Neurological Biomarkers Market Share, Size, Trends, Industry Analysis Report

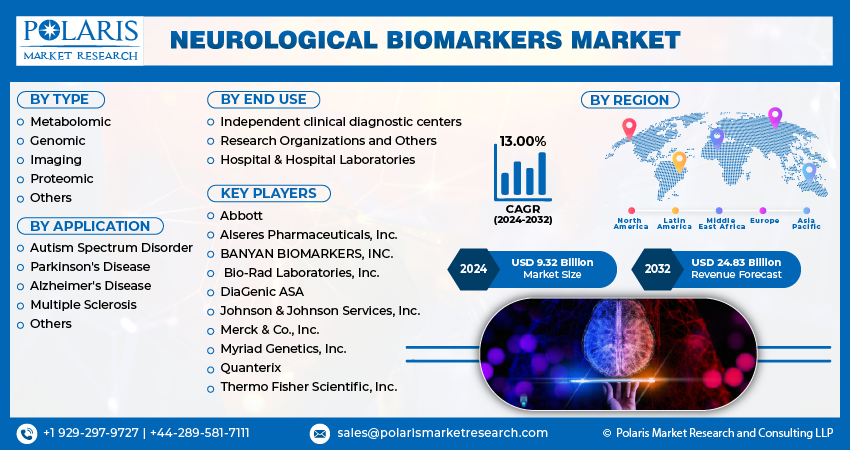

By Type (Metabolomic, Genomic, Imaging, Proteomic, Others); By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4022

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

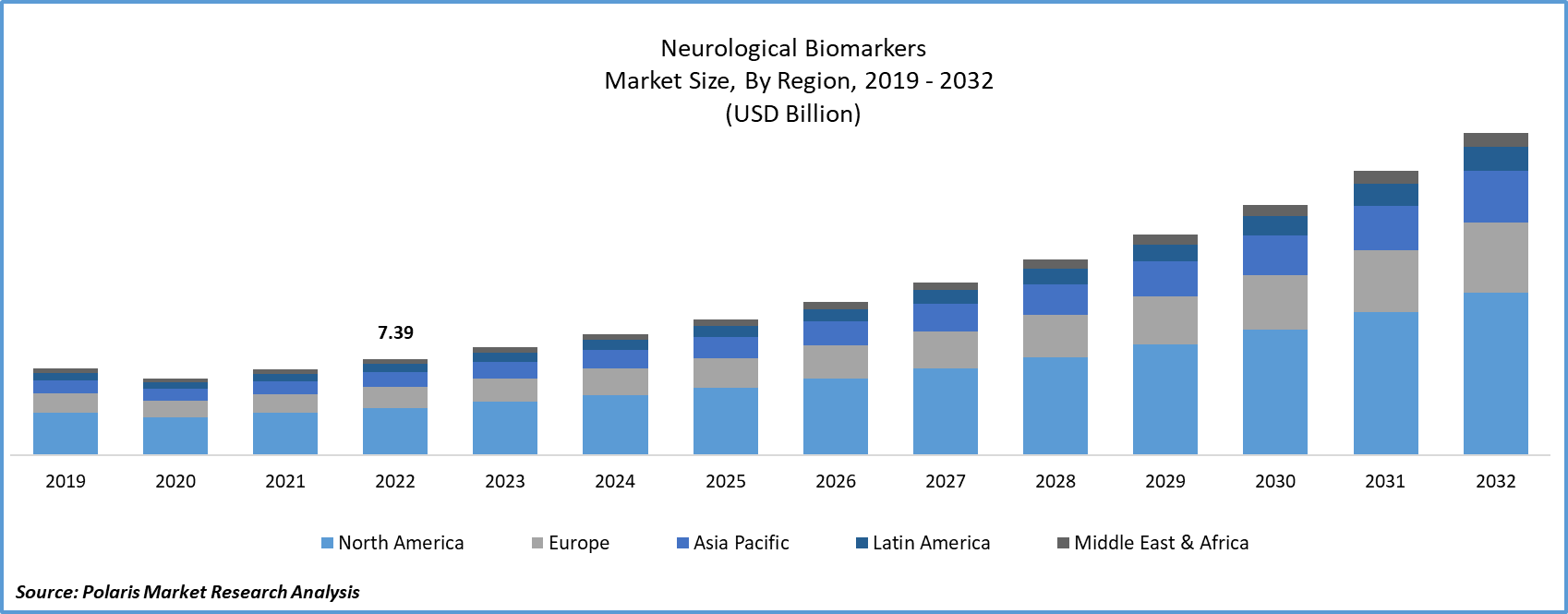

The global neurological biomarkers market was valued at USD 8.29 billion in 2023 and is expected to grow at a CAGR of 13.00% during the forecast period.

The research report offers a quantitative and qualitative analysis of the neurological biomarkers market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Neurological biomarkers are an identifiable compound primarily present in cerebrospinal (CSF) fluid when there has been brain damage. These biomarkers play a crucial role in the early drug development, diagnosis of neurological disorders, and the advancement of personalized medicine. Nevertheless, the continuous research and breakthroughs in the field of neurology have paved the way for innovative detection techniques and improved treatments for conditions like Schizophrenia, Parkinson's disease, Alzheimer's, and more.

To Understand More About this Research: Request a Free Sample Report

Several key factors projected to stimulate neurological biomarkers market growth include the rising incidence of neurological diseases, heightened awareness of the condition among both physicians and patients, as well as ongoing technological advancements, and increased research and development endeavors for the development of drugs to treat neurological disorders.

In a WHO article released in February 2023, it was reported that nearly 5 million individuals worldwide are diagnosed with epilepsy annually. The increasing prevalence of Alzheimer's disease in the elderly is expected to drive market growth. For instance, WHO notes that approximately 10 million new cases are reported globally each year, with an estimated 50 million individuals living with dementia. Furthermore, the Alzheimer's Association projects that by 2050, around 13.8 million people aged 65 and older are anticipated to be affected by Alzheimer's dementia. According to a WHO report in March 2023, it was estimated that approximately 55 million people worldwide are currently living with Alzheimer's dementia.

Additionally, the market is experiencing growth due to increased research and innovation in the diagnosis of Parkinson's disease through antigen-antibody binding techniques. For instance, as reported in a 2022 article by NCBI, the diagnosis of Parkinson's disease can be achieved by investigating the inhibitory effect of serum components on P450 inhibition assays employing immunoblotting analysis. This method demonstrates the ability of the P450 inhibition assay to distinguish between sera from healthy individuals and those from Parkinson's disease patients. Moreover, this technique is more straightforward and faster than other assays, as it doesn't require any prior treatment.

Blood-Based Biomarkers (BBBMs) play a pivotal role in selecting appropriate therapies and monitoring disease progression. This is exemplified by ongoing research endeavors and clinical studies conducted in hospitals to develop biomarker tests, which are expected to drive market growth further. For instance, the Fundació Institut de Recerca de l'Hospital de la Santa Creu i Sant Pau is researching circulating microparticles to create new biomarkers, including BBBMs, for neurological patient prognosis.

Industry Dynamics

Growth Drivers

Rising Incidence of Neurological Disorders

The growing prevalence of neurological disorders, including conditions like migraine, dementia, Alzheimer's disease, brain tumors, epilepsy, and others, is poised to drive market expansion. As an example, according to WHO, epilepsy results in approximately 13 million disability-adjusted life years and constitutes more than 0.5% of the global disease burden.

Furthermore, the increasing occurrence of Alzheimer's disease among older individuals is expected to contribute to market growth. For instance, WHO reports that globally, roughly 50 million people are affected by dementia, with around 10 million new cases reported annually. The development of therapeutics for neurological diseases has been challenging, primarily due to the presence of the blood-brain barrier. Additionally, the rising prevalence of neurological disorders highlights significant unmet medical needs. Consequently, there is a growing demand for biomarkers to support neurological disease drug development, diagnosis, and the study of disease progression.

Report Segmentation

The market is primarily segmented based on type, application, end-use, and region.

|

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Proteomic Segment Held the Largest Revenue Share in 2022

Proteomic biomarkers are essential, especially when mRNA expression alone cannot sufficiently reveal the functional implications of various post-translational modifications. In such instances, proteomic biomarkers become indispensable for accurately diagnosing the onset and progression of diseases by meticulously detecting protein signatures and post-translational changes. These biomarkers have proven highly effective in uncovering the cellular alterations underlying complex and unexplained conditions like Alzheimer's disease (AD). Notable proteomic biomarkers for AD encompass glial fibrillary acidic protein (GFAP), copper-zinc superoxide dismutase (SOD1), Aβ42, tau, and Aβ peptides. The continuous introduction of new products is anticipated to propel market growth.

Metabolomic biomarkers play a crucial role in identifying distinct metabolic pathways affected by disease progression or treatment. These biomarkers serve as indicators of the end products of ongoing biological processes within cells, tissues, and organs. Notable examples include choline, creatine, lactate, and NAAG, which find utility in epilepsy diagnosis. Glutamate and glutamine are essential for detecting cerebral stroke, prolonged seizures, mitochondrial encephalopathy, and neurodegenerative disorders. Furthermore, myoinositol is employed in Alzheimer's disease diagnosis. The pursuit of research endeavors aimed at enhancing diagnostic accuracy and comprehending the underlying mechanisms of conditions like amyotrophic lateral sclerosis (ALS) is poised to contribute to market growth.

By Application Analysis

The Alzheimer’s Disease Segment Accounted for the Highest Market Share in 2022

In 2022, Alzheimer's disease held the most substantial market share and is projected to maintain its dominance throughout the forecast period. This is primarily attributed to the increasing prevalence of the disease and the growing emphasis on early diagnosis and timely treatment. According to the Alzheimer's Association, the global population of individuals living with dementia is estimated at around 55 million, with projections indicating an increase to 98 million by 2030 and approximately 139 million by 2050. Additionally, in the United States, an estimated 6.5 million individuals were living with Alzheimer's disease in 2022.

The Parkinson's disease segment is anticipated to exhibit the most rapid CAGR over the forecast period. The increase in research and development efforts in the realm of biomarkers presents new prospects for Parkinson's therapeutics. As an example, an article published in Pharmaceutical Technology in October 2022 highlighted a research study that unveiled a novel cerebrospinal fluid biomarker for Parkinson's disease, expanding the potential range of drug targets. Consequently, neurological biomarkers are expected to pave the way for innovative avenues in Parkinson's disease treatment and are likely to steer market growth in the forecast period.

Regional Insights

North America Dominated the Largest Market in 2022

North America holds the most substantial stake in the global neurological biomarkers market and is projected to demonstrate a notable CAGR in the forecast period. The North American neurological biomarker market is poised for growth driven by multiple factors, including the prevalence of neurological disorders and an upswing in supportive government initiatives. Additionally, the market is expected to benefit from an increasing number of product introductions and a growing demand for biomarkers. Funding for the research and development of innovative biomarkers remains robust in the region.

The Asia-Pacific market is poised for growth, attributed to the escalation of clinical trials in emerging countries such as China and India, an increasing disease burden, and the rising demand for therapeutics targeting the central nervous system. Key drivers in the Asia-Pacific region are the growing disposable income, enhancements in healthcare infrastructure, and an expanding level of consumer awareness. Economic progress in this region is facilitating wider adoption of biomarkers. Moreover, the development of technologically advanced products aimed at reducing treatment costs and mortality rates is expected to stimulate market demand in the Asia-Pacific. The market in this region is further driven by the necessity for early diagnosis of neurodegenerative conditions, Point-of-Care (PoC) diagnostics, and personalized medicines, supported by the presence of key manufacturers and the demand for cost-effective testing and diagnostic solutions.

Prominent market players like Abbott, Merck & Co., Inc., General Electric Company, and Thermo Fisher Scientific, Inc. collectively command a significant market share. Additionally, the local presence of these leading companies is poised to enhance the accessibility of biomarkers within the region. The regional existence of regulatory bodies in North American countries is expected to promote the advancement of biomarker-based drug development further. This is largely due to their pivotal role in raising awareness among the public about the potential of biomarker-driven therapies in disease management.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Abbott

- Alseres Pharmaceuticals, Inc.

- BANYAN BIOMARKERS, INC.

- Bio-Rad Laboratories, Inc.

- DiaGenic ASA

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Myriad Genetics, Inc.

- Quanterix

- Thermo Fisher Scientific, Inc.

Recent Developments

- In February 2023, On Rare Disease Day, Ad Scientiam, a prominent figure in the realm of digital biomarkers, launch two bold undertakings aimed at creating and validating innovative digital biomarkers for the self-assessment of individuals suffering from widespread Chronic Neurological Diseases like myasthenia gravis (gMG) and neuromyelitis optica spectrum disorders (NMOSD).

- In July 2022, NeuroSense Therapeutics Ltd., a firm dedicated to developing remedies for severe neurodegenerative conditions, and NeuraLight, a company specializing in the creation of precise and responsive biomarkers for neurological disorders, have joined forces in a collaborative effort to advance the field of digital biomarkers for the identification and tracking of neurological diseases, including amyotrophic lateral sclerosis (ALS).

Neurological Biomarkers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.32 billion |

|

Revenue forecast in 2032 |

USD 24.83 billion |

|

CAGR |

13.00% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Browse Our Top Selling Reports

AI in Governance Market Size, Share 2024 Research Report

Location Intelligence Market Size, Share 2024 Research Report

Green Data Center Market Size, Share 2024 Research Report