Passive Fire Protection Market Size, Share, Trends, Industry Analysis Report

By Product (Cementitious Materials, Intumescent Coatings, Fireproofing Cladding, and Others), By End-use Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6290

- Base Year: 2024

- Historical Data: 2020-2023

Overview

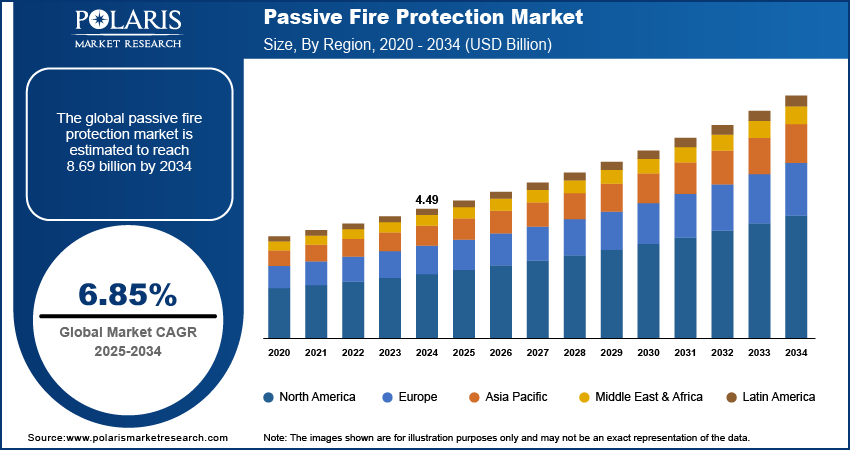

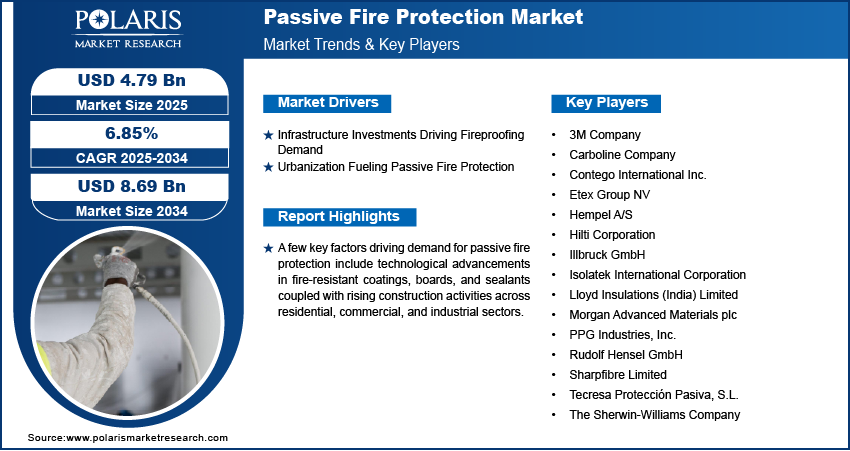

The global passive fire protection market size was valued at USD 4.49 billion in 2024, growing at a CAGR of 6.85% from 2025 to 2034. Key factors driving demand for passive fire protection include growing investments in infrastructure development coupled with rapid urbanization expanding demand for passive fire protection solutions.

Key Insights

- The cementitious materials segment dominated the market share in 2024.

- The oil & gas sector segment is projected to grow at a rapid pace in the coming years, due to the critical need for fireproofing in refineries, petrochemical plants, and offshore platforms to minimize the risk of catastrophic accidents.

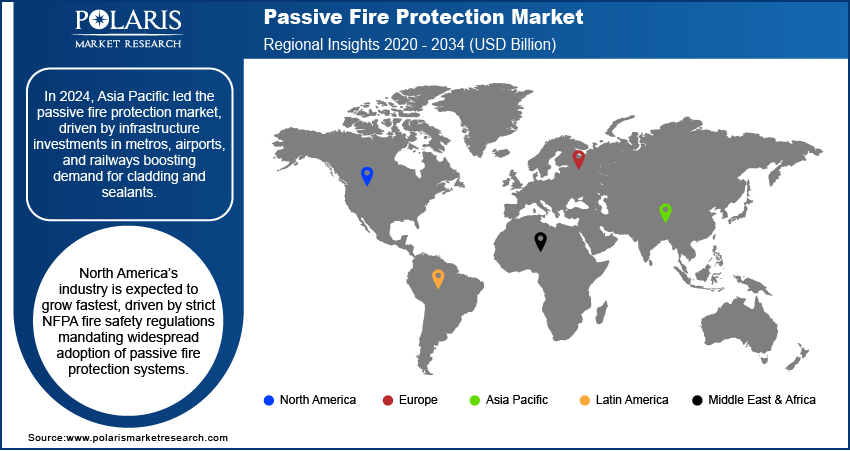

- The Asia Pacific passive fire protection market dominated the global market share in 2024.

- China passive fire protection market is growing, fueled by rapid urbanization and large-scale infrastructure development projects spanning commercial, residential, and industrial sectors.

- The market in North America is projected to grow at a fast pace from 2025-2034, driven by stringent fire safety regulations enforced by organizations such as NFPA (National Fire Protection Association), mandating the adoption of passive fire protection systems.

- The market in the U.S. is growing rapidly, owing to the modernization of aging infrastructure, including bridges, airports, and tunnels, boosting retrofitting projects that require passive fire protection solutions.

Industry Dynamics

- Growing investments in infrastructure development are driving demand for passive fire protection systems, as governments and private players focus on improving safety standards across commercial, residential, and industrial projects.

- Rapid urbanization is fueling adoption of passive fire protection solutions in modern infrastructure, with increasing construction of high-rise buildings, transport hubs, and industrial facilities requiring enhanced fire safety compliance.

- Eco-friendly and low-VOC fireproofing materials present significant opportunities for market growth, as sustainable construction practices and stringent environmental regulations push demand for green alternatives.

- High installation and maintenance costs continue to restrain market expansion. Budget constraints in small- and mid-scale projects limit the adoption of advanced fire protection solutions.

Market Statistics

- 2024 Market Size: USD 4.49 Billion

- 2034 Projected Market Size: USD 8.69 Billion

- CAGR (2025–2034): 6.85%

- Asia Pacific: Largest Market Share

The passive fire protection market comprises advanced materials and systems designed to contain and control the spread of fire, smoke, and heat within buildings and industrial facilities. Widely applied in commercial, residential, oil & gas, energy, and transportation sectors, passive fire protection ensures occupant safety, structural stability, and regulatory compliance. Innovations in fire-resistant coatings, boards, sealants, and intumescent materials are improving durability, efficiency, and installation flexibility. Offering reliability, low maintenance, and compatibility with modern construction practices, passive fire protection solutions support risk mitigation, enhance building resilience, and contribute to sustainable safety management.

Technological advancements in fire-resistant coatings, boards, and sealants are significantly enhancing the effectiveness, durability, and efficiency of passive fire protection solutions. Innovation in intumescent coatings, epoxy systems, and fire-retardant materials enables improved performance in terms of extended fire resistance, faster application, and better compatibility with modern construction practices. For instance, in March 2025, Hempel introduced Hempafire Extreme 550, a high-performance epoxy intumescent coating designed for cellulosic fires, providing up to four hours of fire resistance. Fully compliant with global standards such as EN 13381, BS 476, and AS 4100, this product demonstrates advanced formulations, that are addressing evolving fire safety equipment requirements in critical infrastructure. These developments are accelerating the adoption of passive fire protection systems in commercial, industrial, and energy-intensive environments.

Rising construction activities across residential, commercial, and industrial sectors are further fueling the demand for advanced passive fire protection materials and coatings. Expanding urbanization, coupled with large-scale investments in green infrastructure and smart city projects, is driving the integration of fire-resistant solutions into building designs. According to Oxford Economics, the global construction sector is projected to grow from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, with China, the US, and India leading this expansion. This rapid growth highlights the increasing importance of embedding fire safety measures into modern infrastructure, creating strong demand for passive fire protection providers to supply innovative, compliant, and sustainable solutions tailored for large-scale development projects.

Drivers & Opportunities

Growing Investments in Infrastructure Development Boosting Demand for Fireproofing Systems: Increasing global investments in infrastructure projects, including airports, railways, commercial complexes, and public facilities, are accelerating the adoption of advanced passive fire protection solutions. Fireproofing systems are integrated into structural components, coatings, and safety designs to ensure compliance with stringent building codes and safeguard public safety in high-density environments. For instance, in Australia, the four largest airports, Sydney, Melbourne, Brisbane, and Perth are collectively planning to invest nearly USD 20 billion into infrastructure upgrades over the next decade. According to the Australian Competition and Consumer Commission’s (ACCC) latest Airport Monitoring Report, these airports invested USD 985.1 million in aeronautical facilities in 2023–24, with Melbourne Airport alone accounting for USD 502.3 million. Such large-scale projects highlight the rising need for reliable fireproofing materials that enhance resilience and operational safety in critical infrastructure, thereby fueling market growth.

Rapid Urbanization Expanding Demand for Passive Fire Protection Solutions in Modern Infrastructure: The global trend of urbanization is fueling the demand for passive fire protection systems, owing to the expansion of cities along with new residential, commercial, and industrial spaces. Modern infrastructure projects increasingly require advanced fire-resistant coatings, boards, and sealants to protect occupants, ensure compliance with international safety standards, and reduce potential fire-related losses. According to a United Nations report, urbanization is projected to add an additional 2.5 billion people to urban areas by 2050, driven by the continued shift from rural to urban living. This demographic shift is boosting the demand for safe, sustainable, and fire-resilient buildings across rapidly growing economies, compelling governments and private developers to integrate robust passive fire protection solutions into large-scale construction projects.

Segmental Insights

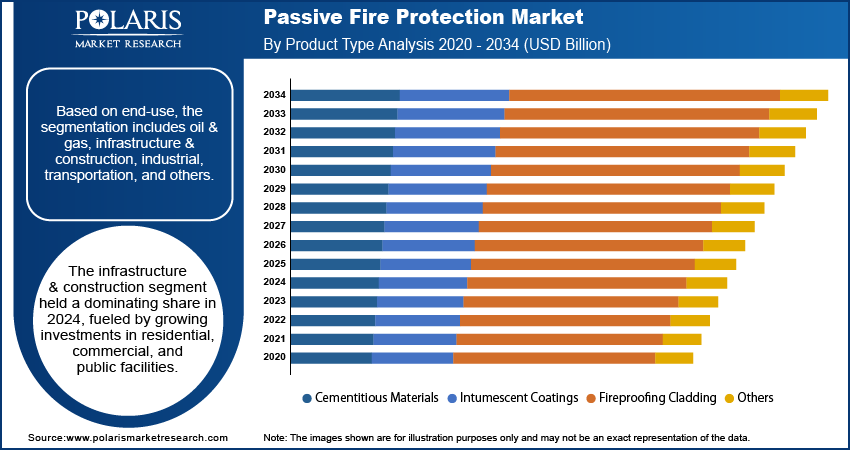

By Product

Based on product, the passive fire protection market is segmented into cementitious materials, intumescent coatings, fireproofing cladding, and others. Cementitious materials accounted for the largest share in 2024, attributed to cost-effectiveness, ease of application, and ability to provide durable fire resistance in structural steel and concrete. Widely used in commercial buildings, tunnels, and industrial facilities, cementitious coatings ensure compliance with stringent fire safety regulations while offering long-lasting protection against high temperatures.

Intumescent coatings are anticipated to witness substantial growth during the forecast period, driven by its superior aesthetic appeal, lightweight properties, and expanding adoption in modern infrastructure. These coatings expand when exposed to heat, forming an insulating char layer that protects structural components such as beams, columns, and floors from fire damage. Increasing usage in airports, railways, and high-rise buildings is further strengthening the growth of this segment.

By End-Use Industry

Based on end-use industry, the passive fire protection market is categorized into oil & gas, infrastructure & construction, industrial, transportation, and others. The infrastructure & construction segment dominated the market in 2024, fueled by growing investments in residential, commercial, and public facilities. Rising urbanization and stricter building codes are driving the integration of passive fire protection systems into new construction projects to safeguard occupants and ensure structural resilience.

The oil & gas sector is expected to remain a significant consumer of passive fire protection, due to the critical need for fireproofing in refineries, petrochemical plants, and offshore platforms to minimize the risk of catastrophic accidents. Cementitious coatings, fireproofing cladding, and intumescent systems are widely used to enhance safety in extreme environments and comply with international fire protection standards.

Regional Analysis

The Asia Pacific passive fire protection market held the largest market share in 2024, driven by rising investments in transportation infrastructure, including metros, airports, and railways, accelerating the demand for fireproof cladding and sealants. The increasing frequency of fire accidents in high-density urban areas is compelling authorities and developers to prioritize passive fire protection in construction projects. Rapid expansion of manufacturing facilities, commercial complexes, and residential developments across the region is generating strong demand for intumescent coatings, fire-resistant boards, and protective sealants to ensure occupant safety and regulatory compliance.

China Passive Fire Protection Market Overview

China passive fire protection market held the largest share, fueled by rapid urbanization and large-scale infrastructure development projects spanning commercial, residential, and industrial sectors. The National Bureau of Statistics indicates that China's urbanization ratio reached 67% in 2024, maintaining a pace of over 1 percentage point increase annually over the past 45 years, reflecting substantial construction activity requiring fireproofing solutions. The government's focus on smart city initiatives and stringent building safety codes is boosting the adoption of advanced passive fire protection systems across high-rise buildings, transportation hubs, and industrial facilities. Expanding petrochemical and manufacturing sectors are further driving demand for specialized fireproofing materials that provide enhanced thermal protection and structural integrity.

North America Passive Fire Protection Market Insights

The North America passive fire protection market projected to witness the fastest growth during the forecast period, driven by stringent fire safety regulations enforced by organizations such as NFPA (National Fire Protection Association), mandating the adoption of passive fire protection systems in commercial, industrial, and residential projects. Rising investments in oil & gas exploration and petrochemical industries in the US and Canada are fueling demand for cementitious coatings, intumescent paints, and fireproof cladding. The region's well-established construction industry, coupled with ongoing modernization of critical infrastructure, is further accelerating passive fire protection adoption across multiple applications.

The U.S. Passive Fire Protection Market Analysis

The U.S. passive fire protection market held significant share of the North America industry in 2024, owing to the modernization of aging infrastructure, including bridges, airports, and tunnels, boosting retrofitting projects that require passive fire protection solutions. The Council on Foreign Relations report as of 2023, indicates that the Infrastructure Investment and Jobs Act (IIJA) allocated USD 550 billion in new spending to upgrade physical infrastructure such as roads, bridges, railways, airports, and water systems, creating substantial opportunities for fire protection material suppliers. The increasing focus on energy-efficient buildings and green construction standards is propelling demand for eco-friendly intumescent coatings and sustainable fireproofing systems across the country.

Europe Passive Fire Protection Market Assessment

The Europe passive fire protection market held significant share globally, attributed to the strict enforcement of fire safety regulations such as EN standards and Eurocodes, driving compliance-led demand for advanced passive fire protection systems. The growing emphasis on sustainable, fire-resistant construction materials is boosting innovation in intumescent coatings and eco-friendly cladding solutions. Countries such as Germany, France, and the UK are leading in integrating comprehensive fire protection strategies across construction projects, ensuring adherence to stringent EU safety standards while meeting environmental sustainability targets. The region's focus on retrofitting older buildings to meet modern fire safety requirements is further propelling the growth of the market.

Key Players & Competitive Analysis

The global passive fire protection market is highly competitive, with leading companies such as 3M Company, Hilti Corporation, and PPG Industries, Inc. driving the industry through product innovation, capacity expansion, and strong distribution networks. 3M Company continues to strengthen its fire protection portfolio with advanced intumescent coatings and fireproof sealant solutions, while Hilti Corporation and PPG Industries, Inc. focus on enhancing production efficiency, expanding regional presence, and diversifying end-use applications across construction, oil & gas, and marine industries.

The market is experiencing rising adoption of passive fire protection systems in commercial, residential, and industrial applications, supported by growing demand for lightweight, durable, and code-compliant materials. Companies are developing high-performance intumescent coatings with improved fire resistance ratings, structural integrity, and application versatility to address the needs of building safety, petrochemical protection, and infrastructure projects. Strategic collaborations with construction contractors, oil & gas operators, and regulatory bodies are helping companies expand global footprint, while investments in sustainable fireproofing technologies and eco-friendly manufacturing practices are aligning production with green building standards.

Prominent companies operating in the passive fire protection market include 3M Company, Carboline Company, Contego International Inc., Etex Group NV, Hempel A/S, Hilti Corporation, Illbruck GmbH, Isolatek International Corporation, Lloyd Insulations (India) Limited, Morgan Advanced Materials plc, PPG Industries, Inc., Rudolf Hensel GmbH, Sharpfibre Limited, Tecresa Protección Pasiva, S.L., and The Sherwin-Williams Company.

Key Players

- 3M Company

- Carboline Company

- Contego International Inc.

- Etex Group NV

- Hempel A/S

- Hilti Corporation

- Illbruck GmbH

- Isolatek International Corporation

- Lloyd Insulations (India) Limited

- Morgan Advanced Materials plc

- PPG Industries, Inc.

- Rudolf Hensel GmbH

- Sharpfibre Limited

- Tecresa Protección Pasiva, S.L.

- The Sherwin-Williams Company

Passive Fire Protection Industry Developments

In January 2025, The Association for Specialist Fire Protection (ASFP) introduced a new membership category designed for manufacturers of passive fire protection products. The initiative is intended to enhance industry collaboration, improve product quality, and meet with ASFP’s mission to advance professionalism in fire safety.

In November 2024, Triangle Fire Systems announced the acquisition of Intrinsic Fire Protection to strengthen its footprint in the UK’s passive fire protection industry. This acquisition broadens Triangle’s service portfolio in sectors such as healthcare and housing.

Passive Fire Protection Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Cementitious Materials

- Intumescent Coatings

- Fireproofing Cladding

- Others

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Oil & Gas

- Infrastructure & Construction

- Industrial

- Transportation

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Passive Fire Protection Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.49 Billion |

|

Market Size in 2025 |

USD 4.79 Billion |

|

Revenue Forecast by 2034 |

USD 8.69 Billion |

|

CAGR |

6.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.49 billion in 2024 and is projected to grow to USD 8.69 billion by 2034.

The global market is projected to register a CAGR of 6.85% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are 3M Company, Carboline Company, Contego International Inc., Etex Group NV, Hempel A/S, Hilti Corporation, Illbruck GmbH, Isolatek International Corporation, Lloyd Insulations (India) Limited, Morgan Advanced Materials plc, PPG Industries, Inc., Rudolf Hensel GmbH, Sharpfibre Limited, Tecresa Protección Pasiva, S.L., and The Sherwin-Williams Company.

The cementitious materials segment dominated the market revenue share in 2024, attributed to cost-effectiveness, ease of application, and ability to provide durable fire resistance in structural steel and concrete.

The oil & gas sector segment is projected to witness the fastest growth during the forecast period, due to the critical need for fireproofing in refineries, petrochemical plants, and offshore platforms to minimize the risk of catastrophic accidents.