Nucleating And Clarifying Agents Market Share, Size, Trends, Industry Analysis Report

By Agent; By Form (Powder, Granules and Liquid); By Polymer; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 116

- Format: PDF

- Report ID: PM2668

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

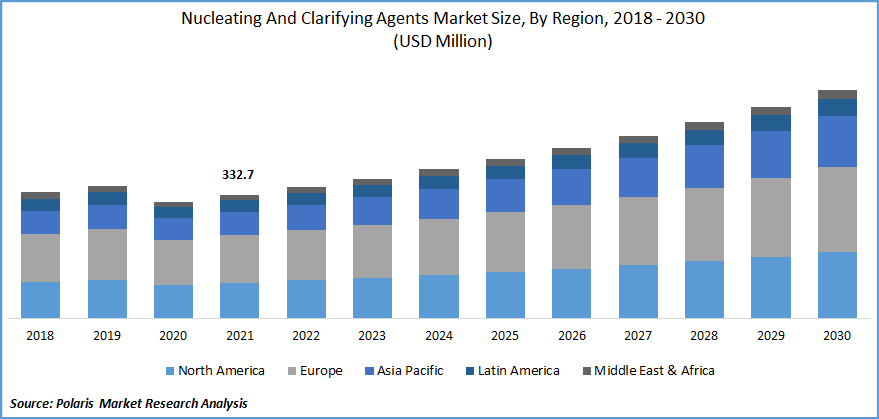

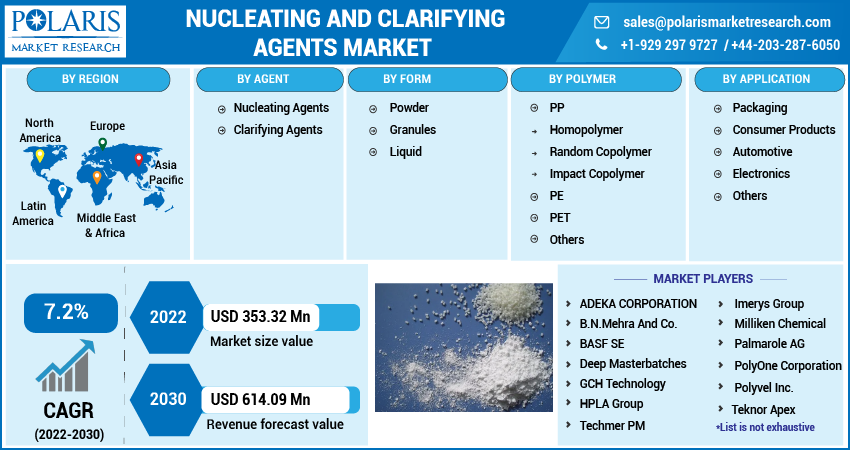

The global nucleating and clarifying agents market was valued at USD 332.7 million in 2021 and is expected to grow at a CAGR of 7.2% during the forecast period. The demand for nucleating and clarifying agents is expected to be driven by increasing penetration in the polymer manufacturing processes owing to their transparency, heat resistance, and better optical properties. In addition, the rising perception of consumer & packaging products in various end-use applications will positively impact the market.

Know more about this report: Request for sample pages

The nucleating and clarifying agents are increasing as it offers efficient and high-quality end products. The pinhole, wavy, and snow patterns are converted into a smooth texture with the help of powdered agents, which are useful in producing many cosmetic end products expected to drive market growth. Additionally, polymers such as polyethylene glycol are used as emulsifiers, and emollients help the product penetrate deep into the skin; such factors drive market growth.

The nucleating and clarifying agents have wide application in the healthcare and pharmaceutical sectors owing to their transparent and rigid nature. Medical apparatus and containers are usually transparent to monitor the proper dosages and ensure accuracy, which is anticipated to bolster market growth.

The COVID-19 pandemic had a negative impact on the growth of the nucleating and clarifying agents market. The shortage of chemicals and raw materials and negligible operations resulted in high prices. The government's stringent rule halted many industries, reducing the production of the products, thus disrupting the supply chain and haltering market growth.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Technological advancement to improve molding and transparency and enhance crystallization to speed the cycle time to create innovative and new final products is expected to drive market growth. Moreover, the wide application of polymers in the end-use industries such as packaging, electronics, and chemical industries is also supporting the market growth.

Polytetrafluoroethylene (PTFE) polymer are in huge demand owing to their high-temperature & chemical resistance and low coefficient of friction properties which has a wide application in chemical industries for shaft sealing to prevent leakage of aggressive chemicals in the food industry from preventing reaction of materials and in pharmaceutical industries to handle strong oxidizer these applications are expected to support the market growth.

Report Segmentation

The market is primarily segmented based on agent, form, polymer, application, and region.

|

By Agent |

By Form |

By Polymer |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Clarifying agents accounted for the largest share in 2021

Clarifying agents market segment accounted for the highest revenue share in 2021 It has a wide application in the end-use industries such as packaging, pharmaceutical, and food & beverage industry to remove particles that cause instability during product formation. Moreover, it also has a massive demand in the automotive industry.

Granule is expected to witness the fastest growth in the coming year

Granule form is expected to witness the fastest growth owing to its cost-effectiveness. Numerous industries such as food & beverage, chemical and automotive have huge demand due to their high efficiency and material handling properties. Additionally, these are used to manufacture cosmetic powders, toners, and different medicines, which is driving the segment growth.

Polypropylene is expected to lead the market over the forecast period

The demand for polypropylene is expected to see a significant surge over the forecast period owing to its properties such as better chemical & fatigue resistance, transparency, semi-rigidness, and flexibility which has a huge demand in end-use industries. The automotive industry has a significant demand as it is used to manufacture car batteries, bumpers, and interior cladding; such factors are expected to contribute to the market growth.

Packaging segment is expected to account for the largest share in 2030

The packaging segment is expected to dominate the market over the forecast period. Rapid urbanization and rising demand for durable and lightweight, packed products in the cosmetics and healthcare sectors are driving market growth. The packaging industry is booming due to the use of polypropylene to make the end product, such as prescription bottles in the healthcare sector to yogurt & cream cheese containers in the food industry, which is propelling the market growth.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

The Asia Pacific is the largest region for nucleating and clarifying agents and is expected to witness faster growth over the forecast period. Rising disposable income and demand for high-quality and personalized products increase the demand in cosmetic and packaging industries, which is likely to have a positive impact on the market. Furthermore, the rising consumption of plastic and plastic products in developing nations such as India, China, and Japan are also expected to support segment growth.

Competitive Insight

Some of the major players operating in the global market include ADEKA CORPORATION, Amfine Chemical Corporation, B.N.Mehra And Co., BASF SE, Deep Masterbatches, Everspring Chemical Co., Ltd, GCH Technology, HPLA Group, Imerys Group, Milliken Chemical, New Japan Chemical Co., Ltd, Palmarole AG, Plastiblends India Limited, PolyOne Corporation, Polyvel Inc., Reedy Chemical Foam& Speciality Additives, Shandong Rainwell New Materials, Shanxi Oriental Faith Tech Co., Ltd, Techmer PM, Teknor Apex, TRAMACO Gmbh, and Zibo Rainwell Co Ltd.

Recent Developments

In September 2022, Avient Corporation acquired DSM and its major Dyneema brand. It offers engineered materials that have a wide application in marine, outdoor sports, personal ballistic protection, and industrial protection.

In October 2019, Clariant AG launched Licocene PE 4201 and Licocene PP 6102, of which the former is a valuable lubricant for polyolefins and also a nucleating agent for EPS that reduces resource consumption.

Nucleating and Clarifying Agents Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 353.32 million |

|

Revenue forecast in 2030 |

USD 614.09 million |

|

CAGR |

7.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Agent, By Form, By Polymer, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ADEKA CORPORATION, Amfine Chemical Corporation, B.N.Mehra And Co., BASF SE, Deep Masterbatches, Everspring Chemical Co., Ltd, GCH Technology, HPLA Group, Imerys Group, Milliken Chemical, New Japan Chemical Co., Ltd, Palmarole AG, Plastiblends India Limited, PolyOne Corporation, Polyvel Inc., Reedy Chemical Foam& Speciality Additives, Shandong Rainwell New Materials, Shanxi Oriental Faith Tech Co., Ltd, Techmer PM, Teknor Apex, TRAMACO Gmbh, and Zibo Rainwell Co Ltd |