical settings to allow for close monitoring of tolerability for compounds targeting systemic metabolism.

The oral route is expected to witness the fastest growth over the forecast period. Innovations in medicinal chemistry and formulation science enabled the development of orally bioavailable NAMPT inhibitors, which offer greater convenience for outpatient therapy and long-term treatment. This trend meets with the growing preference for patient-centric cancer care models and improved adherence to therapy in chronic conditions.

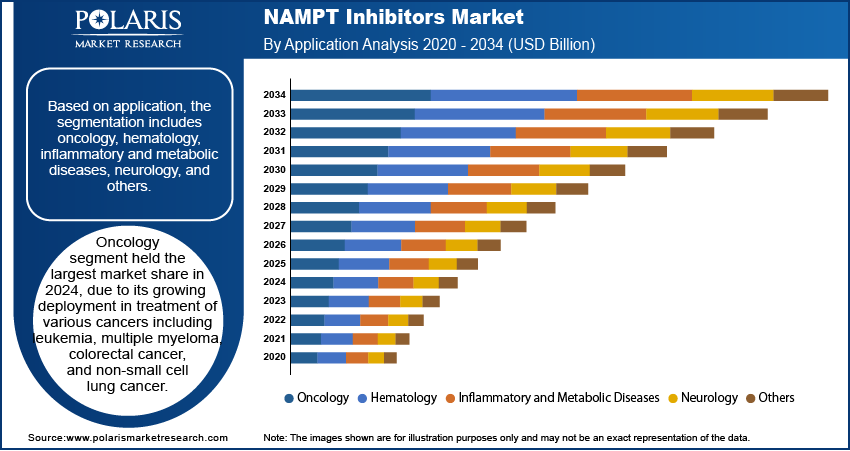

Application Analysis

Based on application, the segmentation includes oncology, hematology, inflammatory and metabolic diseases, neurology, and others. The oncology segment accounted for the highest market share in 2024. This is due to its growing deployment in treatment of various cancers including leukemia, multiple myeloma, colorectal cancer, and non-small cell lung cancer. It helps in disrupting the cancer cell's NAD⁺ metabolism and sensitize tumors to chemotherapy and radiotherapy. Multiple ongoing studies are focusing on NAMPT inhibition as a monotherapy or in synergistic combinations, increasing its demand in tumor metabolism.

The hematology segment is projected to witness the fastest growth during the forecast period in the NAMPT inhibitors market. This accelerated growth is attributed to promising early-stage studies that indicate NAMPT inhibitors’ efficacy in treating hematological malignancies such as leukemia and lymphoma. These inhibitors interfere with cellular metabolism critical to the survival and proliferation of hematopoietic cancer cells. Ongoing clinical trials and increased R&D efforts aimed at developing safer, more effective NAMPT inhibitors for hematological disorders are boosting the rapid segment growth.

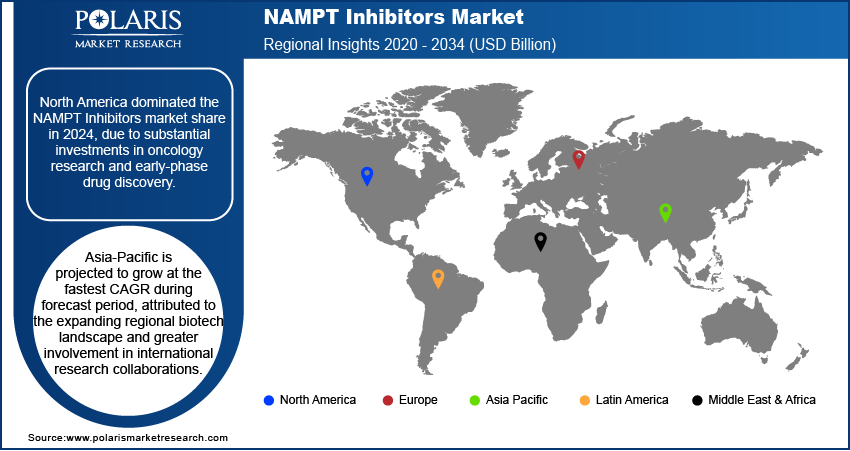

Regional Analysis

North America NAMPT Inhibitors market dominated the global market in 2024. This is due to substantial investments in oncology research and early-phase drug discovery. Biopharmaceutical companies and academic institutions across the region are actively investing in preclinical and clinical-stage R&D to develop NAMPT-targeted therapies for cancer and metabolic disorders. Regulatory pathways offered by the US Food and Drug Administration (FDA), such as fast-track designations and orphan drug status, are creating a favorable environment for NAMPT-based innovation. These factors are accelerating clinical development timelines and provide additional commercial incentives, driving the market growth in the region.

The US NAMPT Inhibitors Market Insight

The US dominated in North America NAMPT inhibitors landscape in 2024. This is driven by country’s high cancer burden, due to aggressive malignancies such as glioblastoma and triple-negative breast cancer. According to the National Brain Tumor Society report, glioblastoma was the most common primary malignant brain tumor in the US in 2023, representing 14.2% of all brain tumors and 50.1% of all malignant brain tumors. NAMPT inhibitors are emerging as a viable approach in overcoming resistance and enhancing treatment efficacy in the country. Moreover, the presence of leading oncology-focused research hubs, clinical trial infrastructure, and targeted drug development partnerships between biotech firms and academic institutions is further supporting the advancement of NAMPT-related therapies in the US market.

Asia Pacific NAMPT Inhibitors Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is attributed to the expanding regional biotech landscape and greater involvement in international research collaborations. Domestic pharmaceutical and biotechnology firms across China, Japan, and South Korea are actively pursuing NAMPT-related innovation through in-licensing agreements and research alliances. The region’s expanding participation in global clinical trials is further supporting the inclusion of NAMPT inhibitor candidates in multi-site studies, benefiting from cost-efficient operations and a genetically diverse patient population. These factors are significantly fueling the market expansion across the region.

China NAMPT Inhibitors Market Overview

The market in China is expanding due to rising investment in oncology-focused R&D infrastructure by leading global pharmaceutical companies. For instance, in March 2025, AstraZeneca announced an investment of USD 2.5 billion to establish a new strategic R&D center in Beijing China, joining Shanghai and part of a global network of six innovation hubs. The center is aimed to collaborate with biotech firms Harbour BioMed, Syneron Bio, and BioKangtai, and expand AZ’s Beijing team to 1,700 supporting immuno-oncology, AI-driven drug discovery, vaccines, and translational research. Additionally, Chinese biotech firms are advancing clinical research through domestic and international trial networks, contributing to a robust pipeline for NAMPT-based therapies.

Europe NAMPT Inhibitors Market

The NAMPT inhibitors landscape in Europe is projected to hold a substantial share in 2034. This is owing to the rising demand for personalized cancer therapies and niche oncology treatments. Rising incidence of rare, drug-resistant tumors is pushing the need for targeted approaches, where NAMPT inhibition offers promising therapeutic potential. EU-backed research frameworks such as Horizon Europe are providing substantial grants and collaborative platforms for companies and research institutions working on NAMPT inhibitor R&D. Regulatory clarity and support for orphan drug development are further contributing to the advancement of NAMPT-focused therapies across the region.

Key Players & Competitive Analysis Report

The NAMPT inhibitors market is moderately competitive, with leading players prioritizing innovation in oncology-targeted therapeutics, metabolic pathway modulation, and treatment-resistant cancer solutions. Companies are heavily investing in early-stage drug discovery, preclinical evaluations, and combination therapy studies to harness the therapeutic potential of NAMPT inhibition. Strategies include strengthening clinical trial pipelines, securing regulatory approvals for orphan and breakthrough designations, and fostering collaborations with academic research institutes and cancer-focused biotechnology firms. Additionally, market participants are expanding oncology portfolios and leveraging advancements in molecular biology and pharmacogenomics to enhance competitive positioning. The push toward precision medicine, coupled with growing interest in targeting cellular metabolism in cancer and inflammatory diseases, is shaping the long-term growth and strategic direction of the market.

Major companies operating in the NAMPT inhibitors industry include AbbVie Inc., Angelini Pharma S.p.A., Antengene Therapeutics Limited, Aqualung Therapeutics Corporation, AstraZeneca plc, Bayer AG, Boehringer Ingelheim GmbH, Calico LLC, FORMA Therapeutics, Inc., Genentech, Inc., GlaxoSmithKline plc (GSK plc), Johnson & Johnson Services, Inc., Karyopharm Therapeutics Inc., Merck & Co., Inc., and Novartis AG.

Key Players

- AbbVie Inc.

- Angelini Pharma S.p.A.

- Antengene Therapeutics Limited

- Aqualung Therapeutics Corporation

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim GmbH

- Calico LLC

- FORMA Therapeutics, Inc.

- Genentech, Inc.

- GlaxoSmithKline plc (GSK plc)

- Johnson & Johnson Services, Inc.

- Karyopharm Therapeutics Inc.

- Merck & Co., Inc.

- Novartis AG

Industry Developments

- May 2025: Remedy Plan Therapeutics secured USD 18 million in financing to accelerate the clinical advancement of its lead asset, RPT1G, into Phase 1/2 trials. As a novel NAMPT inhibitor, RPT1G represents a significant step forward in the NAMPT inhibitors market, aiming to overcome the toxicity challenges faced by earlier-generation candidates. This funding milestone underscores the growing investor confidence in next-generation NAMPT-targeted therapies and reflects ongoing momentum in the development of safer, more effective treatments within this therapeutic class.

NAMPT Inhibitors Market Segmentation

By Type of Molecule Outlook (Revenue, USD Billion, 2020–2034)

- Small Molecules

- Biologics

By Phase Outlook (Revenue, USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase I/II

- Preclinical

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Oral

- Intravenous

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Hematology

- Inflammatory and Metabolic Diseases

- Neurology

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

NAMPT Inhibitors Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.45 Billion |

|

Market Size in 2025 |

USD 1.65 Billion |

|

Revenue Forecast by 2034 |

USD 5.52 Billion |

|

CAGR |

14.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.45 billion in 2024 and is projected to grow to USD 5.52 billion by 2034.

The global market is projected to register a CAGR of 14.3% during the forecast period.

North America dominated the market in 2024, due to substantial investments in oncology research and early-phase drug discovery.

A few of the key players in the market are AbbVie Inc., Angelini Pharma S.p.A., Antengene Therapeutics Limited, Aqualung Therapeutics Corporation, AstraZeneca plc, Bayer AG, Boehringer Ingelheim GmbH, Calico LLC, FORMA Therapeutics, Inc., Genentech, Inc., GlaxoSmithKline plc (GSK plc), Johnson & Johnson Services, Inc., Karyopharm Therapeutics Inc., Merck & Co., Inc., and Novartis AG.

The small molecules segment dominated the market in 2024, due to its favorable pharmacokinetics, ease of formulation, and established history in oncology drug development.

The Phase I segment is projected to grow at the fastest rate, driven by rising early-stage trials of NAMPT inhibitors and increased first-in-human dosing and safety profiling.