Overhead Cables Market Share, Size, Trends, Industry Analysis Report

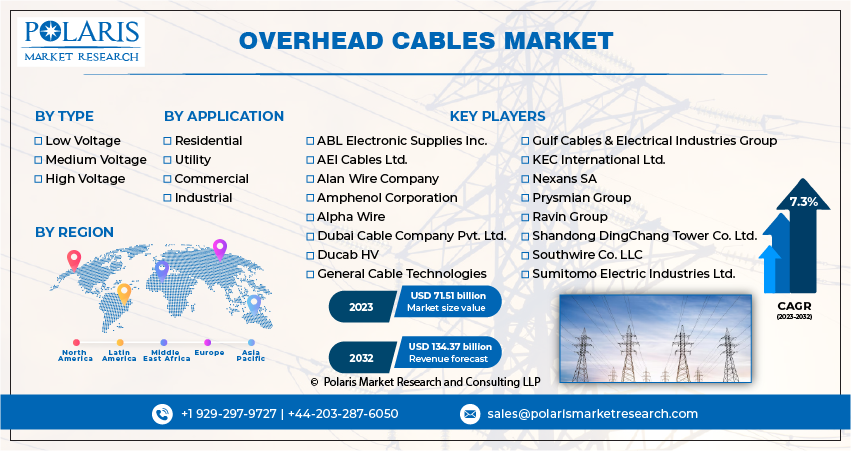

By Type (Low Voltage, Medium Voltage, and High Voltage); By Application; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 116

- Format: pdf

- Report ID: PM3802

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

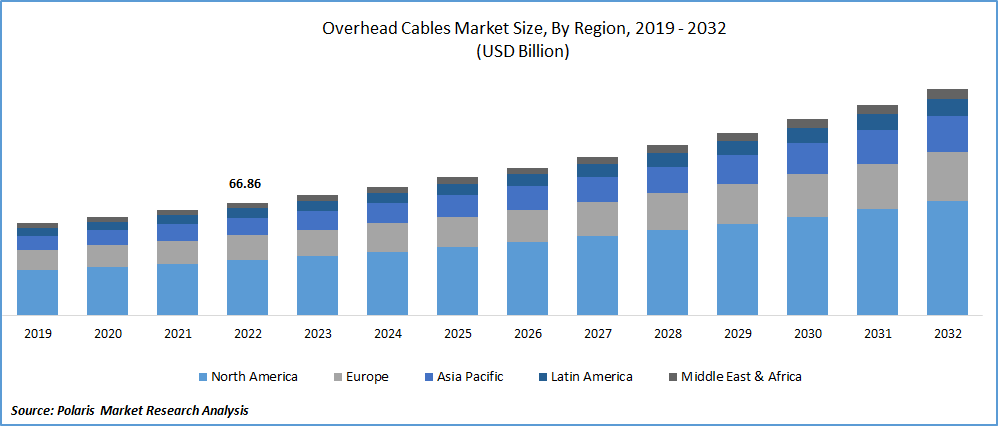

The global overhead cables market was valued at USD 66.86 billion in 2022 and is expected to grow at a CAGR of 7.3% during the forecast period.

Increasing people emphasis on clean and sustainable energy sources and continuous increase in the adoption of various renewable energy sources including solar and wind power along with the growing prevalence for reliable and high-speed communication networks, are the primary factors influencing the growth of the global market.

To Understand More About this Research: Request a Free Sample Report

In addition, the exponential rise in the adoption of electric vehicles globally, that necessitates the development of new advanced charging infrastructure and increased integration of several IoT devices into these cables, are likely to impact the market growth in a positive way.

- For instance, in December 2022, NKT, announced its new low-voltage power cable developed using low-carbon materials. The new cables are being manufactured with low-carbon aluminum and polyolefins at their manufacturing facility in Falun, Sweden, that is completely running on renewable electricity. With this project, the company strengthens its position in the sustainability efforts and become a key partner in the EU market.

Moreover, the rapid development of various types of advanced insulation materials such as cross-linked polyethylene and ethylene propylene rubber, which has significantly improved the durability and performance of overhead cables, increasing their resistance to environmental factors, and extending their operational life are likely to create huge growth potential for the market over the coming years.

However, the high initial investment costs associated with the installation of overhead cables infrastructure and emerging trend towards the undergrounding power transmission and distribution lines due to aesthetical and environmental reasons, are major restraints for the growth of the market.

- For instance, in July 2023, Kolkata Municipal Corporation, announced that they have decided not to accept any new applications for the laying of overhead cables even for telephone, internet, and television and will allow only to repair the existing overhead lines.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the overhead cables market. The emergence of the pandemic led to huge disruptions in manufacturing and supply chains worldwide, as countries have imposed restrictions on movement, lockdown measures, and trade restrictions, that largely affected the production and distribution of overhead cables. The pandemic also caused fluctuations in electricity demand patterns, as commercial establishments and industries were temporarily closed or operating at reduced capacities.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Rising demand for reliable power transmission

The ongoing need and demand for infrastructure development across the world including power transmission and distribution networks and large number of countries focusing on modernization and expansion of their infrastructure, that lead to higher demand and requirement for reliable and efficient power transmission solutions to supply energy flawlessly, are the leading factors driving the demand and growth of the global market.

Furthermore, the growing transition towards smart grids and grid modernization across the globe and incorporation of enhanced monitoring and communication capabilities into smart grids to enable real-time data exchange and efficient energy management coupled with the development of interconnection projects allowing overhead cable manufacturers and suppliers to participate in large-scale energy transmission projects, are further anticipated to create lucrative growth opportunities in the market.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

By Type Analysis

Low voltage segment accounted for the noteworthy market share in 2022

The low voltage segment accounted for significant share. The growth of the segment market can be largely accelerated to its widespread use and applications on both commercial and residential sectors, as it provides more reliable and energy-efficient power distribution along with cost-effectiveness, making them highly preferred among majority of the consumers globally. Beside this, the rapidly surging consumer inclination towards the renewable energy sources such as solar and wind power and significant expansion of global population, that requires the expansion of power distribution networks is also likely to propel the segment market. As low voltage overhead cables have become crucial or vital for connecting renewable energy sources to the grid and delivering the generated power to consumers, the demand for these cables have drastically increased.

The high voltage segment is expected to gain substantial growth rate over the anticipated period, mainly due to rising demand for electricity all over the world due to rapid urbanization, drastic population growth, and higher industrialization. Additionally, the aging power infrastructure in many countries leading to greater need for modernization and upgrades, and resulting in increased demand for high voltage cables due to its ability to cover long distances and cost-effectiveness.

By Application Analysis

Residential segment is expected to witness highest growth over forecast period

The residential segment is projected to grow at highest growth during the projected period, on account of surging rate of urbanization in countries like India, China, and Indonesia that lead to increased demand for residential infrastructure including power distribution networks to meet the rising electricity need and growing number of public initiatives focused on improving power distribution and increase access to electricity in residential areas. For instance, according to a report published by European Commission, the total consumption of final energy across the households represented approx. 27% of total final energy or 18% of gross inland energy consumption in the European Union.

The industrial segment led the industry market with considerable share both in terms of revenue and volume in 2022, that is largely accelerated to significant expansion of existing industrial units and the focus on the establishment of new industrial zones coupled with the increased number of companies expanding their operations, which require additional power supply infrastructure to cater to the increased energy needs.

Regional Insights

North America region dominated the global market in 2022

The North America region dominated the global market with substantial revenue share in 2022, and is projected to maintain its dominance throughout the study period. The regional market growth can be largely attributable to region’s increased demand and need for efficient and reliable power transmission systems and higher focus on government and large private organizations towards innovations and technological advancements. Moreover, growing government support for energy infrastructure projects and regulations promoting the use of efficient power transmission systems have also encouraged the adoption of overhead cables in the region.

Asia Pacific expected to grow at rapid pace, owing to rapid increase in the demand for electricity as a result of booming population across the region and higher implementation on various smart city projects with integrated and efficient power distribution systems coupled with the surging focus on modernizing the power grids in countries like China and India. For instance, according to our findings, the total energy consumption in India increased by over 9% in 2021 to Mtoe 951 and is surging rapidly over the last few years. The electricity consumption per capita also reached approx. 920 kWh in 2021, which almost accounts for a third of the Asian average.

Market Key Players & Competitive Insight

The global overhead cables market is highly competitive, with a diverse range of key players vying for market share. Established companies such as Prysmian Group, Nexans SA, and Sumitomo Electric Industries Ltd. leverage their extensive industry experience and global presence to maintain competitive advantages. The competition in this market is driven by technological advancements, regulatory compliance, and the ability to offer reliable and efficient power transmission solutions to meet the evolving needs of infrastructure development and modernization worldwide.

Some of the major players operating in the global market include:

- ABL Electronic Supplies Inc.

- AEI Cables Ltd.

- Alan Wire Company

- Amphenol Corporation

- Alpha Wire

- Dubai Cable Company Pvt. Ltd.

- Ducab HV

- General Cable Technologies

- Gulf Cables & Electrical Industries Group

- KEC International Ltd.

- Nexans SA

- Prysmian Group

- Ravin Group

- Shandong DingChang Tower Co. Ltd.

- Southwire Co. LLC

- Sumitomo Electric Industries Ltd.

Recent Developments

- In March 2022, ACOME Group, expanded its range of ULW PIA approved 7 mm over-head cables with the launch of UND1344 cable, having a range of upto 48 fibers. The newly developed cable can be easily installed on the Openreach’s pole infrastructure network with higher flexibility for the network builders and also demonstrate the company’s innovative mindset for supporting telecom operators.

- In August 2022, TechLogix, unveiled its newly developed OSPFiber, that delivers a single fiber optic cable for the outdoor direct drop, burial, and aerial applications and is available in 2 strands, 6 strand, & 12 strand configurations. It is a cost-effective for outdoor ISP, broadband, & other network applications that comes with integrated quick strip technology enabling fast in-field termination.

Overhead Cables Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 71.51 billion |

|

Revenue forecast in 2032 |

USD 134.37 billion |

|

CAGR |

7.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The overhead cables market report covering key segments are type, application, and region.

Overhead Cables Market Size Worth $134.37 Billion By 2032.

The global overhead cables market is expected to grow at a CAGR of 7.3% during the forecast period.

North America is leading the global market.

key driving factors in overhead cables market are rising demand for reliable power transmission