North America MRO Distribution Market Share, Size, Trends, Industry Analysis Report

By Product; By End-Use; By Country; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4461

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

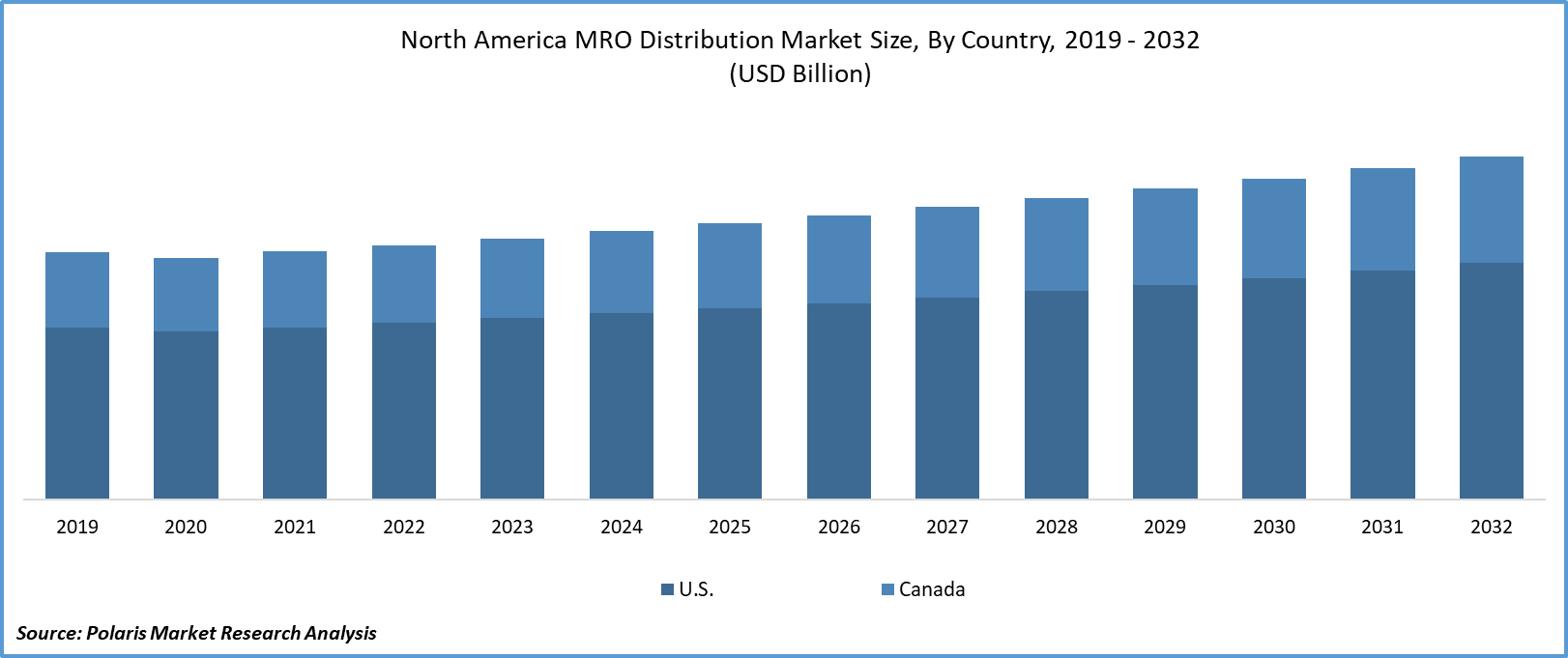

North America MRO Distribution Market size was valued at USD 152.50 billion in 2023. The market is anticipated to grow from USD 156.71 billion in 2024 to USD 200.37 billion by 2032, exhibiting a CAGR of 3.1% during the forecast period

Industry Trends

North America Maintenance Repair & Operations (MRO) Market is a significant sector that supplies various industries with essential goods and services required to maintain their daily operations. The market is witnessing several trends that are transforming the way businesses operate. One of the most notable market trends is the shift towards digitalization and e-commerce adoption. With the rise of e-commerce platforms, customers expect convenient online shopping experiences, fast delivery times, and easy returns. As a result, MRO distributors are investing heavily in digital transformation initiatives, such as creating omnichannel experiences, implementing artificial intelligence-powered chatbots, and optimizing their supply chain management systems.

In parallel, another trend that is gaining traction in the market is a consolidation and mergers & acquisitions. The market is experiencing increased consolidation, with larger players acquiring smaller ones to expand their product offerings, increase their customer base, and strengthen their geographic presence.

- For instance, in March 2022, Stellar Industrial Supply, a leading distributor of over 90,000 maintenance, repair, and operation (MRO) products and tools, acquired Timesaver Industrial - an industrial distribution firm based in Arizona.

Also, predictive maintenance and IoT integration are becoming increasingly important in the MRO distribution services market. The use of predictive analytics and IoT technology enables companies to anticipate potential equipment failures and schedule proactive maintenance, reducing downtime and increasing operational efficiency. MRO distributors are partnering with technology providers to offer integrated solutions that combine hardware, software, and services, providing customers with real-time data and insights to optimize their maintenance strategies.

To Understand More About this Research: Request a Free Sample Report

However, the market also faces some challenges, such as intense competition, price volatility, and fluctuating raw material costs. To overcome these hurdles, MRO distributors are focusing on diversifying their product offerings, improving their supply chain efficiencies, and building strong relationships with suppliers and customers. They are also investing in employee training and development programs to ensure they have the necessary skills to provide value-added services and support to their clients.

Key Takeaways

- The U.S. dominated the market and contributed over 64% of the share in 2023

- By product category, the automation segment accounted for the largest market share in 2023

- By end-use category, the food, beverage & tobacco segment is experiencing substantial growth over the forecast period

What are the market drivers driving the demand for the North American MRO distribution market?

The growth of the service industry in the region is driving the market growth.

Since businesses across various industries increasingly outsource their maintenance and repair operations to third-party providers, there has been a surge in demand for reliable and efficient MRO services. This trend is particularly prominent in sectors such as manufacturing, transportation, and construction, where equipment downtime results in substantial losses and disrupts supply chains. Thus, MRO distributors are expanding their offerings to include a broader range of products and value-added services, such as inventory management, technical support, and predictive analytics. By providing these solutions, MRO distributors help customers streamline their operations, reduce costs, and improve productivity. Consequently, the growing demand for MRO distribution services from various industries, linked with the adoption of technology-driven solutions, is propelling the North America MRO distribution market size.

Which factor is restraining the demand for North American MRO distribution?

Logistics and inventory management challenges are affecting the North American MRO distribution market growth.

The market is facing challenges in terms of logistics and inventory management, which are hindering its growth. The industry relies heavily on efficient supply chains to ensure timely delivery of critical parts and materials to maintain equipment and machinery in various industries.

Nevertheless, factors such as transportation costs, longer lead times, and lack of visibility into the supply chain are creating hurdles for distributors. Inventory management is another area of concern, as distributors struggle to maintain optimal stock levels while dealing with slow-moving items, frequent product changes, and high demand variability. These issues result in increased costs, longer delivery times, and dissatisfaction with customers, ultimately impacting the growth of the market.

Report Segmentation

The market is primarily segmented based on product, end-use, and country.

|

By Product |

By End-Use |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented on the basis of abrasives, automation, chemicals, cutting tools, hand tools, fasteners, valves & fitting, pipes, power transmission-electronics, power tools, power transmission-pneumatics, power transmission-hydraulics, rubber products, seal, welding equipment & gases, and others. The automation segment held the largest market share in 2023 due to the increasing adoption of digital technologies and automation solutions in various industries, including manufacturing, oil and gas, and transportation, among others. This has led to a growing demand for automation-related MRO products and services, such as industrial control systems, sensors, and actuators. In addition, the need for efficient inventory management and supply chain optimization has also driven the growth of the automation segment as companies seek to streamline their operations and reduce costs.

By End-Use Insights

Based on end-use analysis, the market has been segmented on the basis of chemicals, construction, electrical & electronics, food, beverage & tobacco, metal processing & foundry, mining, oil & gas, pharmaceuticals, rubber, plastic & non-metallic, textile, transportation, wood & paper, and other. The food, beverage & tobacco segment is expected to experience substantial growth in the market during the forecast period due to the increasing demand for processed and packaged foods, as well as the growing popularity of online grocery shopping, which is driving the need for more advanced and efficient supply chain management systems. This includes the use of automated MRO products such as conveyor belts, sorting systems, and automated storage and retrieval systems (AS/RS) to optimize warehouse operations and ensure timely delivery to customers. In addition, the rise of e-commerce has led to an increase in the number of fulfillment centers and distribution facilities, further boosting the demand for MRO products and services.

The tobacco industry is also witnessing growth in the region, particularly in the US, which is home to some of the world's largest tobacco companies. As a result, there is a heightened need for MRO solutions that can cater to the unique requirements of this industry, including temperature-controlled storage and handling equipment.

Country Insights

United States

The United States dominated the market in 2023 due to the country's large and well-established aviation as well as manufacturing industry with many major airlines and other sector manufacturers based there. This creates a significant demand for MRO services and products, which drives the growth of the distribution market. Also, the US has a robust logistics infrastructure, including a comprehensive network of airports, seaports, highways, and railroads, which facilitates the efficient transportation of MRO supplies and equipment.

The MRO distribution demand in the US is mainly influenced by the expanding presence of Original Equipment Manufacturers (OEMs). The industrial sector, which contributes significantly to the country's GDP, is expected to grow further due to favorable economic conditions, increasing investments, the presence of major market players, strong financial status, dollar appreciation, and rapid industrialization. This trend is likely to fuel the North America MRO distribution market growth in the country.

Competitive Landscape

North America MRO distribution market companies compete based on their distribution networks, delivery efficiency, and competitive pricing. The market is highly fragmented, with a large number of players vying for market share. The demand for industrial products is heavily reliant on growth in end-use industries and is expected to see moderate growth due to limited expansion in application industries. The key competitive factors that will determine supplier selection for maintenance, repair, and operations (MRO) are quality, price, and delivery efficiency.

Some of the major players operating in the North American market include:

- Applied Industrial Technologies

- Bearing Distributors, Inc.

- Bisco Industries

- DGI Supply

- FCX Performance

- Harrington Process

- Hillman Group, Inc.

- Hisco, Inc.

- Kaydon Bearings

- Lawson Products, Inc.

- MSC Industrial Supply

- R.S. Hughes Co., Inc.

- Stellar Industrial Supply

- Grainger, Inc.

- Wajax Limited

Recent Developments

- In December 2023, Harrington Process acquired MRO Distributor PumpMan. This acquisition was made to add pump service capabilities to the Harrington Process platform with PumpMan.

- In August 2023, Applied Industrial Technologies acquired the assets of UZ Engineered Products, a distributor of high-quality products for maintenance, repair, and operational needs.

- In June 2021, MSC Industrial Supply acquired a majority shares of Wm. F. Hurst Co., a metalworking and MRO supplies distributor based in Wichita, KS.

Report Coverage

The North America MRO Distribution market scope emphasizes the U.S. and Canada to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, end-use, and futuristic growth opportunities.

North America MRO Distribution Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 156.71 billion |

|

Revenue Forecast in 2032 |

USD 200.37 billion |

|

CAGR |

3.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By End-Use, By Region |

|

Country scope |

U.S., Canada |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

key companies in North America MRO Distribution Market are Applied Industrial Technologies, Bearing Distributors, Inc., Bisco Industri, DGI Supply, FCX Performance, Harrington Process

North America MRO Distribution Market exhibiting a CAGR of 3.1% during the forecast period

The North America MRO Distribution Market report covering key segments are product, end-use, and country.

key driving factors in North America MRO Distribution Market are predictive maintenance and IoT integration drives market growth

The global MRO distribution market size is expected to reach USD 200.37 Billion by 2032