Medical Foods Market Size, Share, Trends, Industry Analysis Report

: By Product (Powder, Pills, Liquid, and Other), Route of Administration, Application, Sales Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 120

- Format: PDF

- Report ID: PM4064

- Base Year: 2024

- Historical Data: 2020-2023

Medical Foods Market Overview

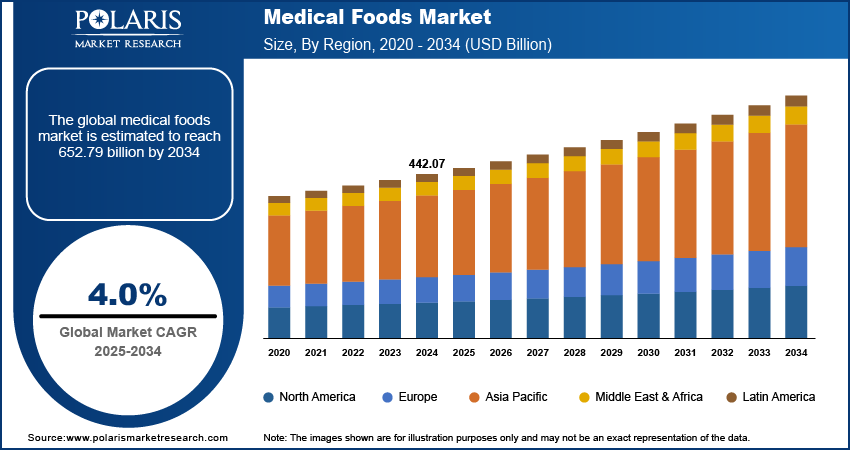

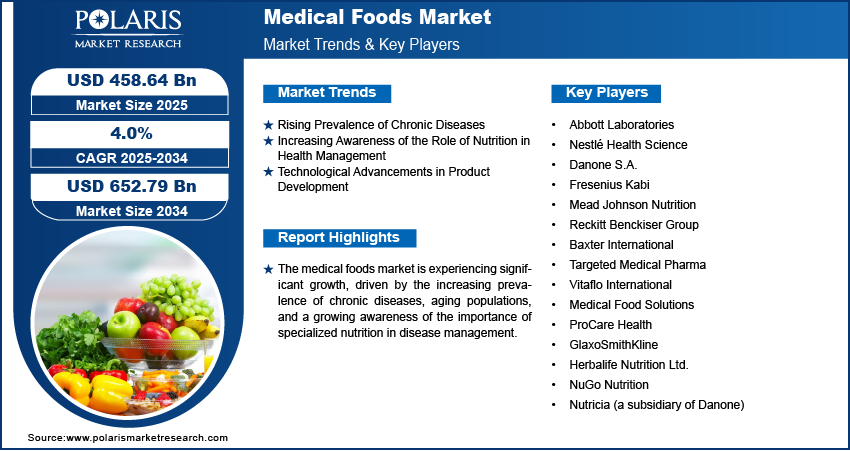

The medical foods market size was valued at USD 442.07 billion in 2024. The market is projected to grow from USD 458.64 billion in 2025 to USD 652.79 billion by 2034, exhibiting a CAGR of 4.0% during 2025–2034.

The medical foods market involves products formulated to meet the nutritional needs of individuals with specific medical conditions or diseases. These products are designed to be consumed under the supervision of a healthcare professional and are typically used for the dietary management of chronic conditions such as diabetes, metabolic disorders, and neurological diseases.

Key drivers of medical foods market growth include an increasing prevalence of chronic diseases, growing awareness of the importance of specialized nutrition, and advancements in medical research that support the use of tailored nutrition for managing specific health conditions. Trends such as the rising demand for personalized nutrition, the development of new formulations, and the expansion of distribution channels are also contributing to the market's expansion.

To Understand More About this Research: Request a Free Sample Report

Medical Foods Market Dynamics

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases globally is a significant driver for the medical foods market. Conditions such as diabetes, cardiovascular diseases, cancer, and neurological disorders require specialized nutrition to manage symptoms and improve overall health. According to the World Health Organization (WHO), chronic diseases are responsible for approximately 71% of all global deaths, with a projected rise in the burden of these diseases over the coming years. The growing incidence of conditions such as Type 2 diabetes, which affects more than 400 million people worldwide, emphasizes the demand for medical foods tailored to manage these diseases effectively. The rising focus on managing chronic conditions through nutrition is expected to contribute to the continued market growth.

Increasing Awareness of Role of Nutrition in Health Management

As healthcare continues to focus on the prevention and management of disease, there is a heightened awareness about the critical role of nutrition. More patients and healthcare providers are recognizing the significance of medical foods in supporting treatment and improving the quality of life for individuals with specific health conditions. A survey by the International Food Information Council (IFIC) found that 75% of the US consumers were increasingly interested in products that offer functional benefits, including medical foods. This shift is particularly evident in managing conditions such as metabolic disorders and gastrointestinal issues, where nutrition-based treatments are becoming a mainstream approach. This growing awareness of the impact of tailored nutrition is driving the medical foods market demand.

Development of Innovative Medical Foods

The development of innovative medical foods, driven by advances in food science and technology, has expanded the market's offerings. The rise of personalized nutrition, supported by technologies such as genomics, is enabling the creation of more precise formulations that cater to individual health needs. In addition, innovations in the bioavailability of nutrients, the use of functional ingredients, and the improvement of taste and texture are making medical foods more accessible and appealing. According to a report from the National Institutes of Health (NIH) in 2022, advancements in biotechnology and nutrigenomics are allowing for a better understanding of how nutrition can influence disease progression, leading to the development of more effective medical food products. These technological advancements are fueling the market's growth as consumers demand more personalized, efficient, and science-backed nutritional solutions.

Medical Foods Market Segment Insights

Medical Foods Market Assessment by Product

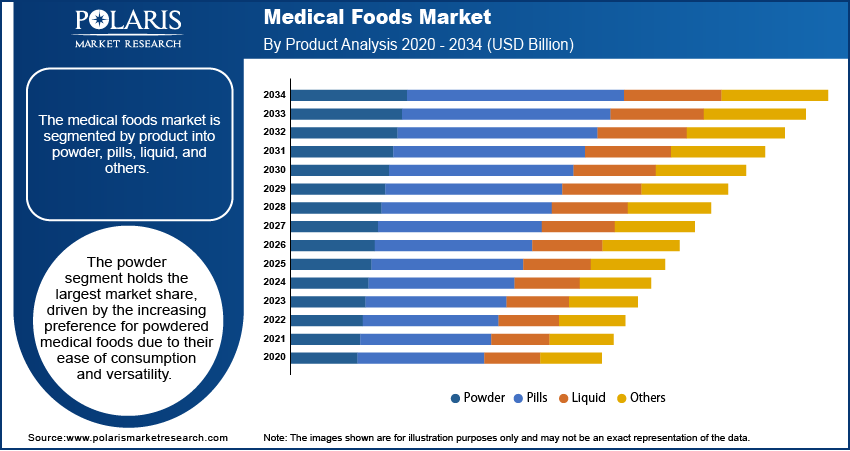

The medical foods market is segmented by product into powder, pills, liquid, and others. The powder segment holds the largest market share, driven by the increasing preference for powdered medical foods due to their ease of consumption and versatility. Powdered formulations are commonly used in managing chronic conditions such as metabolic disorders and diabetes, as they offer a convenient and customizable way to meet specific nutritional needs. This segment is also supported by the growing demand for protein-based powders and supplements tailored to patients with specific dietary restrictions. Additionally, powders are often available in various flavors, making them more appealing to a broader range of patients.

The liquid segment also registers the fastest growth rate due to its ease of administration, especially for patients with swallowing difficulties or those requiring enteral feeding. Liquid formulations of medical foods are increasingly used in clinical settings for individuals with gastrointestinal diseases or neurological disorders, where liquid-based nutrition ensures better absorption. The liquid segment’s expansion is also attributed to innovations in packaging and delivery systems, such as single-dose sachets and ready-to-drink bottles, which provide greater convenience for patients and caregivers. This trend reflects the market’s growing focus on enhancing patient compliance and convenience in the management of medical conditions.

Medical Foods Market Evaluation by Application

The medical foods market is segmented by application into chronic kidney disease (CKD), neurological disorders, genetic disorders, orphan diseases, cancer, and others. The chronic kidney disease (CKD) segment holds the largest medical foods market share, primarily driven by the high prevalence of CKD and the need for specialized nutritional management in these patients. Medical foods designed for CKD patients help manage electrolyte balance, prevent malnutrition, and support kidney function. This segment's dominance is supported by the growing global incidence of kidney diseases, as CKD affects millions worldwide, particularly those with diabetes and hypertension, which are major risk factors.

The cancer segment is also witnessing the highest CAGR, fueled by the increasing number of cancer diagnoses and the nutritional challenges faced by patients undergoing cancer treatments such as chemotherapy. Medical foods are crucial for maintaining nutritional status, managing weight loss, and improving overall treatment outcomes in cancer patients. Advances in cancer care and growing awareness of the importance of supportive nutrition during treatment have led to increased demand for medical foods tailored to this application. Additionally, the rising focus on personalized nutrition for cancer care is contributing to the segment's rapid growth.

Medical Foods Market Outlook by Sales Channel

The medical foods market segmentation, by sales channel, includes DTC sales channel and institutional sales. The direct-to-consumer (DTC) sales channel holds the largest market share, largely due to the increasing consumer preference for purchasing medical foods through online platforms and retail outlets. With the rise of e-commerce and consumer access to personalized nutrition, the DTC channel has become an essential avenue for individuals seeking specialized nutritional products for managing health conditions. The availability of a variety of medical food products through online platforms and pharmacies is making them more accessible to a broader consumer base. This segment benefits from growing health awareness and a shift toward at-home management of chronic diseases.

The institutional sales channel is also registering the fastest growth, driven by the rising demand for medical foods in healthcare settings, such as hospitals, clinics, and long-term care facilities. These institutions require medical foods to meet the nutritional needs of patients with specific conditions such as chronic kidney disease, cancer, and neurological disorders. The demand for medical foods in institutions is particularly strong in developed regions, where healthcare systems are increasingly focused on personalized treatment plans and nutritional management for patients with complex health conditions. As healthcare providers emphasize the importance of nutrition in disease management, the institutional sales channel continues to experience significant expansion.

Medical Foods Market Regional Insights

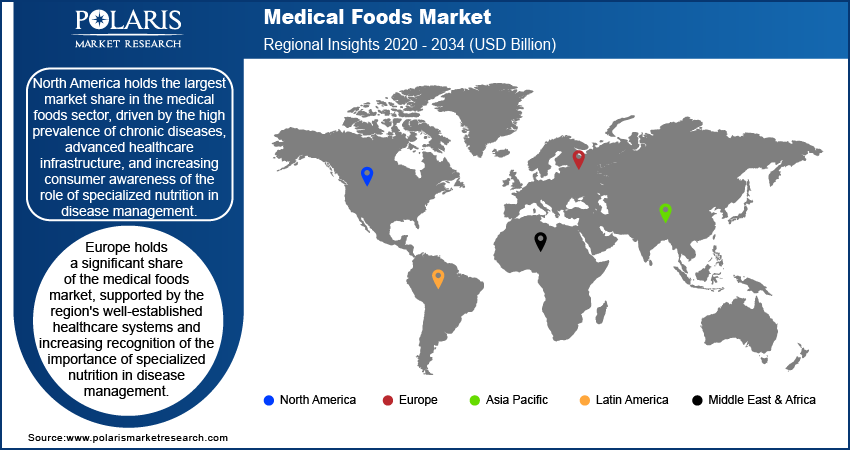

By region, the study provides medical foods market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the high prevalence of chronic diseases, advanced healthcare infrastructure, and increasing consumer awareness of the role of specialized nutrition in disease management. The US is a key contributor to this dominance, where medical foods are widely used in the management of conditions such as diabetes, kidney disease, and cancer. The region benefits from strong healthcare systems, high healthcare expenditure, and a well-established regulatory environment that supports the development and distribution of medical foods. Additionally, the presence of leading pharmaceutical and nutrition companies in North America, along with the growing trend of personalized healthcare, continues to drive market growth in this region.

Europe holds a significant share of the market, supported by the region's well-established healthcare systems and increasing recognition of the importance of specialized nutrition in disease management. Countries such as Germany, France, and the UK are key contributors to market growth, with a rising demand for medical foods used in managing chronic conditions such as cancer, neurological disorders, and metabolic diseases. The aging population in Europe further accelerates the demand for medical foods tailored to geriatric care. Regulatory frameworks in the region, including stringent food safety standards, facilitate the development and distribution of medical foods, ensuring a steady supply of high-quality products. Additionally, the growing trend of personalized nutrition is expected to further drive medical foods market expansion in Europe.

Asia Pacific is experiencing rapid growth in the medical foods market, fueled by the increasing prevalence of chronic diseases and rising healthcare awareness. Countries such as China, India, and Japan are witnessing a surge in demand for medical foods, driven by their large populations and rising incidences of lifestyle-related diseases such as diabetes and cardiovascular conditions. The expanding middle class, coupled with greater access to healthcare and nutritional products, is also contributing to market growth. The region’s diverse healthcare needs are prompting the development of specialized medical foods to address various conditions, and growing awareness about the role of nutrition in disease management is expected to further propel market expansion. Asia Pacific market is also characterized by increasing investments in healthcare infrastructure and improvements in access to medical food products, particularly in emerging markets.

Medical Foods Market – Key Players and Competitive Insights

Key players in the medical foods market include Abbott Laboratories, Nestlé Health Science, Danone S.A., Fresenius Kabi, Mead Johnson Nutrition, and Reckitt Benckiser Group. Other significant companies are Baxter International, Targeted Medical Pharma, Vitaflo International, Medical Food Solutions, ProCare Health, GlaxoSmithKline, Herbalife Nutrition Ltd., and NuGo Nutrition. These companies provide a wide range of medical foods designed to manage specific health conditions, including chronic diseases, metabolic disorders, and cancer-related nutrition needs. They offer products in various forms, such as powders, liquids, and tablets, catering to both direct consumers and healthcare institutions. Each of these players maintains a strong presence in global markets, with some focusing on specific regions or conditions.

The competitive landscape is characterized by companies striving to expand their portfolios and improve their product offerings to cater to the growing demand for medical foods. Companies are investing in research and development to create more targeted, personalized solutions that meet the nutritional needs of patients with chronic and complex diseases. Additionally, there is increasing competition to offer medical foods with improved bioavailability, taste, and convenience, making them more appealing to patients. Some players, such as Abbott Laboratories and Nestlé Health Science, have formed strategic partnerships with healthcare providers and institutions to enhance their market reach and patient compliance.

Market players are also focusing on improving distribution networks to meet the demand from both institutional sales and direct-to-consumer channels. With the rise of e-commerce, companies are exploring digital platforms to offer more accessibility and reach for their products. As demand for medical foods grows in emerging markets, companies are also expanding their presence in regions such as Asia Pacific and Latin America, where there is a growing awareness of the role of specialized nutrition in managing health conditions. This shift reflects the dynamic nature of the market, where players are adapting to changing consumer preferences and regional healthcare needs.

Abbott Laboratories is a prominent player in the medical foods market. It provides a range of products designed to support the nutritional needs of patients with specific medical conditions. The company also offers medical foods that help manage chronic diseases such as diabetes and kidney disease. Abbott has a strong presence in both institutional and direct-to-consumer markets, offering a variety of products in different forms, such as powders and liquids.

Nestlé Health Science is another key player. It offers medical foods that cater to a variety of nutritional needs, particularly for patients with chronic diseases, cancer, and neurological conditions. Nestlé Health Science has focused on personalized nutrition and products designed to support patients in managing their health conditions.

List of Key Companies in Medical Foods Market

- Abbott Laboratories

- Nestlé Health Science

- Danone S.A.

- Fresenius Kabi

- Mead Johnson Nutrition

- Reckitt Benckiser Group

- Baxter International

- Targeted Medical Pharma

- Vitaflo International

- Medical Food Solutions

- ProCare Health

- GlaxoSmithKline

- Herbalife Nutrition Ltd.

Medical Foods Market Developments

- December 2024: Nestlé Health Science announced a partnership with a biotech company to enhance its portfolio of medical foods targeted at managing rare diseases. This collaboration is part of the company’s strategy to expand its presence in specialized nutrition, reflecting the growing trend of developing targeted solutions for specific health conditions.

- Jan2024: Abbott launched PROTALITY brand aimed at supporting the nutritional needs of individuals with specific metabolic disorders. This move highlights the company’s continued commitment to expanding its medical food offerings to address growing healthcare demands.

Medical Foods Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Powder

- Pills

- Liquid

- Other

By Route of Administration (Revenue-USD Billion, 2020–2034)

- Oral

- Enteral

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Chronic Kidney Disease (CKD)

- Neurological Disorders

- Genetic Disorders

- Orphan Diseases

- Cancer

- Others

By Sales Channel Outlook (Revenue-USD Billion, 2020–2034)

- DTC Sales Channel

- Institutional Sales

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Foods Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 442.07 billion |

|

Market Size Value in 2025 |

USD 458.64 billion |

|

Revenue Forecast by 2034 |

USD 652.79 billion |

|

CAGR |

4.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The medical foods market size was valued at USD 442.07 billion in 2024 and is projected to grow to USD 652.79 billion by 2034.

The market is projected to register a CAGR of 4.0% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the medical foods market include Abbott Laboratories, Nestlé Health Science, Danone S.A., Fresenius Kabi, Mead Johnson Nutrition, and Reckitt Benckiser Group. Other significant companies are Baxter International, Targeted Medical Pharma, Vitaflo International, Medical Food Solutions, ProCare Health, GlaxoSmithKline, Herbalife Nutrition Ltd., and NuGo Nutrition.

The powder segment accounted for the larger share of the market in 2024.

Medical foods are specially formulated products designed to meet the nutritional needs of individuals with specific medical conditions or diseases. These products are intended for dietary management under the supervision of a healthcare professional. Unlike general foods or supplements, medical foods are tailored to address the nutritional deficiencies or imbalances associated with specific health conditions such as diabetes, chronic kidney disease, metabolic disorders, neurological diseases, and cancer. Medical foods can come in various forms, including powders, liquids, and pills, and are used as part of a comprehensive treatment plan to support health, improve symptoms, and enhance quality of life.

A few key trends in the market are described below: