North America UV Nail Gel Market Share, Size, Trends, Industry Analysis Report

By Type (UV Nail Gel Polish, UV Nail Gel Basecoat, UV Nail Gel Top Coat); By Applications; By Distribution Channel; By Country; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4254

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

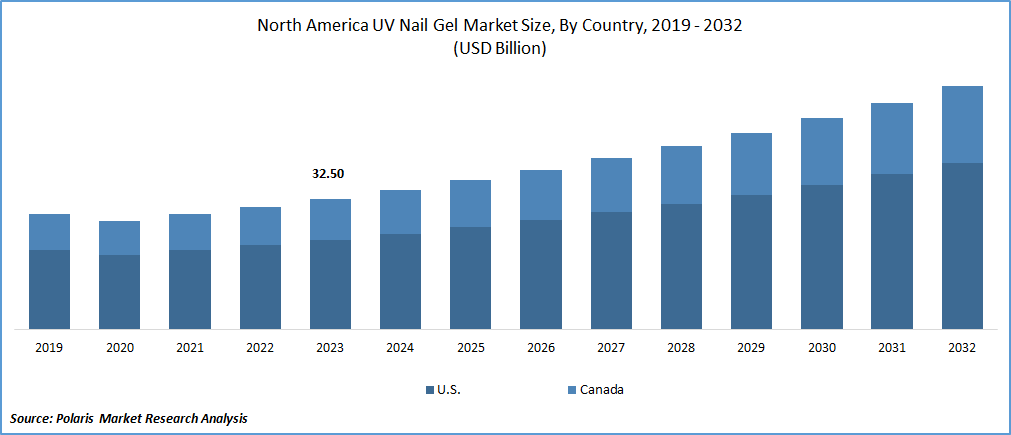

The North American UV nail gel market was valued at USD 32.50 Billion in 2023 and is expected to grow at a CAGR of 7.2% during the forecast period.

The market is a rapidly growing sector within the beauty industry, driven by increasing demand for long-lasting and high-quality nail art. The market has experienced significant growth over the past few years since the rising popularity of nail art and nail extensions, which have become an essential part of fashion and beauty culture. Also, the increasing number of women who are looking for quick and easy ways to enhance their appearance without committing to permanent solutions is propelling growth in North America.

To Understand More About this Research: Request a Free Sample Report

However, one of the major challenges facing the UV nail gel market is the concern over the safety of these products. Some studies have raised concerns about the potential health risks associated with the use of UV nail gels, such as skin irritation, allergic reactions, and even cancer. This has led to a decrease in consumer confidence and a shift towards safer alternatives. Furthermore, the high cost of UV nail gel equipment and the need for more skilled professionals in the field are also limiting the adoption of these products.

Growth Drivers

The increasing popularity of gel nail extensions and enhancements drives market growth

The increasing popularity of gel nail extensions and enhancements has been a significant driver for the growth of the North American UV nail gel market. Gel nails have become a pin in the beauty industry due to their long-lasting, high-shine finish and ease of application. As more individuals seek to achieve salon-quality nails at home, the demand for UV nail gels that can be used with gel nail extensions and enhancements has increased.

Also, the convenience and versatility of gel nail products have made them appealing to professionals and DIY lovers alike, further driving up demand. Advancements in technology have led to the development of newer, easier-to-use gel systems, which have expanded the market beyond traditional nail technicians to include beauty enthusiasts who want to achieve professional-looking results at home. This growing demand for gel nail products is expected to continue, making the North American UV nail gel market an attractive opportunity for businesses.

Report Segmentation

The market is primarily segmented based on type, application, distribution channel, and country.

|

By Type |

By Application |

By Distribution Channel |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The UV nail gel polish segment dominated the market in 2023.

In 2023, the UV nail gel polish segment dominated the North American market owing to the increasing consumer demand for long-lasting and high-quality nail polishes, as well as the growing popularity of gel polishes among professionals and at-home users. The convenience and ease of application of UV nail gel polishes also contributed to their popularity, as they can be easily applied and cured under a UV or LED lamp. In addition, the wide range of colors and finishes available in UV nail gel polishes helped to drive sales, as consumers were able to choose from a variety of options to suit their style and preferences.

By Application Type Analysis

The commercial applications led the North American market in 2023.

The commercial applications of UV nail gels in North America were a significant factor in driving the growth of the market in 2023. Salons and spas widely adopted UV nail gels as they offered several benefits over traditional nail polishes, such as longer-lasting results, quicker drying times, and greater durability. Further, the ease of application and removal of UV nail gels made them an attractive option for salon professionals who could offer their clients a convenient and high-quality service.

Similarly, the availability of a wide range of colors and finishes in UV nail gels allowed salons to serve various customer preferences, thereby expanding their client base. The growing popularity of nail art and nail extensions also contributed to the demand for UV nail gels, as they provided a universal platform for creative nail designs.

Country Insights

The U.S. dominated the market in terms of revenue share in 2023.

The United States held the largest revenue share in the market in 2023 because of the well-established beauty and personal care industry, increasing demand for convenient and long-lasting nail art solutions, and a strong presence of key players in the country. Also, the growing popularity of nail art culture and the rising number of nail salons and spas in the US have further fueled the demand for UV nail gels.

The presence of major players such as OPI, Sally Hansen, and Essie in the US has helped to boost the market growth. These companies have introduced innovative products and marketing strategies that cater to the preferences of consumers, thereby strengthening their position in the market. Thus, the UV nail gel market in North America is expected to continue its upward trajectory, driven by the increasing adoption of these products among consumers and professionals alike.

Key Market Players & Competitive Insights

The North American UV nail gel market is highly competitive, with several key players competing for market share. Some of the prominent companies operating in this market include OPI Products Inc., CND (Creative Nail Design), Artistic Nail Design (AND), Gelish, and NSI (Nails Systems International). These companies have been focusing on product innovation, expansion of distribution channels, and strategic partnerships to strengthen their position in the market.

Some of the major players operating in the North American market include:

- OPI Products Inc.

- CND (Creative Nail Design)

- Artistic Nail Design (AND)

- Gelish

- NSI (Nails Systems International)

- Chemence Ltd.

- Coty Inc

- Kiara Sky

- Light Elegance

- ORLY International Inc.

- Revlon Inc.

Recent Developments

- In May 2022, Light Elegance, unveiled its latest collection of professional-grade nail products and acrylic nail systems that are 100% HEMA-free. The new collection includes Sea LE Color, Glitter Gel, and soak-off P+ Gel Polish.

- In August 2022, Sally Hansen, the producer of gel hybrid polish, launched the Miracle Gel Merry N' Bright Collection, which includes eight frosty shades with different shimmer, glitter, metallic, and pearl finishes.

North America UV Nail Gel Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 34.69 Billion |

|

Revenue Forecast in 2032 |

USD 60.35 Billion |

|

CAGR |

7.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By Distribution Channel, By Country |

|

Country scope |

U.S., Canada |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

Type, application, distribution channel, and country are the key segments in the North America UV Nail Gel Market.

The North American UV nail gel market size is expected to reach USD 60.35 Billion by 2032

The North American UV nail gel market is expected to grow at a CAGR of 7.2% during the forecast period.

U.S regions is leading the global market.

The increasing popularity of gel nail extensions and enhancements drives market growth are the key driving factors in North America UV Nail Gel Market.