OTR Tires Market Size, Share, Trends, Industry Analysis Report

By Tire Type (Radial OTR Tires, Bias OTR Tires), By Equipment Type, By Material Type, By Rim Size, By Industry, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM2307

- Base Year: 2024

- Historical Data: 2020-2023

Overview

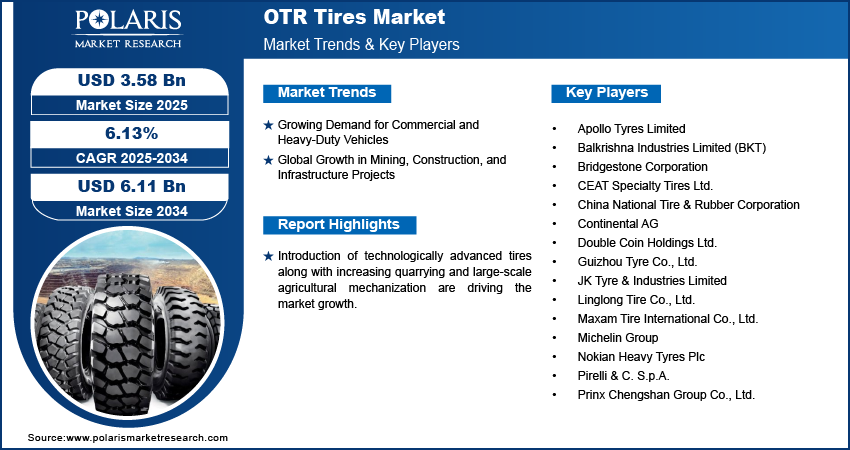

The global OTR Tires market size was valued at USD 3.37 billion in 2024, growing at a CAGR of 6.13% from 2025 to 2034. Growing demand for commercial and heavy-duty vehicles coupled with growing mining, construction, and infrastructure projects is propelling the market growth.

Key Insights

- The radial OTR tires segment dominated the market in 2024, fueled by better traction, fuel economy, and longer lifespan, making them suitable for construction and mining vehicles.

- Synthetic rubber contributed a large share in 2024 due to its hardness, load-carrying ability, and stable performance under extreme conditions.

- Asia Pacific led the OTR tire market in 2024, driven by accelerating industrialization and extensive infrastructure development in China, India, and Southeast Asia.

- India held significant market in Asia Pacific, propelled by increasing government spending on transportation, mining, and infrastructure development.

- North America projected to grow at a rapid pace during the forecast period, fueled by expansion of mining activity in the US and Canada.

- The U.S. dominated the regional market, driven by growing construction and infrastructure refurbishment projects, as well as higher investments in energy and mineral extraction.

- Key players operating in the market include Apollo Tyres Limited, Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Specialty Tires Ltd., China National Tire & Rubber Corporation (ChemChina), Continental AG, Double Coin Holdings Ltd., Guizhou Tyre Co., Ltd., JK Tyre & Industries Limited, Linglong Tire Co., Ltd., Maxam Tire International Co., Ltd., Michelin Group, Nokian Heavy Tyres Plc, Pirelli & C. S.p.A., and Prinx Chengshan Group Co., Ltd.

Industry Dynamics

- Commercial and heavy-duty vehicle demand is pushing the adoption of OTR tires, due to its critical application in construction, agriculture, and industrial work.

- Expansion of mining, construction, and infrastructure projects globally is driving demand for high-performance, long-lasting OTR tires.

- Raw material cost levels remain a major constraint, fueled by volatility in natural and synthetic rubber and reinforcing materials prices.

- IOT sensor integration in smart OTR tires presents opportunities for growth through real-time monitoring, predictive maintenance, and increased operational efficiency.

Market Statistics

- 2024 Market Size: USD 3.37 Billion

- 2034 Projected Market Size: USD 6.11 Billion

- CAGR (2025–2034): 6.13%

- Asia Pacific: Largest Market Share

The OTR (Off-The-Road) tires industry includes heavy-duty tires intended for use in demanding environments like construction sites, mines, agricultural fields, and industrial parks. The tires are engineered to provide superior traction, durability, and load-carrying capacity in adverse conditions. Developments in tire compounds, tread patterns, and pressure monitoring technology are enhancing performance, safety, and life. Increasing infrastructure construction, mining, and mechanization in farming are fueling worldwide demand for OTR tires in various industries.

The OTR (Off-the-Road) tires market is experiencing steady growth fueled by the availability of technologically advanced tires with enhanced traction, increased durability, and improved fuel efficiency. These technologies are capable of withstanding harsh working conditions while reducing downtime and operational expenses.

Rising excavating and mechanization of farming on a large scale are boosting the demand for OTR tires. The increasing adoption of heavy equipment for excavation, transportation, and material handling in earthmoving and mining sectors continues to drive robust replacement and aftermarket demand. According to the Construction Equipment Association as of May 2025 report, sales of construction and earthmoving equipment rose by 11% from March 2024, reflecting steady sectoral growth.

Drivers & Opportunities

Growing Demand for Commercial and Heavy-Duty Vehicles: The growth in construction, mining, and logistics activities is driving demand for commercial vehicles and heavy trucks with high-performance OTR tires. According to the International Energy Agency, electric bus sales worldwide exceeded 70,000 units in 2024, and electric medium- and heavy-duty truck sales crossed 90,000 units. This growth highlights the shift towards efficient, long-lasting environment friendly transportation thus fueling the market growth.

Global Growth in Mining, Construction, and Infrastructure Projects: The rapid infrastructure growth and mining development globally is also boosting the OTR tire market. As per Oxford Economics, global construction output is likely to grow from USD 9.7 trillion in 2022 to USD 13.9 trillion by the year 2037, propelled by urbanization and investment in green infrastructure projects in the major economies of the U.S., China, and India. This expanding pipeline of projects is driving long-term demand for high-durability OTR tires for tough terrain and heavy-duty applications.

Segmental Insights

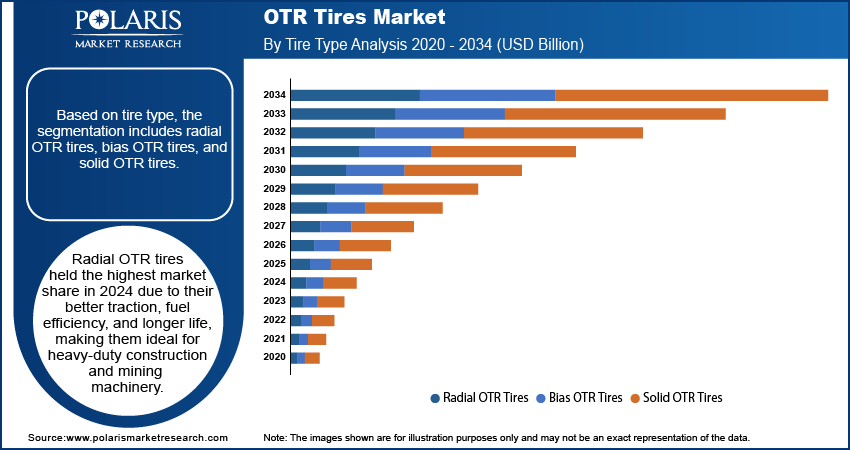

By Tire Type

Based on tire type, the OTR (Off-The-Road) tires market is segmented into radial OTR tires, bias OTR tires, and solid OTR tires. Radial OTR tires held the highest market share in 2024 due to their better traction, fuel efficiency, and longer life, making them ideal for heavy-duty construction and mining machinery.

Bias OTR tires are expected to witness rapid growth due to their strong build and cost-effectiveness, which make them a popular choice for use in severe terrains and short-distance utilization.

By Equipment Type

On the basis of equipment type, the market is categorized into earthmovers, loaders & dozers, dump trucks, tractors, forklifts, graders, and others. Earthmovers led the market share in 2024 due to extensive tire consumption in major mining and construction activities.

Loaders & dozers are anticipated to post fast growth with rising demand for material handling and excavation equipment driven by infrastructure development.

By Material Type

By material type, the market is divided into natural rubber, synthetic rubber, and reinforcing materials. Natural rubber accounted for a dominant share in 2024 propelled by its flexibility, resilience, and high-performance capability in harsh conditions.

Synthetic rubber is expected to post strong growth in the forecast period, owing to its uniform quality, durability, and capacity to carry heavy loads.

By Rim Size

Based on rim size, the market is segmented into below 31 inches, 31–40 inches, 41–45 inches, and above 45 inches. The 31–40 inches led the market in 2024 driven by its extensive adoption in loaders, dozers, and mid-sized earthmoving machinery.

The above 45 inches segment is anticipated to expand at a significant growth rate, fueled by the rising adoption of large dump trucks and heavy machinery in mining and quarrying activities.

By Industry

Based on industry, the OTR tires market is categorized under construction, mining, agriculture, industrial, port operations, and others. The construction industry dominated the market in 2024, due to rapid infrastructure development and urbanization activities across the globe.

The mining division is anticipated to grow steadily due to the increasing mineral mining activity and rising demand for tough, high-performance tires.

By Distribution Channel

Based on distribution channel, the market is segmented into OEM and aftermarket. The OEM segment held the largest share in 2024, driven by the growing production of construction and mining equipment across the world.

The aftermarket segment is expected to exhibit high growth during the forecast period, driven by replacement demand for tires that are worn out and regular maintenance of heavy-duty vehicles running in severe conditions.

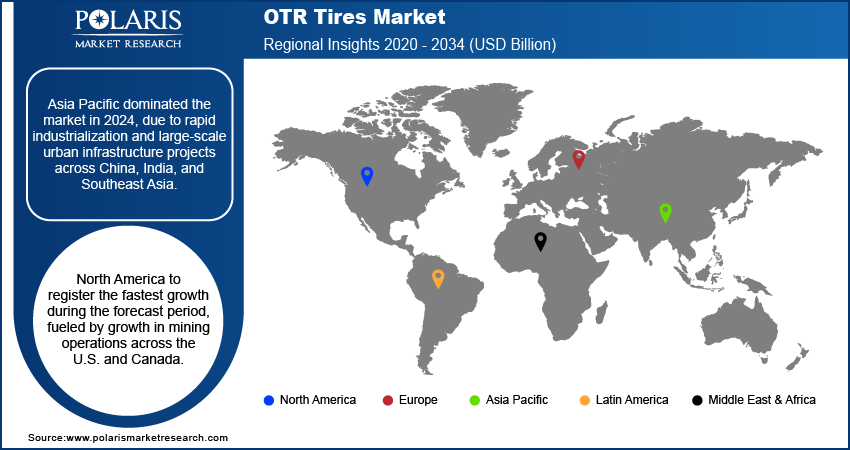

Regional Analysis

Asia Pacific dominated the OTR tire market due to fast pace industrialization and large-scale urban infrastructure development in China, India, and Southeast Asia. These developments are fueling robust demand for construction and earthmoving equipment, thus fueling the market growth. Growing mining and quarrying activities throughout the region are also driving market growth, as industries increasingly use heavy machinery that withstand rugged operating conditions.

India OTR Tires Market Overview

India dominated the market in Asia pacific, propelled by increasing government expenditures on transportation and infrastructure development, which in turn is boosting the deployment of heavy-duty construction equipment. According to the National Highways Authority of India (NHAI), high construction spending hit a record USD 29.26 billion in FY25, surpassing the annual target of USD 28.09 billion. This increase in construction activity is boosting the demand for long-lasting OTR tires.

North America OTR Tires Market Insights

North America is experiencing a fast growth in the OTR tire industry, driven by expansion in mining activities in the U.S. and Canada. The growth is creating robust demand for high-performance and durability-focused OTR tires. The region is experiencing accelerated adoption of radial tire technology, that provides greater traction, load capacity, and operating efficiency along with reduced downtime and maintenance expenses.

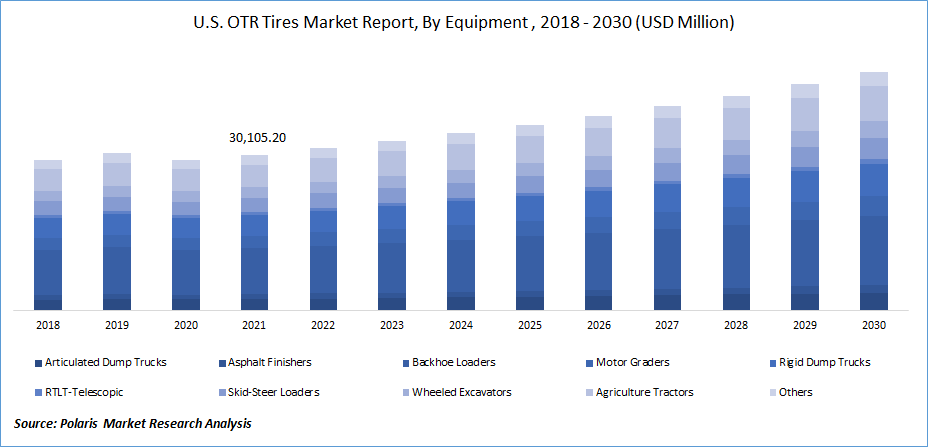

The U.S. OTR Tires Market Analysis

The U.S. is leading the market in North America, due to the growing construction and infrastructure upgrading projects, and increasing investment in energy and mineral mining. The Saudi Business Council Report states that the U.S. mining industry contributed about USD 85 billion to the national GDP in 2023, highlighting the ongoing importance of heavy-duty equipment in industrial production.

Europe OTR Tires Market Assessment

Europe held substantial market share in OTR tire. Growing investments in renewable energy infrastructure and urban development schemes are fueling steady demand for heavy-duty and construction vehicles, thereby accelerating the market growth. The European Commission's REPowerEU Plan, announced in 2022, projected the EU's share of renewable energy to 45% by 2030, spurring large-scale construction and mobilization of resources. This growth in projects coupled with innovation in tire materials and tread design, are further propelling the growth of the market.

Key Players & Competitive Analysis

The OTR (Off-the-Road) tires market is moderately competitive, with leading manufacturers focusing on developing high-durability, puncture-resistant, and fuel-efficient tire solutions for heavy-duty automotive vehicles used in mining, construction, and agriculture. Continuous investments in sustainable rubber compounds, smart tire monitoring technologies, and automated manufacturing processes are improving product performance, extending tire lifespan, and reducing operational costs. Strategic partnerships with OEMs and fleet operators are further strengthening distribution networks and expanding global market presence.

Key players in the global OTR tires market include Apollo Tyres Limited, Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Specialty Tires Ltd., China National Tire & Rubber Corporation (ChemChina), Continental AG, Double Coin Holdings Ltd., Guizhou Tyre Co., Ltd., JK Tyre & Industries Limited, Linglong Tire Co., Ltd., Maxam Tire International Co., Ltd., Michelin Group, Nokian Heavy Tyres Plc, Pirelli & C. S.p.A., and Prinx Chengshan Group Co., Ltd.

Key Players

- Apollo Tyres Limited

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- CEAT Specialty Tires Ltd.

- China National Tire & Rubber Corporation (ChemChina)

- Continental AG

- Double Coin Holdings Ltd.

- Guizhou Tyre Co., Ltd.

- JK Tyre & Industries Limited

- Linglong Tire Co., Ltd.

- Maxam Tire International Co., Ltd.

- Michelin Group

- Nokian Heavy Tyres Plc

- Pirelli & C. S.p.A.

- Prinx Chengshan Group Co., Ltd.

OTR Tires Industry Developments

In December 2024, JK Tyre & Industries launched a fresh set of Off-the-Road (OTR) tyres aimed at the mining sector during Bauma Conexpo 2024 in India. These tyres were engineered to deliver enhanced durability, improved performance in rugged terrains, and better operational efficiency attributes that are highly valued in mining operations.

In April 2025, ZC Rubber unveiled several new off-the-road (OTR) tires at the Bauma 2025 trade show under its Westlake and Tianli brands. The new tires were designed for heavy-duty use in challenging environments like mining, construction, forestry, and agriculture.

OTR Tires Market Segmentation

By Tire Type Outlook (Revenue, USD Billion, 2020–2034)

- Radial OTR Tires

- Bias OTR Tires

- Solid OTR Tires

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Earthmovers

- Loaders & Dozers

- Dump Trucks

- Tractors

- Forklifts

- Graders

- Others

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Natural Rubber

- Synthetic Rubber

- Reinforcing Materials

By Rim Size Outlook (Revenue, USD Billion, 2020–2034)

- Below 31 Inches

- 31–40 Inches

- 41–45 Inches

- Above 45 Inches

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Mining

- Agriculture

- Industrial

- Port Operations

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- OEM

- Aftermarket

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

OTR Tires Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.37 Billion |

|

Market Size in 2025 |

USD 3.58 Billion |

|

Revenue Forecast by 2034 |

USD 6.11 Billion |

|

CAGR |

6.13% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.37 billion in 2024 and is projected to grow to USD 6.11 billion by 2034.

The global market is projected to register a CAGR of 6.13% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Apollo Tyres Limited, Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Specialty Tires Ltd., China National Tire & Rubber Corporation (ChemChina), Continental AG, Double Coin Holdings Ltd., Guizhou Tyre Co., Ltd., JK Tyre & Industries Limited, Linglong Tire Co., Ltd., Maxam Tire International Co., Ltd., Michelin Group, Nokian Heavy Tyres Plc, Pirelli & C. S.p.A., and Prinx Chengshan Group Co., Ltd.

The radial OTR tires segment dominated the market revenue share in 2024.

The loaders & dozers segment is projected to witness the fastest growth during the forecast period.