Neurothrombectomy Devices Market Size, Share, Trends, Industry Analysis Report

: By Product (Clot Retrievers, Aspiration/Suction Devices, and Vascular Snares), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM1798

- Base Year: 2024

- Historical Data: 2020-2023

Neurothrombectomy Devices Market Overview

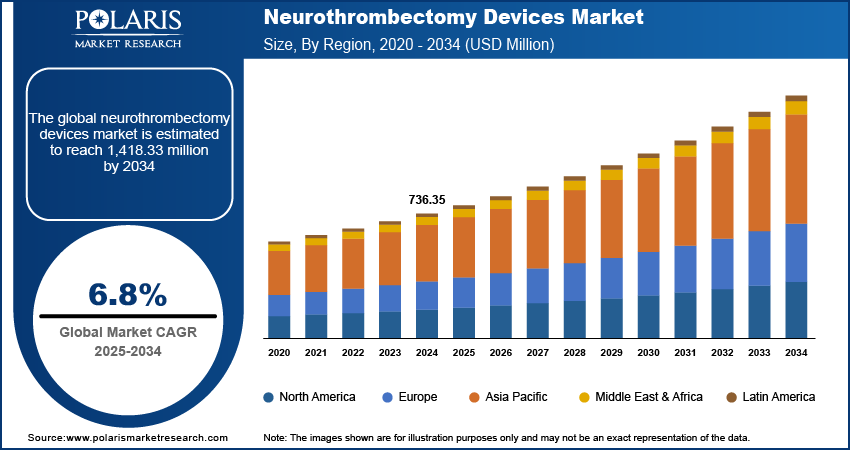

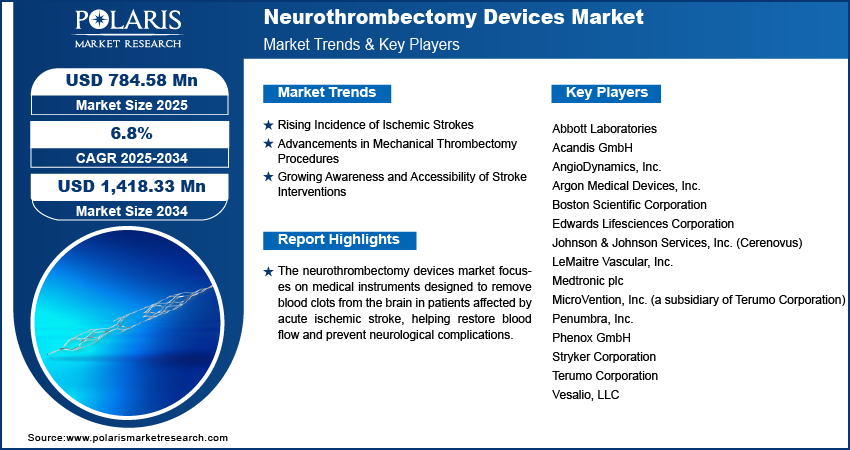

The neurothrombectomy devices market size was valued at USD 736.35 million in 2024. The market is projected to grow from USD 784.58 million in 2025 to USD 1,418.33 million by 2034, exhibiting a CAGR of 6.8% during 2025–2034.

The neurothrombectomy devices market refers to the industry focused on medical devices used to remove blood clots from the brain in patients suffering from acute ischemic stroke. The increasing prevalence of ischemic strokes, advancements in minimally invasive procedures, and the growing adoption of mechanical thrombectomy techniques drive the neurothrombectomy devices market demand. Rising healthcare expenditure, technological innovations, and favorable reimbursement policies are further supporting market growth. Key market trends include the integration of artificial intelligence in stroke management, expanding clinical trials for novel devices, and the increasing preference for early stroke intervention.

To Understand More About this Research: Request a Free Sample Report

Neurothrombectomy Devices Market Dynamics

Rising Incidence of Ischemic Strokes

The increasing prevalence of ischemic strokes significantly propels the neurothrombectomy devices market development. According to the Centers for Disease Control and Prevention, in the US, over 795,000 cases of stroke are reported annually, with approximately 87% of these being ischemic strokes, where blood flow to the brain is obstructed. This high incidence underscores the critical need for effective interventions, thereby driving the adoption of neurothrombectomy procedures.

Advancements in Mechanical Thrombectomy Procedures

Technological advancements in mechanical thrombectomy have enhanced the efficacy and safety of clot removal procedures, contributing to increased utilization. Studies have demonstrated that mechanical thrombectomy is a safe and effective treatment for acute ischemic stroke, achieving successful blood flow restoration in a significant percentage of cases. These improvements have led to broader acceptance among healthcare professionals and patients, further fueling the neurothrombectomy devices market growth.

Growing Awareness and Accessibility of Stroke Interventions

Enhanced awareness of stroke symptoms and the importance of timely medical intervention have led to increased utilization of neurothrombectomy devices. Initiatives aimed at educating the public and healthcare providers about the benefits of early intervention have contributed to this trend. However, disparities in access to mechanical thrombectomy persist globally, with significant differences in availability between high-income and low- to middle-income countries. Addressing these disparities is crucial for ensuring equitable access to life-saving treatments.

Neurothrombectomy Devices Market Segment Insights

Neurothrombectomy Devices Market Assessment by Product Outlook

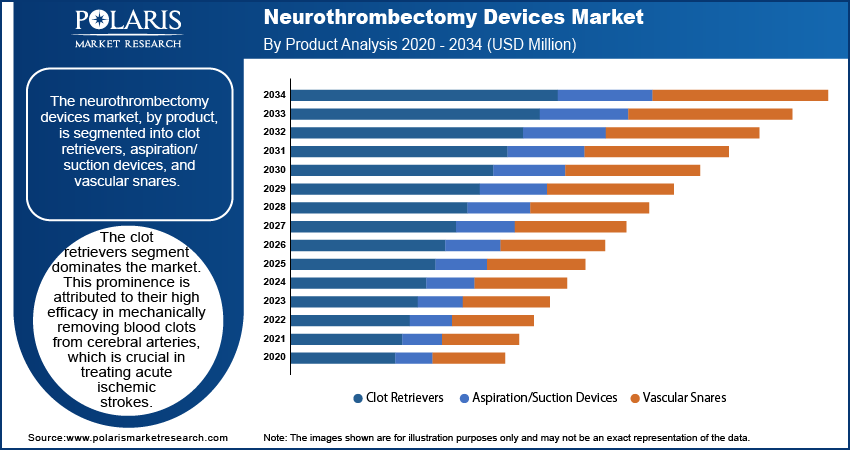

The neurothrombectomy devices market, by product, is segmented into clot retrievers, aspiration/suction devices, and vascular snares. The clot retrievers segment dominates the neurothrombectomy devices market share. This prominence is attributed to their high efficacy in mechanically removing blood clots from cerebral arteries, which is crucial in treating acute ischemic strokes. The increasing prevalence of such strokes has led to a higher adoption rate of clot retrievers among healthcare professionals. Additionally, continuous product innovations by key market players have bolstered this segment's growth. In 2019, Medtronic launched the Solitaire X revascularization device, enhancing the efficiency of clot retrieval procedures.

The aspiration/suction devices segment is expected to register the highest CAGR during the forecast period due to the increasing preference among physicians for their ability to effectively vacuum clots out of blood vessels, ensuring accurate revascularization in cases of large vessel occlusion.

Neurothrombectomy Devices Market Evaluation by End Use Outlook

The neurothrombectomy devices market, by end use, is segmented into hospitals, emergency clinics, and ambulatory surgical centers. The hospitals segment accounted for the largest share of the neurothrombectomy devices market revenue in 2024 due to the comprehensive healthcare services hospitals offer, including advanced diagnostic and surgical capabilities essential for managing acute ischemic strokes. The availability of specialized medical professionals and state-of-the-art equipment in hospital settings enhances the effectiveness of neurothrombectomy procedures, thereby driving the preference for hospitals among patients and healthcare providers.

The ambulatory surgical centers (ASCs) segment is experiencing the fastest growth due to the increasing number of outpatient surgeries performed in ASCs, including those for acute ischemic diseases. Patients often prefer ASCs due to shorter waiting times and the convenience of same-day surgical care. The rising demand for minimally invasive procedures and the introduction of technologically advanced products further support the expansion of ASCs in this market.

Neurothrombectomy Devices Market – Regional Insights

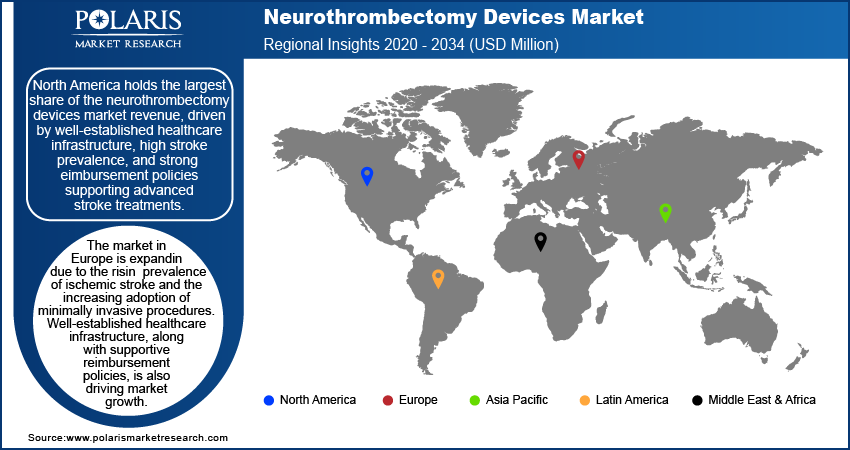

By region, the study provides neurothrombectomy devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest market share, driven by well-established healthcare infrastructure, high stroke prevalence, and strong reimbursement policies supporting advanced stroke treatments. The region benefits from continuous technological advancements and the presence of key market players investing in research and development. Europe also holds a significant share due to the increasing adoption of minimally invasive procedures and favorable regulatory support.

The Europe neurothrombectomy devices market is expanding due to the rising prevalence of ischemic stroke and the increasing adoption of minimally invasive procedures. Well-established healthcare infrastructure, along with supportive reimbursement policies are expanding the market value. Regulatory bodies such as the European Medicines Agency and national healthcare authorities are streamlining approval processes, facilitating faster adoption of advanced neurovascular interventional devices. Additionally, increasing clinical research and collaborative initiatives between medical institutions and device manufacturers are contributing to technological advancements in stroke treatment across the region.

Asia Pacific is expected to witness the highest CAGR during the forecast period, driven by improving healthcare infrastructure, increasing awareness of stroke management, and a rising aging population susceptible to stroke. Countries such as China, India, and Japan are experiencing growing demand for advanced stroke treatments due to government initiatives and expanding access to neurovascular care. In October 2020, Japan announced the Japanese National Plan for Promoting Measures Against Cerebrovascular and Cardiovascular Disease, developed through five council meetings, four parliamentary meetings, and public consultations. The increasing presence of international and regional medical device manufacturers is further accelerating the neurothrombectomy devices market expansion. Additionally, ongoing investments in medical research and training programs for healthcare professionals are enhancing the adoption of neurothrombectomy procedures in the region.

Neurothrombectomy Devices Market – Key Players and Competitive Insights

The competitive landscape of the neurothrombectomy devices market is characterized by the presence of established medical device manufacturers and emerging players focusing on innovation. Companies are actively investing in R&D to enhance device efficiency, reduce procedural complications, and improve patient outcomes. The market is driven by technological advancements, including next-generation stent retrievers and aspiration catheters, which offer improved clot retrieval efficiency and reduced procedure time. Regulatory approvals and clinical trials play a crucial role in market penetration, with firms striving for FDA and CE certifications to expand their geographical reach. Strategic collaborations, acquisitions, and partnerships are shaping the competitive environment, allowing firms to strengthen their product portfolios and enter new markets. Additionally, the growing adoption of minimally invasive neurovascular procedures, along with increasing healthcare expenditures and stroke awareness programs, is intensifying competition. The market remains dynamic, with continuous advancements aimed at enhancing patient safety and procedural success rates.

Medtronic plc is a medical device company with operational headquarters in Minneapolis, Minnesota, and legal headquarters in Ireland. The company operates in more than 150 countries and employs over 90,000 people. Medtronic develops and manufactures healthcare technologies and therapies, including devices for cardiac and vascular conditions, diabetes management, and neurological disorders.

Stryker Corporation is engaged in the medical technology sector. The company offers a diverse range of products, including implants for joint replacement and trauma surgeries, surgical equipment, neurovascular devices, and patient handling systems. Stryker's operations span over 100 countries, serving healthcare professionals and facilities globally.

List of Key Companies in Neurothrombectomy Devices Market

- Abbott Laboratories

- Acandis GmbH

- AngioDynamics, Inc.

- Argon Medical Devices, Inc.

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Johnson & Johnson Services, Inc. (Cerenovus)

- LeMaitre Vascular, Inc.

- Medtronic plc

- MicroVention, Inc. (a subsidiary of Terumo Corporation)

- Penumbra, Inc.

- Phenox GmbH

- Stryker Corporation

- Terumo Corporation

- Vesalio, LLC

Neurothrombectomy Devices Industry Developments

- September 2024: Vesalio launched the pVasc Thrombectomy System in the US to improve thrombectomy procedures for peripheral vascular occlusions, enhancing patient outcomes in these interventions.

- March 2022: Medtronic launched PRAAN, India's first clinical registry to evaluate the effectiveness of brain blood clot retrieval devices in stroke patients.

- March 2021: Penumbra Inc. announced the availability of a thrombus removal device (Indigo System Lightning 7) in the US.

Neurothrombectomy Devices Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Clot Retrievers

- Aspiration/Suction Devices

- Vascular Snares

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Emergency Clinics

- Ambulatory Surgical Centers

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Neurothrombectomy Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 736.35 million |

|

Market Size Value in 2025 |

USD 784.58 million |

|

Revenue Forecast by 2034 |

USD 1,418.33 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The neurothrombectomy devices market size was valued at USD 736.35 million in 2024 and is projected to grow to USD 1,418.33 million by 2034.

The market is projected to register a CAGR of 6.8% during the forecast period.

North America held the largest share of the market, driven by well-established healthcare infrastructure, high stroke prevalence, and strong reimbursement policies supporting advanced stroke treatments.

A few key players in the market include Abbott Laboratories; Acandis GmbH; AngioDynamics, Inc.; Argon Medical Devices, Inc.; Boston Scientific Corporation; Edwards Lifesciences Corporation; Johnson & Johnson Services, Inc. (Cerenovus); and LeMaitre Vascular, Inc.

The clot retrievers segment accounted for the largest share of the market in 2024. This prominence is attributed to their high efficacy in mechanically removing blood clots from cerebral arteries, which is crucial in treating acute ischemic strokes.

The hospitals segment accounted for the largest market share in 2024 due to the comprehensive healthcare services hospitals offer, including advanced diagnostic and surgical capabilities essential for managing acute ischemic strokes.

Neurothrombectomy devices are medical instruments used to remove blood clots from the brain in patients experiencing acute ischemic stroke. These devices help restore blood flow by mechanically retrieving or aspirating the clot, reducing the risk of severe neurological damage. They are primarily used in endovascular procedures and are categorized into clot retrievers, aspiration/suction devices, and vascular snares. Neurothrombectomy procedures are performed in specialized healthcare settings, such as hospitals and stroke centers, to improve patient outcomes and minimize stroke-related disabilities.

A few key trends in the market are described below: