PET Foam Market Share, Size, Trends, Industry Analysis Report

By Density Composition (High-density PET Foam, Low-density PET Foam); By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 114

- Format: PDF

- Report ID: PM2050

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

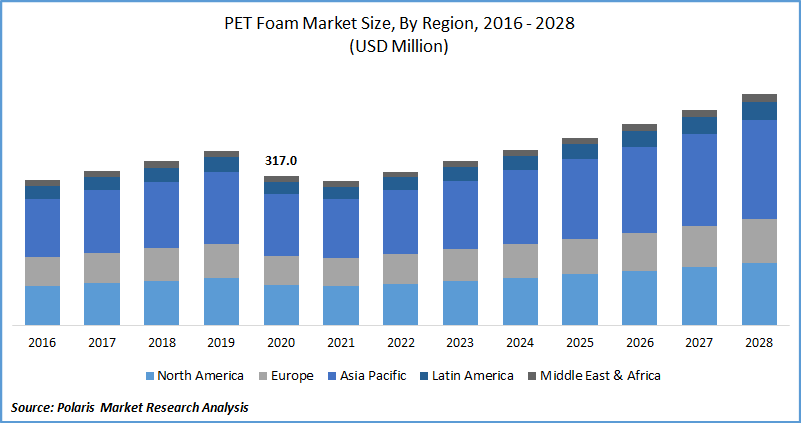

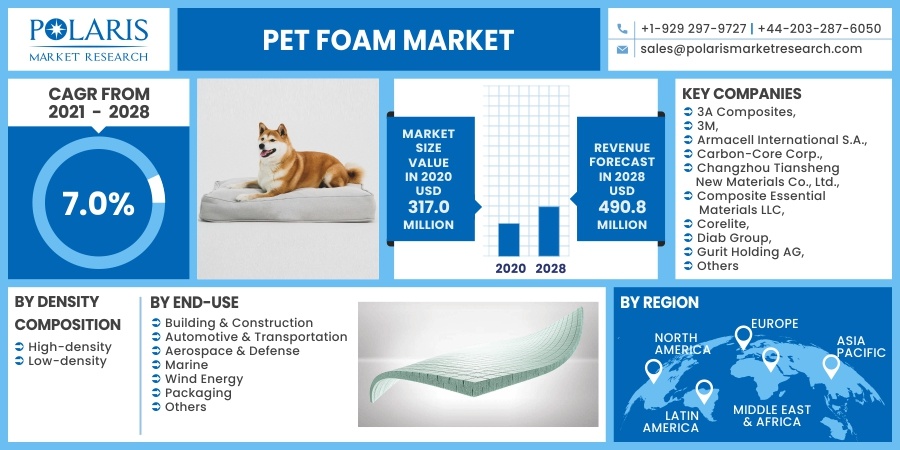

The global PET Foam market size was valued at USD 317 million in 2020 and is expected to grow at a CAGR of 7.0% during the forecast period. PET foam is used as a lightweight and economical core material for sandwich structures. The demand for PET foam has increased from various industries such as wind energy and power, marine, industrial, and transportation over the years.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The transportation and railway sectors are turning towards PET foam for structural solutions due to its high fire resistance, thermal & mechanical stability, and resistance to fatigue. The automotive sector uses PET foam for applications such as interior and exterior structural parts, floors, and sidewalls of vehicles. Increasing environmental awareness along with low toxicity, recyclability, and sustainability associated with PET foam has increased its adoption across the globe.

The COVID-19 pandemic has restricted the market for PET foam. The market has been impacted by operational challenges, disruption of the supply chain, delayed installations, deferred maintenance, and workforce impairment. Manufacturing activities have been halted due to various government regulations across the globe. Industries such as transportation, construction, and wind energy have all been adversely affected by the pandemic.

The market is likely to gain traction post-COVID-19 driven by factors such as supportive government regulations, favorable environmental policies, and increasing environmental concerns. Some trends expected to drive the market growth post-COVID-19 include the development of energy-efficient products, research & development to make products more sustainable and eco-friendlier, and the growing application of lightweight materials.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The global market for PET foam is fueled by increasing demand from the wind energy sector. The economic growth in countries such as India, China, and Japan, rising industrialization, and growing demand from automobile and construction sectors also supplement the market growth. Global players are expanding into these countries to cater to market potential.

Technological advancements and increasing adoption of bio-based products further support the market growth. New product launches and acquisitions by leading players in the market coupled with increasing use in furniture and footwear have resulted in greater demand across the globe. Increasing investment in the construction industry, growing disposable income, development of public infrastructure, and changing lifestyles would provide growth opportunities during the forecast period.

The application of the product has increased in the building and construction sector because of its properties such as acoustic control, fire resistance, thermal insulation, strength to weight ratio, and corrosion resistance. PET foam, used as a sandwich structure, enables innovative technical solutions for constructing roofs and facades. It is easy to install, incurs low repair and maintenance costs, and offers higher energy efficiency.

A combination of load-bearing, insulation, and thermoformability offers reduced weight and greater freedom in designing futuristic designs. The utilization of the product in construction structures such as bridges, balconies, and facades results in reduced weight, lower costs, decreased time, and less structural strengthening for older buildings during renovation.

Report Segmentation

The market is primarily segmented on the basis of density composition, end-use, and region.

|

By Density Composition |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Density Composition

The density composition segment has been divided into high-density and low-density. The low-density segment accounts for a significant market share and is used in diverse industries such as construction, wind energy, and transportation owing to higher versatility. This foam is widely used for its density, lightweight, durability, and quality. The use of the low-density segment provides enhanced flexibility, durability, support, comfort, and aesthetics. It offers thermal stability, chemical & electrical resistance.

Insight by End-Use

On the basis of the end-use, the foam market is segmented into building & construction, automotive and transportation, aerospace & defense, marine, wind energy, packaging, and others. The demand for the product is expected to increase from the wind energy segment during the forecast period.

PET foam is used in manufacturing wind blades and other components because of its high strength-to-weight ratio, durability, and versatility. The use of PET foam in wind energy offers greater performance, reduced costs, design flexibility, and increased energy efficiency. Growing environmental concerns coupled with initiatives taken by governments to promote the use of sustainable and renewable energy sources has increased its adoption.

Geographic Overview

Asia Pacific accounts for a major market share. Increasing urbanization, growing automotive industry, technological advancements, and expansion of international players in this region are some factors attributed to the growth of this region. Rising awareness regarding energy conservation in the construction sector and initiatives to promote the adoption of electric vehicles in developing countries have led to the PET foam market growth.

The industrial growth in countries such as Japan, India, and China, rising automotive penetration, and the established electronics industry have resulted in greater demand for PET foam. Increasing applications in packaging and wind energy are expected to offer growth opportunities during the forecast period.

Competitive Landscape

The leading players in the PET foam market include Huntsman International LLC, Gurit Holding, Sekisui Plastic, Petro Polymer Shargh, Changzhou Tiansheng New Materials Co. Ltd, Carbon-Core Corp., 3M, Nitto Denko Corporation, Armacell International SA, and DIAB Group.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

PET Foam Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 317.0 million |

|

Revenue forecast in 2028 |

USD 490.8 million |

|

CAGR |

7.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Density Composition, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

3A Composites, 3M, Armacell International S.A., Carbon-Core Corp., Changzhou Tiansheng New Materials Co., Ltd., Composite Essential Materials LLC, Corelite, Diab Group, Gurit Holding AG, Hunan Rifeng Composite Co., Ltd., Huntsman International LLC, Nitto Denko Corporation, Petro Polymer Shargh (PPS), Sekisui Chemical Co. Ltd., Visight Composite Material Co., Ltd., XTX Composites |