North America Hearing AID Market Share, Size, Trends, Industry Analysis Report

By Product (Hearing AID Devices and Hearing Implant); By Type (Conductive Hearing Loss and Sensorineural Hearing Loss); By Patient; By technology; Segment Forecast, 2024 – 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM4535

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

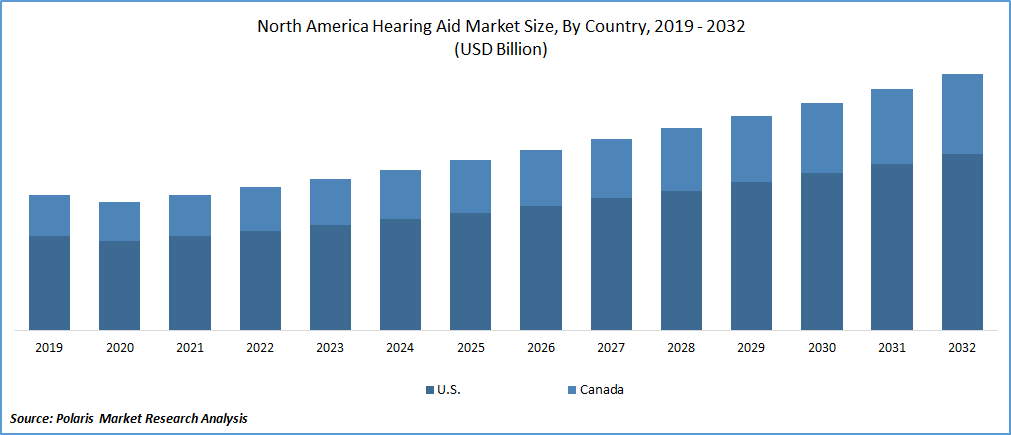

The North America Hearing AID market was valued at USD 8.58 billion in 2023 and is expected to grow at a CAGR of 6.0% during the forecast period.

A hearing aid is an electronic device used for patients with mild to moderate hearing loss. It contains a microphone, amplifier, and speaker. It runs on traditional batteries and is also a rechargeable battery. Hearing aids are adjustable devices; if one cannot hear the sound at a specific Hz, the device is adjusted at a specific volume. The life of any hearing aid device is 6 to 7 years.

These devices are primarily used in the geriatric population and are commonly associated with ear infections resulting from the use of earbuds, headphones, and similar accessories. The unnecessary or excessive utilization of ear cleaning equipment and drops can cause harm to the inner ear, due to increased inflammation. These factors collectively contribute to the rising Prevalence of hearing impairment, driving the growing adoption of such devices.

To Understand More About this Research:Request a Free Sample Report

Furthermore, a government study reveals that millions of Americans are experiencing some degree of hearing loss. This significant Prevalence of hearing impairment has contributed to a notable increase in the use of hearing aid devices in North America. As the study underscores the widespread impact of hearing loss on a substantial portion of the population, individuals seeking solutions for improved hearing have turned to hearing aid devices as a viable and effective means of addressing their auditory challenges. The growing awareness of hearing issues and the availability of advanced hearing aid technologies further propel the adoption of these devices and the North American hearing aid market.

- For instance, according to the Hearing Loss Association of America (HLAA), Approximately 48 million Americans have some degree of hearing loss. Only 1 in 5 people would benefit from a hearing aid.

However, manufacturers of hearing aids are enhancing patient experiences with cutting-edge features and technology, which is anticipated to drive market expansion in the upcoming years. According to the National Institute on Deafness and Other Communicable Disorders estimates that 15% of patients in the United States who are 18 years of age or older have hearing loss, which indicates the rising need for hearing aid devices and contributes to the demand for the North America Hearing AID market

Early deafness detection and the provision of hearing aids to individuals are priorities for local government hearing service offices and general healthcare service organizations in both developed and developing economies. The rapid expansion of healthcare infrastructure in these countries is a result of the trend toward privatization of the healthcare sector in developing economies. Public health awareness campaigns and education campaigns are driving up demand for these devices and related diagnostic services. The COVID-19 pandemic has had a major effect on the healthcare industry.

Numerous elective treatments were delayed or halted to optimize resource allocation more efficiently. The Hearing Industries Association (HIA) reports an anticipated 20% decline in hearing aid sales in the United States for 2020, largely attributed to a decrease in audiology consultations. Consequently, major manufacturers experienced a significant drop in product sales. However, with the gradual normalization of the COVID-19 scenario, other medical sectors and the hearing aid industry are witnessing growth, contributing to the recovery of revenue in the North American hearing aid industry.

Industry Dynamics

Growth Drivers

- Increasing Prevalence of the senior population

The increasing Prevalence of hearing loss in patients is boosting the market share of the North American hearing aid market. According to the Centers for Disease Control and Prevention, about 40 million Americans are facing auditory loss problems, and it is continuously about to grow over the forecast period. This shows every one person among 20 people in America is facing hearing loss.

Moreover, the growing adult population is supposed to experience hearing loss; hence, increasing demand for innovative hearing devices shows an increase in the market share. The Labor Force Survey estimates that each year in Great Britain, around 11,000 prevalent cases of hearing impairments brought on or worsened by work occur.

A considerable number of individuals exposed to high decibel levels from sources like music, devices, work-related tasks, or recreational activities may only be aware of the damage once they undergo hearing loss. With the aging population in the United States and Canada, there is a growing prevalence of individuals becoming deaf or experiencing hearing impairment. This trend, coupled with an increasing rate of hearing loss in the younger population, is driving the demand for hearing aids in the market.

Segmentation

The market is primarily segmented based on product, type, patient, technology, and region.

|

By Product |

By Type |

By Patient |

By Technology |

By Country |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

- The hearing aid devices held the largest revenue share in 2023

In 2023, hearing aid devices held the largest revenue share. These products can easily be altered to Bluetooth if connectivity is provided. Depending upon ear type of device it, the hearing Aid device drive the market share in the upcoming years. These products are compatible with Bluetooth, and so the demand for this product is expected to grow tremendously. A hearing aid device is an ear-shaped small device that can be perfectly fitted onto the ear and can be used conveniently. A hearing aid devices does not require any surgery, so it's a cost-effective treatment, so preferentially it is always the first option for the hearing-disabled person.

By Patient Analysis

- Adult patients are projected to grow at the highest CAGR during the forecast period.

Adult patients are projected to grow at the highest CAGR during the forecast period, The aging demographic is a significant driver for the increased prevalence of hearing loss. As the population in North America continues to age, the likelihood of adults experiencing age-related hearing impairment rises, due to an elevated demand for hearing aids. Age-related hearing loss, also known as presbycusis, is a common condition affecting older adults. The gradual deterioration of hearing acuity with age necessitates the use of hearing aids to address hearing difficulties. This age-related factor contributes to the higher projected growth in the adult patient segment.

Country Analysis

In 2023, the United States accounted for the largest share of the North American hearing aid market. The prevalence of hearing loss within the U.S. population is experiencing substantial growth annually. The increasing demand for cost-effective devices to address auditory loss among patients is identified as a primary catalyst propelling the growth of the hearing aid market in the United States.

The World Health Organization (WHO) underscores auditory loss as a prevalent concern, particularly in developed countries. Within the U.S., approximately 14-15% of the total population, equivalent to 48 million citizens, grapple with some degree of hearing impairment. Additionally, the market is witnessing growth due to an enhanced reimbursement scenario for hearing implants in the U.S., driven by government initiatives and efforts by industry players.

Significant regulatory changes have been implemented in the U.S. to facilitate access to auditory loss assistance products for patients dealing with this condition. Notably, in July 2021, the New Jersey Human Services announced an augmented state budget, leading to an increased reimbursement rate for the Hearing Aid Assistance to the Aged and Disabled (HAAD) program. This initiative aims to improve patients' accessibility to hearing aid assistance devices.

These factors, coupled with the continuous endeavors of market players to introduce technologically advanced products in the country, are anticipated to fuel the demand for and adoption of hearing aid devices among the U.S. population.

Key Market Players & Competitive Insights

The North American hearing aid market is characterized by intense competition among key players striving for market share and innovation. The competitive landscape is influenced by technological advancements, product differentiation, strategic collaborations, and a focus on meeting the evolving needs of the diverse consumer base. Companies are investing heavily in research and development to introduce advanced features such as noise cancellation, Bluetooth connectivity, and artificial intelligence in hearing aid devices. Technological advancements are crucial for gaining a competitive edge and meeting the diverse demands of consumers.

Some of the major players operating in the market include:

- Adicus

- Audina hearing Instrument Inc

- Eargo. Inc,

- Earlens Corporation

- Jabra

- Lively hearing corporation

- MD hearing

- Sebotek hearing system, LLC

- Starkey laboratories

- WS Audiology

Recent Developments

- In October 2020, Starkey partnered with OrCam Technologies to provide technology for hearing and visually impaired people. These provide advanced computer vision and machine learning methods. In collaboration with Starkey Livio Edge, they developed the visual world through audio.

- In October 2022, Lexie Hearing introduced the Lexie B2 hearing aids as part of its collaboration with Bose, aiming to meet the robust demand for the product in the country.

Hearing AID Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.08 billion |

|

Revenue forecast in 2032 |

USD 14.48 billion |

|

CAGR |

6.0% from 2023 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Type, By Patient, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

North America Hearing AID Market report covering key segments are product, type, patient, technology, and region.

North America Hearing AID Market Size Worth $ 14.48 Billion By 2032.

The North America Hearing AID market is expected to grow at a CAGR of 6.0% during the forecast period.

The key driving factors in North America Hearing AID Market are Increasing Prevalence of geriatric population.