Operating Room Management Software Market Share, Size, Trends, Industry Analysis Report

By Deployment (Cloud- & Web-based, On-premise), By End-use (ASCs, Hospitals, Others), By Solution, By Region, And Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4452

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

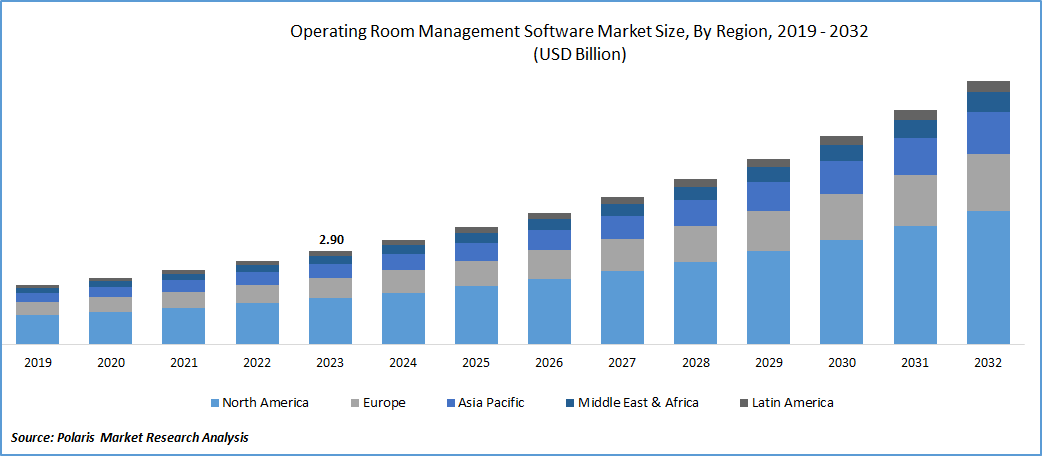

The global operating room management software market was valued at USD 2.90 billion in 2023 and is expected to grow at a CAGR of 12.3% during the forecast period.

Growth is due to increasing adoption of electronic health records (EHRs), a rise in the number of surgical procedures, a heightened focus on cost reduction and efficiency improvements in hospitals and ambulatory surgery centers (ASCs), and advancements in technology associated with managing operating rooms (ORs). As the healthcare sector undergoes substantial digital transformation, these software solutions have become indispensable. They play a crucial role in optimizing surgical scheduling, resource allocation, and the management of patient data, ultimately enhancing efficiency and the quality of patient care.

To Understand More About this Research: Request a Free Sample Report

An increase in the volume of surgical procedures is expected to drive the demand for software, leading to market expansion. The COVID-19 pandemic has profoundly influenced the market, particularly during its initial phases. This decline had adverse effects, as outlined in a study published in the British Journal of Surgery, which reported the postponement or cancellation of 28 million surgeries worldwide in 2020. Many of these delayed surgeries were rescheduled for 2021, creating an increased need to enhance scheduling efficiency. In response to this demand, various technologies have been introduced by companies to address the evolving landscape of surgical procedures.

Industry Dynamics

Growth Drivers

Advancements in technology

Furthermore, advancements in artificial intelligence and data analytics are poised to be key drivers of market growth. The escalating prevalence of chronic diseases on a global scale also plays a significant role in the rising need for efficient operating rooms, primarily due to the nature of severe chronic illnesses often requiring surgical interventions. A notable example is a study published by JAMA Network Open in 2021, which disclosed that over 13 million surgical procedures were conducted across 49 U.S. states from 2019 through 2021. The study reported a 10% decline in surgical procedures by the end of 2020 compared to 2019, largely attributed to the impact of the COVID-19 pandemic.

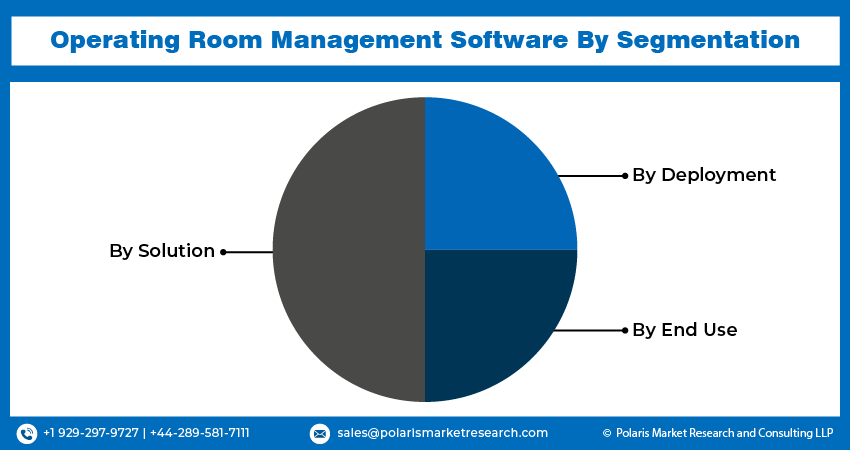

Report Segmentation

The market is primarily segmented based on solution, deployment, end use, and region.

|

By Solution |

By Deployment |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Solution Analysis

Solution segment accounted for the largest market share in 2023

Data management & communication segment accounted for the largest share. These solutions play a crucial role in facilitating efficient data sharing, seamless communication, and effective collaboration among surgical teams. They establish a centralized storage system for patient information, enabling medical professionals to access critical data in real time. Moreover, these solutions simplify the sharing of patient status updates throughout various perioperative care stages, aid in maintaining schedule adherence, and streamline the exchange of media and case-related information across different operating rooms and hospital departments.

Anesthesia information management segment will grow rapidly. It is primarily driven by the growing emphasis on accurate anesthetic dosing & data management. According to the Anesthesia Patient Safety Foundation, projections indicated that by 2020, approximately 84% of the academic anesthesiology departments in the U.S. would adopt these systems, marking a notable increase from an estimated 75% in 2014. This trend is anticipated to contribute significantly to the substantial expansion of the segment in the foreseeable future.

By Deployment Analysis

Cloud segment held the significant market share in 2023

Cloud segment held the significant market share. Segment’s growth is propelled by the increasing adoption of cloud solutions in clinics aimed at enhancing efficiency and lowering costs. Cloud solutions offer scalability, enabling healthcare organizations to adjust their software usage seamlessly or expand it as needed. This adaptability empowers them to effectively address the growing needs of hospitals and cater to a larger patient population without substantial investments in infrastructure. Furthermore, the cloud affords advantages such as real-time data sharing, secure data handling, flexible storage options, and reliable performance.

On premises segment is expected to gain substantial growth rate. The introduction of new on-premises software offerings equips healthcare organizations with improved offline accessibility, compliance adherence, customization options, and heightened control over their data. This type of software enables organizations to exert more influence over system upgrades, long-term cost management, and seamless integration with their existing systems. These factors contribute to a heightened demand for and increased adoption of on-premises software within the healthcare sector.

By End Use Analysis

Hospitals segment held the significant market share in 2023

Hospitals segment held the significant market share. This dominance is driven by the escalating number of surgical procedures. The American Cancer Society reported that in the U.S. in 2021, there were around 1.9 million new cancer cases and 608,570 cancer-related deaths. Notably, 43% of all cancer diagnoses in males in 2020 were attributed to colorectal, lung, and prostate cancers. Similarly, for women, breast, lung, and colorectal cancers were identified as the three most prevalent types, accounting for an expected 50% of all new cancer diagnoses in female patients.

ASCs segment is expected to gain substantial growth rate. It is attributed to the trend of transitioning from in-patient to out-patient surgical procedures. The Ambulatory Surgery Center Association (ASCA) reported that in 2020, over 5,800 ASCs performed around 30 million procedures. The significant growth of ASCs, particularly in specialized fields like orthopedics, highlights the critical role of customized operating room management software market, positioning it as a key factor driving market growth in the foreseeable future.

Regional Insights

North America dominated the global market in 2023

North America dominated the global market. This supremacy is attributed to the swift adoption of technologically advanced products. The regional growth is fueled by factors such as well-established infrastructure, an increasing embrace of operating room management software, and the presence of major industry players. In the United States, the market is poised for expansion, driven by the innovative strategies implemented by key industry players.

The Asia Pacific will grow with substantial pace. This is primarily due to high prevalence of chronic diseases, a large patient population, and a growing number of hospitals and healthcare facilities with improving infrastructure. Moreover, in August 2021, the government of Delhi announced a USD 19 million project aimed at establishing a cloud-based hospital information management system. This initiative was anticipated to further support the healthcare technology market in the region.

Key Market Players & Competitive Insights

The market is characterized by competitiveness due to the presence of key providers. To secure higher market shares, companies are implementing diverse strategies, including forming partnerships, introducing new products, and expanding regionally.

Some of the major players operating in the global market include:

- BD

- GE Healthcare

- Getinge

- Koninklijke Philips N.V.

- Max Systems Inc.

- Oracle Corporation

- PerfectServe, Inc.

- Picis Clinical Solutions, Inc., a division of N. Harris Computer Corporation.

- Surgical Information Systems

- Veradigm LLC (Allscripts Healthcare Solutions, Inc.)

Recent Developments

- In September 2023, Fujitsu and Baptist Health South Florida have introduced an innovative solution with the aim of revolutionizing operating room (OR) scheduling. The key goals of this recently unveiled solution include enhancing utilization rates and advancing the financial well-being of surgical practices. The improvements in OR scheduling carry substantial advantages, including decreased wait times for patients, optimal utilization of expensive surgical facilities, and the potential for reducing overall healthcare costs.

- In June 2022, Proximie has raised USD 80 Mn in Series C financing spped up its development of the Proximie's Operating System for the Operating Room (OR). This centralized platform is specifically crafted to improve connected surgical care.

- In June 2021, Getinge has unveiled the "Torin" AI-based operating room management system in the United States. This technology is designed to tackle the challenges presented by the pandemic and enhance the overall management of operating rooms.

Operating Room Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.25 billion |

|

Revenue forecast in 2032 |

USD 8.21 billion |

|

CAGR |

12.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Solution, By Deployment, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the market dynamics of the 2024 Monitor Operating Room Management Software Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Monitor Operating Room Management Software Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Bestselling Reports:

Ready Mix Concrete Market Size, Share Research Report

Medical Foods Market Size, Share Research Report

Location Based Advertising Market Size, Share Research Report

FAQ's

BD, GE Healthcare, Getinge, Philips, Max Systems are the key companies in Operating Room Management Software Market.

The global operating room management software market is expected to grow at a CAGR of 12.3% during the forecast period.

Solution, deployment, end use, and region are the key segments covered.

Advancements in technology are the key driving factors in Operating Room Management Software Market.

The global operating room management software market size is expected to reach USD 8.21 billion by 2032