Nitrile Gloves Market Share, Size, Trends & Industry Analysis Report

By Type (Powdered, Powder-Free); By Product; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM1932

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

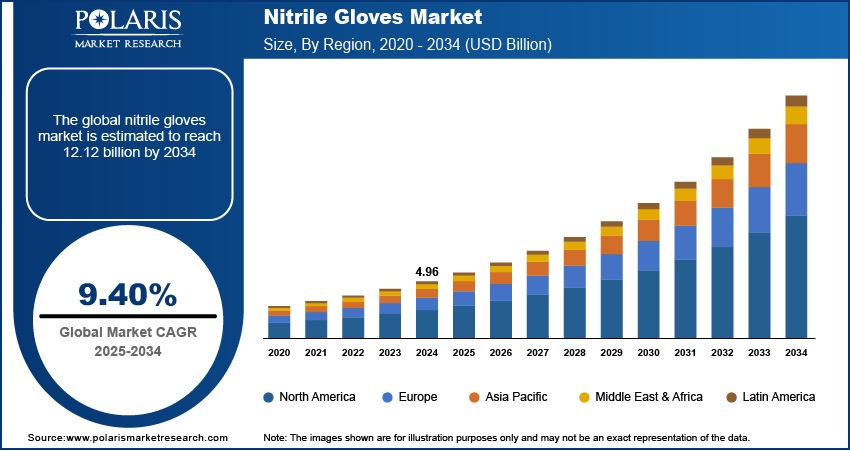

The global Nitrile Gloves Market was valued at USD 4.96 billion in 2024 and is expected to grow at a CAGR of 9.40 % from 2025 to 2034. The surge in healthcare and industrial hygiene needs continues to be a major growth driver.

Key Insights

- In 2024, the powder-free segment was the most dominant in the global market due to its chlorination process, which removes powdered residue.

- The disposable segment is expected to continue growing steadily due to its one-time use, which ensures hygiene and prevents cross-contamination.

- North America accounted for the highest revenue market share globally due to the preference for nitrile gloves over latex, as they are more resistant to chemicals, safe from allergens, and puncture-resistant.

Industry Dynamics

- Increasing workplace safety concerns are driving demand in manufacturing, food processing, and healthcare industries across various regions of the world.

- The increasing number of healthcare facilities in emerging countries is driving the use of nitrile gloves in hospitals, clinics, and diagnostic laboratories.

- Public and private sector investment is increasing production capacities to meet the growing global demand.

- Disruptions in the supply chain and labor scarcity limit manufacturers' capacity to respond to soaring demand worldwide.

Market Statistics

2024 Market Size: USD 4.96 billion

2034 Projected Market Size: USD 12.12 billion

CAGR (2025–2034): 9.40%

North America: Largest Market Share

To Understand More About this Research:Request a Free Sample Report

Industry Trends

The major factors driving the demand for nitrile gloves are increasing workplace safety concerns, rising awareness of healthcare infection, and growing healthcare infrastructure in developing countries. The covid 19 pandemic had surged the demand for nitrile gloves as they are highly used in healthcare and pharmaceutical industries during a pandemic. The global gap between demand and supply for nitrile gloves is anticipated to widen as a result of supply constraints like the limited capacity of manufacturers, the lengthy time required to set up new plants, and the limited workforce availability.

Synthetic latex is used to make nitrile gloves which are more resistant to punctures than natural rubber. Nitrile gloves' advantages in terms of strength, durability, chemical resistance, allergy-friendliness, tactile sensitivity, and reduced risk of contamination make them a preferred choice over vinyl and latex gloves in various industries such as healthcare, food handling, laboratory work, and more. Powder-free nitrile gloves are utilized in the food and dairy industries due to their excellent solvent resistance, odourlessness, and anti-static properties. These gloves are protected from solvents, oils, a few acids, and biohazards. They are more cut-safe than plastic with a time span of usability of 5 years. However, traditional nitrile gloves are more expensive than latex gloves and do not biodegrade 100%.

The manufacturing process of nitrile gloves involves material preparation, mixing, dipping, glove forming, vulcanization, stripping, leaching, quality control, and packaging. Nitrile, a synthetic rubber compound, is mixed with additives and dipped onto ceramic or metal molds. After vulcanization, the gloves are stripped, leached, and undergo quality control tests. The final gloves are then packaged for distribution, with sterilization as an optional step for sterile gloves. This process ensures the production of high-quality nitrile gloves that offer chemical resistance, durability, and tactile sensitivity. Continuous improvements in manufacturing techniques aim to meet the increasing demand for nitrile gloves in various industries.

Key Takeaways

- North America dominated the market and contributed over 35% market share of the nitrile gloves market size in 2024

- By type category, the powder-free segment dominated the global nitrile gloves market size in 2024

- By product category, the disposable segment is projected to grow with a significant CAGR over the nitrile gloves market forecast period

What are the market drivers driving the demand for market?

Increasing investment from public and private companies

In recent years, there has been a significant increase in investment from both public and private companies in producing and distributing nitrile gloves. Nitrile gloves, made from a synthetic rubber compound, have gained immense popularity due to their superior strength, durability, and resistance to punctures and chemicals. This surge in investment can be attributed to several driving factors that have created a robust market for nitrile gloves.

One of the key driving factors behind the increased investment in nitrile gloves is the growing demand from various industries. Nitrile gloves are widely used in healthcare settings, such as hospitals, clinics, and laboratories, where the need for high-quality disposable gloves is crucial for maintaining hygiene and preventing the spread of infections. The industrial sector, including manufacturing, automotive, and food processing industries, has also witnessed a rising demand for nitrile gloves to ensure worker safety and compliance with strict regulations. This increasing demand across multiple sectors has created a lucrative market opportunity for companies involved in the production and supply of nitrile gloves, prompting them to invest in expanding their manufacturing capabilities.

Which factor is restraining the demand for the market?

Fluctuations in raw material prices may affect the product cost

The concern is warranted because the price of natural gas will impact the price of nitrile gloves as well as the cost of utilities. Natural gas and 0.00812 Kwh of electricity is required for a single glove. Malaysia, one of the biggest makers of gloves, saw a 24% expansion in the cost of natural gas, which will influence the costs of nitrile gloves by around 1% to 1.5% of the production cost. The cost of nitrile rubber was unstable in nature during the beyond three years, prompting an unexpected spike in the cost of nitrile gloves, particularly during the pandemic. The glove makers saw their working benefits arrive at more than half during 2021 and 2022, because of the unexpected demand for examination gloves from the clinical industry due to Covid-19. The disruption in the supply chain of raw materials from Asian countries to production facilities across the globe led to a huge gap between demand and supply. During the peak of COVID-19, the demand for Nitrile Gloves witnessed peak demand in the majority of countries. As a result, the shortage in supply led to increased prices of Nitrile Gloves.

Report Segmentation

The market is primarily segmented based on type, product, end-use, and region.

|

By Type |

By Product |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Type Insights

Based on type category analysis, the market has been segmented on the basis of powdered and powder-free. In 2024, the powder-free segment has emerged as the dominant segment in the global market. Powder-free gloves are normally recommended due to the absence of powder by treating the gloves with chlorine solution, rinsed with water and dried to remove the powdered residue. For instance, the United States Food and Drug Administration banned powdered surgeon's gloves, absorbable powder for lubricating a surgeon's gloves, and powdered patient gloves on December 19, 2016 due to the substantial risk of illness to individuals exposed to the powdered gloves.

Due to the absence of powder in the gloves, it is majorly accepted in the healthcare and food industry. Surgeons uses these gloves in medical procedures, such as surgery, to protect the wearer from contact with blood and other bodily fluids. They also help to prevent the spread of infection. It is also used in food preparation, such as cooking, handling, or serving food. They help to protect the wearer from contact with foodborne illness-causing pathogens and prevent the spread of contamination.

The growing medical industry, hotels, restaurants, and fast-food chains are the key supporting factors for the market. In the last few years, the demand for these gloves has increased manifold from the mentioned industries and is projected to grow substantially in the projected period.

By Product Insights

Based on product category analysis, the market has been segmented on the basis of disposable and durable. The disposable segment is projected to witness a progressive growth rate in the forecasting years. Disposable gloves are single-use protective gloves designed to be used once and discarded. They are usually made from substances like latex, nitrile, or vinyl and utilized in various applications to uphold cleanliness and avoid cross-contamination.

Individuals wear disposable nitrile gloves to protect their hands and minimize the risk of contamination. They find applications in various industries, such as healthcare, food processing, automotive, laboratories, and janitorial services. They are used when handling chemicals, biological materials, and general hygiene. Moreover, disposable gloves have been adopted in a wide range of end-use industries as a precaution against contamination. The combined effect of the pandemic, government regulations, and growing hygiene awareness has resulted in a substantial rise in disposable gloves across sectors, playing a crucial role in safeguarding workers and reducing the risk of infection transmission.

Regional Insights

North America

North America accounted for the largest revenue share in the global market since nitrile gloves have become preferred over latex gloves due to their superior properties, such as chemical resistance, allergen sensitivity, and puncture resistance. The increasing demand for disposable gloves across various industries, particularly healthcare, has significantly driven market growth. Additionally, concerns over latex allergies have driven the shift from latex to nitrile gloves. Strict safety regulations and standards imposed by regulatory bodies have also contributed to the rising adoption of nitrile gloves as personal protective equipment. The expansion of the healthcare sector, driven by an aging population and advancements in medical technology, has further fueled the demand for nitrile gloves in hospitals, clinics, and laboratories.

The COVID-19 pandemic has significantly impacted the market, with a surge in demand for nitrile gloves to prevent the transmission of the virus. Industries such as food processing, automotive, manufacturing, and janitorial services have also contributed to the market growth due to nitrile gloves' chemical resistance and durability. Continuous product innovation, including textured surfaces and powder-free options, has expanded the applications of nitrile gloves.

Competitive Landscape

The competitive landscape of the nitrile gloves market is marked by intense competition among a mix of global leaders, regional manufacturers, and emerging players. Major companies dominate the market with their large-scale production capabilities, extensive distribution networks, and strong brand recognition. These industry giants invest heavily in research and development to enhance the quality, durability, and functionality of their nitrile gloves, catering to diverse sectors such as healthcare, industrial, and food processing.

Some of the major players operating in the global market include:

- AMMEX

- ANSELL LTD

- Atlantic Safety Products

- Cardinal Health

- Globus Group

- Hartalega Holdings Berhad

- Hospeco Brands Group

- Kossan Rubber Industries Bhd

- MAPA Professional

- Thermo Fisher Scientific Inc

Recent Developments

- In October 2024, Unigloves, a leading specialist in hand protection, and KluraLabs, innovators in antimicrobial solutions, have partnered to launch the CrossGuard antimicrobial nitrile glove, the first of its kind to eliminate 99.99% of selected bacteria in just 60 seconds.

- In April 2023, Ammex has launched a new lineup of disposable gloves that would protect users in an environment ranging from the office to the garage to outer space.

- In July 2019, HOSPECO has recently announced the addition of a new variant to its ProWorks Pyramid Grip nitrile glove collection. The latest addition features a vibrant High Visibility Neon Green color, enhancing the assortment's offerings known for their exceptional blend of protection, dexterity, and grip.

- In September 2022, Medline Industries, LP has invested $500 million in medical supply inventory to ensure the availability of required products and timely delivery to healthcare providers.

- In March 2023, Medline Industries, LP has opened a state-of-the-art LEED-certified distribution center in Hammond, Los Angeles. The site is expected to handle over $200 million of annual orders and distribute thousands of individual products to healthcare providers.

Report Coverage

The nitrile gloves market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, product, end-use, and their futuristic growth opportunities.

Nitrile Gloves Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.33 billion |

|

Revenue forecast in 2034 |

USD 12.12 billion |

|

CAGR |

9.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Nitrile Gloves Market are AMMEX, ANSELL LTD, Atlantic Safety Products, Cardinal Health, Globus Group

Nitrile gloves market exhibiting the CAGR of 9.40% during the forecast period.

Nitrile Gloves Market report covering key segments are type, product, end-use, and region

The key driving factors in Nitrile Gloves Market are Increasing investment from public and private companies

Nitrile Gloves Market Size Worth USD 12.12 Billion by 2034