Peristaltic Pumps Market Size, Share, & Industry Analysis Report

: By Type (Tube Pump and Hose Pump), By Discharge Capacity, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5724

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

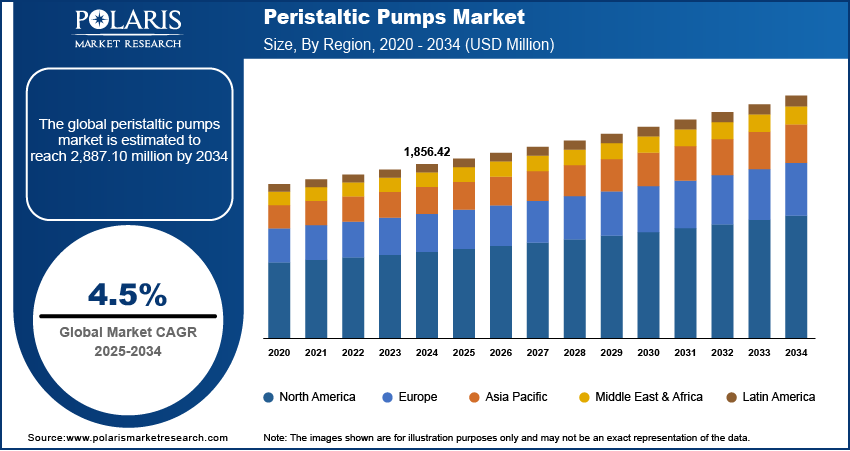

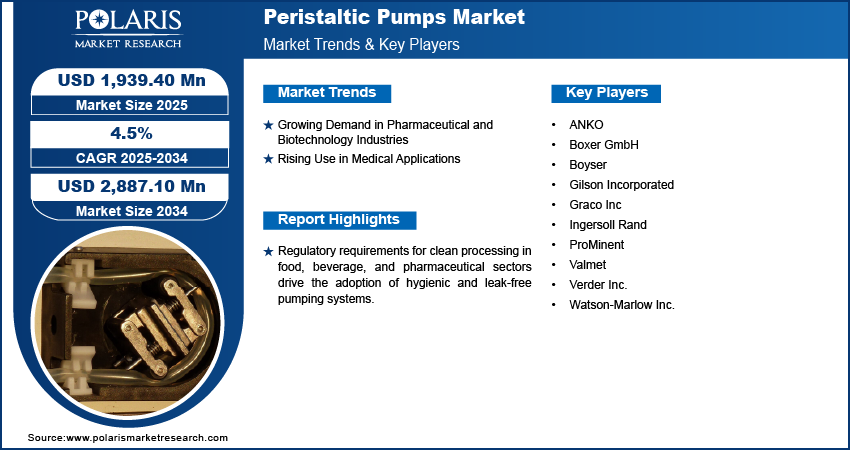

The global peristaltic pumps market size was valued at USD 1,856.42 million in 2024 and is projected to register a CAGR of 4.5% during 2025–2034. Growing infrastructure investments in municipal and industrial wastewater management boost demand for reliable and corrosion-resistant pumping solutions, such as peristaltic pumps.

Peristaltic pumps are a type of positive displacement pump used to move fluids through a flexible tube or hose. The fluid is contained within the tubing, and motion is created by rollers or shoes compressing the tube in sequence, creating a vacuum that draws fluid through the system. This design allows for gentle, pulse-free fluid transfer without exposing internal components to the fluid, making them ideal for handling sensitive, viscous, or abrasive liquids. They are widely used in industries such as healthcare (in dialysis machines), biotechnology, pharmaceuticals, water treatment, food & beverage, and chemical processing. Regulatory requirements for clean processing in food, beverage, and pharmaceutical sectors drive the adoption of hygienic and leak-free pumping systems.

To Understand More About this Research: Request a Free Sample Report

Innovations such as digitally controlled and smart peristaltic pumps with enhanced durability and precision improve efficiency and broaden application scope. Additionally, in chemical processing and agriculture, accurate dosing of additives, fertilizers, and reagents drives consistent demand for peristaltic pumps.

Industry Dynamics

Growing Demand in Pharmaceutical and Biotechnology Industries

The pharmaceutical and biotechnology sectors are increasingly relying on peristaltic pumps for fluid handling systems due to their contamination-free operation. According to the India Brand Equity Foundation, India's bio-economy is projected to reach USD 300 billion by 2030, and the biotechnology sector is anticipated to reach USD 150 billion by 2025, driven by advancements and increased investments in research and applications. These pumps ensure that sensitive fluids such as vaccines, biologics, and drug formulations remain isolated within the tubing, preventing cross-contamination. Their precision and reliability make them ideal for dosing, filtration, and chromatography processes. As R&D activities expand globally, especially in biopharma, the demand for sterile and repeatable fluid transfer solutions has surged. This growth is further driven by stricter regulatory standards requiring high hygiene levels, reinforcing the adoption of peristaltic pumps in critical manufacturing and lab environments in the pharmaceutical and biotechnology sectors.

Rising Use in Medical Applications

Peristaltic pumps play a crucial role in various medical devices due to their ability to handle sterile and shear-sensitive fluids with high accuracy. They are widely used in infusion therapy, dialysis machines, and blood processing equipment, where maintaining fluid integrity is essential. These pumps minimize the risk of contamination by ensuring that the fluid only contacts the tubing, which can be easily replaced. As healthcare facilities prioritize patient safety and precision in treatment delivery, the use of peristaltic pumps continues to grow. Their gentle pumping action also preserves the structure of biological fluids such as blood and plasma during medical procedures. For instance, High Purity New England offers the VerderFlex Vantage 5000 Peristaltic Pump from Verder Inc. to its bioprocessing solutions. Designed for low to medium flow rates and pressures, this pump is ideal for biopharmaceutical applications and is available for immediate deployment. The rising use in medical applications boosts the market expansion.

Segment Insights

Market Assessment by Type

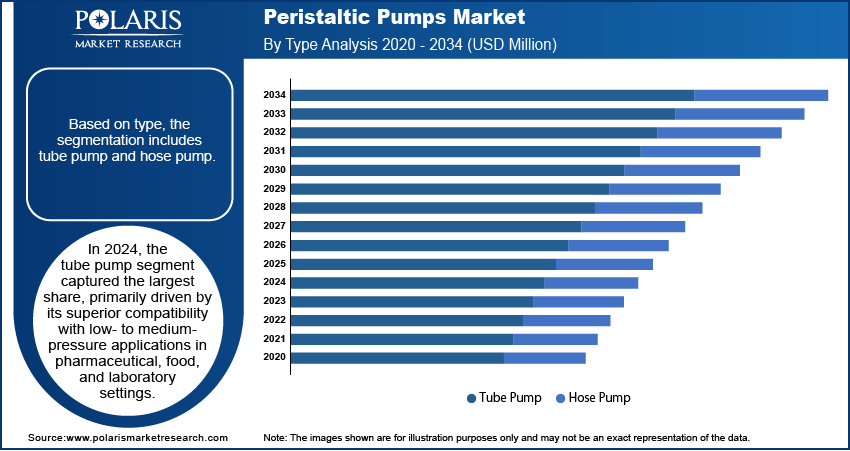

Based on type, the segmentation includes tube pump and hose pump. In 2024, the tube pump segment captured a larger share, primarily driven by its superior compatibility with low- to medium-pressure applications in pharmaceutical, food, and laboratory settings. Its ability to deliver precise, pulseless flow using flexible tubing systems made it a preferred solution for fluid metering, particularly in processes requiring contamination-free transfer. The growing implementation of single-use systems in biopharmaceutical production also accelerated demand for compact, modular tube pumps, as they integrate seamlessly with disposable fluid paths. In addition, cost-effectiveness, ease of maintenance, and reduced risk of shear damage to sensitive fluids further reinforced the segment's dominance across regulated industries.

The hose pump segment is projected to register a higher CAGR during the forecast period, supported by its ability to handle high-viscosity slurries and abrasive fluids in demanding industrial environments. Advanced elastomeric hose technologies and strengthened casing designs have enhanced durability and pressure ratings, enabling broader adoption in mining, chemical dosing, and wastewater treatment operations. These pumps offer extended service intervals and require minimal maintenance, making them ideal for continuous-duty applications. Rising preference for seal-less systems in aggressive media handling and the shift toward decentralizing fluid transfer in heavy-duty industries are key factors accelerating growth. Integration into process automation ecosystems is also improving pump efficiency and system uptime.

Market Assessment by Discharge Capacity

Based on discharge capacity, the segmentation includes up to 30 psi, 31 to 50 psi, 51 to 100 psi, 101 to 150 psi, and above 150 psi. In 2024, the up to 30 psi segment accounted for the largest share, largely due to its extensive utilization in life sciences, laboratory diagnostics, and precision dosing systems. These low-pressure configurations are well-suited for delicate fluids and are frequently used in closed-loop bioprocessing setups, where flow integrity and sterility are essential. Enhanced tube materials offering consistent compression characteristics, coupled with miniaturized motor drives, have strengthened their position in compact equipment. The demand for low-shear, pulsation-free pumping in analytical instruments and cleanroom environments continues to drive adoption, especially where flow accuracy outweighs pressure requirements.

The 51 to 100 psi segment is expected to grow significantly during the forecast period, driven by increasing deployment in semi-industrial and municipal applications requiring moderate pressure for efficient transfer of viscous fluids and chemical reagents. Advancements in tubing and hose durability, along with precise motor control systems, have expanded the operating envelope of peristaltic pumps in this pressure range. These systems are increasingly favored for their ability to provide high-performance pumping without seals or valves, reducing contamination risks and simplifying maintenance. Their use in flocculant dosing, polymer transfer, and industrial fluid blending reflects a shift toward reliable mid-pressure systems with improved throughput capabilities.

Market Evaluation by End Use

Based on end use, the segmentation includes pharmaceutical & medical, water & wastewater, food & beverage, chemicals, pulp & paper, and others. In 2024, the pharmaceutical & medical segment dominated the market, fueled by stringent sterility requirements and the expanding bio manufacturing landscape. The adoption of closed-loop, single-use systems in biologic drug production and vaccine development has accelerated demand for peristaltic pumps due to their ability to maintain product integrity and eliminate cross-contamination. Integration into modular and continuous processing setups, where cleanroom compliance and repeatable dosing are non-negotiable, has positioned these pumps as essential process components. Precision in low-volume dispensing, compatibility with a range of bioprocessing fluids, and increasing investments in personalized medicine and cell therapy manufacturing continue to reinforce segment leadership.

The water & wastewater segment is projected to experience significant growth during the forecast period. The growth is driven by increased infrastructure investments and stricter environmental regulations. Peristaltic pumps are gaining traction for their ability to dose treatment chemicals such as chlorine, flocculants, and pH adjusters with high accuracy and minimal operator intervention. The self-priming, dry-running capability, and abrasion-resistant design of hose pumps make them particularly effective in handling sludge, lime slurry, and grit-laden fluids. Utilities and municipal operators are increasingly transitioning to peristaltic technology due to lower total cost of ownership, simplified maintenance protocols, and the ability to maintain metering precision under fluctuating flow and pressure conditions.

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America peristaltic pumps market held a significant share due to robust pharmaceutical and biotechnology manufacturing infrastructure and sustained capital investments in advanced healthcare and laboratory technologies. Stringent regulatory standards in drug manufacturing and fluid handling have intensified the adoption of precision-engineered peristaltic pumps that comply with GMP and FDA requirements. Strong R&D activities in biopharmaceuticals and a well-established culture of single-use systems have boosted demand for contamination-free fluid transfer solutions. Market players in the region have actively pursued technological advancements in pump control systems and tubing materials, catering to evolving process automation requirements. Widespread adoption across water treatment, chemical processing, and food safety applications, combined with increasing replacement cycles in legacy equipment, continues to consolidate the region's leadership position. According to the US Environmental Protection Agency, in the US, wastewater treatment facilities manage around 34 billion gallons of wastewater daily. This volume highlights the increasing reliance on peristaltic pumps within water treatment processes, given their precision in fluid handling and capability to manage viscous and shear-sensitive materials effectively.

The Asia Pacific peristaltic pumps market is projected to register the highest CAGR during the forecast period, supported by rapid industrialization, expansion of pharmaceutical manufacturing hubs, and infrastructure investments in water treatment facilities. Rising healthcare expenditure and the push toward domestic vaccine and biologic drug production have spurred demand for sterile, scalable fluid handling systems. For instance, according to the India Brand Equity Foundation, India's vaccine market is set to grow from USD 2 billion to USD 5 billion in 2024 as both local and global pharmaceutical companies prioritize vaccines in their portfolios. By 2025, the market is projected to be valued at around USD 3.04 billion. Emerging economies in the region are modernizing their water and wastewater management systems, driving the uptake of peristaltic pumps in dosing and sludge handling. Advancements in localized manufacturing, rising awareness of hygienic process technologies, and cost-effective product offerings by regional manufacturers are further accelerating market expansion. Increasing automation across sectors such as food processing, chemicals, and diagnostics is boosting a favorable ecosystem for sustained peristaltic pump adoption.

The China peristaltic pumps market is expected to register the highest CAGR during the forecast period, fueled by extensive government support for biotechnology innovation and water infrastructure modernization. Accelerated production of biosimilar, generics, and traditional Chinese medicine formulations under aseptic conditions is increasing reliance on single-use, contamination-free pumping technologies. Expansion of pharmaceutical contract manufacturing organizations (CMOs) and the imposition of stringent environmental policies have pushed industries to adopt precision fluid handling systems for chemical metering and wastewater dosing. Local manufacturers are focusing on technology transfer and R&D collaborations to develop high-performance peristaltic pumps tailored to domestic process requirements. Growing emphasis on food safety standards and rapid deployment of medical diagnostics, particularly in rural healthcare expansion, are additional contributors to the market’s strong growth trajectory.

The Europe peristaltic pumps market is experiencing steady growth driven by regulatory alignment toward hygienic and environmentally sustainable industrial practices. Strong emphasis on circular economy models and resource-efficient technologies in sectors such as water treatment, pharmaceutical manufacturing, and food processing has elevated the demand for non-contact, energy-efficient pumping systems. Regional manufacturers are integrating digital monitoring capabilities and industrial IoT features into peristaltic pump designs to meet the needs of advanced process control and predictive maintenance. Adoption is further supported by a mature infrastructure for clinical diagnostics and biopharmaceutical innovation, particularly in Germany, Switzerland, and the Nordic countries. Compliance with stringent EU regulations concerning fluid purity and operational safety continues to be a core driver for investments in peristaltic pumping solutions.

Key Players and Competitive Analysis

The competitive landscape of the peristaltic pumps market is shaped by aggressive market expansion strategies, including joint ventures, strategic alliances, and targeted mergers and acquisitions aimed at consolidating distribution channels and strengthening regional footprints. Industry analysis indicates a growing emphasis on product differentiation through technology advancements such as intelligent flow control systems, IoT-enabled monitoring, and precision dosing capabilities. Companies are focusing on the development of high-performance tubing materials and enhanced pump head designs to cater to increasingly demanding applications across biopharmaceutical, water treatment, and chemical processing sectors. Post-merger integration has played a crucial role in streamlining product portfolios and aligning operational synergies to accelerate innovation cycles.

Launches of next-generation peristaltic pump solutions tailored to aseptic, shear-sensitive, and high-viscosity fluid handling have positioned players to capture market share in niche segments. The shift toward sustainable manufacturing practices and energy-efficient fluid transfer technologies is influencing corporate R&D investment strategies. Increasing demand for modular and automated peristaltic pump systems has prompted players to explore collaborative development models with OEMs and system integrators. Competitive dynamics are further driven by enhancements in digital service offerings, including remote diagnostics and predictive maintenance platforms, as the market evolves toward integrated, value-added pumping solutions across end-use industries.

List of Key Companies

- ANKO

- Boxer GmbH

- Boyser

- Gilson Incorporated

- Graco Inc

- Ingersoll Rand

- ProMinent

- Valmet

- Verder Inc.

- Watson-Marlow Inc.

Peristaltic Pumps Industry Developments

In November 2024, Netzsch launched an advanced peristaltic tube pump specifically designed to meet the requirements of high-precision dosing applications. This innovative pump offers enhanced performance and reliability for demanding processes, making it ideal for industries that require accurate and consistent fluid transfer.

In February 2024, Baoding Lead Fluid Technology Co., Ltd. launched its new generation of explosion-proof peristaltic pumps at the "Lead Fluid Explosion-Proof Series Product Launch Conference." These pumps are designed for superior safety and performance in hazardous environments, addressing the critical needs of industries at risk of explosions.

In January 2024, QED Environmental Systems, Inc., a manufacturer and subsidiary of Graco Inc., launched the MicroPurge MP100 peristaltic pump system, designed for efficient low-flow groundwater purging and sampling.

In November 2023, Verder Liquids launched the Verderflex Dura 60, a peristaltic pump designed for transferring abrasive slurries and highly viscous liquids, with a flow rate of up to 16.5 m³/hr.

Peristaltic Pumps Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Tube Pump

- Hose Pump

By Discharge Capacity Outlook (Revenue, USD Million, 2020–2034)

- Up to 30 psi

- 31 to 50 psi

- 51 to 100 psi

- 101 to 150 psi

- Above 150 psi

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical & Medical

- Water & Wastewater

- Food & Beverage

- Chemicals

- Pulp & Paper

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Peristaltic Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,856.42 million |

|

Market Size Value in 2025 |

USD 1,939.40 million |

|

Revenue Forecast by 2034 |

USD 2,887.10 million |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,856.42 million in 2024 and is projected to grow to USD 2,887.10 million by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

In 2024, North America held a significant share due to robust pharmaceutical and biotechnology manufacturing infrastructure and sustained capital investments in advanced healthcare and laboratory technologies.

A few of the key players include ANKO, Boxer GmbH, Boyser, Gilson Incorporated, Graco Inc., Ingersoll Rand, ProMinent, Valmet, Verder Inc., and Watson-Marlow Inc.

In 2024, the tube pump segment captured a larger share, primarily driven by its superior compatibility with low- to medium-pressure applications in pharmaceutical, food, and laboratory settings.

In 2024, the pharmaceutical & medical segment dominated the peristaltic pumps market, fueled by stringent sterility requirements and the expanding bio manufacturing landscape.