Pension Administration Software Market Share, Size, Trends, Industry Analysis Report

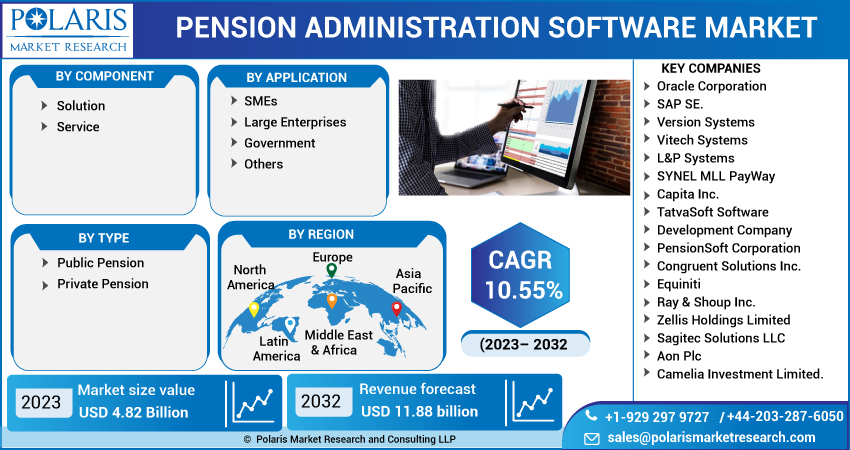

By Component (Solution and Service); By Type; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 116

- Format: PDF

- Report ID: PM3393

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

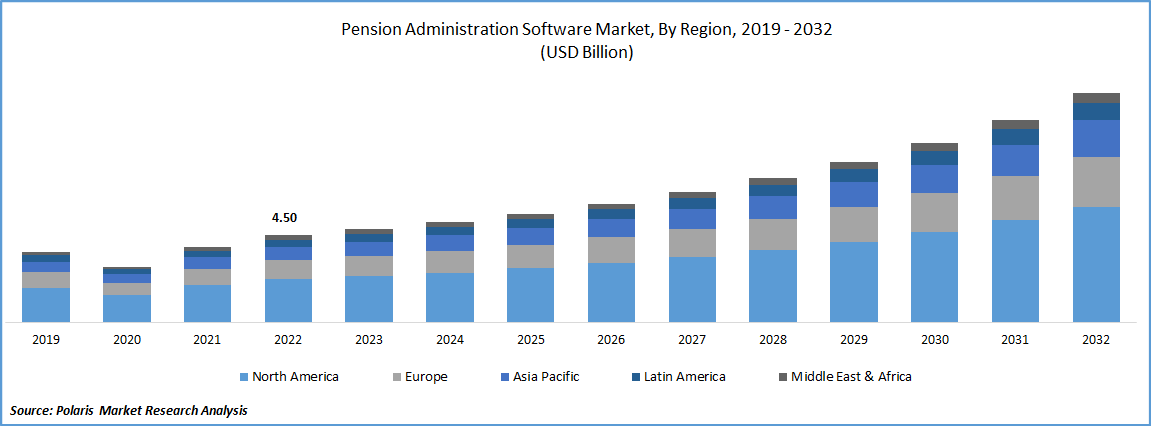

The global pension administration software market was valued at USD 4.50 billion in 2022 and is expected to grow at a CAGR of 10.55% during the forecast period. Rising demand and adoption of the solution/services across the global from small and medium-sized businesses, as increasing number of people becoming more and more aware regarding the advantages of utilizing such technological innovations coupled with the growing popularity of cloud-based solutions, are among the primary factors fueling the growth of the global market. In addition, the emerging trend for automations of these solutions that can efficiently assist firms in reducing the overall processing time while enhancing efficiency and accuracy along with the rising penetration among key companies for launching new and improved solutions, is also likely to boost the market growth. For instance, in July 2022, Smart, introduced new product “Keystone”, delivering retirement solutions. The new platform enables financial services organizations and governments to deliver 21st century technology.

To Understand More About this Research: Request a Free Sample Report

Moreover, with the growing use of artificial intelligence and machine learning, pension administration software is now able to automate routine tasks such as data entry, benefit calculations, and compliance monitoring, that has reduced the risk of errors and increased efficiency. Beside this, this software now comes with mobile apps that allow users to access their pension information on-the-go, that led to increased convenience for users worldwide.

The outbreak of the COVID-19 pandemic has positively impacted the growth of the pension administration software market. There has been significant rise in the demand for digital solutions to manage several kinds of remote work and pandemic has also accelerated the digitalization trends which makes the software more necessary and relevant than ever before. The spread of the pandemic has also increased the awareness for the need of secure and reliable technology solutions to manage the pension funds.

For Specific Research Requirements, Speak to Research Analyst

Industry Dynamics

Growth Drivers

The widespread adoption of the software across the globe, as it helps to reduce the overall process turnaround time by automating the pension process which usually takes longer time to do manually and help in streamlining several elements of day-to-day work and allow the team to focus their efforts and energy of crucial duties, which is expected to boost the demand and growth of the global market at rapid pace. Furthermore, the continuous rise in the number of small firms and technological improvements in the administration and management field and emerging popularity of delivering advanced services like convenient and quick pension plans with very few and reduced paper work is pushing the pension administration software market growth forward.

The growing popularity of accelerated digital pension platforms especially in developed economies, which can make services more enhanced and efficient for both employers and scheme members, has been supporting a collaborative and end-to-end approach. Improved online employer hubs will further allow administrators to easily collaborate online and solve issues quickly, that is resulting in significant product adoption.

Report Segmentation

The market is primarily segmented based on component, type, application, and region.

|

By Component |

By Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Solution segment accounted for the largest market share in 2022

Solution segment accounted for major global market share in 2022, and is likely to retain its market position over the forecasted period. The capabilities of these solutions to effectively improve productivity and reduce costs through the automation of various manual processes and also reduce the requirements for paper-based record keeping, which are the major factors propelling the segment market growth. In addition, the growing prevalence for using the software to easily communicate with plan participants including sending out the statements and alerts on plan modifications, that improve members satisfaction and communication, thereby boosting the market.

The services segment is anticipated to grow at significant growth rate during the forecast period, which is mainly driven by continuous rise in the number of retirees and growing need to efficiently manage large volumes of data and transactions, that could be managed or address by these services. Pension funds and other retirement plans have unique requirements that cannot be met or tailored by off-the-shelf software, as a result there is a emerging need for enhanced services that are well-positioned to meet the growing demand.

Public pension segment held the significant market revenue share in 2022

The public pension segment held the significant market share in terms of revenue in 2022, which can be highly attributable to their reliance and heavily regulated by government entities, which require pension administrators to comply with certain standards and reporting requirements, as it can help streamline compliance and reporting, that is making it an important factor in the public pension segment. Additionally, pension administrators are constantly looking for solutions that can help them to manage the growing volume of pensioners and associated data more conveniently, which in turn, has propelled the market in the recent years.

For instance, according to an article published by The Hindu, the active number of pensioners in India is approx. 77 lakhs as of February 2023, which is even more than the number of active personnel about 50-60 lakh. Currently, there are about 6,000 to 7,000 pensioners are in the age bracket of more than 100 yrs & nearly, 1 lac in 90-100 yrs age bracket.

Large enterprise segment is projected to witness highest growth during forecast period

The large enterprise segment is projected to grow at a higher CAGR during the anticipated period, mainly due to growing demand for these software tools as large enterprises have thousands of employees and beneficiaries, which means they need software that can handle large volumes of data and complex calculations. Moreover, large enterprises generate vast amounts of data and require data analytical solutions that led to increased demand for these types of software, as they can help companies analyze this data to identify trends and make informed decisions about their plans.

Asia Pacific region dominated the global market in 2022

Asia Pacific region dominated the global market. The growth of the regional market can be mainly attributed to increased aging population and growing prevalence of various retirement income possibilities especially among the medium and large-sized enterprises along with the significant expansion in the number of businesses providing private pension across the region.

North America region is expected to account for noteworthy growth rate over the next coming years, owing to rapid growth in the advancement in financial management and administration industry mainly because of the rising incorporation of modern technologies like machine learning, big data, cloud services, artificial intelligence, and blockchain among others. Additionally, the surge in the awareness regarding the availability of pension administration software among financial institutions and banks coupled with the growing penetration among FinTech companies to partner with regulatory bodies, are also likely to fuel the regional market growth over the coming years.

Competitive Insight

Some of the major players operating in the global market include Oracle Corporation, SAP, Version Systems, Vitech Systems, L&P Systems, SYNEL MLL PayWay, Capita Inc., TatvaSoft Software Development Company, PensionSoft Corporation, Congruent Solutions, Equiniti, Ray & Shoup, Zellis Holdings, Sagitec Solutions, Aon Plc, and Camelia Investment.

Recent Developments

- In January 2022, Visma Idella, announced the acquisition of ActuIT, a leading company providing software that simplifies communications about pensions, that will expand the company’s position in the Dutch pension landscape. With this acquisition, the company significantly expands is portfolio scope for pension, investment, and disbursement services, while implementing on several new financial tools for variety of financial services.

- In August 2021, Congruent Solutions, a leading retirement plan administration services provider, announced its plan to expand its footprint outside in the primary US market with the help of partnerships and collaborations. In the last few months, the company have signed up with two large system integrators who are widely preset in other geographies.

Pension Administration Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.82 billion |

|

Revenue forecast in 2032 |

USD 11.88 billion |

|

CAGR |

10.55% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Component, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Oracle Corporation, SAP SE. Version Systems, Vitech Systems, L&P Systems, SYNEL MLL PayWay, Capita Inc., TatvaSoft Software Development Company, PensionSoft Corporation, Congruent Solutions Inc., Equiniti, Ray & Shoup Inc., Zellis Holdings Limited, Sagitec Solutions LLC, Aon Plc, and Camelia Investment Limited. |

FAQ's

The pension administration software market report covering key segments are component, type, application, and region.

Pension Administration Software Market Size Worth $11.88 Billion By 2032

The global pension administration software market is expected to grow at a CAGR of 10.55% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in pension administration software market are pension administration software helps to reduce processing time.