Oral Transmucosal Drugs Market Share, Size, Trends, Industry Analysis Report

By Product Type (Tablets, Films), By Route of Administration, By Indication, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4439

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Market Outlook

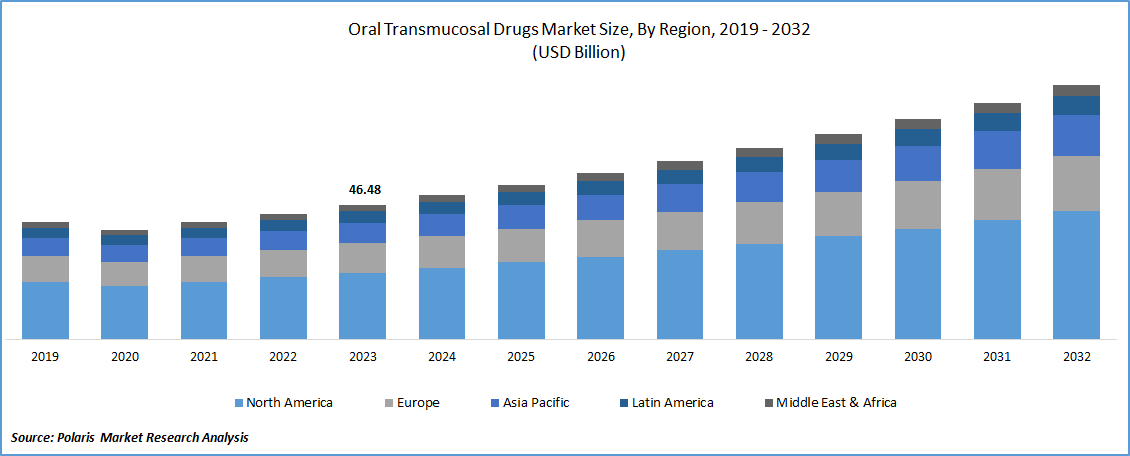

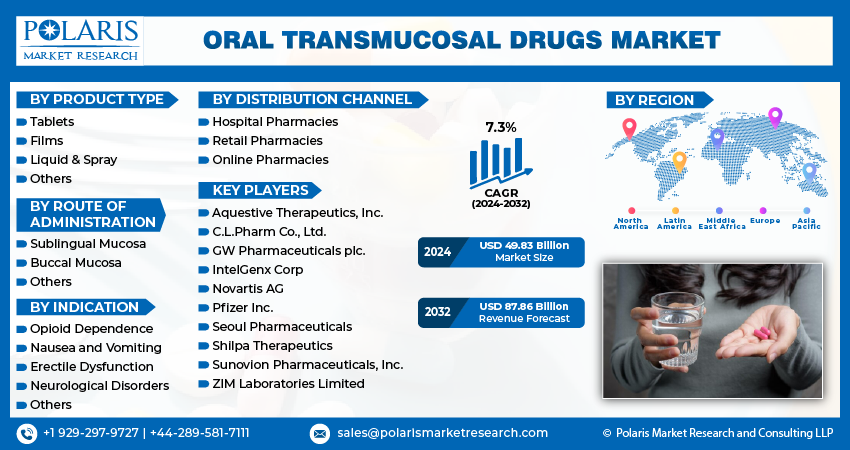

Oral Transmucosal Drugs Market size was valued at USD 46.48 billion in 2023. The market is anticipated to grow from USD 49.83 billion in 2024 to USD 87.86 billion by 2032, exhibiting the CAGR of 7.3% during the forecast period.

Market Overview

The increasing occurrence of autoimmune diseases, Parkinson's disease, and cancer is anticipated to propel the market forward. Both autoimmune diseases and Parkinson's disease have observed a notable rise in global prevalence, leading to an increased need for oral transmucosal medications. These medications are preferred for their ability to bypass gastrointestinal breakdown and provide swift therapeutic effects. For instance, as per the CDC's National Diabetes Statistics Report, the global prevalence of diabetes is estimated to reach 37.3 million cases in 2022, with approximately 11.3% of Americans, equivalent to 37.3 million individuals, affected by the condition. This significant diabetic population contributes to the growing demand for transmucosal medications, indicating substantial market growth potential.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the market is expected to expand as more individuals require these drugs, particularly opioids, for pain relief. According to the World Health Organization (WHO), in 2021, approximately 275 million people globally used medications, with around 62 million using opioids. This data underscores the growing demand for treatments that offer effective pain management, contributing to the overall growth of the oral transmucosal drugs market share. The continuous exploration of novel formulations and the increasing prevalence of conditions necessitating such drugs are key factors driving the expansion of this market.

Growth Drivers

Need for Rapid Drug Delivery Systems Drives the Market

Growth is driven by the increasing demand for effective and rapid drug delivery systems, especially for medications requiring quick absorption into the circulatory system. These drugs offer a more efficient route of administration, making them valuable for pain management and addressing specific medical conditions. Furthermore, advancements in pharmaceutical formulations and technology have enabled the development of innovative drug products, expanding their applications across numerous therapeutic areas. This growth is reflective of the continuous efforts in the pharmaceutical industry to enhance drug delivery methods, providing patients with more effective and convenient treatment options.

Strategic Product Launches

The anticipated growth in the oral transmucosal drugs market size is fueled by increased research efforts and the introduction of new products designed to address specific diseases. For instance, in June 2021, Shilpa Medicare launched a pediatric paracetamol oral thin film in the Indian sub-continent following the completion of clearance conditions. This highlights a focus on developing formulations that cater to specific patient demographics and medical needs.

Restraining Factors

Limited Applications

Despite the advantages associated with these routes of administration, they faced limitations, such as a mucus barrier, a relatively small surface area conducive to optimal drug absorption, and a limited volume of fluid available for drug dissolution. Consequently, transmucosal delivery was suitable for a smaller number of medications.

Report Segmentation

The market is primarily segmented based on product type, route of administration, Indication, distribution channel, and region.

|

By Product Type |

By Route of Administration |

By Indication |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Tablets Segment Held the Largest Share in 2023

The tablets segment held the largest revenue share in 2023. Tablets are a preferred form of medication administration due to their user-friendly nature, and patients are accustomed to using them. Innovations, such as rapidly dissolving tablets, have enhanced the convenience and efficiency of drug absorption. A research study published in the National Library of Medicine's journal in August 2021 highlighted that older adults, especially those on multiple medications, often experience reduced salivary output, increasing the risk of dental issues.

Tablets find widespread use in managing various medical conditions, including pain, and are prescribed by doctors in both clinical settings and for at-home use. The adaptability of the different types of drug formulations contributes to the popularity of tablets among drug manufacturers, establishing their dominance in the market.

Moreover, the surge in approvals for these oral transmucosal tablets is expected to fuel market growth. In May 2020, Breckenridge Pharmaceutical received approval from the FDA for its 5 mg Asenapine sublingual tablets—a product jointly developed by the Breckenridge Pharmaceutical & MSN Laboratories. These regulatory clearances are anticipated to contribute to the market's overall expansion.

By Indication Analysis

Opioid Dependence Segment Held the Largest Market Share in 2023

The opioid dependence segment accounted for the largest market share in 2023. This is due to the increasing prevalence of opioid addiction and the demand for advanced and effective treatments. A July 2023 research article from the NIH highlighted the growing challenges of opioid use disorder (OUD) and addiction across the world. The study revealed that approximately 3 Mn people in the U.S. and around 6 Mn globally have experienced OUD, with approximately 0.5 Mn people in the U.S. dependent on heroin.

Oral transmucosal drugs are proven effective in delivering medication to those with opioid dependence. These drugs facilitate quick drug absorption through the mucosa under the tongue, providing quick relief from the withdrawal symptoms, thereby reducing the risk of relapse.

By Route of Administration Analysis

Sublingual Drugs Registered a Significant Market Revenue Share in 2023

The sublingual drugs segment held a significant share in 2023, driven by its capability to provide faster and more efficient drug delivery compared to other methods. Sublingual drugs are absorbed via blood vessels with a rich blood supply and thin mucosa. This attribute makes these drugs suitable for acute conditions, such as pain. Ongoing advancements in research and technology within the industry are anticipated to sustain the dominance of the segment in the market.

By Distribution Channel Analysis

Hospital Pharmacies Segment Registered the Most Dominant Growth in 2023

The hospital pharmacies segment registered the dominant share in 2023. These pharmacies play a pivotal role in the distribution of medications, including oral transmucosal drugs, and provide essential pharmaceutical services. Healthcare professionals rely on hospital pharmacies to deliver medications to patients within a controlled and closely monitored environment. Serving a diverse patient population, including those with acute medical conditions, hospital pharmacies play a crucial role in addressing the medication requirements of such patients. This central role establishes hospital pharmacies as dominant distributors of oral transmucosal drugs.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North American region dominated the market in 2023. Region's growth is due to the high prevalence of target populations affected by conditions like Parkinson's, Alzheimer's, and dysphagia in the region. Additionally, the region benefits from the presence of an increasing geriatric population, which is more susceptible to these medical conditions. Furthermore, there is a robust willingness within the population to adopt innovative oral transmucosal drugs, contributing to the region's dominance in the market.

The region's growth is further bolstered by the proactive efforts of regional pharmaceutical companies and the availability of medications aimed at addressing opioid use disorders. The region has been particularly responsive to the ongoing global opioid use disorder and addiction crisis, with a focus on developing and providing effective treatment solutions. Notable developments, such as the acceptance of a new drug application for Libervant by the U.S. FDA in July 2021, indicate the region's commitment to advancing innovative therapies.

Key Market Players & Competitive Insights

The oral transmucosal drugs market industry exhibits a degree of fragmentation with a few major players, and it is expected to experience increased competition in the future. Ongoing developments, coupled with the growing approvals of drugs in the market, are fueling additional research activities among both companies and government institutions.

Some of the major players operating in the global market include:

- Aquestive Therapeutics, Inc.

- C.L.Pharm Co., Ltd.

- GW Pharmaceuticals plc.

- IntelGenx Corp

- Novartis AG

- Pfizer Inc.

- Seoul Pharmaceuticals

- Shilpa Therapeutics

- Sunovion Pharmaceuticals, Inc.

- ZIM Laboratories Limited

Recent Developments in the Industry

- In October 2023, atai Life Sciences has successfully concluded a Phase 1 study on VLS-01, an innovative oral trans-mucosal film (OTF) containing DMT. The study demonstrated that VLS-01 is well-tolerated and has a favorable safety profile in healthy participants.

Report Coverage

The Oral Transmucosal Drugs market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, route of administration, indication, distribution channel, and their futuristic growth opportunities.

Oral Transmucosal Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 49.83 billion |

|

Revenue forecast in 2032 |

USD 87.86 billion |

|

CAGR |

7.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Oral Transmucosal Drugs Market report covering key segments are product type, route of administration, Indication, distribution channel and region.

Oral Transmucosal Drugs Market Size Worth $ 82.99 Billion By 2032

oral transmucosal drugs market size is CAGR: 7.2% grow during the forecast period (2023-2032)

North America regions is leading the global market

Need for rapid drug delivery systems drives the market are the key driving factors in Oral Transmucosal Drugs Market