Photoinitiator Market Size, Share, Trends, & Industry Analysis Report

: By Type (Free Radical and Cationic), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5742

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

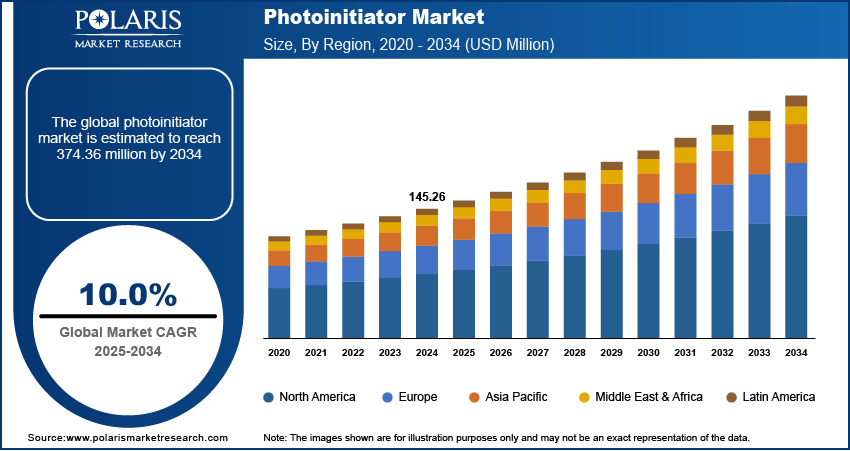

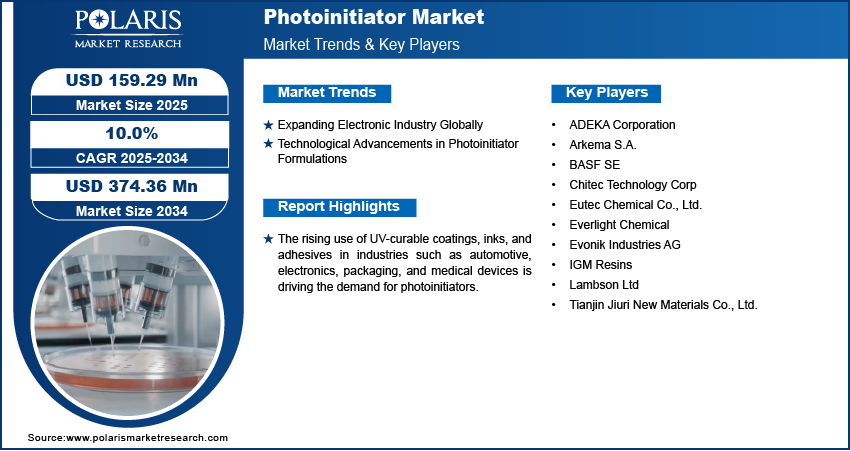

The global photoinitiator market size was valued at USD 145.26 million in 2024, growing at a CAGR of 10.0 % during 2025–2034. The rise in use of UV-curable coatings, inks, and adhesives in industries such as automotive, electronics, packaging, and medical devices is driving the demand for photoinitiators.

Photoinitiator is a chemical compound that initiates a chemical reaction when exposed to light, typically UV or visible light. These compounds are essential in UV curing applications, where a polymer or other material is hardened or cured using UV light. Photoinitiators are used in various applications, including coatings, inks, adhesives, 3D printing, dental restoratives, and composites. The selection of the appropriate photoinitiator is crucial for achieving the desired curing properties. Factors such as the light source's wavelength, the presence of pigments or fillers, and the desired depth of cure influence this selection.

The growing production of motor vehicles globally is driving the photoinitiator market growth. Automotive manufacturers rely heavily on UV-curable coatings and adhesives to enhance the durability, aesthetics, and performance of vehicles. These coatings require photoinitiators to cure quickly at room temperature, without the need for heat. Additionally, the trend toward lightweight and electric vehicle production is leading to the increased use of composite materials. These materials often require UV curing processes, which involve photoinitiators, to achieve the desired mechanical properties and durability. The Association of European Automobile Manufacturers in its report stated that in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Therefore, the demand for photoinitiators is increasing with the growing production of motor vehicles globally.

To Understand More About this Research: Request a Free Sample Report

The photoinitiator demand is driven by rising industrialization, particularly in emerging nations such as India, Brazil, and others. According to the Economic Survey 2023-24, Robust industrial growth of 9.5% was witnessed in India during the period. This expanding industrialization requires faster and more sustainable curing methods, which photoinitiators facilitate by enabling instant polymerization under UV light. Furthermore, expanding industrialization in these regions is encouraging the government to set strict environmental regulations, pushing manufacturers to adopt low-VOC (volatile organic compound) and solvent-free alternatives, leading to high demand for photoinitiators.

Industry Dynamics

Expanding Electronic Industry Globally

Photoinitiators are essential for producing high-performance coatings, adhesives, and inks used in electronic devices. Manufacturers of electronic devices rely on photoinitiator-based materials to protect circuit boards, display screens, and semiconductor components from moisture, heat, and mechanical stress. The rising production and demand for flexible electronics and foldable displays are further driving demand for photoinitiators as they offer the necessary flexibility and scratch resistance. Moreover, the push for sustainable manufacturing in the electronics sector is accelerating the adoption of photoinitiator. According to NITI Aayog’s Electronics: Powering India’s Participation in Global Value Chains report, India’s electronics sector has witnessed rapid growth, reaching USD 155 billion in FY23. As the electronic industry expands globally, the demand for photoinitiators increases.

Technological Advancements in Photoinitiator Formulations

Technological advancements in photoinitiator formulations are driving higher demand by enhancing performance, expanding applications, and addressing industry challenges. Manufacturers are developing next-generation photoinitiators that cure faster, work under lower energy UV light, and offer better compatibility with diverse materials. These improvements make UV-curable technologies more efficient and cost-effective for industries ranging from electronics to automotive manufacturing, leading to high adoption of photoinitiators. Environmental and safety improvements in photoinitiator chemistry are also accelerating its adoption. New bio-based and nontoxic photoinitiators are addressing regulatory concerns while maintaining high performance, making them attractive for food packaging, children's toys, and other sensitive applications.

Segmental Insights

By Type Analysis

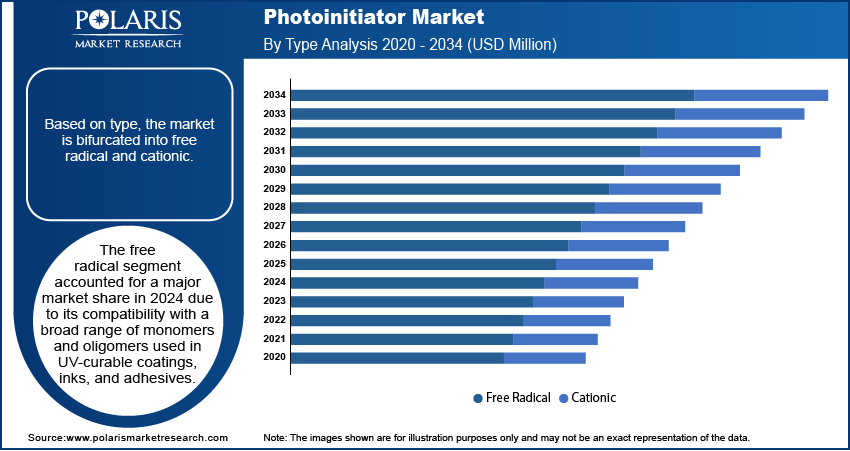

Based on type, the segmentation includes free radical and cationic. The free radical segment accounted for a major market share in 2024 due to its compatibility with a broad range of monomers and oligomers used in UV-curable coatings, inks, and adhesives. Free radical photoinitiators offer fast curing speeds, high reactivity, and excellent surface cure properties, which significantly reduce production time and energy consumption in packaging, electronics, and automotive industries. The widespread use of free radical photoinitiators in LED-based curing systems, especially for printing and varnishing applications, further strengthened their position as the dominant segment in 2024.

The cationic segment is expected to grow at a robust pace in the coming years, owing to its superior properties such as low shrinkage, enhanced adhesion, and excellent resistance to heat and chemicals. Unlike free radical systems, cationic photoinitiators continue to cure even after UV exposure ends, making them ideal for thick or pigmented coatings where complete light penetration is difficult. The electronics and 3D printing industries are increasingly using cationic photoinitiators due to their reliability in producing high-performance, dimensionally stable components. The rising shift toward low-emission and energy-efficient curing systems is also supporting the growing preference for cationic initiators, particularly in environmentally sensitive regions such as Europe and North America.

By End Use Analysis

Based on end use, the market is divided into adhesives, ink, coating, and other. The coatings segment held the largest share in 2024. Manufacturers in the automotive, construction, and electronics industries increasingly adopted UV-curable or photoinitiator-based coatings due to their ability to offer faster curing times, superior surface hardness, and environmentally friendly formulations. The shift toward solvent-free, energy-efficient coating solutions also drove demand for photoinitiators, especially in regions such as North America and Europe, where stringent environmental regulations restrict VOC emissions. Technological advancements in high-performance surface protection and the growing need for durable, scratch-resistant finishes in industrial and decorative applications further accelerated the adoption of UV-cured coatings.

The adhesives segment is projected to grow at a significant pace during the forecast period, owing to the rising use of UV-curable or photoinitiator-based adhesives in electronics, medical devices, and packaging applications. These adhesives offer excellent bonding strength, rapid curing under UV light, and thermal stability, making them ideal for precision bonding and miniaturized assemblies. The growing demand for compact electronic devices and disposable medical components is pushing manufacturers to adopt photoinitiators that improve adhesives production efficiency.

Regional Analysis

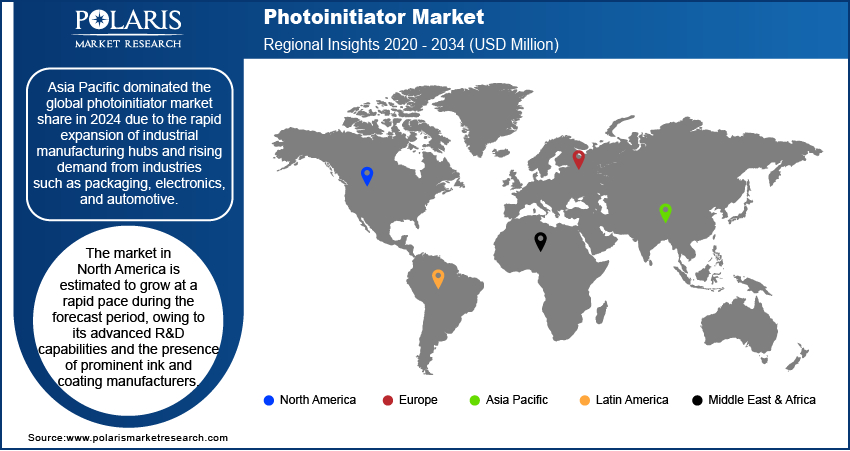

By region, the market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific photoinitiator market dominated with the largest share in 2024 due to the rapid expansion of industrial manufacturing hubs and rising demand from industries such as packaging, electronics, and automotive. Countries such as China, Japan, and South Korea witnessed a surge in UV-curable coating and adhesive applications, supported by strong investments in infrastructure, favorable regulatory frameworks, and a large base of electronics and plastic manufacturing units. China dominated the regional market due to its raw material availability, low production costs, and advanced photopolymer technologies. The country’s wide printing industry also contributed to the overall consumption levels of photoinitiators in the region.

The North America photoinitiator market is estimated to grow at a rapid pace during the forecast period, owing to its advanced R&D capabilities and the presence of prominent ink and coating manufacturers. The US is expected to witness high adoption of UV curing chemicals, including photoinitiators, in the packaging and 3D printing sectors. Additionally, regulatory support for sustainable printing practices and increasing investments in high-performance formulations are likely to fuel photoinitiators demand in the coming years. The region’s commitment to innovation and stringent environmental standards is further projected to shape market dynamics, particularly in specialty applications requiring precision and consistency.

The Europe photoinitiator market is expected to hold a substantial share in the coming years, owing to its growing automotive, packaging, and industrial coatings sectors. The region’s strict environmental regulations and early adoption of eco-friendly technologies are encouraging widespread use of energy-efficient curing solutions such as photoinitiators, particularly in UV and LED-based applications. European manufacturers are also focusing on developing low-VOC and sustainable solutions in response to tightening EU directives on emissions, which is estimated to fuel the market revenue during the forecast period.

Key Players and Competitive Analysis Report

The global photoinitiator market is highly competitive, with key players leveraging product portfolio expansion, strategic partnerships, and mergers & acquisitions (M&A) to strengthen their positions. Companies such as IGM Resins, Arkema, BASF, and Tianjin Jiuri New Materials are actively adopting these strategies to enhance their share in the rapidly growing UV-curable inks, coatings, and adhesives industries. Major manufacturers are investing in R&D to develop advanced photoinitiators that meet evolving regulatory and performance demands. Collaborations with raw material suppliers, resin formulators, and end-users are becoming increasingly vital. Partnerships enable companies to co-develop customized solutions, optimize supply chains, and accelerate product commercialization. M&A activities are reshaping the competitive landscape, allowing companies to expand geographic reach, acquire advanced technologies, and consolidate market share.

A few prominent companies in the photoinitiator market are ADEKA Corporation; Arkema S.A.; BASF SE; Chitec Technology Corp; Eutec Chemical Co., Ltd.; Everlight Chemical; Evonik Industries AG; IGM Resins; Lambson Ltd; and Tianjin Jiuri New Materials Co., Ltd.

Key Players

- ADEKA Corporation

- Arkema S.A.

- BASF SE

- Chitec Technology Corp

- Eutec Chemical Co., Ltd.

- Everlight Chemical

- Evonik Industries AG

- IGM Resins

- Lambson Ltd

- Tianjin Jiuri New Materials Co., Ltd.

Industry Developments

January 2023: Everlight Chemical, a global chemical company that specializes in producing a wide range of chemicals, introduced a new type of water-based photoinitiator.

July 2022: Chitec Technology Corp. is a major brand in the global plastic and coating additives industry, launched a new cationic photoinitiator, CHIVACURE 1176, for thin and colorless coatings.

Photoinitiator Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Free Radical

- Cationic

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Adhesives

- Ink

- Coating

- Other

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Photoinitiator Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 145.26 Million |

|

Market Size Value in 2025 |

USD 159.29 Million |

|

Revenue Forecast by 2034 |

USD 374.36 Million |

|

CAGR |

10.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 145.26 million in 2024 and is projected to grow to USD 374.36 million by 2034.

The global market is projected to register a CAGR of 10.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are ADEKA Corporation; Arkema S.A.; BASF SE; Chitec Technology Corp; Eutec Chemical Co., Ltd.; Everlight Chemical; Evonik Industries AG; IGM Resins; Lambson Ltd; and Tianjin Jiuri New Materials Co., Ltd.

The free radical segment dominated the market share in 2024.

The adhesives segment is expected to witness the fastest growth during the forecast period.