Perfumes & Deodorants Market Share, Size, Trends, Industry Analysis Report

By Type (Perfumes and Deodorants); By Distribution Channel; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM2098

- Base Year: 2022

- Historical Data: 2019-2921

Report Outlook

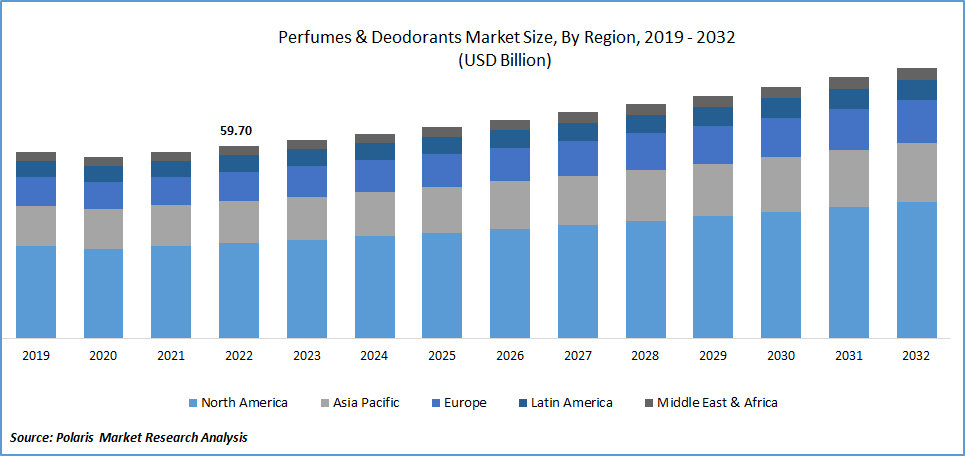

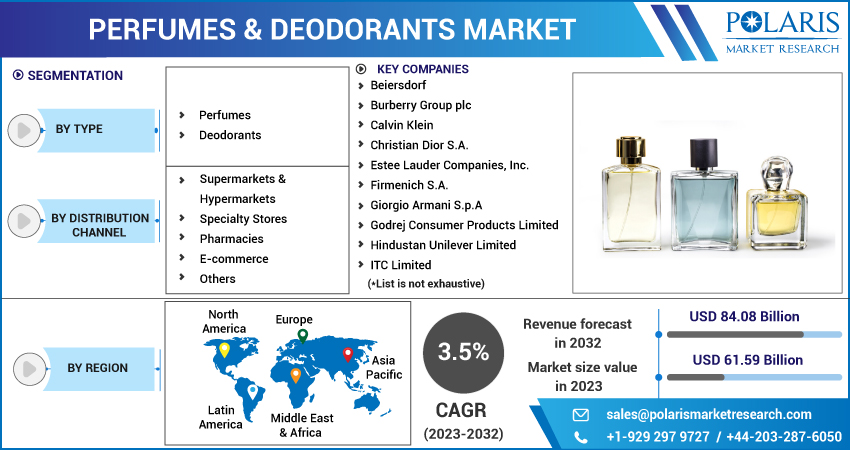

The global perfumes & deodorants market was valued at USD 59.70 billion in 2022 and is expected to grow at a CAGR of 3.5% during the forecast period.The industry is positively influenced by the factors such as advancement in the perfumes & deodorants such as anti-bacterial, novel aromas coupled with increasing disposable income, especially in emerging countries, which may drive the market worldwide.

To Understand More About this Research: Request a Free Sample Report

The perfumes and deodorants market is experiencing steady growth due to the increasing demand for fragrances that are cruelty-free. To meet the needs of the growing number of environmentally aware consumers worldwide who have adopted veganism, well-known brands in the fragrance industry are concentrating on developing new products.

In recent years, numerous perfume and deodorant brands have introduced vegan products for consumers of all ages. For instance, The Perfume Shop Limited, a perfume retailer based in the United Kingdom, launched a line of vegan perfumes in August 2019 featuring three brands: Amber Glow, Citrus Fresco, and Peppered Earth. Each perfume was certified as cruelty-free and vegan and packaged in 100% recyclable materials.

The widespread COVID-19 greatly impacts the personal care products industry in various aspects. The perfumes & deodorants industry is slowing down due to the need for raw materials availability, government restrictions such as lockdowns in various regions, and social distancing. However, the perfumes & deodorants market is growing considerably because it is considered an essential personal care product, mainly among millennials and Gen Z. Gradual reopening lockdowns and business industries may fuel the demand for the perfumes and deodorants market.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The perfumes & deodorants industry has seen significant development in recent years due to the growing expenditures on various platforms' promotion and advertisement activities. Leading players capitalize on numerous promotional activities to stimulate consumers' purchasing decisions. Moreover, product promotion by several celebrities’ endorsements and social media may encourage the adoption of perfume and deodorants, which are opted for by the vendors by implementing advertising policies.

Furthermore, increasing numbers of retailers for cosmetics and perfume on e-commerce platforms are using images and videos of perfumes & deodorants for accelerating global sales. Those retailers also present some modified scents and perfumes, which gain a huge consumer base. Therefore, dominating players in the perfumes and deodorants market increasingly participate in promotional activities for the digital platform's enticing population.

For instance, a dubbed cockpit is a tool industrialized by L’Oréal which evaluates the ROI and production efficiency of the company’s media investment at the actual time. This tool is developed with the cloud business Domo, which facilitates the detailed analysis of what is or is not working for every product manager or media owner.

Report Segmentation

The market is primarily segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

Deodorants segment accounted for the highest revenue generator in 2022

The deodorants segment was highest revenue generator in the overall perfumes & deodorants industry in 2022 and is projected to grasp its supremacy in the foreseeable future. The demand for perfumes & deodorants is rising because it is applied to the body to avoid unpleasant smells mainly caused by bacteria, especially in the armpits, feet, and groin, along with in several situations of vaginal secretion.

Antiperspirants are a variety of deodorants that are applied to a wide range of the body for blocking the sweat glands from preventing sweating. Thus, these benefits offered by this segment may fuel the perfumes & deodorants industry demand. Furthermore, deodorants are pocket-friendly that provide accessibility to large groups of people. In addition, increasing awareness for a physical workout or gyming also contributes to the global demand for perfumes and personal care products.

The perfume segment accounted for the fastest-growing returns over the forecast period. The adoption of perfume is increasing due to the rising inclination towards the luxury lifestyle and the escalating disposable income. In addition, numerous modifications by the manufacturers, such as the introduction of new fragrances using natural components, are more likely to gain huge traction among the population in the near future.

Hypermarket & Supermarket segment is projected to exhibit the fastest rate of growth

The hypermarket & supermarket segment is expected to record the topmost position in the market. It is projected to maintain its leading position during the estimated period. The segment continues as the top choice for offline shopping due to the physical selection of perfumes & deodorants. The diverse products offered by the numerous offline retailers may further propel the segment’s growth.

Furthermore, factors like rapid urbanization and growing spending on self-care goods & services present by the supermarkets/hypermarkets will boost the segment’s fortunes. The E-commerce segment is projected to record the highest CAGR over the forecasting years. The progression of online retail networks like Parfumdreams, Flaconi, Amazon, and Sephora is the major contributor to the segment growth. Moreover, the segment offers benefits such as convenience. It presents a certain discount on perfumes & deodorants, which may catalyze the segment growth in the upcoming years.

North America dominated the global market in 2022

North America is the largest contributor to revenue. The industry development is attributed to the accessibility of perfumes & deodorants with on-the-go transferability in the region. Also, the adoption of slightly scented spray across the region with leading manufacturers and growing marketing policies act as a catalyzing factor, which, in turn, leads the market development in the overall region in the near future.

Moreover, Europe is expected to project the highest CAGR in the forthcoming scenario. The demand for perfumes & deodorants is expected to increase due to the increasing expenditure power among the population on luxurious and premium personal care goods & services.

Also, increasing penetration of naturally derived products is another significant factor for the perfumes & deodorants market. Moreover, demand for pocket-size perfumes is also developing, contributing to the market progression in the forecasting period. Thus, these factors are gaining considerable eminence all over the region.

Competitive Insight

Some of the major players operating in the global perfumes & deodorants market include Beiersdorf, Burberry Group plc, Calvin Klein, Christian Dior S.A., Estee Lauder Companies, Inc., Firmenich S.A., Giorgio Armani S.p.A, Godrej Consumer Products Limited, Hindustan Unilever Limited, ITC Limited, J.K. HELENE CURTIS LTD, L'Oreal Group, LVMH, Marico Limited, McNroe Consumer Products Private Limited, Nivea India Private Limited, Revlon, Inc., VINI International, and Wipro Consumer Care & Lighting.

Recent Developments

In May of 2021, Unilever introduced a deodorant that was designed to cater specifically to individuals with disabilities

In April 2021, Revlon launched two new fragrances - Reign On and One Heart. Reign On is a playful and refreshing scent that complements the summertime atmosphere, while One Heart features lovely floral and musk notes that offer a sense of comfort.

Perfumes & Deodorants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 61.59 billion |

|

Revenue forecast in 2032 |

USD 84.08 billion |

|

CAGR |

3.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Beiersdorf, Burberry Group plc, Calvin Klein, Christian Dior S.A., Estee Lauder Companies, Inc., Firmenich S.A., Giorgio Armani S.p.A, Godrej Consumer Products Limited, Hindustan Unilever Limited, ITC Limited, J.K. HELENE CURTIS LTD, L'Oreal Group, LVMH, Marico Limited, McNroe Consumer Products Private Limited, Nivea India Private Limited, Revlon, Inc., VINI International, and Wipro Consumer Care & Lighting. |

FAQ's

The global perfumes & deodorants market size is expected to reach USD 84.08 billion by 2032.

Key Players in the perfumes & deodorants market are Beiersdorf, Burberry Group plc, Calvin Klein, Christian Dior S.A., Estee Lauder Companies, Inc.

North America contribute notably towards the global perfumes & deodorants market

The global perfumes & deodorants market expected to grow at a CAGR of 3.5% during the forecast period.

The perfumes & deodorants market report covering key segments are type, distribution channel, and region.