North America Microencapsulation Market Share, Size, Trends, Industry Analysis Report

By Technology (Coating, Emulsion, Spray Technologies, Dripping, and Others); By Application; By Country; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4801

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

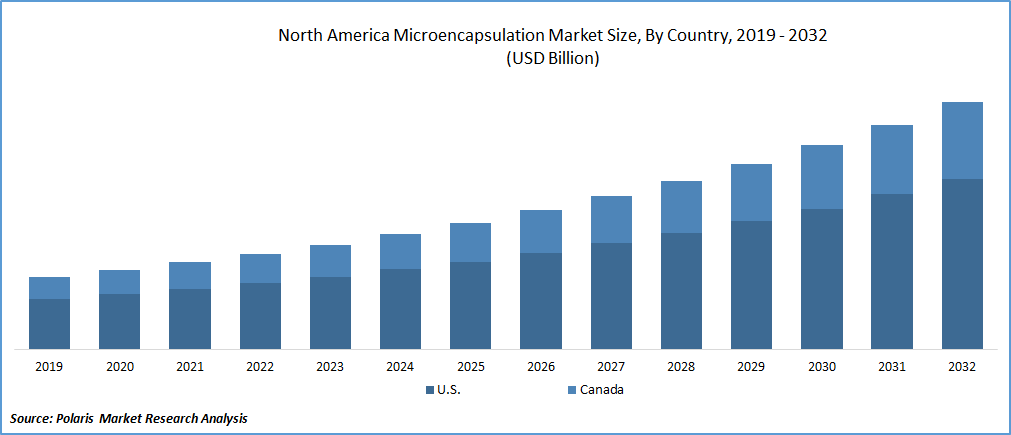

North America microencapsulation market size was valued at USD 5.17 billion in 2023. The market is anticipated to grow from USD 5.68 billion in 2024 to USD 12.23 billion by 2032, exhibiting the CAGR of 10.1% during the forecast period.

Market Overview

There is increasing consumer demand for functional and fortified food products, dietary supplements, and personal care products in North America. Microencapsulation allows for the controlled release of active ingredients, enhancing the effectiveness and appeal of these products to consumers. The pharmaceutical industry in North America extensively utilizes microencapsulation for drug delivery systems, targeted drug release, taste masking, and improving the stability of drugs. The rising prevalence of chronic diseases, coupled with advancements in drug delivery technologies, fuels the demand for microencapsulation in the pharmaceutical sector.

To Understand More About this Research:Request a Free Sample Report

The substantial increase in the demand for fragrances, flavors, enzymes, minerals, and essential oils in food & beverage products, the surging need for controlled release of active ingredients, and increasing applications of microencapsulation in the agriculture sector to deliver fertilizers and pesticides are among the key factors propelling the market growth as microencapsulation is widely used to encapsulate flavors and fragrances while improving their stability and release properties, thereby the surge in demand for functional food products resulting in greater need for microencapsulation. Companies obtaining FDA approval for drugs formulated using patented microcapsules indicate a growing demand for microencapsulation.

Furthermore, there have been significant advancements in the field of microencapsulation technology that have revolutionized the way medications are administered and absorbed by the body. Over the years, microencapsulation technology has evolved to address several challenges in drug delivery, including the protection of unstable compounds, targeted delivery to specific areas within the body, and controlled release. In addition, the continuous exploration of new novel applications and techniques like ionic gelation and the use of biological carriers has been paving the way for safer and more effective drug delivery systems.

Growth Factors

-

Growing demand for fortified food & pharmaceutical products to drive market growth

The need for microencapsulation is drastically increasing with the growing demand for fortified food & pharmaceutical products with numerous health benefits, as microencapsulation enhances the taste, texture, and nutritional value of food products and improves the stability & efficacy of active ingredients in pharmaceuticals. With the rise in the number of fortified or functional food product launches by major players and the introduction of new pharmaceuticals, the demand for microencapsulation is growing rapidly.

Also, the pharmaceutical industry extensively utilizes microencapsulation for drug delivery systems, targeted drug release, taste masking, and improving drug stability. With the rising prevalence of chronic diseases and the need for innovative drug delivery technologies, the demand for microencapsulation in the pharmaceutical sector is increasing.

- Advancements in microencapsulation technology to boost market growth

The continuous advancements in microencapsulation technology, like coacervation and nanoencapsulation, that are leading to the development of its new applications and improvements in existing ones, are further boosting the market growth. Nanoencapsulation has emerged as a pioneering technique that can significantly improve the durability and bioavailability of natural bioactive and also promises a paradigm in drug delivery systems and nanocarrier formulations.

Industry Challenges

- The complexity of microencapsulation process and the availability of alternatives hinder growth

The high complexity associated with microencapsulation processes that lead to increased production costs for microencapsulation products and the easy availability of alternative technologies to microencapsulation, like nano-emulsions and solid lipid nanoparticles, are key factors restraining market growth.

Report Segmentation

The market is primarily segmented based on technology, application, and region.

|

By Technology |

By Application |

By Country |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Technology Insights

- Spray technologies segment accounted for the largest market share in 2023

In 2023, the spray technologies segment accounted for the largest share. This dominance is attributed to high production capacity, better recovery efficiency, process simplicity, safety, and cost-effectiveness. Additionally, spray technologies enable the encapsulation of active ingredients in a highly controlled manner and allow targeting of specific sites or areas in the human body that can improve drug efficacy and compliance for patients.

The coating segment is expected to grow at the highest pace. Segment’s growth is attributable to the ability of coating technology to encapsulate big particles and improve the handling or processing of characteristics of active ingredients. In addition, there are several advantages of incorporating microencapsulated probiotics with suitable coating materials in the food matrices, which led to the creation of new applications for microencapsulated powder in several food products as effective carriers.

By Application Insights

- The food & beverage segment is expected to witness the highest CAGR growth during the forecast period.

The food & beverage segment is expected to witness the highest CAGR growth during the forecast period. This growth is due to the growing consumption of functional food products as a result of increasing consumer awareness towards preventing illnesses and maintaining good health that can be achieved with the help of functional food as they offer health benefits beyond basic nutrition. Moreover, microencapsulation is also being used to encapsulate flavors and aromas and protect them from degradation, which is driving the product demand from the food & beverage segment.

The pharmaceutical & healthcare products segment led the market. Segment’s dominance is fueled by the widespread use of microencapsulation in the pharmaceutical sector to enable the controlled release of drugs, enhancing drug stability and targeted drug delivery. The need for microencapsulation in the pharma sector is also driven by its use in the reduction of particle size for improving the solubility of less soluble drugs, cell encapsulation, and environmental protection for pharmaceuticals.

Regional Insights

- U.S. dominated the largest market share in 2023

In 2023, the U.S. dominated the largest market share. Region’s dominance is attributed to the presence of some of the leading pharmaceutical companies and growing research & development activities focused on drug delivery systems. With the growing consumer interest in health & wellness, the demand for functional food & beverage is rising, propelling the need for microencapsulation as it enables the incorporation of bioactive ingredients in such products.

Canada is expected to emerge as a significant growing market, owing to an increased usage of microencapsulation in the agriculture sector for the controlled release of fertilizers and the availability of a favorable regulatory environment that promotes innovations and development in microencapsulation technologies. Furthermore, the rising demand for personal care products in Canada as a result of growing consumer disposable income or spending capacity further propelling the demand for microencapsulation in the country.

Key Market Players & Competitive Insights

The North America microencapsulation market is fragmented in nature with the presence of several large market players. Key players in the region is heavily investing in research & development activities of controlled drug delivery systems, cell encapsulation, and protecting drugs from environment. Also, companies are adopting several business expansions strategies including strategic partnerships, collaborations, mergers, and new product launches to gain a competitive edge in the market.

Some of the major players operating in the market include:

- AnaBio Technologies

- Ashland Global Holdings Inc

- Aveka Group

- Balchem Corporation

- BASF SE

- BUCHI

- Encapsys LLC

- Lipo Technologies

- Microtek Laboratories Inc.

- Reed Pacific

Recent Developments in the Industry

- In April 2022, Sol-Gel Technologies and Galderma disclosed the FDA's approval of EPSOLAY, a unique cream formulation containing 5% benzoyl peroxide, for treating inflammatory lesions associated with rosacea in adults. The benzoyl peroxide in EPSOLAY is encapsulated within patented microcapsules made of silica-based materials.

Report Coverage

The North America microencapsulation market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, application, and their futuristic growth opportunities.

North America Microencapsulation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.68 billion |

|

Revenue forecast in 2032 |

USD 12.23 billion |

|

CAGR |

10.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

North America Microencapsulation Market report covering key segments are technology, application, and region.

North America Microencapsulation Market Size Worth $ 12.23 Billion By 2032

North America microencapsulation market exhibiting the CAGR of 10.1% during the forecast period.

The key driving factors in North America Microencapsulation Market are growing demand for fortified food & pharmaceutical products to drive market growth