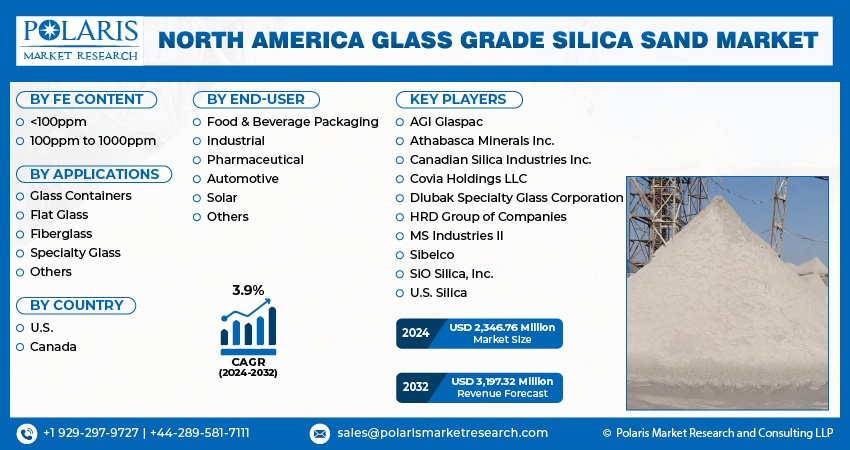

North America Glass Grade Silica Sand Market Share, Size, Trends, Industry Analysis Report

By Fe Content (<100ppm, 100ppm to 1000ppm); By Applications; By End-User; By Country; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 119

- Format: PDF

- Report ID: PM4943

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

North America Glass Grade Silica Sand market size was valued at USD 2,264.62 million in 2023. The market is anticipated to grow from USD 2,346.76 million in 2024 to USD 3,197.32 million by 2032, exhibiting the CAGR of 3.9% during the forecast period.

Industry Trends

The North America glass grade silica sand market has witnessed significant growth in recent years, driven by a robust manufacturing base, particularly in the automotive and construction sectors. The region is home to numerous companies engaged in the production of flat glass. The demand for high-quality flat glass from these industries is a key driver for the need for silica sand in the manufacturing process. The United States, in particular, stands out as a dominant force in the glass-grade silica sand market. The country possesses vast reserves of high-quality silica sand, notably in states such as Wisconsin, Illinois, and Texas. This abundance ensures a reliable source for both domestic consumption and international exports, reinforcing the United States' position in the global market.

To Understand More About this Research:Request a Free Sample Report

The advanced industrial and manufacturing sectors heavily rely on silica sand to produce various glass products, including flat glass, fiberglass, and specialty glass. The use of silica sand in these manufacturing processes is substantial, contributing to the overall demand for glass-grade silica sand in the region.

For instance, in February 2024, data compiled by the US Census Bureau revealed that construction spending in December 2023 reached an estimated seasonally adjusted annual rate of $2,096.0 billion. This marked a 0.9 percent increase (± 0.8 percent) from the revised November estimate of $2,078.3 billion. Comparatively, the December 2023 figure demonstrated a significant surge of 13.9 percent (±1.5 percent) compared to the estimate for December 2022, which stood at $1,840.9 billion. The overall value of construction in 2023 totaled $1,978.7 billion, exhibiting a notable 7.0 percent (±1.0 percent) increase over the $1,848.7 billion spent in 2022.

The emphasis on using renewable energy sources in manufacturing, as seen in Canadian Premium Sand's intention to power its new facility with renewable energy, aligns with the growing trend toward sustainable practices. This not only reduces the carbon footprint of glass production but also enhances the market appeal of glass-grade silica sand. In conclusion, the increasing demand for glass in key industries, coupled with the abundant reserves of high-quality silica sand in North America, positions the region as a significant player in the global glass-grade silica sand market. Ongoing initiatives and collaborations underscore the importance of sustainable practices and local sourcing, further contributing to the market's rise in the region.

Key Takeaways

- US dominated the market and contributed the highest market share

- By Fe content category, the 100ppm to 1000ppm segment accounted for the largest and fastest growing market share in North America glass grade silica sand market

- By application category, the flat glass segment is anticipated to grow with a lucrative CAGR over the North America glass grade silica sand market forecast period

What are the market drivers driving the demand for market?

Expansion of Construction Industry

The growth of the construction sector in North America has a significant impact on the market for glass grade silica sand. As urbanization progresses and infrastructure projects increase, the demand for glass products in construction also rises. Glass, especially flat glass used in windows, doors, and facades, is crucial in modern architectural designs as it provides aesthetic appeal, natural light, and energy efficiency. Furthermore, the expansion of the construction industry extends to infrastructure projects like roads, bridges, and tunnels, all of which incorporate glass elements for safety, aesthetics, and functionality, further driving the demand for glass grade silica sand.

Silica sand with specific purity levels is vital for producing low-iron glass, which offers exceptional clarity and allows maximum natural light penetration while reducing heat transfer. With the increasing adoption of green building techniques, the construction industry is increasingly turning to these specialty glasses, highlighting the importance of high-quality silica sand in achieving sustainability goals.

Which factor is restraining the demand for market?

Fluctuating Raw Material Prices

Fluctuations in the prices of raw materials present a significant restraining factor in the North American market for glass-grade silica sand, affecting both producers and consumers. Various factors, such as supply and demand dynamics, production costs, energy prices, and currency fluctuations, influence the prices of silica sand. The instability in these factors can result in sudden price changes, making it challenging for market participants to accurately predict costs and plan production budgets. Additionally, the interconnected nature of global markets means that events like alterations in international trade policies or disruptions in supply chains can quickly impact silica sand prices in North America, further adding to market uncertainty.

The volatility in raw material prices can also impact the competitiveness of glass manufacturers, especially smaller players with limited resources to absorb cost fluctuations. When raw material prices increase, manufacturers may be compelled to transfer the additional costs to customers, potentially risking a loss of market share in price-sensitive segments.

Report Segmentation

The market is primarily segmented based on Fe content, applications, end-user, and country.

|

By Fe Content |

By Applications |

By End-User |

By Country |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Fe Content Insights

Based on Fe content analysis, the market is segmented into <100ppm, 100ppm to 1000ppm. The 100ppm to 1000ppm segment dominated and is expected to grow at the fastest CAGR over the forecast period owing to several factors. Firstly, silica sand within this purity range meets the stringent quality standards required for manufacturing high-quality glass products. Glass manufacturers prioritize the use of silica sand with low impurity levels to ensure the clarity, strength, and durability of their glass products. Consequently, there is a high demand for silica sand falling within the 100ppm to 1000ppm purity range, which drives the dominance of this segment.

By Applications Insights

Based on application analysis, the market has been segmented into glass containers, flat glass, fiberglass, specialty glass, others. The glass containers segment dominated the market owing to its widespread use of glass packaging across various industries. Glass containers offer numerous advantages such as inertness, impermeability, and recyclability, making them a preferred choice for packaging food and beverages, pharmaceuticals and others. The increasing focus on sustainability and eco-friendliness has boosted the demand for glass packaging as consumers seek alternatives to single-use plastics. Consequently, this heightened demand for glass containers drives the need for high-quality silica sand, which serves as a key raw material in glass production.

The flat glass segment is witnessing rapid expansion owing to the growth of the construction industry, fueled by urbanization and infrastructure development projects, automotive sector's increasing embrace of advanced glazing technologies and the increasing preference for energy-efficient buildings and vehicles is further increasing the demand for specialty flat glass products, necessitating high-quality silica sand with precise purity levels.

Country-wise Insights

U.S.

The US leads the glass grade silica sand market driven by its extensive utilization in the construction industry. This specialized type of silica sand possesses distinct physical properties that set it apart from conventional construction sands. The demand for glass-grade silica sand in the construction sector is influenced by its unique combination of chemical and physical characteristics, making it highly sought after for various applications. Glass-grade silica sand is characterized by its elevated silica content. This high concentration of silica is crucial for the production of quality glass, as silica is a primary component in glass manufacturing processes. The construction industry in the United States relies on glass-grade silica sand for various applications,

Competitive Landscape

The competitive landscape of the North American glass grade silica sand market is shaped by key players which utilize strategies such as mergers and acquisitions, product innovations, and capacity expansions to uphold their market positions and meet the increasing demand for high-quality silica sand. Collaborations with glass manufacturers and a focus on sustainability initiatives serve to boost competitiveness in the market. Companies focus on offering specialized silica sand products customized to meet specific customer needs.

Some of the major players operating in the European market include:

- AGI Glaspac

- Athabasca Minerals Inc.

- Canadian Silica Industries Inc.

- Covia Holdings LLC

- Dlubak Specialty Glass Corporation

- HRD Group of Companies

- MS Industries II

- Sibelco

- SiO Silica, Inc.

- U.S. Silica

Recent Developments

- In September 2020, AMI Silica Inc., a subsidiary of Athabasca Minerals Inc., signed a Term Sheet to undertake the Duvernay Silica Sand Project as a joint venture initiative. The primary objective of this initiative is to collaborate and operate one of the eco-friendliest silica sand facilities in North America.

- In January 2019, U.S. Silica acquired a ceramic proppant facility located in Millen, Georgia. The facility is transformed to manufacture high-end products for the Company's Industrial and Specialties Products (ISP) business.

Report Coverage

The North America glass grade silica sand market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, Fe content, applications, end-user, and their futuristic growth opportunities.

North America Glass Grade Silica Sand Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,346.76 million |

|

Revenue forecast in 2032 |

USD 3,197.32 million |

|

CAGR |

3.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Fe Content, By Applications, By End-User, By Country |

|

Regional scope |

U.S., Canada |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

North America Glass Grade Silica Sand Market Size Worth USD 3,197.32 Million By 2032

The top market players in the market are Covia Holdings LLC, Dlubak Specialty Glass Corporation

North America Glass Grade Silica Sand market exhibiting the CAGR of 3.9% during the forecast period.

The key segments in the North America Glass Grade Silica Sand Market Increasing Use in Solar Panel Production