North America Probiotic Dietary Supplements Market Share, Size, Trends, Industry Analysis Report

By Form (Chewable and Gummies, Capsules, Powders, Tablets and Soft gels, Others); By Application; By End Use; By Country; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4473

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

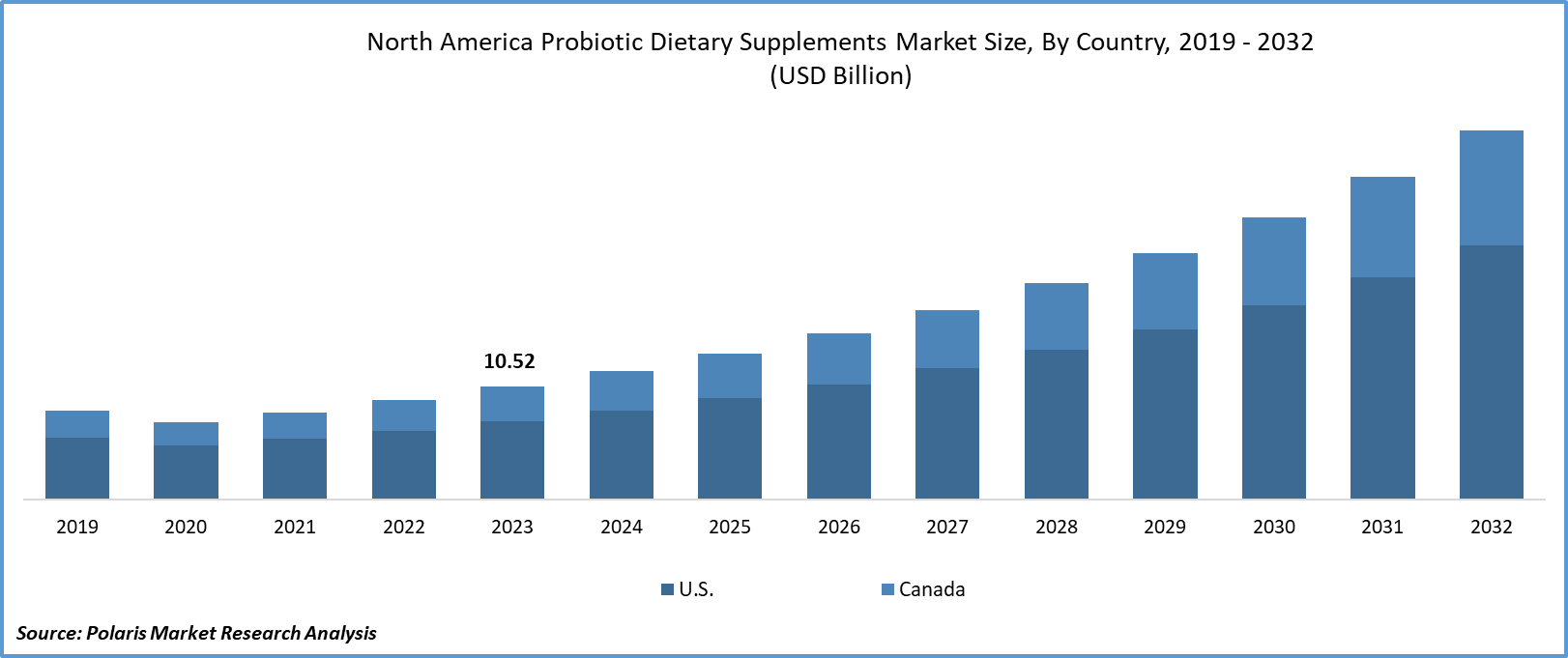

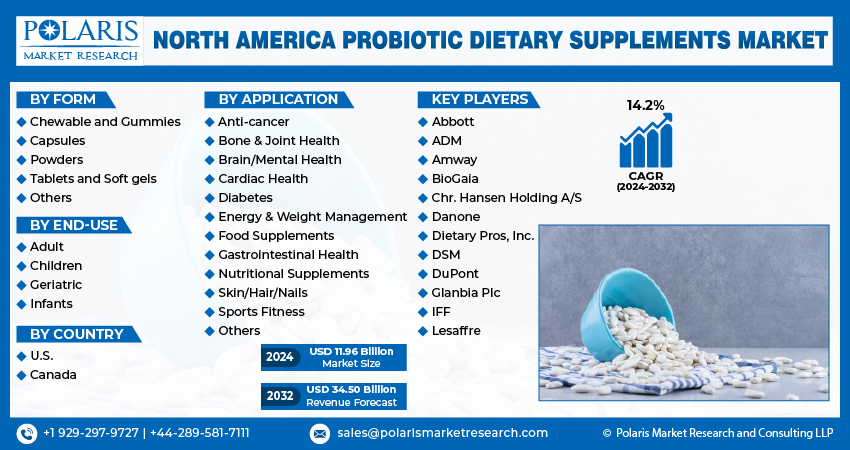

The north america probiotic dietary supplements market size was valued at USD 10.52 billion in 2023. The market is anticipated to grow from USD 11.96 billion in 2024 to USD 34.50 billion by 2032, exhibiting the CAGR of 14.2% during the forecast period.

Industry Trends

The North American region dominated the global market for probiotic supplements, and this was due to the increasing consumer awareness of the health benefits associated with probiotics. Probiotics are live microorganisms that can help support digestive health and boost the immune system and even mental health. The growing awareness of gut health fuels the growth of the market. Consumers are becoming more aware of the importance of maintaining a healthy balance of gut bacteria. As a result, there is increasing demand for products containing probiotics, which can help promote digestive health and overall well-being. Another factor contributing to the growth of the probiotic market is the expanding range of products available.

To Understand More About this Research: Request a Free Sample Report

In addition, there is a growing focus on preventative healthcare measures, and probiotics fit well into this category. With rising healthcare costs and an aging population in North America, consumers are looking for ways to stay healthy and avoid illness. Probiotics can help prevent various health issues, such as digestive problems, allergies, and even certain mental health conditions.

Despite the many positive factors driving the probiotic market, some challenges, such as regulatory uncertainty, affect the market expansion. There is still some uncertainty regarding the classification and labeling of these products. This lack of clarity makes it difficult for manufacturers to bring new products to market, potentially suppressing innovation.

Key Takeaways

- The U.S. dominated the market and contributed over 65% of the share in 2023

- By form category, the tablets and soft gels segment accounted for the largest market share in 2023

- By application category, the nutritional supplements segment is expected to grow with a significant CAGR over the forecast period

- By end-use category, the adult segment led the North American market in 2023

What are the market drivers driving the demand for North America probiotic dietary supplements market?

Increasing prevalence of digestive disorders are creating need for probiotic solutions.

Digestive disorders such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and other gastrointestinal issues are becoming more common, leading to a growing demand for effective solutions in North America.

- For instance, as per the 2020 United States Census, Inflammatory Bowel Disease (IBD) has been diagnosed in an estimated 2.39 million Americans. These figures highlight the pressing need for heightened research efforts to enhance our understanding of the condition and develop more effective treatments.

Probiotics are beneficial bacteria that can help maintain gut health and alleviate symptoms associated with these disorders. As consumers within the region become more aware of the benefits of probiotics, they are seeking out dietary supplements that contain these beneficial bacteria. This has led to an increase in demand for probiotic dietary supplements, driving the growth of the market.

Which factor is restraining the demand for probiotic dietary supplements?

The regulatory uncertainty is hindering the North American probiotic dietary supplements market growth.

The North American probiotic dietary supplements market is facing challenges due to regulatory uncertainty. In the US, for instance, probiotics are considered dietary supplements and are regulated by the Food and Drug Administration (FDA) under the Dietary Supplement Health and Education Act (DSHEA). However, there should be clearer guidelines and standards for the production, labeling, and distribution of probiotic supplements, which creates confusion among manufacturers, retailers, and consumers.

Furthermore, the FDA still needs to establish a specific definition or criteria for what constitutes a probiotic, leading to inconsistencies in product labeling and claims. This regulatory ambiguity makes it difficult for companies to ensure compliance with laws and regulations, and they may face legal issues or reputational damage if their products do not meet quality standards.

Report Segmentation

The market is primarily segmented based on form, application, end-use, and country.

|

By Form |

By Application |

By End-Use |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Form Insights

Based on form analysis, the market is segmented on the basis of chewable and gummies, capsules, powders, tablets and soft gels, and others. The North American probiotic dietary supplements market was dominated by tablets and soft gels in 2023 and this dominance was because of the ease of use, convenience, and consumer familiarity with these forms. Tablets and soft gels are widely available and easily accessible, making them a popular choice among consumers who are looking for a convenient way to incorporate probiotics into their daily routine.

In addition, they offer accurate dosing and longer shelf life compared to other formats, which has contributed to their popularity. Also, consumers tend to trust these traditional delivery forms, having been used to taking pills and capsules for various health supplements for years.

By End-Use Insights

Based on end-use analysis, the market has been segmented on the basis of adult, children, geriatric, and infants. The adult segment dominated the North American probiotic dietary supplements market in 2023, owing to factors such as increasing health awareness among adults and rising demand for preventive healthcare measures. As people age, their digestive system becomes more susceptible to various disorders, and probiotics help maintain gut health and boost immunity. Along with this, the hectic lifestyle of adults has led to poor eating habits, which resulted in digestive issues, and probiotics aid in restoring the balance of good bacteria in the gut, thereby improving overall health. There has also been an increase in the number of working professionals opting for probiotic supplements to reduce stress levels and improve mental well-being.

Country-wise Insights

United States

The United States held the largest revenue share in the North American probiotic dietary supplements market in 2023, owing to the country's well-established dietary supplement industry, with a strong presence of major players and a large consumer base. In addition, there is a growing awareness among Americans about the health benefits of probiotics, driving demand for these supplements.

Also, the U.S. has a relatively high disposable income, which allows consumers to spend more on healthcare products, including probiotic supplements. The country has an advanced distribution channel and a strong online retail platform, making probiotic supplements easily accessible to consumers. Similarly, the presence of prominent players such as Amway, Danone, and ADM in the U.S. has contributed to the country's dominant position in the North American market.

Competitive Landscape

The market is highly competitive, with several established players such as ADM, Abbott, and DSM competing for market share. Manufacturers are involved in various activities to differentiate themselves and stay ahead of the competition. These activities encompass investing in research and development to introduce new and innovative probiotic dietary supplements and expand product portfolios. Some companies are also investing in clinical studies to support the health benefits of their supplements and gain a competitive edge.

Some of the major players operating in the North American market include:

- Abbott

- ADM

- Amway

- BioGaia

- Chr. Hansen Holding A/S

- Danone

- Dietary Pros, Inc.

- DSM

- DuPont

- Glanbia Plc

- IFF

- Lesaffre

Recent Developments

- In April of 2021, Bausch Health Companies Inc. disclosed the release of ENVIVE™ in the U.S. market, a new daily over-the-counter probiotic supplement designed to alleviate the frequency and severity of five periodic gastrointestinal (GI) symptoms, specifically constipation, diarrhea, bloating, gas, and discomfort.

- In February 2022, Sweet Cures, a natural health food supplement manufacturer, launched an all-new range of probiotics including up to 17 live strains of bacteria backed by clinical studies.

Report Coverage

The North America Probiotic Dietary Supplements market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, form, application, end-use, and their futuristic growth opportunities.

Probiotic Dietary Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.96 billion |

|

Revenue forecast in 2032 |

USD 34.50 billion |

|

CAGR |

14.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Form, By Application, By End-Use, By Country |

|

Regional scope |

U.S., Canada |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The North America probiotic dietary supplements market size is expected to reach USD 34.50 Billion by 2032

Key players in the market are Abbott, ADM, Amway, BioGaia, Chr. Hansen Holding A/S, Danone, Dietary Pros, Inc

North America Probiotic Dietary Supplements Market exhibiting the CAGR of 14.2% during the forecast period.

The North America Probiotic Dietary Supplements Market report covering key segments are form, application, end-use, and country.