Permanent Magnet Motor Market Size, Share, Trends & Industry Analysis Report

: By Type (Permanent Magnet AC Motor, Permanent Magnet DC Motor, and Brushless DC Motor), By Power Rating, End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 128

- Format: PDF

- Report ID: PM5862

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

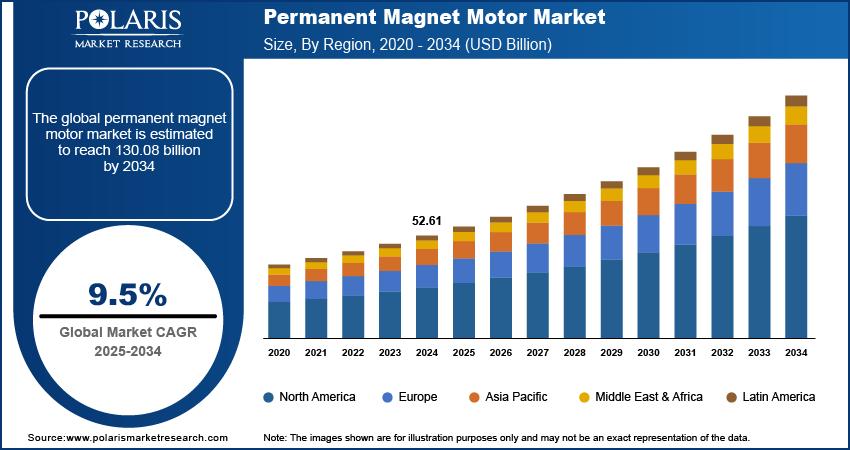

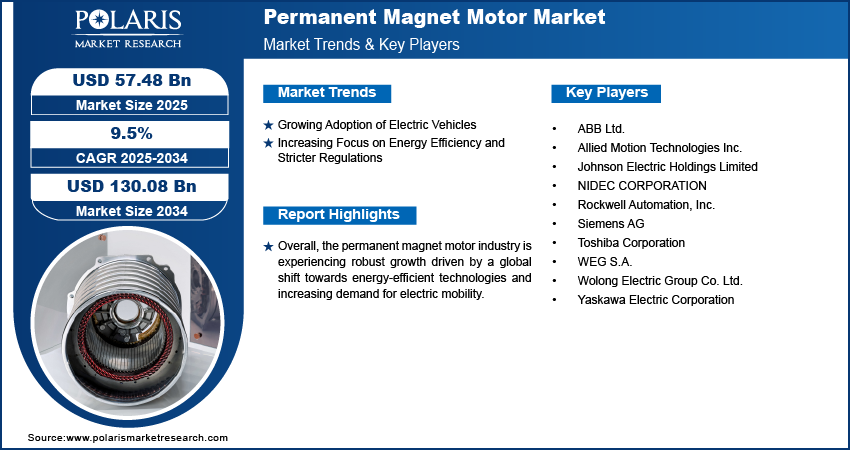

The global permanent magnet motor market size was valued at USD 52.61 billion in 2024, and is anticipated to grow at a CAGR of 9.5% from 2025 to 2034. The permanent magnet motor is seeing significant growth due to the rising demand for energy-efficient solutions across various sectors. Another major factor is the rapid increase in electric vehicle (EV) adoption worldwide.

The permanent magnet motor involves the production and sale of electric motors that use permanent magnets to create a magnetic field, rather than relying solely on electrical windings. These motors are known for their efficiency, compact size, and good performance across various applications.

Ongoing innovation in magnetic materials and manufacturing processes is significantly driving the growth. Researchers are continuously developing new magnet compositions that offer improved magnetic properties, such as higher flux density and better temperature stability, while sometimes reducing reliance on expensive rare-earth elements. These material advancements allow for the creation of even more compact, powerful, and efficient permanent magnet motors.

To Understand More About this Research: Request a Free Sample Report

The increasing adoption of robotics and advanced automation across diverse industries is a crucial driver. Permanent magnet motors are ideal for robotic applications and automated systems due to their precise control capabilities, high torque-to-inertia ratio, and compact design, which are essential for robotic arms, automated guided vehicles (AGVs), and other precision machinery.

Industry Dynamics

Growing Adoption of Electric Vehicles

The global push towards electric vehicles (EVs) is a primary force driving the demand for permanent magnet motors. These motors are highly valued in EV powertrains due to their superior efficiency, high power density, and compact size, all of which are essential for extending battery range and enhancing vehicle performance. As countries worldwide commit to reducing carbon emissions and promoting sustainable transportation, the production and sales of EVs are rapidly increasing.

For instance, the International Energy Agency (IEA) highlighted in their "Global EV Outlook 2024" report that worldwide electric car sales exceeded 10 million units in 2022. This significant rise in EV sales directly translates into a higher demand for permanent magnet motors. The efficiency and performance benefits offered by these motors make them the preferred choice for automakers looking to optimize their EV designs. This trend is substantially driving the growth of the permanent magnet motor.

Increasing Focus on Energy Efficiency and Stricter Regulations

There is a growing global emphasis on energy efficiency across industrial, commercial, and residential sectors. Permanent magnet motors are inherently more efficient than traditional motors, consuming less electricity to perform the same amount of work. This efficiency helps reduce operating costs and contributes to lower carbon footprints. Governments and regulatory bodies are implementing stricter energy efficiency standards for various equipment, further boosting the adoption of these motors.

For example, the U.S. Department of Energy (DOE) issued a direct final rule on June 1, 2023, for "Energy Conservation Standards for Electric Motors," with compliance required on and after June 1, 2027. These updated standards aim to improve the energy efficiency of electric motors, encouraging manufacturers and industries to adopt more efficient technologies like permanent magnet motors. Such regulations and the overall drive for energy savings are strongly contributing to the expansion.

Segmental Insights

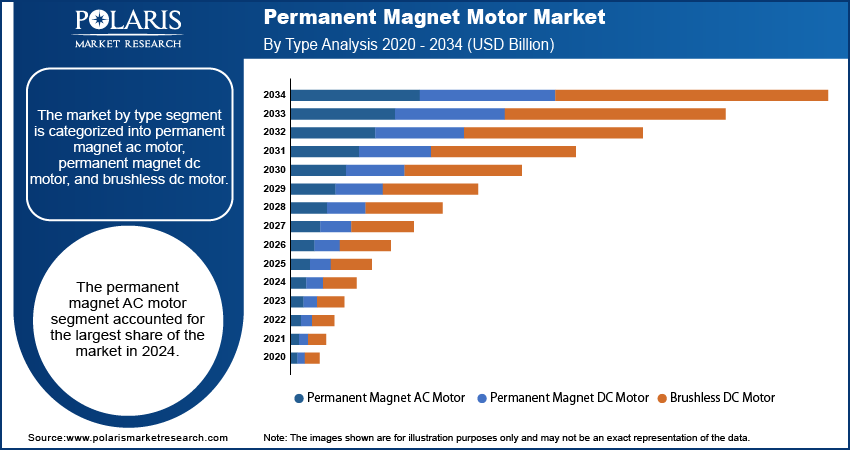

By Type

The permanent magnet AC motor segment held the largest share in 2024. These motors are widely adopted due to their high efficiency, superior torque output relative to their size, and excellent performance in situations where speed needs to be adjusted. They find extensive use in applications like electric vehicles, industrial automation systems, and heating, ventilation, and air conditioning (HVAC) systems, where both energy savings and precise control are very important. The continuous advancements in control technologies for these motors, along with efforts to reduce the cost of rare-earth magnets, have made them even more appealing for many different industries.

The brushless DC motor (BLDC) segment is anticipated to grow at the highest growth rate during the forecast period. BLDC motors offer advantages such as high reliability, long lifespan, and low maintenance, as they do not have brushes that wear out over time. This makes them highly suitable for a wide range of consumer electronics, automotive applications like electric power steering and braking systems, and various industrial machinery. For instance, the increasing integration of BLDC motors in robotics and drones for precise movement and energy efficiency further fuels their demand.

By Power Rating

Power rating of up to 25 KW held the largest share in 2024. This is primarily due to their widespread use across a diverse range of low to medium-duty applications. These smaller motors are essential components in consumer appliances like washing machines and vacuum cleaners, as well as in various electric hand tools and light industrial machinery. Their compact size and efficiency make them ideal for applications where space is limited and energy savings are important. The continuous integration of these motors into everyday household items and the growing adoption of small-scale automation contribute significantly to this segment's dominance.

The power ratings of 300 KW and above is anticipated to grow at the highest growth rate during the forecast period. This robust growth is largely driven by the increasing demand for high-power, high-efficiency solutions in heavy industrial applications, large-scale electric vehicles such as buses and trucks, and renewable energy systems like wind turbines. These powerful motors offer superior torque and efficiency, which are critical for demanding operations. For example, advancements in offshore wind turbine technology, often requiring motors in this power range, contribute to this trend. The ongoing global transition towards sustainable energy sources and the electrification of heavy transport sectors are key factors fueling the rapid expansion of this high-power segment.

By End Use Industry

The industrial sector held the largest share in 2024. This is because permanent magnet motors are widely adopted in various industrial applications that require high efficiency, precise control, and reliable performance. These motors are crucial in factory automation, robotics, pumps, fans, and material handling equipment. The ongoing push for Industry 4.0 and smart manufacturing across different countries further drives the demand for these advanced motor solutions in production lines and automated systems, where their energy-saving benefits and ability to operate continuously are highly valued.

The commercial and residential sector is anticipated to grow at the highest growth rate during the forecast period. This growth is fueled by increasing consumer awareness regarding energy efficiency and the growing adoption of smart appliances and HVAC systems. Permanent magnet motors are increasingly integrated into household appliances like washing machines, refrigerators, and air conditioners, as well as in commercial heating and cooling units, due to their quiet operation, compact size, and significant energy savings. The global emphasis on reducing energy consumption in buildings and the development of energy-efficient building codes are key factors propelling the rapid expansion of permanent magnet motor use in these environments.

Regional Analysis

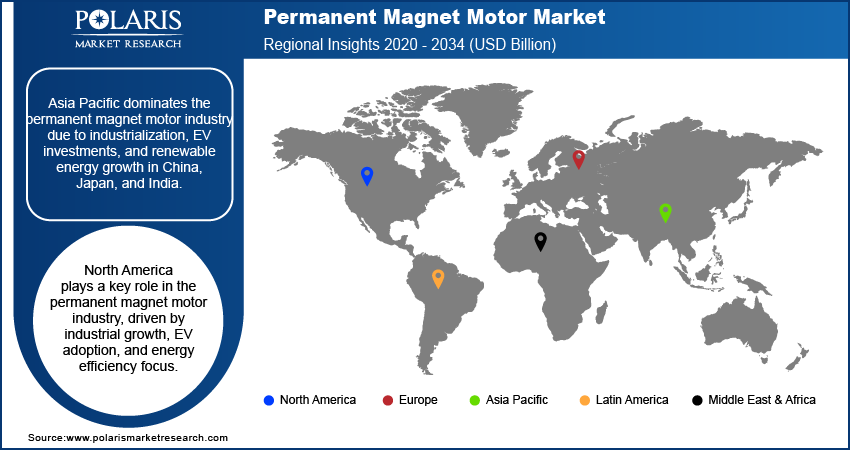

The Asia Pacific permanent magnet motor market held the largest share in 2024 and is rapidly growing. This is primarily due to rapid industrialization, significant investments in electric vehicle manufacturing, and a strong focus on renewable energy development. Countries in this region are major producers of consumer electronics and industrial equipment, where permanent magnet motors are widely integrated for their efficiency and performance. The expanding urban populations and rising disposable incomes also contribute to the demand for energy-efficient appliances, further fueling market growth.

China permanent magnet motor is a key player within the Asia Pacific and globally. As a major manufacturing hub and the world's largest electric vehicle market, China's demand for permanent magnet motors is substantial. The country's extensive investments in industrial automation, robotics, and large-scale renewable energy projects, particularly wind power, heavily rely on these advanced motors. Furthermore, government initiatives promoting energy conservation and sustainable development significantly bolster the adoption of permanent magnet motors across various sectors in China.

North America Permanent Magnet Motor Market

North America is a significant region in the permanent magnet motor market, driven by robust industrial growth, increasing adoption of electric vehicles, and a strong focus on energy-efficient solutions. The region's advanced manufacturing sector readily integrates these motors into various equipment and automation systems. Additionally, the increasing demand for sustainable transportation and renewable energy projects contributes to the rising use of permanent magnet motors across different applications in this region.

US Permanent Magnet Motor Market Insight

Within North America, the US plays a leading role in the permanent magnet motor market. The country's strong automotive sector, coupled with considerable investments in electric vehicle production, significantly boosts the demand for these motors. Furthermore, the emphasis on modernizing industrial infrastructure and the stringent energy efficiency standards in commercial and residential buildings further support the adoption of permanent magnet motors. The presence of key players and ongoing technological advancements also contribute to the market's strength in the US.

Europe Permanent Magnet Motor Market

Europe is a prominent region for the permanent magnet motor market, characterized by its strong commitment to environmental sustainability and advanced industrial capabilities. The widespread adoption of permanent magnet motors is driven by strict regulations promoting energy efficiency and the growing electrification of transportation. Industries across Europe are increasingly using these motors in diverse applications, including industrial automation, robotics, and renewable energy generation, such as wind power. The region's ongoing efforts to reduce carbon emissions and its focus on green technologies further stimulate the demand for high-performance and energy-efficient permanent magnet motors. Germany permanent magnet motor market stands out as a major contributor to the Europe market. The country's strong automotive sector, a leader in electric vehicle innovation, is a key driver for the demand for these motors. Germany's advanced manufacturing base also heavily relies on permanent magnet motors for precision engineering, factory automation, and high-tech machinery. The nation's dedication to renewable energy and its stringent energy efficiency policies also foster the widespread use of these motors, making it a critical hub for market development in Europe.

Key Players and Competitive Insights

The competitive landscape of the permanent magnet motor market is quite varied, with numerous companies vying for a strong position. Innovation in motor design, magnet materials, and control systems are key factors that companies focus on to gain an edge. Many players are also investing in expanding their production capacities and global reach, particularly in regions with high demand for electric vehicles and industrial automation.

Prominent companies in the industry include ABB Ltd., Siemens AG, NIDEC CORPORATION, Wolong Electric Group Co. Ltd., WEG S.A., Toshiba Corporation, Rockwell Automation, Inc., Johnson Electric Holdings Limited, Yaskawa Electric Corporation, and Allied Motion Technologies Inc.

Key Players

- ABB Ltd.

- Allied Motion Technologies Inc.

- Johnson Electric Holdings Limited

- NIDEC CORPORATION

- Rockwell Automation, Inc.

- Siemens AG

- Toshiba Corporation

- WEG S.A.

- Wolong Electric Group Co. Ltd.

- Yaskawa Electric Corporation

Industry Developments

December 2024: ABB (based in Switzerland) announced plans to acquire the power electronics division of Gamesa Electric from Siemens Gamesa. This move is intended to strengthen ABB’s renewable energy conversion offerings.

April 2024: Rockwell Automation released a firmware update for its PowerFlex 6000T VFD, enabling improved support for permanent magnet motors in high-speed, medium-voltage settings.

Permanent Magnet Motor Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Permanent Magnet AC Motor

- Permanent Magnet DC Motor

- Brushless DC Motor

By Power Rating Outlook (Revenue – USD Billion, 2020–2034)

- Upto 25KW

- 25-100 KW

- 100-300KW

- 300KW & Above

By End Use Industry Outlook (Revenue – USD Billion, 2020–2034)

- Industrial

- Commercial & Residential

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Permanent Magnet Motor Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 52.61 billion |

|

Market Size in 2025 |

USD 57.48 billion |

|

Revenue Forecast by 2034 |

USD 130.08 billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 52.61 billion in 2024 and is projected to grow to USD 130.08 billion by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

Key players in the market include ABB Ltd., Siemens AG, NIDEC CORPORATION, Wolong Electric Group Co. Ltd., WEG S.A., Toshiba Corporation, Rockwell Automation, Inc., Johnson Electric Holdings Limited, Yaskawa Electric Corporation, and Allied Motion Technologies Inc.

The permanent magnet AC motor segment accounted for the largest share of the market in 2024.

The 300KW & above segment is expected to witness the fastest growth during the forecast period.