Palm Sugar Market Share, Size, Trends, Industry Analysis Report

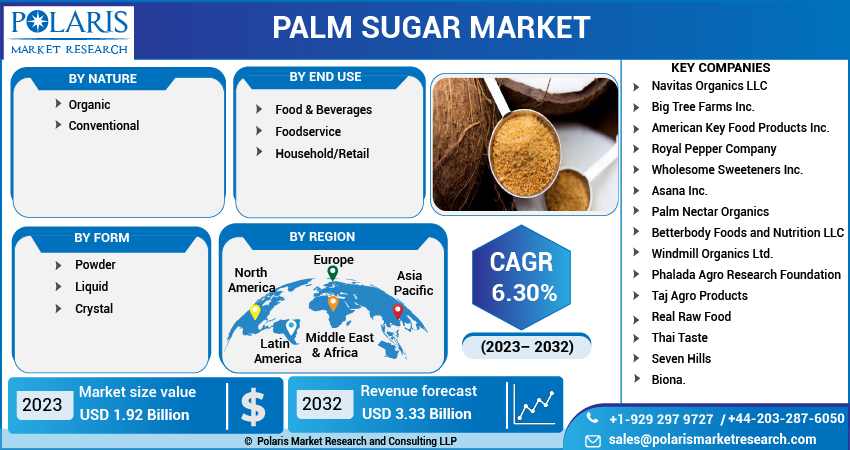

By Nature (Organic and Conventional); By Form; By End Use; By Region; Segment Forecast, 2023 – 2032

- Published Date:Aug-2023

- Pages: 119

- Format: PDF

- Report ID: PM3714

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

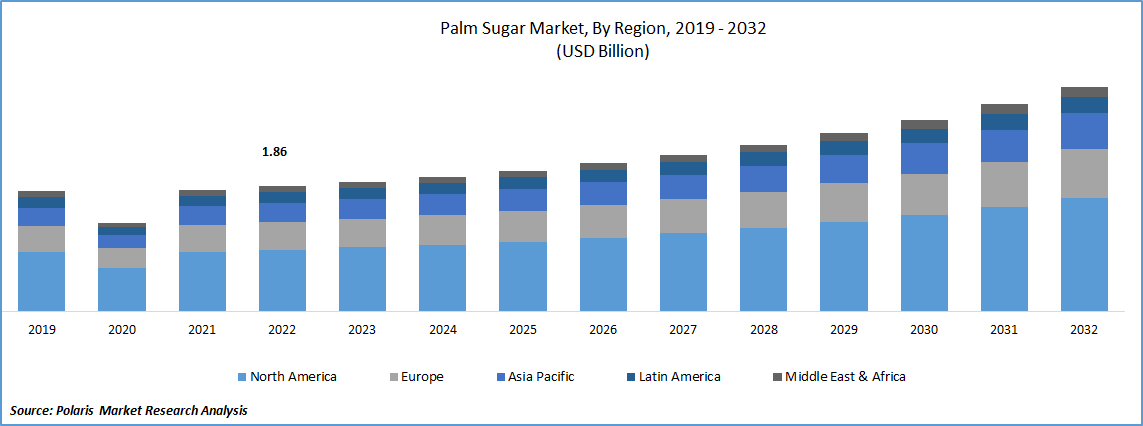

The global palm sugar market was valued at USD 1.86 billion in 2022 and is expected to grow at a CAGR of 6.30% during the forecast period.

Increasing product demand from various industry including Food & beverage because of its low-calories compared to conventional sugars, changing consumer eating habits and preferences, higher awareness about the consumption of excess or significant amount of sugar, and growing availability of alternative sugar options like palm sugar, are among the primary factors fueling the market growth.

To Understand More About this Research: Request a Free Sample Report

Many businesses are exploring and developing new palm sugar-based products or incorporating palm sugar as an ingredient in existing food and beverage products, which include items such as palm sugar-infused sauces, spreads, baked goods, beverages, and snacks, is positive influencing the global market.

- For instance, in March 2021, Phenolaeis, a leading supplier of sustainable palm fruit extract, announced the launch of its new functional chocolate, which is made of palm fruit extract and has added wellness benefits. The newly developed functional chocolate consists of 72% cacao and is ideal for the formulators, who are looking to launch healthier chocolate products with higher polyphenolic content.

Moreover, growing incorporation of automation technologies such as process automation systems and robotics, that can enhance efficiency and productivity in palm sugar production and popularity of data analytics tools enabling better decision-making by analyzing data related to production, quality control, inventory management, and market trends, which helps to optimize operations and improve overall business performance, is likely to have a positive impact on the global market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the palm sugar market. The rapid spread of deadly coronavirus resulted in signification restriction on trade activities and have implemented lockdowns and travel restrictions, which caused disruptions in the supply chains of agricultural products, including palm sugar, which largely affected the availability and distribution of palm sugar, leading to temporary shortages in some markets worldwide.

For Specific Research Requirements, Request for a Sample Report

Industry Dynamics

Growth Drivers

Increasing number of health-conscious people across the globe

Increasing number of health-conscious people across the globe who are seeking alternatives to refined sugar and emergence of palm sugar as a more natural and less processed sweetener compared to the refined sugar are major factors boosting the market growth at significant pace. Beside this, the rising globalization of different Asian cuisines including Thai, Chinese, and Indonesian and prevalence for the use of palm sugar in these recipes, have expanded its demand in the international markets.

Furthermore, major product manufacturers around the world are highly focusing and concentration on the innovations in palm sugar characteristics and uses, and are ensuring a enhanced nutritive value and healthier variety of product along with the surging number of initiatives taken by government about the associated health benefits of consuming palm sugar like reduced risks of diabetes, obesity and metabolic diseases, which in turn, propelling the demand and growth of the market.

Report Segmentation

The market is primarily segmented based on nature, form, end use, and region.

|

By Nature |

By Form |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Nature Analysis

Organic segment is expected to witness highest growth during forecast period

The organic segment is expected to grow at highest growth rate during the anticipated period, which is mainly driven by rapidly increasing demand for organic palm sugar among health-conscious consumers as a safer and convenient alternative to conventional sugar. In addition, the popularity of vegan and plant-based diets has grown drastically in the recent years, since palm sugar is a vegan-friendly sweetener and have various natural and unrefined characteristics, which makes it appealing to individuals following these dietary choices and creating huge growth potential in the market.

The conventional segment led the industry market with substantial revenue share in 2022, that is largely accelerated to higher demand and preference for traditionally grown palm trees as an effective and healthier sweetener option due to its lower glycemic index and the presence of essential nutrients. Conventional palm sugar is being widely used in various culinary applications such as desserts, beverages, sauces, and confectioneries, making it more attractive to chefs, food manufacturers, and consumers alike.

By Form Analysis

Powder segment held the significant market revenue share in 2022

The powder segment held the significant market share in terms of revenue in 2022, mainly due to its versatility of applications and it can easily blend well with several other ingredients and can also be used in baking, confectionery, desserts, beverages, sauces, and dressings. Additionally, powder-based palm sugar offers convenience and ease of use compared to other forms like solid blocks or liquid syrup, as it can be easily measured, stored, and incorporated into various recipes, which led to higher adoption of the product among consumers and food manufacturers globally.

The liquid segment is likely to exhibit substantial growth rate over the next coming years, because of the growing popularity of various ethnic cuisines in countries like Indonesia, Malaysia, and Thailand and high availability of essential minerals such as potassium, magnesium, and iron, along with small amounts of vitamins and antioxidants.

By End-Use Analysis

Food & beverage segment accounted for the largest market share in 2022

The food & beverage segment accounted for more than of global market share in 2022, and is projected to maintain its dominance throughout the study period, on account of higher consideration of palm sugar as a healthier substitute for refined sugar as it contains some of the nutrients present in the palm sap along with the continuous expansion of customer base for food & beverage products and their changing taste preferences towards the exotic flavors.

In the recent years, the food industry has been experiencing a drastic shift towards natural sweeteners due to concerns over the health effects of refined sugars and artificial sweeteners. Thus, the adoption of palm sugar with its natural and unrefined properties, that fits well within this trend, and driving its demand in various food and beverage applications.

The household/retail segment is anticipated to grow at significant growth rate over the projected period, mainly attributable to its widespread use in various traditional cuisines especially in the Southeast Asian countries and surge in the number of people opting for plant-based diet worldwide.

Regional Insights

The North America region dominated the global market in 2022

The North America region dominated the global market with considerable share in 2022, and is projected to maintain its dominance throughout the forecast period. The regional market growth can be largely accelerated to increased demand for organic and natural products, surging awareness of sustainable farming practices, and continuous rise in the population of vegan and vegetarians in countries like US and Canada and growing focus of manufacturers and producers towards introducing new palm sugar-based products to cater to evolving consumer preferences.

The Asia Pacific region is anticipated to be the fastest growing region with a healthy CAGR over the course of study period, owing to significant increase in population and rising awareness regarding the potential health benefits of consuming palm sugar and adverse health effects of traditional sugar. The increasing popularity of Asian cuisines and the growing use of palm sugar in international food manufacturing have created export opportunities for the region.

Key Market Players & Competitive Insights

The palm sugar market is highly competitive and is anticipated to witness competition due to several players' presence. Major players in the market are constantly upgrading their product lines to stay ahead of the competition. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- American Key Food Products

- Asana Inc.

- Betterbody Foods and Nutrition

- Biona.

- Big Tree Farms

- Navitas Organics

- Palm Nectar Organics

- Phalada Agro Research Foundation

- Real Raw Food

- Royal Pepper Company

- Seven Hills

- Taj Agro Products

- Thai Taste

- Windmill Organics

- Wholesome Sweeteners

Recent Developments

- In March 2022, Wingscorp, a major coffee maker in Indonesia, announced the launch of Top Café Palm Sugar Coffee in Philippines, to be available for customers at the WalterMart Supermarket. With this, the company has significantly expanded its market reach and broaden its customer base, resulting in higher revenues in the next years.

- In February 2021, HERZA Schokolade, announced the launch of their latest and new organic product line named “Inspired by nature” to meet the rising demand for sugar free alternatives like palm sugar. The newly launched product line mainly focuses on the chocolate pieces with a large amount of fruit components such as creamy milk chocolate with banana flakes.

Palm Sugar Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.92 billion |

|

Revenue forecast in 2030 |

USD 3.33 billion |

|

CAGR |

6.30% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Nature, By Form, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Navitas Organics LLC, Big Tree Farms Inc., American Key Food Products Inc., Royal Pepper Company, Wholesome Sweeteners Inc., Asana Inc., Palm Nectar Organics, Betterbody Foods and Nutrition LLC, Windmill Organics Ltd., Phalada Agro Research Foundation, Taj Agro Products, Real Raw Food, Thai Taste, Seven Hills, and Biona. |

FAQ's

The palm sugar market report covering key segments are nature, form, end use, and region.

Palm Sugar Market Size Worth $3.33 Billion by 2032.

The global palm sugar market is expected to grow at a CAGR of 6.30% during the forecast period.

North America is leading the global market.

key driving factors in palm sugar market are increasing number of health-conscious people