Hearing Aid Market Size, Share, & Industry Analysis Report

: By Product, By Type, By Patient Type (Adult and Pediatrics), By Technology, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 150

- Format: PDF

- Report ID: PM1210

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

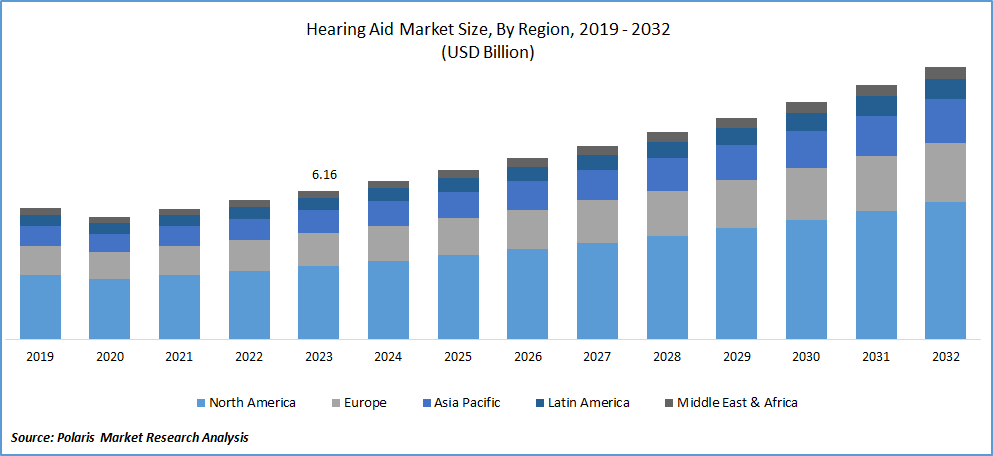

The global hearing aid market size was valued at USD 8.19 billion in 2024. It is expected to grow from USD 8.72 billion in 2025 to USD 15.50 billion by 2034, at a CAGR of 6.60% during 2025–2034. The market expansion is fueled by an aging global population and increasing prevalence of hearing disorders.

Hearing aids are small electronic devices designed to amplify sound for individuals experiencing hearing loss, thereby improving their ability to communicate and engage in daily activities. A February 2025 WHO report projects that nearly 2.5 billion people worldwide will experience some degree of hearing loss by 2050, with over 700 million requiring hearing rehabilitation services. Factors such as an aging population, heightened exposure to noise pollution, and rising prevalence of chronic conditions such as diabetes and cardiovascular diseases contribute to the growing number of auditory impairment cases. The demand for advanced and accessible solutions is rising as awareness around hearing health continues to improve, encouraging manufacturers to innovate with user-friendly and discreet designs.

To Understand More About this Research: Request a Free Sample Report

The hearing aid market is witnessing the expansion of telehealth and remote fitting services. Audiologists can conduct hearing assessments, device calibrations, and follow-up consultations remotely, offering greater convenience to users with advancements in digital technology, particularly in underserved or rural areas. In May 2024, hearX launched hearOAE, an FDA-cleared smartphone-compatible OAE testing device featuring TEOAE/DPOAE capabilities. The Bluetooth-enabled tool offers customizable hearing screening with integrated data management. This shift enhances accessibility and also reduces the logistical challenges associated with frequent clinic visits. It is reshaping consumer expectations and pushing companies to develop these devices compatible with remote programming and real-time support as telehealth becomes an integral part of hearing care delivery.

Market Dynamics

Growing Geriatric Population

The growing geriatric population is boosting the market development as age-related hearing loss, known as presbycusis, becomes increasingly common among older adults. An October 2024 WHO report projected that the global population aged 60+ will rise from 1 billion in 2020 to 1.4 billion by 2030 and double to 2.1 billion by 2050. Those aged 80+ will triple to 426 million in the same period. The demand for effective hearing solutions is rising steadily. Hearing loss in elderly individuals often leads to social isolation, cognitive decline, and reduced quality of life, prompting a greater need for these devices to maintain communication and independence, with a higher proportion of the global population entering the senior age group. The healthcare focus on addressing age-associated conditions, such as hearing impairment, is intensifying as life expectancy continues to improve, thereby supporting the sustained market growth.

Advancement in Hearing Technologies

Advancements in hearing technologies are accelerating hearing aid market expansion by transforming the functionality and appeal of modern devices. Innovations such as digital signal processing, Bluetooth connectivity, artificial intelligence integration, and rechargeable battery have significantly enhanced user experience and device performance. In January 2021, Oticon launched Oticon More, the first hearing aid with an onboard deep neural network (DNN) trained on 12 million real-world sounds. The technology mimics brain processing to improve speech clarity and reduce listening effort in noisy environments. These technological improvements offer better sound quality, greater customization, and seamless integration with other smart devices, addressing many of the traditional limitations associated with hearing aids. Consumer acceptance is rising as hearing devices become more sophisticated, discreet, and user-centric, further fueling the adoption rate across diverse age groups.

Segment Insights

Market Assessment by Product

The global market segmentation, based on product, includes hearing aid devices and hearing implants. The hearing aid devices segment dominated the market share in 2024 due to its widespread accessibility, ease of use, and a broad range of available designs tailored to varying degrees of hearing loss disease treatment. Traditionaldevices, such as behind-the-ear and in-the-ear models, offer noninvasive solutions that are often more affordable and readily available compared to hearing implants. Additionally, advancements in miniaturization, wireless connectivity, and sound processing technologies have particularly enhanced device performance and user comfort, reinforcing the strong preference for these devices among a diverse patient population.

Market Evaluation by Platform Features

The global hearing aid market segmentation, based on platform features, includes adult and pediatric. The pediatric segment is expected to witness the fastest growth during the forecast period, driven by increasing early diagnosis rates of congenital and early-onset hearing loss. Growing awareness among parents and healthcare providers regarding the critical importance of early auditory intervention for language and cognitive development is leading to higher adoption rates of pediatric hearing aids. Moreover, technological advancements specifically catering to children, such as tamper-proof designs, wireless streaming, and durable materials, are encouraging the use of these devices among younger populations, contributing to rapid expansion in this segment.

Regional Insights

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024, supported by the presence of well-established healthcare infrastructure, high healthcare expenditure, and strong adoption of advanced medical devices. A 2021 ASTP report found that 78% of US office-based physicians and 96% of non-federal acute care hospitals had adopted certified electronic health record (EHR) systems, showing widespread healthcare digitization. A greater emphasis on early hearing loss screening programs, coupled with favorable reimbursement policies and widespread awareness initiatives, has greatly boosted the demand for hearing aids across the region. Additionally, the presence of major market players and continuous product innovations tailored to consumer needs have strengthened North America's leadership position in the global market.

The Asia Pacific hearing aid market is projected to witness the fastest growth during the forecast period fueled by a rapidly aging population, rising disposable incomes, and improving healthcare accessibility across emerging economies. Increasing awareness about hearing health, coupled with government initiatives to enhance audio logical care and early intervention programs, is creating a strong growth environment. According to a 2025 report by the NHE, the National Hearing Week campaign, led by the MATANAND Welfare Foundation and supported by ENTOD Pharmaceuticals, raised awareness about pediatric hearing loss and early intervention in India, reaching 30 million people, such as parents, educators, and healthcare providers. Furthermore, expanding urbanization and greater acceptance of technologically advanced hearing solutions are contributing to the rising demand for hearing devices across key countries such as China, India, and Japan.

Key Players and Competitive Analysis

The hearing aid industry is witnessing a transformation driven by technological innovation and shifting demographics. Major players such as Sonova, Demant, WS Audiology, and GN Store Nord collectively control the global industry, creating considerable barriers for new entrants. Consumer expectations are evolving toward discreet, AI-enhanced devices with connectivity capabilities, which has accelerated product development cycles and intensified competition based on innovation rather than price. Over-the-counter options following FDA regulatory changes have introduced new competitive dynamics, with companies such as Bose and Jabra entering this space. The competitive landscape shows differentiation through distribution strategies, with traditional manufacturers relying on audiologist networks while newer entrants leverage direct-to-consumer approaches. This bifurcation creates distinct competitive advantages depending on target demographics. Financial performance indicates high margins but increasing pressure from lower-cost alternatives. The competitive future will hinge on balancing innovative features with accessibility as the global population ages and hearing loss prevalence increases. A few key major players are Adicus; Audina Hearing Instruments, Inc.; Eargo, Inc.; GN Store Nord A/S; Horentek Hearing Diagnostics; Jabra; MD Hearing; Sebotek Hearing Systems, LLC; Sonova; Starkey Laboratories; and WS Audiology.

Sonova specializes in innovative hearing care solutions, with a strong focus on hearing aids as a core part of its business. Founded in 1947 and headquartered in Stäfa, Switzerland, Sonova operates through four main business segments: Hearing Instruments, Audiological Care, Consumer Hearing, and Cochlear Implants. Its renowned brands-Phonak, Unitron, AudioNova, Sennheiser (under license), and Advanced Bionics-deliver advanced hearing aids and accessories to consumers in over 100 countries. Sonova’s hearing aids are recognized for their advanced technology, including features such as Bluetooth connectivity, rechargeable batteries, and real-time artificial intelligence for speech enhancement, particularly in noisy environments. The company’s latest platforms, such as Phonak Audéo Sphere Infinio, leverage proprietary AI and chip technology to greatly improve speech understanding, addressing one of the most pressing needs for people with hearing loss. Sonova’s commitment to research, innovation, and comprehensive audiological care has positioned it at the forefront of the hearing aid industry, enabling millions to enjoy improved hearing, better communication, and enhanced quality of life.

Sebotek Hearing Systems, LLC, headquartered in Tulsa, Oklahoma, is a privately held company renowned for revolutionizing the hearing aid industry with its patented receiver-in-the-canal (RIC) technology. SeboTek introduced the first-ever modular RIC hearing device to the global market in 2003, addressing long-standing challenges of traditional hearing aids, such as discomfort, occlusion effects, and the need for frequent remakes of plastic ear molds. SeboTek’s innovative approach separates the sound processor and the speaker, placing the receiver deep inside the ear canal, which allows for a discreet, comfortable fit and improved sound quality. The company’s flagship products, such as the High Definition 2 (HD2) series and the Voice-Q PAC system, offer advanced digital signal processing, wideband frequency response up to 14,000 Hz, and sophisticated noise reduction algorithms that prioritize speech clarity in noisy environments. SeboTek’s modular design enables instant fittings for a wide range of hearing losses, from mild to severe, and reduces barriers for first-time users by providing a more natural listening experience and greater cosmetic appeal.

List of Key Companies in Hearing Aid Industry

- Adicus

- Audina Hearing Instruments, Inc.

- Eargo, Inc.

- GN Store Nord A/S

- Horentek Hearing Diagnostics

- Jabra

- MD Hearing

- Sebotek Hearing Systems, LLC

- Sonova

- Starkey Laboratories

- WS Audiology

Industry Developments

March 2025: Cochlear and GN expanded their R&D partnership under the Smart Hearing Alliance to develop integrated hearing solutions combining cochlear implants and hearing aids. The collaboration focuses on AI-driven connectivity improvements and seamless device integration for enhanced user experiences.

March 2025: NewSound launched its first AI-powered OTC hearing aid featuring Femtosense's Clara AI technology. The deep neural network enhances speech clarity by 7-13 dB in noisy environments while consuming minimal power through advanced compression techniques.

August 2024: Sonova launched Phonak's Audéo Infinio and Audéo Sphere Infinio hearing aids featuring dual-chip technology with real-time AI sound processing. The platform enhances speech clarity, connectivity, and power efficiency.

Hearing Aid Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Hearing Aid Devices

- Receiver in the Ear

- Behind the Ear

- Canal Hearing

- Other Hearing Devices

- Hearing Implants

- Cochlear Implant

- Bone Anchor

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Conductive Hearing Loss

- Sensorineural Hearing Loss

By Patient Type Outlook (Revenue, USD Billion, 2020–2034)

- Adult

- Pediatrics

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Digital Hearing Devices

- Analogue Hearing Device

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hearing Aid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.19 billion |

|

Market Size Value in 2025 |

USD 8.72 billion |

|

Revenue Forecast in 2034 |

USD 15.50 billion |

|

CAGR |

6.60% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.19 billion in 2024 and is projected to grow to USD 15.50 billion by 2034.

The global market is projected to register a CAGR of 6.60% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Adicus; Audina Hearing Instruments, Inc.; Eargo, Inc.; GN Store Nord A/S; Horentek Hearing Diagnostics; Jabra; MD Hearing; Sebotek Hearing Systems, LLC; Sonova; Starkey Laboratories; and WS Audiology.

The hearing aid devices segment dominated the market share in 2024.

The pediatric segment is expected to witness the fastest growth during the forecast period.