North America Reverse Osmosis Equipment Market Share, Size, Trends, Industry Analysis Report

By Type (Pretreatment System, Reverse Osmosis Device, Post-Processing System, Cleaning System, Electrical Control System); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 119

- Format: PDF

- Report ID: PM4938

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

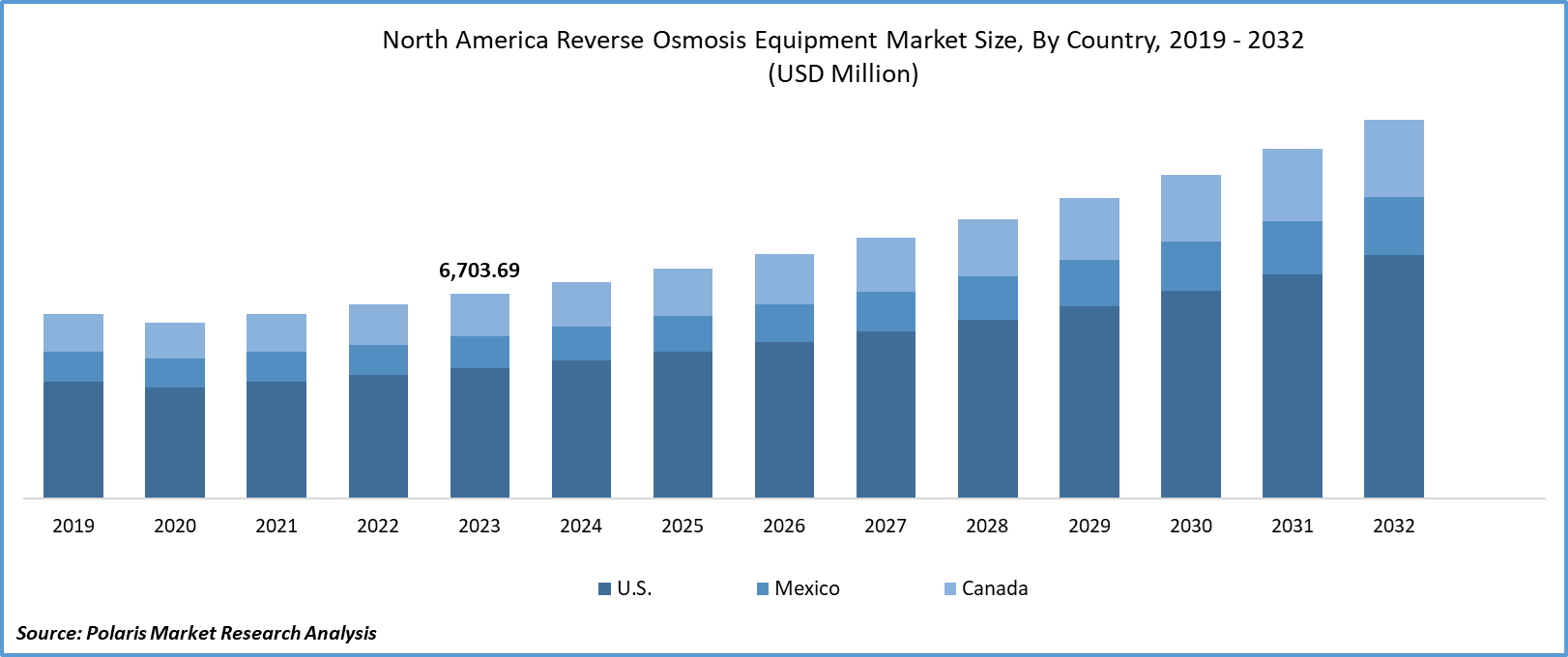

North America Reverse Osmosis Equipment Market size was valued at USD 6,703.69 million in 2023. The market is anticipated to grow from USD 7,090.09 million in 2024 to USD 12,409.21 million by 2032, exhibiting the CAGR of 7.2% during the forecast period.

Industry Trends

The North American reverse osmosis (RO) equipment market is experiencing robust growth, driven by several key factors that underscore its importance in various industries. Reverse osmosis, a water purification process that employs a semipermeable membrane to remove molecules, larger particles, and ions from drinking water, has become increasingly vital due to rising concerns over water quality and scarcity. In this dynamic market, factors such as technological advancements, increasing demand for clean water, stringent government regulations, and growing awareness of waterborne diseases are shaping the landscape.

To Understand More About this Research: Request a Free Sample Report

Technological advancements play a pivotal role in the growth of the North American RO equipment market. Continuous innovations have led to the development of more efficient and cost-effective RO systems, enhancing their adoption across residential, commercial, and industrial sectors. Manufacturers are focusing on improving membrane materials, system design, and energy efficiency, thereby driving market expansion.

Moreover, the escalating demand for clean and safe drinking water is fueling the adoption of RO equipment across North America. Growing concerns regarding water contamination, pollution, and the presence of harmful contaminants such as lead, arsenic, and fluoride have propelled consumers and industries to invest in advanced water treatment solutions like RO systems. As a result, residential households, commercial establishments, and industrial facilities are increasingly integrating RO equipment into their water treatment infrastructure to ensure the delivery of high-quality drinking water.

Key Takeaways

- The U.S. dominated the market and contributed over 60% of the North America reverse osmosis (RO) equipment market share in 2023

- By type category, the reverse osmosis device segment accounted for the largest market share in 2023

- By application category, the food segment led the North American market in 2023

What are the market drivers driving the demand for North America reverse osmosis equipment market?

Increasing use in industrial applications fuel the sales of reverse osmosis equipment

The reverse osmosis (RO) equipment market in North America is experiencing significant growth, largely fueled by increasing demand from industrial applications. Reverse osmosis, a water purification process that utilizes a semi-permeable membrane to remove molecules and larger particles from water, has become indispensable in various industries due to its effectiveness in producing high-quality water for numerous applications.

One of the primary drivers behind the surge in demand for reverse osmosis equipment is the stringent regulations governing water quality and safety in industrial settings. Industries such as pharmaceuticals, food and beverage, power generation, and chemical processing require water of extremely high purity for their operations. Reverse osmosis technology offers an efficient solution for meeting these stringent requirements by effectively removing contaminants and impurities from water, ensuring that it meets the necessary standards.

Moreover, as environmental concerns continue to escalate, there is a growing emphasis on sustainable water management practices across industries. Reverse osmosis equipment enables businesses to treat and recycle water efficiently, reducing their environmental footprint and conserving precious water resources. This aspect has become particularly crucial in regions facing water scarcity or experiencing drought conditions, driving the adoption of reverse osmosis technology as a sustainable water treatment solution.

Which factor is restraining the demand for reverse osmosis equipment?

The high cost of raw materials and production processes hinder the market.

In recent years, reverse osmosis (RO) technology has experienced significant advancements, particularly in North America where the demand for clean, potable water continues to rise. Reverse osmosis, a process that utilizes a semi-permeable membrane to remove contaminants from water, has become increasingly efficient and cost-effective, driving its widespread adoption across various industries and residential applications.

One notable advancement in RO technology is the development of high-performance membranes. These membranes are engineered to have enhanced permeability and selectivity, allowing for greater water throughput while effectively removing a wider range of impurities. This improvement not only increases the efficiency of the RO process but also extends the lifespan of the equipment by reducing fouling and scaling.

Moreover, innovations in membrane materials have contributed to the durability and reliability of RO systems. Manufacturers have introduced novel materials that exhibit superior resistance to chemical degradation and mechanical stress, ensuring prolonged operation even in harsh operating conditions. These advancements have bolstered the confidence of consumers and industries in relying on RO technology for their water purification needs.

Report Segmentation

The market is primarily segmented based on type, application, and country.

|

By Type |

By Application |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented on the basis of pretreatment system, reverse osmosis device, post-processing system, cleaning system, and electrical control system. In 2023, reverse osmosis device segment accounted for the largest share of the North America market. The reverse osmosis device segment is categorized into industrial and residential product types. Industrial or commercial and residential-based reverse osmosis devices or systems are plotted on large premises at the plant locations. The systems are designed to serve a large section of the plant, be it for distribution or commercial applications.

Industries such as food and beverages, textiles, and pharmaceuticals are largely setting up reverse osmosis plants in order to fulfill their requirement of desalinized water for the manufacturing process. Moreover, residential application of reverse osmosis devices is bifurcated into countertop and under-sink types. Countertop reverse osmosis systems are placed at the countertop to minimize the area of use, whereas the sink type is placed at the desired location of the sink.

By Application Insights

Based on application analysis, the market has been segmented on the basis of electronic, medicine, food, textile, chemical industry, power generation, and others. The food segment is anticipated to grow with a significant CAGR over the forecast period. The food and beverage industry is highly regulated, with a high demand for clean water. Owing to its growing requirement for food and beverage products, there is a constant demand for high volumes of water since major ingredients require water for processing. In addition, pure water also prevents the culmination of bacteria and harmful pathogens that could lead to the health deterioration of an individual. Furthermore, pure water is also essential for the sterilization process in the workplace to avoid any bacterial and fungal growth. Furthermore, food and beverage companies rely heavily on RO-treated water for manufacturing juice and beverages as it is required for diluting concentrates, ensuring consistent product quality, and preventing microbial growth.

Country-wise Insights

United States

The United States held the largest revenue share in the North America market in 2023. The demand for reverse osmosis (RO) equipment is steadily growing in the United States across various sectors, driven by several factors. Firstly, increasing concerns about water quality and scarcity have prompted industries to invest in advanced water purification technologies like RO to ensure the availability of clean and safe drinking water. Additionally, stringent regulations regarding water treatment and environmental protection further propel the adoption of RO systems in industrial, commercial, and residential settings. With advancements in RO technology making, it more efficient and cost-effective, there is a growing preference for RO equipment to meet the diverse water purification needs of different applications, such as drinking water treatment, wastewater recycling, and industrial process water treatment.

Competitive Landscape

The key players in the North America Reverse osmosis equipment market include Sulzer Ltd, Grundfos Holding A/S, Torishima Pump Mfg. Co., Ltd., Flowserve Corporation, SPX Flow, Inc., and more. These companies have a large customer base and strong distribution networks, which gives them an advantage in terms of market reach and penetration. The North American market is characterized by intense competition, with companies striving to gain a larger market share by constantly improving their technology, forming strategic partnerships, and showing unwavering dedication to innovation.

Some of the major players operating in the North American market include:

- Cat Pumps

- Danfoss

- DÜCHTING PUMPEN

- Flowserve Corporation

- Fluid Equipment Development Company

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- SPX Flow, Inc.

- Sulzer Ltd

- Torishima Pump Mfg. Co., Ltd.

Recent Developments

- In October 2023, TSG Water and FEDCO collaborated on a 1.4 MGD SWRO system in Los Cabos, Mexico, using BiTurbo technology for tourism industry water supply.

- In September 2023, Torishima Pump Mfg. Co., Ltd. collaborated with Waterise to provide subsea desalination plants, utilizing Torishima Pumps for efficient water transfer.

- In February 2023, FEDCO collaborated with Biwater on innovative energy recovery design for San Diego's Pure Water Project, enhancing RO system efficiency.

- In October 2022, Sulzer introduced next-gen pumps for desalination, aiming for higher efficiency and lower costs. The MSN-RO range offers enhanced features like high-efficiency designs, PEEK polymer wear parts, and increased capacities for large-scale projects.

Report Coverage

The North America reverse osmosis equipment market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, and their futuristic growth opportunities.

Reverse Osmosis Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7,090.09 million |

|

Revenue forecast in 2032 |

USD 12,409.21 million |

|

CAGR |

7.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Country |

|

Regional scope |

U.S., Canada, Mexico |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in North America Reverse Osmosis Equipment Market are Cat Pumps, Danfoss, DÜCHTING PUMPEN, Flowserve Corporation, Fluid Equipment Development Company

North America Reverse Osmosis Equipment Market exhibiting the CAGR of 7.2% during the forecast period.

The North America Reverse Osmosis Equipment Market report covering key segments are type, application, and country.

key driving factors in North America Reverse Osmosis Equipment Market are 1. Increasing use in industrial applications fuel the sales of reverse osmosis equipment

The North American reverse osmosis equipment market size is expected to reach USD 12,409.21 Million by 2032