North America Extrusion Machinery Market Share, Size, Trends, Industry Analysis Report

By Material (Metal, Plastic, Others); By Type; By End Use; By Country; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4712

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

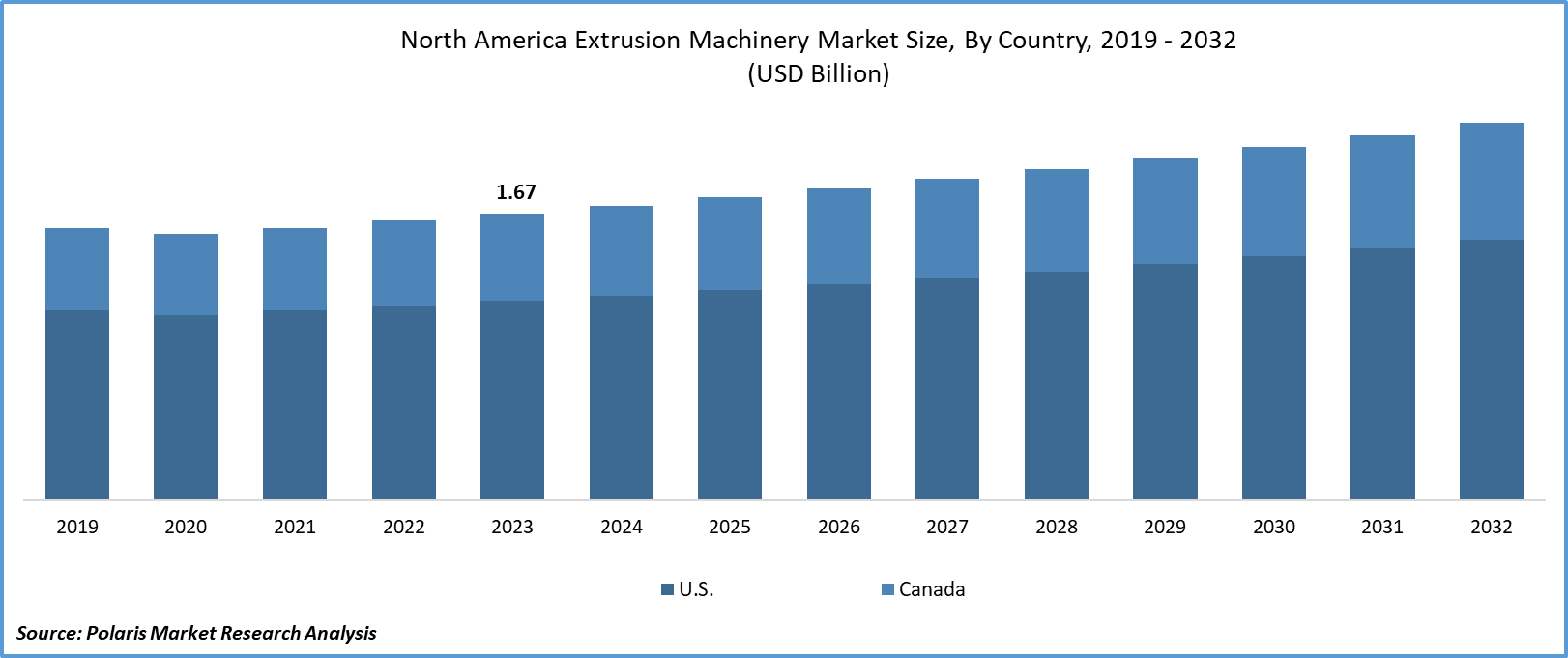

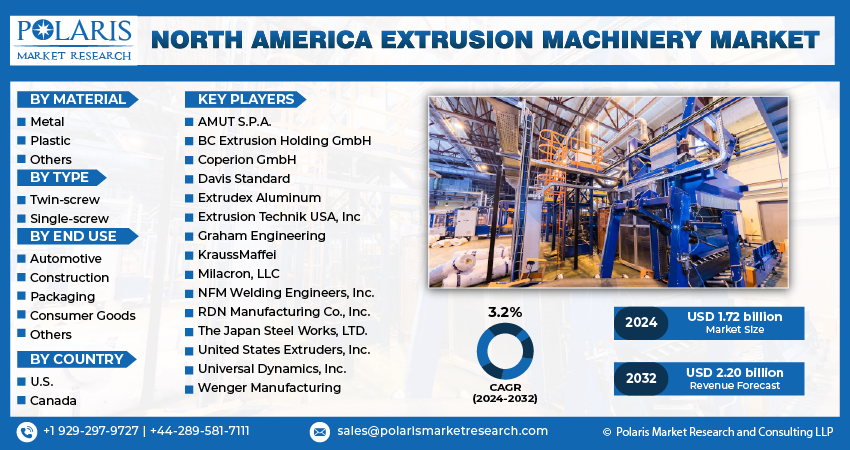

The north america extrusion machinery market size was valued at USD 1.67 billion in 2023.

The market is anticipated to grow from USD 1.72 billion in 2024 to USD 2.20 billion by 2032, exhibiting a CAGR of 3.2% during the forecast period.

Market Introduction

The North American extrusion machinery market is growing due to the resurgence of the manufacturing sector. With a renewed emphasis on domestic production and investments in infrastructure, manufacturing in North America is experiencing significant growth. As manufacturers prioritize productivity and quality, there's a rising demand for advanced extrusion machinery. Furthermore, technological advancements in automation and digitalization drive the adoption of extrusion machinery in manufacturing.

In addition, companies operating in the market are introducing new products to enhance their offerings in the market, expand market reach, and strengthen their presence.

To Understand More About this Research: Request a Free Sample Report

For instance, in February 2023, Guill unveiled its new iteration of its Series 800, a 2-to-6 layer extrusion tooling engineered to manufacture top-tier, material-efficient tubing ranging from 1/8” to 6” OD. This tooling is tailored for automotive, medical, appliance, and industrial applications, ensuring the production of high-quality tubing.

The market is also witnessing growth, propelled by the burgeoning aerospace and defense sector. Increasing demand for advanced aircraft, military equipment, and aerospace components necessitates specialized materials and manufacturing processes. Extrusion machinery plays a crucial role in producing aerospace-grade materials like aluminum and titanium profiles, as well as composite structures. Technological advancements in extrusion technology enable the fabrication of lightweight yet durable materials, meeting stringent industry requirements. Additionally, government investments in defense modernization programs further boost demand for extrusion machinery, driving innovation to meet the evolving needs of the sector.

Industry Growth Drivers

Surging Construction and Infrastructure Projects are Projected to Spur Product Demand

The North American extrusion machinery market is witnessing growth, fueled by a surge in construction and infrastructure projects. Urbanization and population growth drive demand for residential, commercial, and industrial spaces, necessitating various construction materials produced by extrusion machinery. Additionally, substantial investments in infrastructure, including transportation and renewable energy, further bolster demand. Extrusion machinery plays a crucial role in manufacturing materials like pipes, profiles, and structural components vital for these projects. Furthermore, the emphasis on sustainable building practices boosts the need for eco-friendly construction materials, driving innovation in the extrusion machinery sector.

The Emergence of Industry 4.0 and Smart Manufacturing is Expected to Drive North America Extrusion Machinery Market Growth

The North American extrusion machinery market growth is propelled by the emergence of Industry 4.0 and smart manufacturing. Industry 4.0 integrates digital technologies into manufacturing, revolutionizing industrial processes. Extrusion machinery is integral in this shift, enabling the production of advanced materials for smart manufacturing. By incorporating sensors and data analytics, extrusion machinery facilitates real-time monitoring and predictive maintenance, enhancing efficiency and productivity. Smart manufacturing practices, facilitated by extrusion machinery, optimize processes, reduce downtime, and minimize waste.

Industry Challenges

Supply Chain Disruptions are Likely to Impede North America Extrusion Machinery Market Growth

Supply chain disruptions constrain the North American extrusion machinery market. Global supply chains are vulnerable to various factors like natural disasters, trade disputes, and pandemics, leading to delays in critical components and raw materials. Such disruptions can halt or slow down production, impacting the availability and cost of extrusion machinery. The COVID-19 pandemic, in particular, highlighted vulnerabilities in supply chains, prompting the need for resilience strategies. Companies are diversifying suppliers, increasing inventory levels, and adopting digital supply chain management solutions to mitigate future disruptions.

Report Segmentation

The North American extrusion machinery market analysis is primarily segmented based on material, type, end use, and country.

|

By Material |

By Type |

By End Use |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

The Plastic Segment Held a Significant North America Extrusion Machinery Market Share in 2023

The plastic segment held a significant North America extrusion machinery market share in 2023 owing to its cost-effectiveness and widespread applications across construction, packaging, automotive, and consumer goods. Extrusion machinery offers the flexibility and customization required to process a diverse array of plastic materials, including sustainable options derived from recycled or bio-based polymers. As environmental concerns grow, there is an increasing demand for sustainable plastics, further driving the adoption of extrusion machinery.

By Type Analysis

The Demand for the Twin-Screw Segment is Expected to Increase During the North American Extrusion Machinery Market Forecast Period

The demand for the twin-screw segment is expected to increase during the North American extrusion machinery market forecast period. Twin-screw extruders offer higher throughput rates and faster processing speeds compared to single-screw counterparts, enhancing overall productivity and efficiency while meeting escalating production demands. Furthermore, their proficiency in processing high-viscosity materials like polymer melts and rubber compounds is pivotal for industries such as plastics, rubber, and food processing.

By End Use Analysis

The Construction Segment Held a Significant North America Extrusion Machinery Market Share in 2023

The construction segment held a significant number of North America extrusion machinery market share in 2023. The industry's demand for essential building materials like pipes, profiles, and panels drives the need for extrusion machinery. Ongoing infrastructure projects, including roads, bridges, and utilities, further contribute to this demand. Extruded materials find extensive use in architectural applications such as window and door frames, roofing systems, and curtain walls. Additionally, the rising focus on sustainability and energy efficiency in construction fuels the demand for extruded materials meeting green building standards.

Country Insights

The U.S. Accounted for a Significant North America Extrusion Machinery Market Share in 2023

In 2023, the U.S. accounted for a significant market share due to its industrial prominence across the automotive, construction, packaging, and consumer goods sectors. With advanced manufacturing infrastructure and technological capabilities, it efficiently meets industry demands. Ongoing large-scale infrastructure projects in transportation, utilities, and renewable energy drive demand for extrusion machinery. Furthermore, continuous innovation and technological advancements reinforce the U.S.'s position as a market leader. Strong and steady economic growth encourages increased investments in industrial machinery, solidifying its dominance in the region.

Canada is expected to experience significant growth during the North America extrusion machinery market forecast period. Its growing construction industry, driven by infrastructure projects and residential/commercial developments, boosts demand for extruded materials and machinery. The nation's vast natural resource extraction activities necessitate specialized equipment, including extrusion machinery, for processing and transportation. Additionally, Canada's focus on renewable energy sources prompts the production of extruded components for infrastructure projects, further driving market growth. Government investments in infrastructure, particularly in transportation and renewable energy sectors, provide opportunities for market expansion.

Key Market Players & Competitive Insights

The North American extrusion machinery market is characterized by a wide range of participants, and the anticipated arrival of new competitors is set to heighten competitive pressures. Key players in the market consistently refine their technologies, aiming to sustain a competitive edge through a focus on effectiveness, dependability, and safety. These entities prioritize strategic initiatives such as forging partnerships, enhancing product offerings, and engaging in cooperative projects. Their main objective is to surpass rivals within the sector, ultimately capturing a notable share of the North American extrusion machinery market.

Some of the major players operating in the North American extrusion machinery market include:

- AMUT S.P.A.

- BC Extrusion Holding GmbH

- Coperion GmbH

- Davis Standard

- Extrudex Aluminum

- Extrusion Technik USA, Inc

- Graham Engineering

- KraussMaffei

- Milacron, LLC

- NFM Welding Engineers, Inc.

- RDN Manufacturing Co., Inc.

- The Japan Steel Works, LTD.

- United States Extruders, Inc.

- Universal Dynamics, Inc.

- Wenger Manufacturing

Recent Developments

- In December 2022, KraussMaffei, a partner of PureCycle Technologies based in Munich, delivered the last crucial piece of equipment required for PureCycle's purification facility in Ironton, Ohio. This final extruder delivery enabled PureCycle to adhere to its construction timeline and commence pellet production as planned.

- In July 2022, Graham Engineering has completed the acquisition of Kennedy Tool & Die. This acquisition is expected to enhance the company's capacity to assist customers throughout the entire lifespan of their extrusion equipment, thereby expediting their support capabilities.

Report Coverage

The North American extrusion machinery market report emphasizes key countries across the region to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction in the region. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, materials, types, end uses, and their futuristic growth opportunities.

North America Extrusion Machinery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.72 billion |

|

Revenue Forecast in 2032 |

USD 2.20 billion |

|

CAGR |

3.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Country scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries and segmentation. |

FAQ's

The global North America Extrusion Machinery market size is expected to reach USD 2.20 billion by 2032

Key players in the market are AMUT S.P.A., BC Extrusion Holding GmbH, Coperion GmbH, Davis Standard

The north america extrusion machinery market exhibiting a CAGR of 3.2% during the forecast period.

The North America Extrusion Machinery Market report covering key segments are material, type, end use, and country.