North America Endoscopy Devices Market Share, Size, Trends, Industry Analysis Report

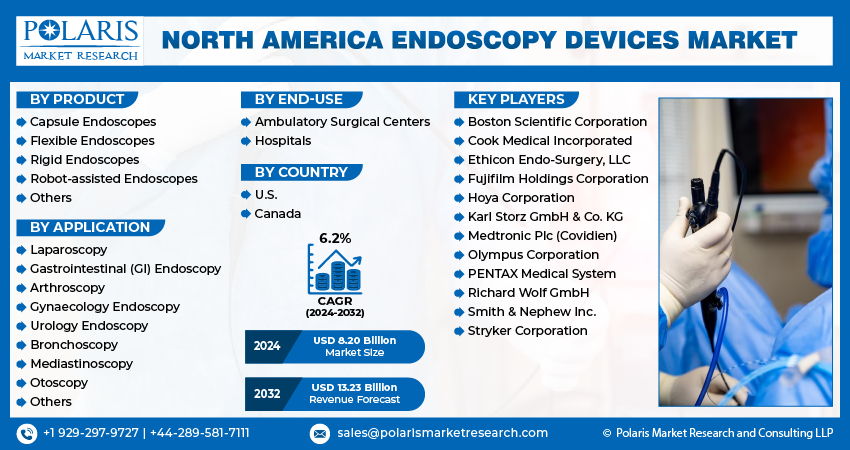

By Product (Capsules Endoscopes, Flexible Endoscopes, Rigid Endoscopes, Robot-assisted Endoscopes, Others); By Application; By End-Use; By Country; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4216

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

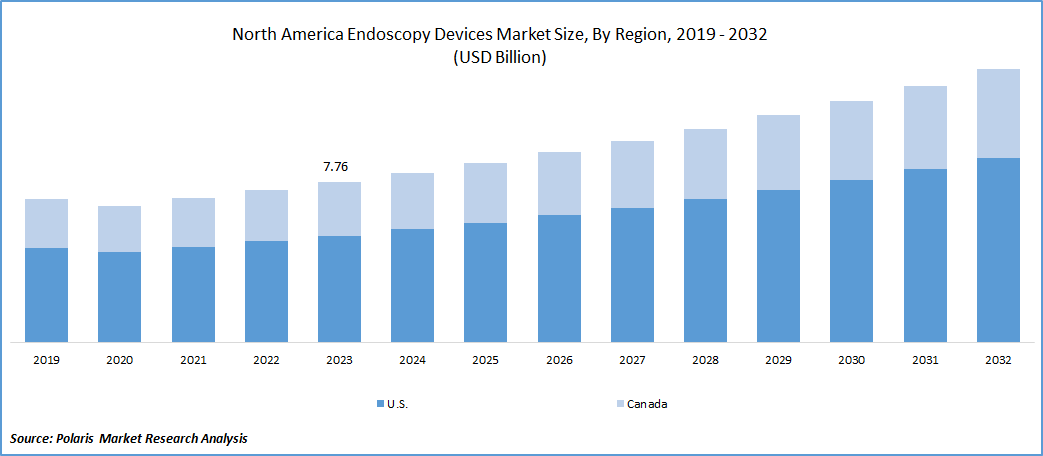

The north america endoscopy devices market was valued at USD 7.76 Billion in 2023 and is expected to grow at a CAGR of 6.2% during the forecast period.

Endoscopy devices are medical devices with a small camera and light source that are utilized to examine the interior of organs, cavities, or tissues within the body. They are commonly used for diagnostic and therapeutic purposes, allowing healthcare professionals to visualize and treat conditions without the need for invasive surgery.

Surge in disorder related to the gastrointestinal tract, rising demand for endoscopy, and the increasing awareness about the endoscopy devices are mainly driving the growth of the endoscopy devices market in the north america. Further, the technological enhancements in the endoscopy assures superior results with accurate information which is anticipated to foster the market’s growth.

To Understand More About this Research; Request a Free Sample Report

The growing popularity of neuroendoscopy is anticipated to create opportunities for manufacturers to unveil innovative endoscopy devices, potentially leading to a surge in market revenue. Furthermore, due to their increased susceptibility to various chronic diseases, the rising geriatric population plays an important role in driving the growth of the endoscopy market in north america.

Additionally, the recent trend toward minimally invasive endoscopic procedures has witnessed a rapid a surge, owing to benefits such as reduced postoperative complications and faster recovery rates.

The COVID-19 pandemic has significant impact on the north america endoscopy devices market. During the early stages of the pandemic, elective procedures, including many endoscopic examinations, were postponed or canceled in order to prioritize resources for COVID-19 patients and reduce the risk of viral transmission in north america. As a result, demand for endoscopy devices fell as hospitals and healthcare facilities focused on emergency and essential services.

However, as the healthcare system adapted to the new normal and implemented safety measures, the endoscopy devices market began to recover slowly. The increased awareness of the importance of early diagnosis and routine healthcare screenings, combined with an abundance of postponed procedures, has contributed to a resurgence in demand for endoscopic devices in the north america region.

Growth Drivers

Rising Prevalence of Minimally Invasive Surgeries will Drive the Growth of the Market

The increasing prevalence of minimally invasive will drive growth of the endoscopy devices market in north america. Minimally invasive surgery has several advantages, including fewer incisions or stitches, fewer painkiller requirements, shorter recovery times, less pain, and fewer postoperative care needs. Endoscopy, in particular, is known for its low postoperative pain, which necessitates lower painkiller doses.

Endoscopy devices market in North America have increased as a result of rising demand for minimally invasive procedures, technological advancements, and an aging population with a higher prevalence of conditions treatable with endoscopy. Minimally invasive surgical techniques are preferred by surgeons in north america because they aim to cause the least amount of damage to human tissues. Furthermore, the use of robotic technology in these surgeries has improved outcomes while allowing for precise control over the procedure.

Report Segmentation

The market is primarily segmented based on product, application, end-use, and country.

|

By Product |

By Application |

By End-Use |

By Country |

|

|

|

|

To Understand the Scope of this Report; Speak to Analyst

By Product Analysis

The Flexible Endoscopes Segment Accounted for the Largest Market Share in 2023

The flexible endoscopes segment held the largest market share in the north america endoscopy devices market. Flexible endoscopes are the therapeutic and diagnostic instruments that are utilized to see the interior of the hollow organs of human body and to collect the tissue samples. These devices enable physicians to examine the digestive tract for abnormalities, perform biopsies, and even perform certain therapeutic interventions.

The use of flexible endoscopes continues to evolve with technological advancements, contributing to improved diagnostic capabilities, patient comfort, and outcomes in a variety of medical specialties. The widespread use of these devices emphasizes their importance in modern healthcare practices in North America.

By Application Analysis

The Laparoscopy Segment Accounted for the Largest Market Share in 2023

The laparoscopy segment held the largest market share in the north america endoscopy devices market. Laparoscopy is a minimally invasive endoscopic procedure for examining abdominal organs with few risks. This technique uses only minor incisions and is widely used in North America for both diagnostic and therapeutic purposes. Common procedures include hysterectomies (uterus removal) and appendectomies.

The increasing demand for minimally invasive surgical procedures, surging burden of chronic diseases like cardiac diseases, gynecological diseases, gastrointestinal diseases, and urological diseases, increasing demand for enhanced diagnostic accuracy, and key market players presence in the region will also drive the growth of the north america endoscopy devices market.

The gastrointestinal endoscopy witnessed for the fastest growth in the north america endoscopy devices market due to the increased prevalence of cancer and gastrointestinal illnesses as well as chronic conditions in the region, as well as the surging appetite for the minimally invasive procedures. Also, the increasing research activities to improve endoscopy and the increasing investments by the hospitals in north america to purchase the new gastrointestinal endoscopic devices, will facilitate the market’s growth in region.

Country Insights

U.S. Dominated the Endoscopy Devices Market in 2023

U.S. dominated the endoscopy devices market. The anticipated rise in gastric diseases, which will require precise endoscopic assessments for effective treatment, is expected to fuel market growth in the country. According to the American Cancer Society's projections, 4,470 cases of urethral and other urinary organ cancers will be diagnosed in the United States in 2023. Similarly, the same source predicts that 12,070 cases of small intestine cancer will be diagnosed in the country that year.

The projected rise in urethral, urinary organ, and small intestine cancer incidences in the United States is expected to fuel the demand for flexible endoscopy devices. These devices improve accessibility and visualization during diagnosis and treatment of specific organs, thereby contributing significantly to the expected growth of the endoscopy devices market in the United States.

Key Market Players & Competitive Insights

The North America Endoscopy Devices market is highly competitive, with several prominent players varying for market share. Leading manufacturers such as Aeroflex, Inc., Chroma ATE Inc., Danaher Corporation, LTX-Credence Corporation, National Instruments Corporation, Roos Instruments, Inc., STAr Technologies, Inc., Teradyne, Inc., Virginia Panel Corporation, Xcerra Corporation are also present in the region.

Some of the major players operating in the North America Endoscopy Devices Market include:

- Boston Scientific Corporation

- Cook Medical Incorporated

- Ethicon Endo-Surgery, LLC

- Fujifilm Holdings Corporation

- Hoya Corporation

- Karl Storz GmbH & Co. KG

- Medtronic Plc (Covidien)

- Olympus Corporation

- PENTAX Medical System

- Richard Wolf GmbH

- Smith & Nephew Inc.

- Stryker Corporation

Recent Developments

- In January 2023, UC Davis Health has launched an innovative endoscopy suite in the United States, that features advanced technology and seamless integration of healthcare services. The expanded suite provides more space to meet the increasing demand for endoscopy procedures.

- In August 2022, Medtronic has launched GI Genius in India, an artificial intelligence module developed specifically for endoscopy to fight colorectal cancer. This innovative medical tool provides real-time data, allowing healthcare professionals to more effectively identify and manage colorectal cancer while also improving visualization during colonoscopy procedures.

- In August 2021, Fujifilm Holdings Corporation launched the ELUXEO Endoscopic Surgical System, an advanced system that seamlessly integrates innovative imaging capabilities with therapeutic functionalities.

North America Endoscopy Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.20 billion |

|

Revenue Forecast in 2032 |

USD 13.23 billion |

|

CAGR |

6.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By End-Use, By Country |

|

Country scope |

U.S., Canada |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

The North America Endoscopy Devices market size is expected to reach USD 13.23 Billion by 2032

Boston Scientific Corporation, Cook Medical Incorporated, Ethicon Endo-Surgery LLC., Fujifilm Holdings Corporation, Hoya Corporation, Karl Storz GmbH & Co. KG are the top market players in the market.

U.S region contribute notably towards the global North America Endoscopy Devices Market.

The north america endoscopy devices market is expected to grow at a CAGR of 6.2% during the forecast period.

The North America Endoscopy Devices Market report covering key segments are product, application, end-use, and country