Pet Wearable Market Size, Share, Trends, Industry Analysis Report

: By Product (Smart Collars, Activity Trackers, Pet Emotion Sensors, Smart Vests, Smart Cameras, and Smart Harnesses), Technology, Animal Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 119

- Format: PDF

- Report ID: PM1116

- Base Year: 2024

- Historical Data: 2020-2023

Pet Wearable Market Overview

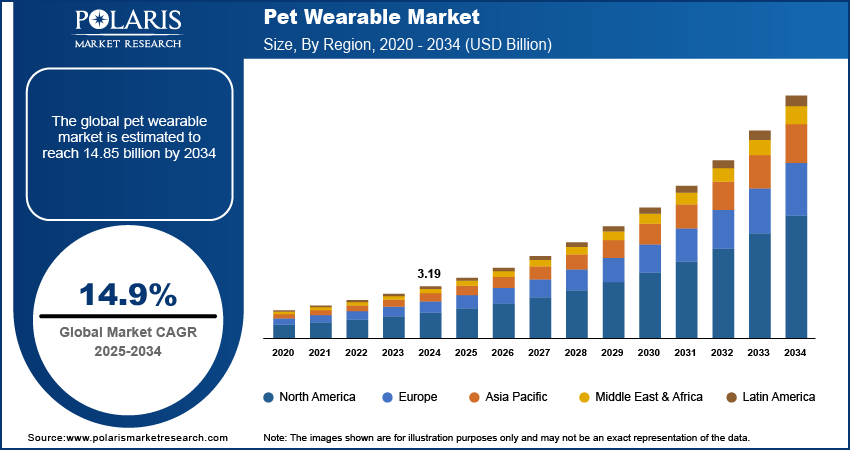

The global pet wearable market size was valued at USD 3.19 billion in 2024. The market is projected to grow from USD 3.71 billion in 2025 to USD 14.85 billion by 2034, exhibiting a CAGR of 14.9% from 2025 to 2034.

Pet wearables are small devices that can be worn on a pet’s body to monitor and track pet activities on a daily basis. These wearables also monitor pet health by tracking their heart rate, sleep patterns, and calories burned. Also, they have location tracking features that help pet owners know their pet’s location. Smart collars, motion sensors, vests, and harnesses are a few commonly used pet wearables.

To Understand More About this Research: Request a Free Sample Report

The surge in pet ownership, innovations and significant investments in pet tracking technologies, growing awareness about pet mental and physical fitness, and rising expenditure on pets/animals are among the key factors driving the pet wearable market demand. Concerns over pet obesity and the rising popularity of pet insurance also fuel the adoption of pet wearables.

The connectivity of Internet of Things (IoT) devices, which supports the transmission of real-time data concerning pet health to pet owners and veterinarians, is anticipated to play a crucial role in shaping the pet wearable market development in the coming years. The emerging demand for remote monitoring and tracking of pets in major economies such as the US and Europe is anticipated to create increased market opportunities for pet wearable companies during the forecast period.

Factors such as privacy issues, the lack of regulatory framework as proposed by pet well-wisher associations such as PETA, the short shelf-life of batteries, data misuse, and operational limitations among pet owners hinder the pet wearable market expansion.

Pet Wearable Market Dynamics

Rising Pet Humanization

The pet humanization trend, which involves treating pets like family members and applying human lifestyles and dietary patterns to them, has led to increased demand for advanced devices among pet owners. Market participants are catering to this demand by introducing pet wearables for pets like cats, dogs, and other animals. These devices can track a pet’s activity level and detect if it is too hyperactive or sedentary. Also, pet wearables can assist with disease detection and behavioral difficulties. Thus, the rising awareness about pet health contributes to the pet wearable market growth.

Technological Advancements and Innovations

The incorporation of advanced technologies such as artificial intelligence (AI), machine learning (ML), and IoT fuels the pet wearable market development. By leveraging AI and IoT technologies, ordinary pet wearable products can be improved to provide smart capabilities for analyzing and interpreting pet health information. These smart pet wearables can effectively monitor pet health trends, analyze behaviors, and detect changes. Also, they can assess the impact of nutrition and exercise on the pet. That way, pet owners can take quick action and maintain the overall well-being of their pets. Thus, the rising technological advancements and innovations in pet wearables will boost the pet wearable market growth during the forecast period.

Pet Wearable Market Segment Insights

Pet Wearable Market Outlook – Based on Product

The pet wearable market, based on product, is segmented into smart collars, activity trackers, pet emotion sensors, smart vests, smart cameras, and smart harnesses. In 2024, the smart collars segment accounted for the largest share of 64.55%. Smart collars connect wirelessly to the pet owner’s/livestock keeper's smartphone, allowing them to monitor their pet’s or animal’s fitness, health, training, and food behaviors. The hectic lifestyle and long working hours of individuals are driving the demand for smart, connected pet collars to get real-time insights into their pets/livestock health and well-being. Factors such as herd management for livestock keepers and the rising need for pet health monitoring and location tracking further drive the growth of the segment.

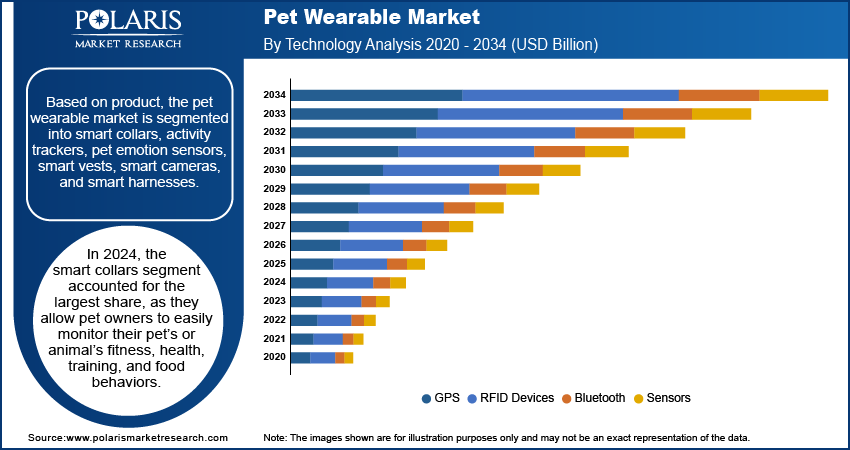

Pet Wearable Market Assessment – Based on Technology

The pet wearable market, based on technology, is segmented into GPS, RFID devices, Bluetooth, and sensors. The RFID segment held the largest pet wearable market revenue share of 43.01% in 2024. Accuracy and reliability are two major advantages of RFID technology that are driving the segment’s robust growth in the market. RFID pet wearables can help with tracking lost pets. Also, they can be linked to the pet’s health records, providing easy access to the pet’s disease history, vaccination history, and other vital data. Further, RFID tags are lightweight and compact as compared to other animal tracking technologies, such as satellite telemetry and GPS.

Pet Wearable Market Regional Analysis

The market report offers pet wearable market insights into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. North America dominated the market with the largest revenue share of 35.0% in 2024. The regional market growth is driven by several factors, including the increasing trend of pet adoption, growing concerns related to feedstock health, rising per capita expenditure of pet owners, the presence of innovative companies, and the adoption of advanced products and services by pet owners. In addition, the growing penetration of pet insurance and the presence of various dedicated pet care associations boost the regional market growth.

The Asia Pacific pet wearable market accounted for a revenue share of 23.34% in 2024. The growth can be attributed to the increasing incidence of chronic conditions in pets and growing expenditure on pets due to rising disposable income. Further, the growing investments in pet technologies and the integration of AI and ML algorithms support the regional market expansion.

Pet Wearable Market – Key Players and Competitive Insights

The pet wearable market has the presence of established players and new entrants. The leading market players focus on offering advanced products to improve their offerings. Also, they are undertaking various strategic initiatives such as collaborations, mergers and acquisitions, and partnerships to expand their market share. To expand and survive in a more competitive and rising market environment, the pet wearable market players must offer innovative solutions.

Manufacturing locally is one of the key business strategies used by manufacturers to benefit clients and increase market share. In recent years, the market for pet wearables has witnessed several technological and innovation breakthroughs. The pet wearable market research report offers a market assessment of all the leading players such as Datamars; Felcana; FitBark Service; Avid Identification Systems, Inc.; Barking Labs; LATSEN; Link My Pet; Garmin Ltd.; GoPro Inc.; Loc8tor Ltd.; PetPace; PetTech.co.uk.Ltd.; Mars, Incorporated; PETFON; and Tractive.

List of Key Companies in Pet Wearable Market

- Datamars

- Felcana

- FitBark Service

- Avid Identification Systems, Inc.

- Barking Labs

- LATSEN

- Link My Pet

- Garmin Ltd.

- GoPro Inc.

- Loc8tor Ltd.

- PetPace

- PetTech.co.uk.Ltd.

- Mars, Incorporated

- PETFON

- Tractive

Pet Wearables Industry Developments

January 2024: Tractive, UK’s largest pet wearables company, announced the introduction of new pet policies for dog and cat owners in the UK. The company stated that these new policies provide comprehensive coverage for illness, accident, and dental treatment.

November 2023: PetPace collaborated with Veterinary Health Research Centers (VHRC) to research Canine Alzheimer's Disease. The partnership, named Dogs Overcoming Geriatric Memory and Aging (DOGMA), will leverage PetPace's biometric collars for monitoring and analyzing the behavior and health of adult dogs.

Pet Wearable Market Segmentation

By Product Outlook

- Smart Collars

- Activity Trackers

- Pet Emotion Sensors

- Smart Vests

- Smart Cameras

- Smart Harnesses

By Technology Outlook

- GPS

- RFID Devices

- Bluetooth

- Sensors

By Animal Type Outlook

- Dogs

- Cats

- Other Animals

By Application Outlook

- Identification & Tracking

- Medical Diagnosis & Treatment

- Behavior Monitoring & Control

- Safety & Security

- Facilitation

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pet Wearable Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.19 billion |

|

Market Size Value in 2025 |

USD 3.71 billion |

|

Revenue Forecast by 2034 |

USD 14.85 billion |

|

CAGR |

14.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.19 billion in 2024 and is projected to grow to USD 14.85 billion by 2034.

The market is projected to register a CAGR of 14.9% from 2025 to 2034.

North America accounted for the largest region-wise market share in 2024.

Datamars; Felcana; FitBark Service; Avid Identification Systems, Inc.; Barking Labs; LATSEN; Link My Pet; Garmin Ltd.; GoPro Inc.; Loc8tor Ltd.; PetPace; PetTech.co.uk.Ltd.; Mars, Incorporated; PETFON; and Tractive are a few key players in the market.

The smart collar segment accounted for the largest market share in 2024.

The RFID segment held the largest market share in 2024.