On-board Charger Market Share, Size, Trends, Industry Analysis Report

By Power Output (Less than 11kW, 11kW to 22kW, More than 22kW); By Vehicle (Passenger Cars, Buses, Vans, Medium & Heavy-Duty Vehicles, Boats, Others); By Propulsion; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 113

- Format: PDF

- Report ID: PM2203

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

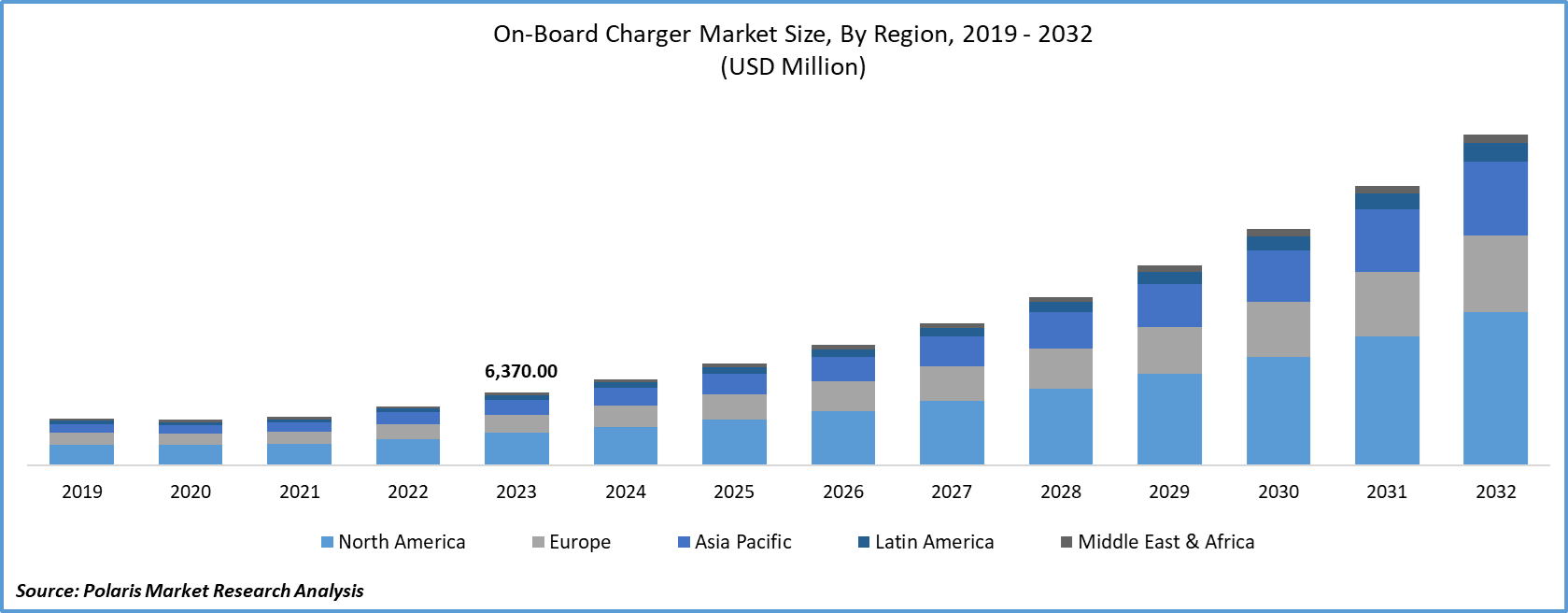

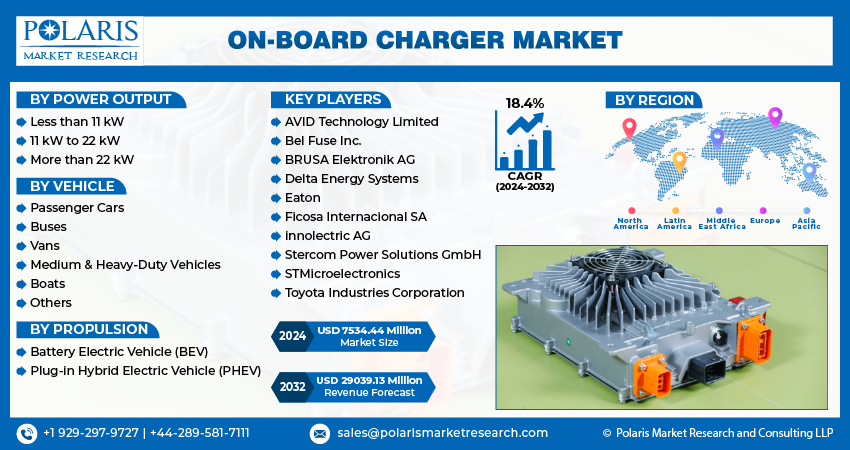

The global on-board charger market size was valued at USD 6370.00 million in 2023. The market is anticipated to grow from USD 7534.44 million in 2024 to USD 29039.13 million by 2032, exhibiting the CAGR of 18.4% during the forecast period.

The prime factors for the market growth are the rising number of AC public and private charging stations globally. The AC level-1 on-board charger facility is implemented across a variety of electric vehicles and can be plugged into ordinary power outlets.

Know more about this report: request for sample pages

In addition, the growing penetration of electric vehicles, as well as increasing government initiatives for advancements and promoting the adoption of electric vehicles, are further projected the on-board charger industry development in the near future.

The onset of the COVID-19 has a profound influence on the overall industries, and this also considerably affects the global economy. The sale of electric vehicles was hampered during this period because of the imposition of lockdown across various regions. As per the Society of Electric Vehicle Manufacturers, in 2021, registration of electric vehicles was turned down by 20%, to 236,802 units in contrast to 295,683 units in 2020.

However, the growing support by the government authorities, such as a decrease in costs of batteries, offering incentives for purchase, further policies to the manufacturers, is creating various opportunities for on-board charger industry growth. For instance, in Germany, the purchase subsidy offered on Battery Electric Vehicle (BEV) was to likely end in 2021 but was extended to 2025 because of the pandemic.

The On-Board Charger Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

Growth Drivers

The growing penetration of electric vehicles globally is one of the significant impelling factors for the on-board charger industry growth. For supporting the sustainable development initiative population is more tends to decline the usage of gasoline or other fossil fuels is leading the market demand. The adoption of electric vehicles does not harm the environment thereby; the government is also taking various initiatives for promoting the use of electric vehicles. Moreover, electric vehicles do not use gas and are a cost-effective mode of transport in comparison to conventional vehicles.

EVs present numerous benefits, such as it decreases fuel (petrol, gas, and diesel) consumption and lessening emissions from tailpipes, which, in turn, fuels the on-board charger industry demand globally. Furthermore, rising strategic developments and moves such as mergers and acquisitions by the manufacturers are also driving the market growth.

For instance, in 2020, BYD Company Ltd. (BYD) and Toyota Motor Corporation (Toyota) declared the agreement for the joint venture for the research and development of their battery electric vehicles (BEVs). Companies will work together to fulfill the growing demand for BEVs and also encourage their extensive adoption and makes them contribute to environmental development.

Report Segmentation

The market is primarily segmented on the basis of power output, vehicle, propulsion, and region.

|

By Power Output |

By Vehicle |

By Propulsion |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Vehicle

The passenger cars segment is accounted for the largest revenue shares in the global on-board charger industry and is expected to dominate the segment growth. The growing demand for electric cars, majorly for cab services, is acting as the major driving factor for the market demand. In the United States, plug-in passenger car sales recorded 5.5% of the on-board charger market share in 2020, which exhibits the rising demand, in comparison of 4.2% shares from 2019. Moreover, European plug-in passenger car sales are recorded with 7.7% in 2020 in contrast to 3.5% in 2019.

Moreover, the buses segment is likely to show the highest CAGR in the approaching years. The adoption of the on-board charger is increasing in buses for the conversion of AC to DC meant for charging the battery. The rising sales of zero-emission buses across the globe positively influence the segment demand. As per the statistics presented by Sustainable Bus- a web magazine that mainly focuses on the electric buses market, the sales of electric buses are projected to grow to 83% by 2040.

Insight by Propulsion

The BEV segment is accounted for the largest share in 2021 and is expected to lead the on-board charger market in the forecasting years. In Battery Electric Vehicle (BEV), the propulsion is endowing through the plug-in charged battery. The escalating demand for BEV vehicles is propelling the segment development.

Moreover, many companies such as Mercedes-Benz, Audi, and Volkswagen are recorded with the highest shares in the BEV vehicle market shares. For instance, Volkswagen recorded 17.4% shares in BEV that was tagged along with Mercedes-Benz with 14.9% in the year 2020. Thereby, these factors lead the segment dominance across the globe.

The PHEV segment is likely to be the fastest-growing segment across the on-board charger market. Numerous Plug-in Hybrid Electric Vehicle (PHEV) producers are deploying on-board chargers with an output between 3 to 3.7 kW that may fuel the segment demand. Car models like Outlander PHEV, Kia K5 PHEV, and Hyundai Sonata PHEV are utilizing on-board chargers for charging their car batteries. PHEVs are anticipated to exhibit exponential growth worldwide in the near future.

Geographic Overview

Geographically, Asia Pacific is accounted with the highest shares in the global market in 2021 owing to the increasing government efforts for encouraging the sales and adoption of electric vehicles majorly across regions like India and China are stimulating the on-board charger market growth. For instance, the Chinese government launched the sales quota for the years 2019, 2020, and 2021 are anticipated to stimulate the EV on-board charger sales across the nation. BYD Qin Pro EV, Tesla Model 3, and GAC Aion S, among others, are the EVs that use on-board chargers in China. Moreover, the availability of cheap manpower and raw materials, a large population pool, and government support may accelerate the market demand across the APAC region.

Moreover, Europe is expected to grow at the highest CAGR across the globe in the approaching years. Factors such as the presence of a large number of vendors for EVs and the launch of various initiatives may propel the demand for the on-board chargers. As per the BMW vision, the business has intended to electrify its Mini vehicles, sedans, and SUVs present across Europe by the end of 2030. Simultaneously, the rise in subsidies offered on the purchase of EVs is also one of the prime driving factors for the market growth across Europe in the impending period.

Competitive Insight

Some of the major players operating the global market include AVID Technology Limited, Bel Fuse Inc., BRUSA Elektronik AG, Delta Energy Systems, Eaton, Ficosa Internacional SA, innolectric AG, Stercom Power Solutions GmbH, STMicroelectronics, and Toyota Industries Corporation.

On-board Charger Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7534.44 million |

|

Revenue forecast in 2032 |

USD 29039.13 million |

|

CAGR |

18.4% from 2024 - 2032 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 - 2032 |

|

Segments covered |

By Power Output, By Vehicle, By Propulsion, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AVID Technology Limited, Bel Fuse Inc., BRUSA Elektronik AG, Delta Energy Systems, Eaton, Ficosa Internacional SA, innolectric AG, Stercom Power Solutions GmbH, STMicroelectronics, and Toyota Industries Corporation. |

Uncover the dynamics of the On-Board Charger Market sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

U.S. Residential Remodeling Market Size, Share 2024 Research Report

Animal Sedatives Market Size, Share 2024 Research Report

Biguanides Market Size, Share 2024 Research Report

Cloud Mobile Backend as a Service (BaaS) Market Size, Share 2024 Research Report

Solvent Recovery and Recycling Market Size, Share 2024 Research Report